Japan and Switzerland’s economies contract as US tariffs hit exports; Alphabet shares jump after Warren Buffett reveals stake – as it happened

Time to recap.Japan and Switzerland have both suffered an economic hit from Donald Trump’s trade wars.Japan’s GDP shrank by 0.4% in July-September, dragged down by a fall in exports.In a double-blow to Tokyo, shares in Japanese tourism and retail firms have fallen sharply after China warned its citizens not to travel to Japan.

Switzerland, which agreed a new trade deal with the US last week, shrank by 0,5% in Q3,The European Commission, though, is more optimistic than earlier this year,It has raised its forecast for eurozone growth this year,Shares in Google’s parent company, Alphabet, have jumped by more than 5% after Berkshire Hathaway took a stake in the firm.

But billionaire tech investor Peter Thiel has sold his entire stake in Nvidia…WPP’s share price has risen sharply amid speculation that the advertising group could be the subject of a takeover by a rival or a private equity buyer.US construction spending accelerated a little in August, new delayed data shows.A Census Bureau report that had been delayed by the US government shutdown shows that construction spending rose by 0.2% in August, to an annualized ratee of $2.17trn.

Economists had been expecting construction spending to contract by 0.2% in August, so this is encouraging – although rather out of date too!Time to recap.Japan and Switzerland have both suffered an economic hit from Donald Trump’s trade wars.Japan’s GDP shrank by 0.4% in July-September, dragged down by a fall in exports.

In a double-blow to Tokyo, shares in Japanese tourism and retail firms have fallen sharply after China warned its citizens not to travel to Japan,Switzerland, which agreed a new trade deal with the US last week, shrank by 0,5% in Q3,The European Commission, though, is more optimistic than earlier this year,It has raised its forecast for eurozone growth this year.

Shares in Google’s parent company, Alphabet, have jumped by more than 5% after Berkshire Hathaway took a stake in the firm,But billionaire tech investor Peter Thiel has sold his entire stake in Nvidia…WPP’s share price has risen sharply amid speculation that the advertising group could be the subject of a takeover by a rival or a private equity buyer,Another interesting trade to flag…,,tech billionaire Peter Thiel’s hedge fund has sold off its entire stake in Nvidia during the third quarter.

The sale, in a regulatory filing, intensifying worries of an artificial intelligence bubble.The fund, Thiel Macro, sold around 537,742 shares in the AI chip frontrunner in the quarter, the filing showed on Friday.The stake would have been worth around $100m, as of the company’s closing price on September 30, according to Reuters….This is the second major investor to divest from Nvidia, following SoftBank…Bank of England policymaker Catherine Mann has warned that UK businesses are continuing to react to elevated levels of inflation.In a sign that Mann, for one, will not ease off in the battle against inflation, she has insisted there is “work to do” to get inflation back to the BOE’s 2% target.

She pointed to evidence that firms are paying attention to inflation when they come up with their one-year ahead pricing strategies, Bloomberg reports,Mann told a King’s College London event:“For me as a decision maker, that means the underlying dynamic for inflation continues to show upside risk,”“In a high inflation environment, there’s this asymmetry,Firms are far more likely to raise prices than to reduce them,”Mann was one of five policymakers who voted to leave UK interest rates on hold earlier this month, narrowly outvoting the four who wanted a cut,The entire AI trade likely depends on Nvidia earnings due on Wednesday, warns Neil Wilson, UK investor strategist at Saxo Markets:Earnings are seen +54% to $1.

25 per share with revenues +56% yoy to $54,8bn,Analysts are sounding upbeat ahead of the report with guidance expected to be strong on continued ramp of the GB300 advanced AI servers and generally insatiable AI demand as hyperscalers continue to bolster capex,But the bar is set very high and we know that if investors are starting to wobble the whole house of cards can come crashing down at any point,Wall Street’s has opened slightly lower, at the start of a busy week that will bring us a flurry of delayed US economic data and results from Nvidia.

The Dow Jones Industrial Average fell 79.4 points, or 0.17%, at the open to 47068.06, while the broader S&P 500 is down 03% and the Nasdaq has lost 0.5%.

Alphabet’s shares are flying, though – they’re up 5.5% after Warren Buffett’s Berkshire Hathaway revealed it has build a multi-billion dollar stake in the company.A filing on Friday showed that Berkshire owned 17.85 million shares in Google’s parent at the end of September.Buffett is due to step down as CEO of Berkshire Hathaway at the end of this year, so this could be one of the company’s last major trading moves under his leadership.

