FTSE 100 winning streak ends as WPP shares hit lowest level since 1998; ECB holds rates at 2% - as it happened

Time to recap,Shares in advertising group WPP fell to their lowest level since 1998, after the FTSE 100 group slashed its revenue guidance for the year and its new chief executive Cindy Rose said its recent performance has been “unacceptable”,The former Microsoft executive has announced a review of the business, saying she was taking action to address the “unacceptable” performance at the company, which has struggled to stem a growing exodus of clients and compete with the AI and data capabilities of its rivals,Over in Frankfurt, the European Central Bank kept interest rates on hold on Thursday for the third meeting in a row despite concerns that a modest economic recovery across the eurozone would fuel inflation,The ECB kept its key deposit rate at 2% despite annual price growth rising to 2.

2% across the 20-member euro bloc in September, up from 2% in August and 1.7% a year earlier.In the 27-member EU, annual inflation was 2.6% in September, up from 2.4% in August, according to Eurostat.

The ECB said its six-member governing council’s view of inflation was “broadly unchanged”.It said: “The robust labour market, solid private sector balance sheets and the governing council’s past interest rate cuts remain important sources of resilience.”In other news, Virgin Trains is now on track to challenge Eurostar cross-Channel monopoly after the UK rail regulator approved its application to use a key depot in east London.The Office of Rail and Road (ORR) approved Virgin’s application to use the Temple Mills depot in Leyton – which is used for maintaining and storing trains.It said this would unlock £700m of investment in new services and create 400 jobs.

Access to Temple Mills is a critical step in helping Virgin Trains challenge the monopoly held by Eurostar, which has been the only passenger service allowed to access the Channel tunnel since it opened in 1994.Temple Mills is the only train depot that can be accessed from High Speed 1, the line that runs between London and the tunnel.Faced with a multibillion-pound shortfall in the public finances, if Rachel Reeves does, as reported, raise the basic rate of income tax in next month’s budget, she will be the first chancellor to do so since Labour’s Denis Healey, 50 years ago.Healey announced his radical budget in April 1975, in which he raised the basic rate by two percentage points to 35%, and other rates by the same amount.In the Guardian’s budget coverage the next day, political correspondent, Ian Aitken, told readers that “like a stern Edwardian head waiter at the end of a wild West End orgy, Mr Healey yesterday presented Britain with the bill for a year of reckless wage indulgence”.

The backdrop to his budget was an ‘economic crisis’, as some experts called it, with inflation galloping at nearly 20%, unemployment rising, and the pound falling.The UK was, like other world economies, also suffering the consequences of a massive rise in oil prices.Healey, quoted by The Guardian, defended his budget, saying, with reference to industrial relations and spiralling wage demands:The tragedy is that a lot of the bitter medicine would not have been needed if so many people had not tried to get more than their share of what the country can afford.”The new leader of the Conservative Party, Margaret Thatcher, called it a “genuine socialist budget”, consisting of “equal shares of misery for all”.WPP shares are now at their lowest point since 1998, down by just under 17% today.

The share price fall came after the advertising group slashed its sales guidance and its new chief executive, Cindy Rose, said its recent performance had been “unacceptable”.Shares in WPP are down by about 63% in the year so far, and have lost just over 50% in the past five years.The FTSE 100 group, which is now worth £3.3bn, was valued at £25bn eight years ago.The ECB’s decision to leave its ket interest rates unchanged at 2% suggests that policymakers feel that the eurozone economy is in decent shape.

Mark Wall, chief European economist at Deutsche Bank, says:Where’s the smoking gun for a rate cut? Despite the US tariffs, despite all the various sources of uncertainty, the European economy continues to eke out some growth.Economic ‘resilience’ is keeping the ECB doves in check, and the policy pause on the rails.”However, Irene Lauro, eurozone economist at Schroders notes that if inflation gets too low, the ECB could follow the Federal Reserve’s suit.The US central bank cut its benchmark interest rate by a quarter point to a range of 3.75% to 4% yesterday.

