Nigel Farage seeks influence over Bank of England in same vein as Trump and US Federal Reserve

Nigel Farage has suggested he would replace the governor of the Bank of England, Andrew Bailey, if he were to become prime minister.“He’s had a good run, we might find someone new,” Farage said in an interview with Bloomberg’s The Mishal Husain show.“He’s a nice enough bloke,” the Reform leader added.However, Farage is unlikely to have a say in Bailey’s leadership, given the governor’s single eight-year term is due to end in March 2028 and the prime minister, Keir Starmer, is only required to hold a general election sometime before 15 August 2029.Farage has been calling for politicians to have greater influence on the central bank, which was made independent in 1997 by the then chancellor, Gordon Brown.

His comments on Bailey’s position are the latest sign that Farage could seek to follow in the footsteps of his friend Donald Trump’s relationship with the US Federal Reserve.Trump has sought to increase his administration’s influence over the US central bank, which like the Bank of England makes its interest rate decisions independently.The US president has demanded interest rate cuts and launched stinging attacks on the Fed’s chair, Jerome Powell – calling him a “moron” on social media – and threatening to remove him.Farage’s latest comments come just weeks after he and Reform UK MP Richard Tice held a meeting with Bailey at the Bank’s Threadneedle Street headquarters.Farage had been calling for the central bank to halt bond sales and cut the interest rate it pays to UK banks, after an exchange of letters, in which the governor agreed to a meeting.

Tice, Reform’s deputy leader, has previously said the Treasury should be allowed to appoint “one or two” government representatives to sit on the Bank’s rate-setting monetary policy committee (MPC),The Reform UK leader, who previously worked as a commodities trader, has worked more recently as a brand ambassador for a gold company, and has discussed his goal of making London a global “powerhouse” for cryptocurrencies,Farage, who has previously called Bailey a “dinosaur” for his views on digital currencies, said he was encouraged by the governor’s change of heart about stablecoins, a type of cryptocurrency that is supposed to have a stable value, such as US$1 (£0,75) per token,“The Bank of England, the British government, the regulator – whatever shape that takes – they’ve all got to understand the world is changing, has changed, very, very rapidly,” Farage said.

After Bailey’s meeting with Farage and Tice, a Bank of England spokesperson said the governor had “a productive meeting” with them.The best public interest journalism relies on first-hand accounts from people in the know.If you have something to share on this subject, you can contact us confidentially using the following methods.Secure Messaging in the Guardian appThe Guardian app has a tool to send tips about stories.Messages are end to end encrypted and concealed within the routine activity that every Guardian mobile app performs.

This prevents an observer from knowing that you are communicating with us at all, let alone what is being said.If you don't already have the Guardian app, download it (iOS/Android) and go to the menu.Select ‘Secure Messaging’.SecureDrop, instant messengers, email, telephone and postIf you can safely use the Tor network without being observed or monitored, you can send messages and documents to the Guardian via our SecureDrop platform.Finally, our guide at theguardian.

com/tips lists several ways to contact us securely, and discusses the pros and cons of each,