Alphabet are heavily involved in the artificial intelligence sector, with Google having bought AI research laboratory DeepMind in 2014.Google is also expected to unveil Gemini 3.0, its next major AI model, soon.AXA Investment Managers has revealed that it cut its exposure to UK government bonds on Friday.AXA halved its exposure to UK bonds in some of its portfolios on Friday following news that the government has no plans to raise income tax, a senior fund manager has told Reuters.

Nicolas Trindade, who manages global and sterling bond portfolios for the firm, says:“We are much less comfortable going into the budget,”UK bond yields jumped on Friday, as the price of the debt fell, after it emerged that chancellor Rachel Reeves had abandoned plans to raise the headline rate of income tax,The City has given a mixed reception to a proposed merger of two infrastructure giants,The proposed combination of HICL Infrastructure and The Renewables Infrastructure Group (TRIG) will create the UK’s largest listed infrastructure investment company with net assets in excess of £5,3bn, they told the City this morning.

The boards of HICL and TRIG have signed detailed heads of terms for the deal, under which TRIG would be reconstructed and wound up, with its assets transferred to HICL in return for new HICL shares and cash.The two companies say they have received a “positive market sounding” from large shareholders of both companies.However, HICL’s shares have fallen by 7.3% today while TRIG are up 3.3%.

HICL was the first infrastructure investment company listed on the London Stock Exchange in 2006, and owns a range of infrastucture assets including a portfolio of schools and universities in the UK, Ireland and France, a stake in Affinity Water, and an interest in London St.Pancras Highspeed, the rail link between London St Pancras station and the Channel tunnel.TRIG is focused on renewable energy assets, including a 10% stake in Hornsea One, the wind farm off the Yorkshire coastline.Germany’s finance minister is due to arrive in Beijing today as tensions between China and Europe over supply of chips deepen.Lars Klingbeil’s trip will be the first visit to China by a cabinet minister of the current German government and comes as trade figures show that Germany, once the engine of European manufacturing, is now importing more from China than it is exporting.

It also comes weeks after a cancelled visit by foreign minister Johann Wadephul,China overtook the US largest trading partner in the first eight months of 2025 fuelling European fears that Beijing has been redirecting exports to the EU in the wake of the trade war ignited by Donald Trump,Germany faces a record trade deficit of €87bn with China this year, according to a forecast by state-owned international economic promotion agency Germany Trade & Invest,“Germany is uniquely exposed to the risks of Chinese industrial overcapacity—and it’s going to hit very hard,” said Jacob Gunter, head of the economy and industry programme at the think tank Merics,The dependency of Europe including the UK on China for everything from semi-conductors, to rare earths and critical raw materials, has come into sharp focus in the last two months after the Dutch government effectively took control of the Chinese-owned chip maker Nexperia.

That triggered a fierce response from Beijing, which slapped a global ban on exports of Nexperia’s finished chips, which in turn led to Dutch economy minister Vincent Karremans telling the Guardian that the crisis was a “wake up call” for Europe and the west,A Dutch delegation is also due to land in Beijing this week to try and resolve the matter,In Germany, politicians have called for a full-blown reassessment of policy towards Beijing, some accusing the previous Social Democrat-led government of having let Germany become too dependent on Beijing,Germany’s parliament appointed an expert commission on Thursday to rethink trade policy towards China, which on Friday hit out at Karremans blaming him for the extraordinary chip row and expressing “extreme disappointment” with him,Volker Treier, head of foreign trade at the German Chamber of Commerce DIHK, says:“The Nexperia example should spur us to talk and demand transparency - otherwise a business problem gets used as a geopolitical issue.

”Juergen Hardt, foreign policy spokesperson for chancellor Friedrich Merz’s CDU party, adds:“It must be clear to the Chinese government that we cannot accept economic and political interests being mixed together.”Amazon founder Jeff Bezos is making a move into the AI world.Bezos is to serve as co-chief executive officer of a new artificial intelligence startup that focuses on AI for engineering and manufacturing of computers, automobiles and spacecraft, the New York Times is reporting.The company, called Project Prometheus, has garnered $6.2bn (£4.

7bn) in funding, partly from the Amazon founder, making it one of the most well-financed early-stage startups in the world, the report said, citing three people familiar with the company,This is the first time Bezos has taken a formal operational role in a company since he stepped down as the CEO of Amazon in July 2021, Reuters points out,Though he is involved in Blue Origin, his official title at the space firm is founder,Shares in Google’s parent company are set to rally in a few hours time in New York, after Warren Buffett’s Berkshire Hathaway group revealed it has bought a stake in the tech giant,Alphabet’s shares are up 4.