She said:We remain confident that growth will strengthen into next year, supporting the ECB’s decision to keep interest rates on hold into 2026.However, if inflation comes in lower beyond current projections, the ECB could follow the Fed’s risk-management approach and deliver a precautionary rate cut.For now, the outlook for the eurozone has shifted positively – a welcome change after months of stagnation.”The European Central Bank kept interest rates on hold on Thursday for the third meeting in a row despite concerns that a modest economic recovery across the eurozone will fuel inflation.The ECB kept its key deposit rate at 2% despite annual price growth rising to 2.

2% across the 20-member euro bloc in September, up from 2% in August and 1.7% a year earlier.In the 27-member EU, annual inflation was 2.6% in September, up from 2.4% in August, according to Eurostat.

The eurozone economy expanded by 0,2% in the third quarter from the previous three months, according to preliminary data from the European Commission published on Thursday,Elsewhere in the auto world, the Chinese electric car manufacturer BYD has reported a 33% drop in its third quarter profits,Net profit dropped 33% year-on-year to 7,8bn yuan ($1.

1bn), its second quarterly decline in a row and the biggest fall in more than four years.Total revenue fell by about 3% to about 195bn yuan.It comes as the world’s biggest electric car company faces increasingly tight competition in its home market from rivals such as Leapmotor and the state-owned SAIC Motor Corp.In September, BYD’s market share in China dropped from 18% last year to 14%, according to reports.The company has lowered its sales target this year by 16% to 4.

6 million vehicles, Reuters reported, although it still expects its EV and plug-in hybrid exports to double from 2024, boosted by growth in Europe,The German carmaker Volkswagen has said Donald Trump’s trade tariffs will cost it up to €5bn (£4,4bn) a year in revenue,The group, which owns car brands including Porsche and Audi, said this morning that it made a €1,3bn loss in its third quarter, compared with a €2.

8bn profit in the same period last year.Volkswagen said the losses were due to a shift in strategy for Porsche’s electric cars, as well as the impact of US tariffs.The company, which is headquartered in Wolfsburg and employs about 650,000 people worldwide, raised the prospect of job cuts as it said it seeks to cut back on costs.Chief financial officer Arno Antlitz said:Increased trading tariffs and the resulting negative volume effects burden us by up to 5 billion EUR on a full-year basis.Those effects will continue to persist – and that is why we must rigorously implement the performance programs in place, push forward efficiency measures and develop new approaches.

Our focus will be – among others - on the targeted use of our scale and exploiting synergies within the Group even more effectively.”Last year the group laid out plans to cut back its German workforce by 35,000 roles, which it said would lead to about €4bn in cost savings per year in the medium term.We’re at the midday point, and WPP is still the standout on the FTSE 100, with the shares now down by about 14.5%.There are fears that jobs at WPP could be at risk under new boss Cindy Rose’s strategic review to address “unacceptable” performance at the advertising company.

The FTSE 100 business lost its top spot as the world’s biggest advertising agency by revenue to its French rival Publicis last year.My colleague Kalyeena Makortoff has the full story here:The Eurozone economy grew by 0.2% in the third quarter, slightly ahead of expectations of 0.1% , as France recorded its strongest growth in more than two years.France reported a 0.

5% rise in output, driven by trade and domestic demand.Germany and Italy both narrowly avoided recessions in the third quarter, but overall the figures paint a picture of decent resilience against the uncertainty of US trade tariffs.The economic data comes just a few hours before the European Central Bank sets interest rates this afternoon.The ECB is widely expected to leave interest rates unchanged for the third time in a row.Topshop is to dance into John Lewis more then two months earlier than expected with pop-ups in four stores for six weeks from 3 November, with the London site including regular DJ sessions.

The fashion brand, which is currently only available online or in the Liberty department store in central London, will go into John Lewis’s outlets in Bristol, Leeds, and Liverpool and London’s Oxford Street.In Oxford Street, Topshop will host weekly DJ Sessions every Thursday evening from 13 November in which the brand promised a guest each week would be “bringing live music and energy to shoppers in-store”.The ranges will include party outfits and basics including denim.Topshop, which is owned by online retailer Asos, said last month that it would open 32 outlets in John Lewis from February – its sole UK high street partner.Michelle Wilson, the managing director of Topshop, said:We’ve seen an incredible response to Topshop’s return, and we know our customers are excited to shop the brand in person again.