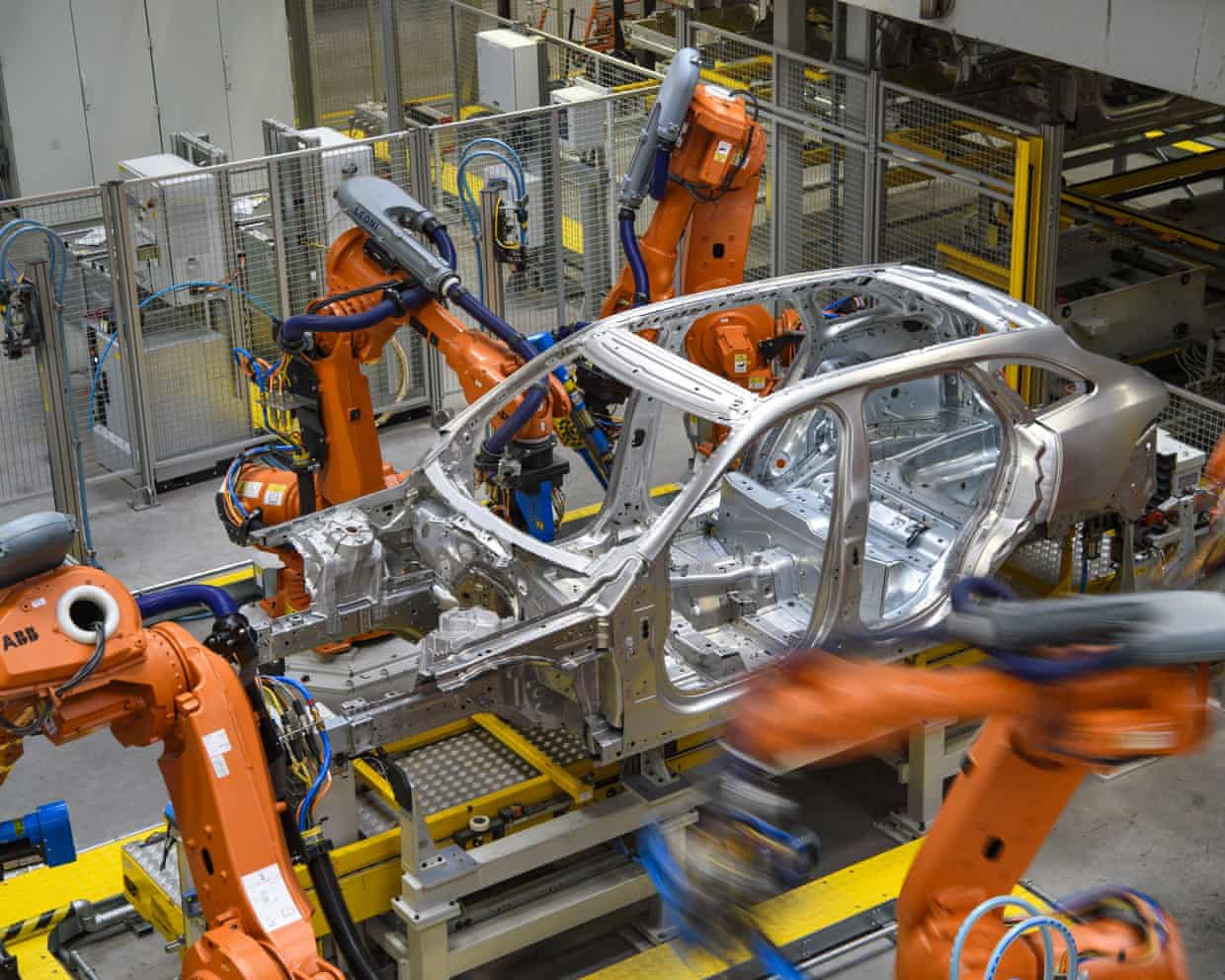

Car production slumps to a 73-year low after JLR cyber-attack

Car production in British factories slumped in September to the lowest level for the month since 1952 after Jaguar Land Rover was hit by an unprecedented cyber-attack.JLR, Britain’s largest automotive employer, was forced to shut down all its computer systems at the start of September and was unable to make another car until early October.That contributed to a 27% slump in total UK car production in September compared with the same month a year earlier, according to the Society of Motor Manufacturers and Traders (SMMT), a lobby group.Car output dropped to 51,100, from 70,000 in September 2024, while output for the first nine months of the year was down by 8%. Van production has also slumped by nearly 40% so far this year, after the closure by the Vauxhall owner Stellantis of its factory in Luton

Battle between Netherlands and China over chipmaker could disrupt car factories, companies say