9% in pre-market trading, after a filing on Friday showed that Berkshire owned 17,85 million shares in Google’s parent at the end of September,This could be one of Berkshire’s last trading moves under Buffett, who is due to step down as CEO of the company at the end of this year,Despite the challenges facing WPP, its chairman could soon be adding a new job to his responsibilities,Sky News reports that Philip Jansen will be named as the next chairman of Heathrow Airport later this month.

They say Jansen got the nod partly thanks to his experience running BT, which like Heathrow is a regulated utility.Heathrow is currently pressing on with its plans for a privately financed third runway and associated airport improvements, at an estimated cost of almost £50bn.A decision on the third runway is expect by the end of this parliament.Jansen became chair of WPP at the start of this year, and last week gave it a vote of confidence by buying 50,000 shares in the company.

Stock market sell-off continues, as Google boss warns ‘no company immune’ if AI bubble bursts – business live

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.Global markets are racking up their fourth day of losses in a row, as concerns over technology valuations are worrying investors.Asia-Pacific stocks have dipped to a one-month low today, amid signs that the enthusiasm that has driven stocks higher in recent months is fading, with shares, risky currencies and crypto assets all slidingMSCI’s broadest index of Asia-Pacific shares outside Japan has lost 1.8%, slipping to its lowest level since mid-October. South Korea’s KOSPI has lost 3

Crest Nicholson plans job cuts and warns on profits, blaming budget uncertainty

The housebuilder Crest Nicholson has warned of job cuts and worse than expected profits after a summer of “subdued” sales amid uncertainty around the possible property taxes in the budget.The Surrey-based company said it planned to close one divisional office and cut 50 roles, including staff at that site and “selective other roles” across the business.Crest said its adjusted profit before tax for the year to 31 October would be at the low end or slightly below the previous estimated range of £28m to £38m, “reflecting a housing market that has remained subdued through the summer, and the continued uncertainty surrounding government tax policy ahead of the forthcoming budget” on 26 November.It cautioned that near-term market conditions were likely to remain challenging.Anthony Codling, a housing analyst at RBC Capital Markets, said budget uncertainty had “wiped out the autumn selling season, a critical period for Crest with an October year-end”