By taking our Winter and Party collections beyond London, the Topshop pop-ups bring our signature energy and style to locations across the UK, just in time for the festive season.”OpenAI is preparing for an initial public offering that could value the company behind ChatGPT at up to $1 trillion, according to a report by Reuters.The AI company is considering filing for an IPO as soon as the second half of 2026, Reuters has reported, citing three unnamed people familiar with the matter.The news comes after OpenAI completed a new restructuring deal with Microsoft this week, giving the software company a stake of about 27%.Earlier this year OpenAI’s chief financial officer Sarah Friar said the restructuring better positioned the company for a potential IPO, while chief executive Sam Altman has previously said an IPO is the most likely path for the company given how much money it needs to train and build AI systems.

A spokesperson for OpenAI told Reuters:An IPO is not our focus, so we could not possibly have set a date.We are building a durable business and advancing our mission so everyone benefits from AGI.”The energy regulator Ofgem is considering a plan that would cancel up to £500m in energy debt owed to suppliers.The regulator said it is considering plans that would mean people on means-tested benefits with energy debt of more than £100, built up between April 2022 and March 2024, will be eligible for help.These people would need to make some contribution towards paying off the debt or their ongoing energy use.

If they are unable to do so, they would need to work with a debt charity to help manage their money.It comes as the regulator grapples with an energy debt crisis, with unpaid energy bills and fees climbing to a record £4.4bn as of the end of June.This year the Office for National Statistics found that a record proportion of British households were unable to pay their energy bills by direct debt because there was not enough money in their bank accounts.The regulator’s proposal is part of a final consultation and is not yet a firm decision.

However, a spokesman said that on average households could receive debt relief of around £1,200 per account (gas/electric), or around £2,400 per dual fuel customer,Over in Germany, Puma has told investors this morning that it plans to cut more than 900 jobs in a turnaround plan under the new boss Arthur Hoeld,The sportswear brand said it will cut 900 roles by the end of next year as part of a plan to get back to growth by 2027,Puma said it had to address the “the fact that it has become too commercial, which is reflected in muted brand heat, low distribution quality, and a product offering that is not cutting through in the market,”Puma, which is listed in Germany and employed more than 22,000 people at the end of 2024, has lost almost three-quarters of its market value over the past five years, as it has struggled to attract shoppers in an increasingly competitive sportswear market.

The company has already announced about 500 job cuts this year, on top of the 900 further cuts announced today.Hoeld, who joined Puma this spring, said:At the end of July, we stated that 2025 would be a year of reset.Since then, we have taken important steps to clean up Puma’s distribution, improve our cash management and reset our operational expenses.By expanding our cost efficiency programme, we are moving quickly to address challenges and make the business more efficient and resilient.I strongly believe the Puma brand has incredible potential with more than 77 years of history, one of the best product archives in the industry and huge credibility in many major sports.

We have identified the areas in which we need to take decisive action and outlined our strategic priorities to become one global sports brand with globally resonating product ranges and inspiring storytelling across markets,With these strategic priorities, we have the clear ambition to establish Puma as a Top 3 sports brand globally, returning to above industry growth and generating healthy profits in the medium term,”European stocks are opening broadly lower this morning: London’s blue chip FTSE 100 index has fallen by 0,4%,The ad group WPP is the worst performer across the index, with its shares down 8.