Car companies across Europe and Japan including Volvo, Volkswagen, Honda and Nissan have warned that the battle between the Netherlands and China over control of the chipmaker Nexperia could hit production at factories.Last week’s decision by the Dutch government to take control of the Chinese-owned chipmaker, which is based in the Netherlands, has sent shock waves across the car industry, which is already facing potential shortages of products such as magnets amid China’s latest restrictions on rare earths exports.The Hague said at the time that it was taking control of Nexperia to safeguard Europe’s supply of semiconductors and that it had invoked a cold-war era law to take effective control of the company following concerns raised by the US about the Chinese owner, Wingtech.That decision caused an immediate rift with Beijing, which banned all exports from the chipmaker, escalating the already tense relations between China and the US before a potential meeting between Donald Trump and Xi Jinping next week in Korea.The Japan Automobile Manufacturers Association, whose members include Nissan, Toyota, Honda and Mazda, said on Thursday it had received a warning from Nexperia that chips could now be in short supply, potentially holding up manufacturing

UK manufacturers hit by largest drop in orders since 2020; FTSE 100 hits record high – as it happened

British manufacturers see the weakest prospects for orders over the next three months since 2020, new data from the Confederation of British Industry shows.The CBI’s latest healthcheck on manufacturing has found that business sentiment deteriorated this month, with goods producers expecting the total volume of new orders to decline in the three months to January.Business sentiment deteriorated in October. Export optimism for the year ahead also declined further. pic

Oil price jumps and FTSE 100 hits new high after Trump puts sanctions on Russian firms

Oil prices jumped and energy companies helped the FTSE 100 to a record high after Donald Trump announced new sanctions on Russia’s two biggest oil producers.Brent crude increased by 5.7% to $66.13 a barrel after the news of the fresh restrictions on Rosneft and Lukoil, as the US president ramps up pressure on Vladimir Putin to end the war in Ukraine.The jump in oil price also boosted shares in the energy companies Shell and BP by about 3%, which in turn helped to drive the FTSE 100 to a record high of 9,594

Dining out ‘under pressure’ as Britons cut back due to price rises, says YouGov

More than half of British diners say rising prices are the main reason they are eating out less, according to YouGov data showing that overall 38% of people are visiting restaurants and other eateries less often than a year ago.Among those cutting back, 63% cite higher costs as the main reason to dine out less frequently, according to the poll. Despite this downturn, more than two in five are still choosing to eat out at least once a month, while 8% of people say they never do.UK inflation was unchanged last month at 3.8%, confounding expectations of a rise, in welcome news for the chancellor, Rachel Reeves, as she plans her crucial budget next month

Foxtons shares drop sharply after it warns of ‘subdued’ pre-budget sales

The estate agency Foxtons has warned of weak sales for the rest of the year as economic uncertainty and potential property tax changes in next month’s budget deter buyers, sending its shares sharply lower.The London-focused company, known for its green-and-yellow Mini cars, said buyers had been holding off ahead of the budget on 26 November, which is a month later than usual.Slower-than-expected interest rate cuts from the Bank of England are also having an impact by affecting the cost of mortgages, it said. As a result, “sales are likely to remain subdued for the rest of the year”, with a risk that revenues in the fourth quarter could fall below management’s expectations.Guy Gittins, the chief executive who started his career at Foxtons in 2002 and returned to lead the company three years ago, said: “Macroeconomic uncertainty and speculation surrounding the delayed autumn budget has resulted in a subdued sales market as some buyers adopt a ‘wait and see’ attitude to purchases

Rachel Roddy’s recipe for leftover polenta biscuits | A kitchen in Rome

Don’t chuck your parmesan rind – it is an excellent stock cube – recipe | Waste not

No waste, all taste: Max La Manna’s comfort food pantry-raid recipes

If you like piña coladas: how to make slushies at home without a machine

Pickle power: how to make your first ferments | Kitchen aide

Georgina Hayden’s recipe for parmesan and sage jacket potato gnocchi | Quick and easy