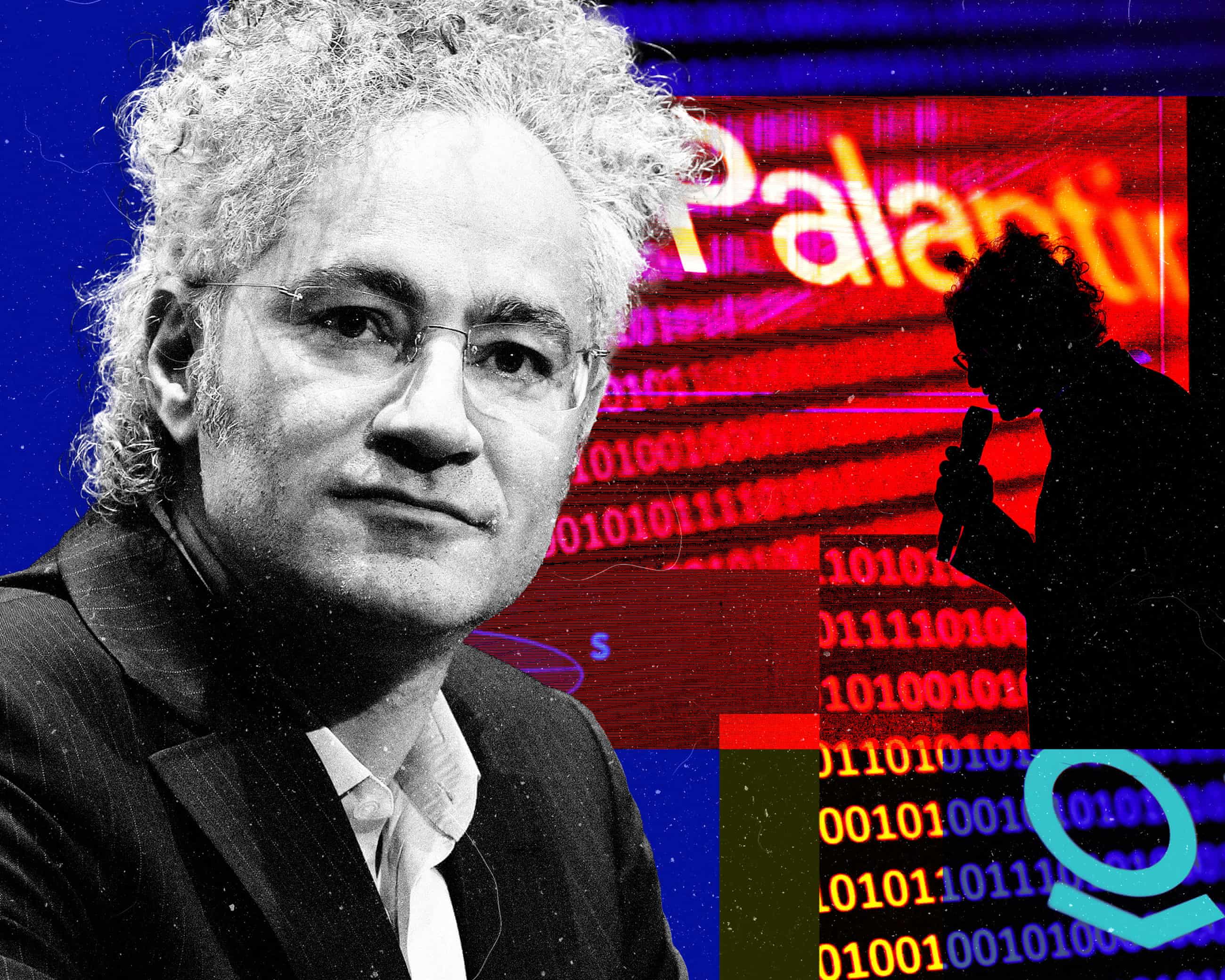

‘Fear really drives him’: is Alex Karp of Palantir the world’s scariest CEO?

His company is potentially creating the ultimate state surveillance tool, and Karp has recently been on a striking political and philosophical journey. His biographer reveals what makes him tickIn a recent interview, Alex Karp said that his company Palantir was “the most important software company in America and therefore in the world”. He may well be right. To some, Palantir is also the scariest company in the world, what with its involvement in the Trump administration’s authoritarian agenda. The potential end point of Palantir’s tech is an all-powerful government system amalgamating citizens’ tax records, biometric data and other personal information – the ultimate state surveillance tool

Don’t blindly trust everything AI tools say, warns Alphabet boss

The head of Google’s parent company has said people should not “blindly trust” everything artificial intelligence tools tell them.In an interview with the BBC, Sundar Pichai, the chief executive of Alphabet, said AI models were “prone to errors” and urged people to use them alongside other tools.In the same interview, Pichai warned that no company would be immune if the AI bubble burst.Since May, Google has introduced an “AI Mode” into its search using its Gemini chatbot, which aims to give users the experience of talking to an expert.Google’s consumer AI model, Gemini 3

The Breakdown | Could new Nations Championship transform Test rugby? The jury is out

There is logic to the fresh international format, due to launch next year, but glaring issues and logistical challenges tooOK, let’s just pick the ball up and run with it for a little while. A reimagined global Test landscape pitching the northern hemisphere against the south commencing next July. Twelve men’s national sides playing six games each with a final playoff weekend. Concluding with one champion team hoisting a shiny trophy aloft in front of, hopefully, a worldwide television audience of millions.On paper – and years of scribbling on the backs of envelopes have gone into this – there is some logic to it

Mark Wood declared fit for first Ashes Test as England seamers ‘lick their lips’ at surface

Mark Wood is fully fit and available for selection in the first Ashes Test on Friday, having come through an extended spell of bowling at full pace in the Perth Stadium nets without issue – before emerging with his pads on to have a bat minutes later – as England’s seamers found conditions at the ground so good they were “licking their lips”.Wood’s left leg was heavily strapped throughout, as it has been since he returned after surgery to that knee in March, but the tightness in his hamstring that concerned him during the first day of England’s warm-up against the Lions last week has dissipated. It is believed that the scan he underwent last Friday was primarily intended to alleviate the player’s fitness worries, with the team’s medical staff never hugely concerned.Jamie Smith was one of the batters who faced Wood in the nets on Tuesday. “He was absolutely rapid today, I can tell you that first-hand,” he said

Spanish Armada-era astrolabe returns to Scilly after mysterious global journey

My Cultural Awakening: I moved across the world after watching a Billy Connolly documentary

The Running Man to David Hockney: your complete entertainment guide to the week ahead

The Guide #217: The Louvre heist seems straight out of a screenplay – no wonder on-screen capers have us gripped

Seth Meyers on Trump: ‘The most unpopular president of all time’

Colbert on Trump and Epstein: ‘They were best pals and underage girls was Epstein’s whole thing’