6%, after it cut its sales guidance for the year.Haleon, the consumer healthcare group that owns brands such as Sensodyne and Centrum, is the best performer, up 3.3%, after it beat expectations for its third quarter revenue growth.Standard Chartered is a close second, up 3%, after it raised its profit guidance for the year, partly thanks to a boost in its wealth management businsess.The Stoxx Europe 600 index is down 0

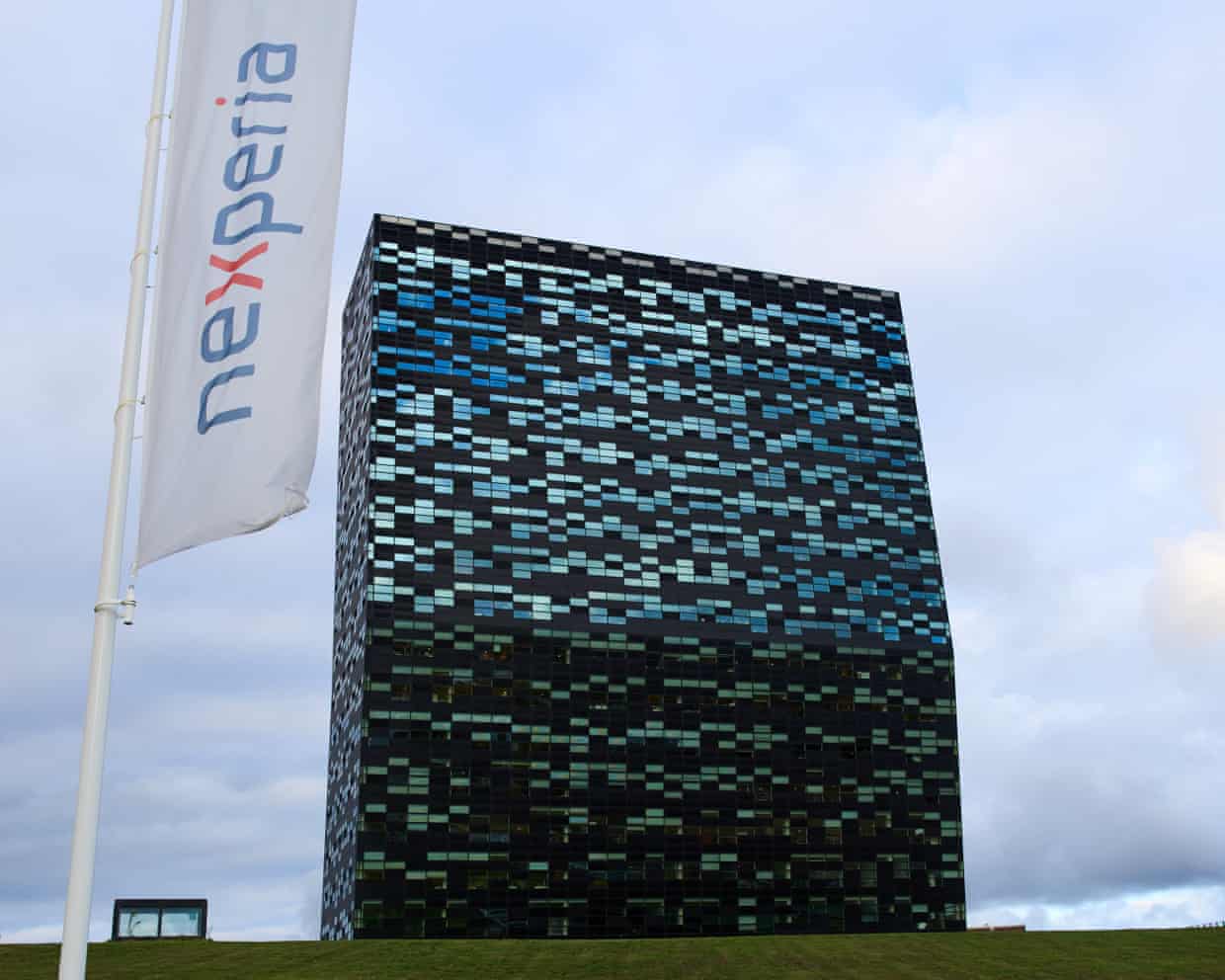

Nexperia halts chip supplies to China in threat to global car production

Nexperia, the EU-based automotive chipmaker at the centre of a geopolitical dispute, has suspended supplies to its Chinese factory, stepping up a trade war that threatens to halt production at carmakers around the world.The company wrote to customers this week informing them all supplies to a Chinese plant had been suspended.In September, the Netherlands used national security laws to take control of the chipmaker, citing concerns that its Chinese owner, Wingtech Technologies, was planning to shift intellectual property to another company it owned. The Dutch government said that threatened the future of European chip capacity, and removed the Wingtech chairman, Zhang Xuezheng, as chief executive.China responded by halting exports from all Nexperia’s factories in China, prompting warnings this week that the embargo would force production lines at EU car factories to close within days

JP Morgan warned US of $1bn in Epstein transactions possibly related to human trafficking

JP Morgan warned the US government about more than $1bn in transactions linked to Jeffrey Epstein that were possibly related to reports of human trafficking, new documents confirm.The largest bank in the US filed a suspicious activity report (SAR) in 2019, just weeks after Epstein was found dead in a New York jail cell, about transactions linked to the paedophile financier and prominent business figures. It also flagged wire transfers made by Epstein to Russian banks.JP Morgan’s report said it had flagged about 4,700 transactions, totalling more than $1bn, that were potentially related to reports of human trafficking involving Epstein, the New York Times reported. The report, filed during the last Trump administration, also flagged sensitivities around Epstein’s “relationships with two U

Apple reports record iPhone sales as new lineup reignites worldwide demand

Apple reported its first quarterly earnings since the release of its new lineup of iPhones on Thursday, beating Wall Street analysts’ expectations. The company showed steady financial growth and a strong bottom line despite slow progress on artificial intelligence. The report comes just days after the company hit a $4tn market value for the first time.“Today, Apple is very proud to report a September quarter revenue record of $102.5 billion, including a September quarter revenue record for iPhone and an all-time revenue record for Services,” Apple’s CEO, Tim Cook, said in a statement

Amazon reports strongest cloud growth since 2022 after major outage

Amazon has made its first financial disclosures since the disastrous outage suffered by its cloud computing division that brought everything from smart beds to banks offline.In spite of the global outage, Amazon Web Services has continued to grow, and this quarter reported a 20% increase in revenue year over year. Wall Street estimated that AWS would bring in $32.42bn in net sales in the third quarter, with the company reporting actual revenue of $33bn.“AWS is growing at a pace we haven’t seen since 2022,” CEO Andy Jassy said in a statement accompanying the earnings report

Liam Lawson cleared of blame by FIA for marshals scare at Mexico Grand Prix

Formula One’s governing body the FIA have issued a statement absolving the Racing Bulls driver Liam Lawson of all blame in an exceptionally dangerous incident when he came close to hitting two marshals running across the track in front of him at the Mexico Grand Prix.The statement is a strong rebuttal to an attempt to hold Lawson responsible made by the Mexican racing federation, the Organización Mexicana De Automovilismo Internacional (Omdai), while the FIA is still carrying out an investigation into the incident.On Tuesday the Omdai issued a statement, not ratified by the FIA, that claimed the marshals should have been “clearly visible” to Lawson and that the New Zealander “did not interrupt his [driving] line despite the obvious presence of marshals on the track”.On Friday the FIA responded by dismissing the assertion. “Having analysed the telemetry from the incident, we can confirm that the driver of Car #30, Liam Lawson, slowed appropriately and reacted correctly to the double yellow flags displayed in the area, braking earlier than in other laps and passing significantly slower than racing speed into Turn 1

Your Guardian sport weekend: England v Australia x2, Women’s World Cup final and more

An epic World Series returns to Toronto for Game 6 with the Blue Jays one win away from their first championship since 1993. We’ll bring you all the action live.England are 2-0 down in the series but can salvage pride in Wellington. James Wallace and Tanya Aldred will be at the OBO helm, while Simon Burnton reports from Sky Stadium.Billy Munday will bring you all the news and set the scene for the day’s football, which includes seven matches in the Premier League as well as the FA Cup first round

Nearly 150,000 aged 90 and above wait 12 hours in England’s A&Es each year

Jaywick’s continued decline and intensifying London poverty tell same story of ‘broken’ Britain

Living with the hidden horrors of illegal HMOs | Letters

Why can’t we eradicate both pensioner and child poverty? | Letters

Alan Kilburn obituary

Almost all children in 73 areas of England live in low-income households