NEWS NOT FOUND

Benjamina Ebuehi’s recipe for coffee and walnut cookies | The sweet spot

When it comes to British cakes, coffee and walnut is such a staple that if there isn’t one present at a bake sale or coffee morning, I’ll raise an eyebrow. I’ve taken the classic combination and put them in a cookie for something fun and quicker to make. Full of toasty walnuts and a hit of that very nostalgic instant coffee flavour, I finish them off with a white chocolate button as a nod to the sweet, creamy icing.Prep 5 minChill 2 hr+ Cook 55 min Makes 1080g shelled walnuts 140g unsalted butter 1½ tbsp instant espresso powder 100g dark brown sugar 75g caster sugar 1 large egg 150g plain flour 80g porridge oats ½ tsp bicarbonate of soda ½ tsp flaky sea salt 10 white chocolate buttonsHeat the oven to 180C (160C fan)/350F/gas 4. Put the walnuts in a single layer on a small baking tray and roast for 10-12 minutes, until toasty

Bitter-sweet symphony: vermouth is more than just another cocktail ingredient

I like to think of vermouth as the Nile Rodgers of drinks, a backbone of good times known more for big hit collaborations than for its solo work. It is a foundation of any self-respecting cocktail cabinet (though it should be kept in the fridge), and also a family of drinks with many individual talents, which are now at long last being more widely recognised – Waitrose’s most recent Food & Drink report even touted vermouth as a 2026 trend, with searches for the stuff up by 26%.The Guardian’s journalism is independent. We will earn a commission if you buy something through an affiliate link. Learn more

The bubbling beauty of baked pasta

The other day, I climbed the communal stairs and opened the front door to the smell of cheese on toast. A welcome aroma made even more welcome when I realised that it was actually the tips of pasta tubes turning golden among grated cheese and creamy bechamel sauce. To add to the pleasant scene, my partner, Vincenzo, was washing up. Because that is the thing about pasta al forno – baked pasta – the time between finishing the construction and the eating is around about 25 minutes. That is, exactly the right amount of time to wash up and wipe up, or delegate those tasks to someone else while you make a salad and open a bottle of wine

Rachel Roddy’s recipe for beans with greens and sausages | A kitchen in Rome

The benefit of soaking and cooking (or, better still, pressure cooking) your own beans are many: less packaging; money saved (a 500g bag of dried beans costing £2.50 will yield 1.5kg cooked beans, while some 400g tins can cost more or less the same); the suspiciously coloured but flavourful and starchy bean cooking water; and some personal satisfaction that you actually remembered to soak the beans in the first place. The benefits – and joy – of tinned beans, however, are almost instantaneous. That is, just a ring-pull away – unless, of course, said ring-pull comes off prematurely, turning the tin into a door without a knob and leaving you two options: searching for the tin opener that is somewhere in the miscellaneous drawer (or among the picnic equipment, which is on top of the wardrobe), or puncturing the tin at exactly the right spot on the seam with a pointy parmesan knife, which is somewhere in the same drawer

Doom Bar maker Sharp’s Brewery in Cornwall to be closed by US owner

The Cornish brewery that makes Doom Bar ale is to be closed by its US owner, throwing the popular beer brand’s future into doubt and putting about 200 jobs at risk.The drinks company Molson Coors said it plans to shut Sharp’s Brewery in Rock, along with its national call centre in Wales, saying it was “no longer financially sustainable”.The Chicago-based company, which bought Sharp’s 15 years ago, said it was planning to close the site by the end of this year but it “remains committed” to Sharp’s beer brands.Sharp was founded in 1994, and most its sales come from Doom Bar, which is among the bestselling cask ales in the UK, and was named after a notoriously dangerous sandbank in Cornwall’s Camel estuary. Sharp’s also makes Atlantic and Twin Coast pale ales

Table for one: is eating lunch at work on your own a bad thing?

Name: The lonely lunch.Age: Recent, but growing.Appearance: Très misérable.Why are you talking French to me? Have you gone all pretentious? I am talking French to you because this is a French problem.It is? Oui

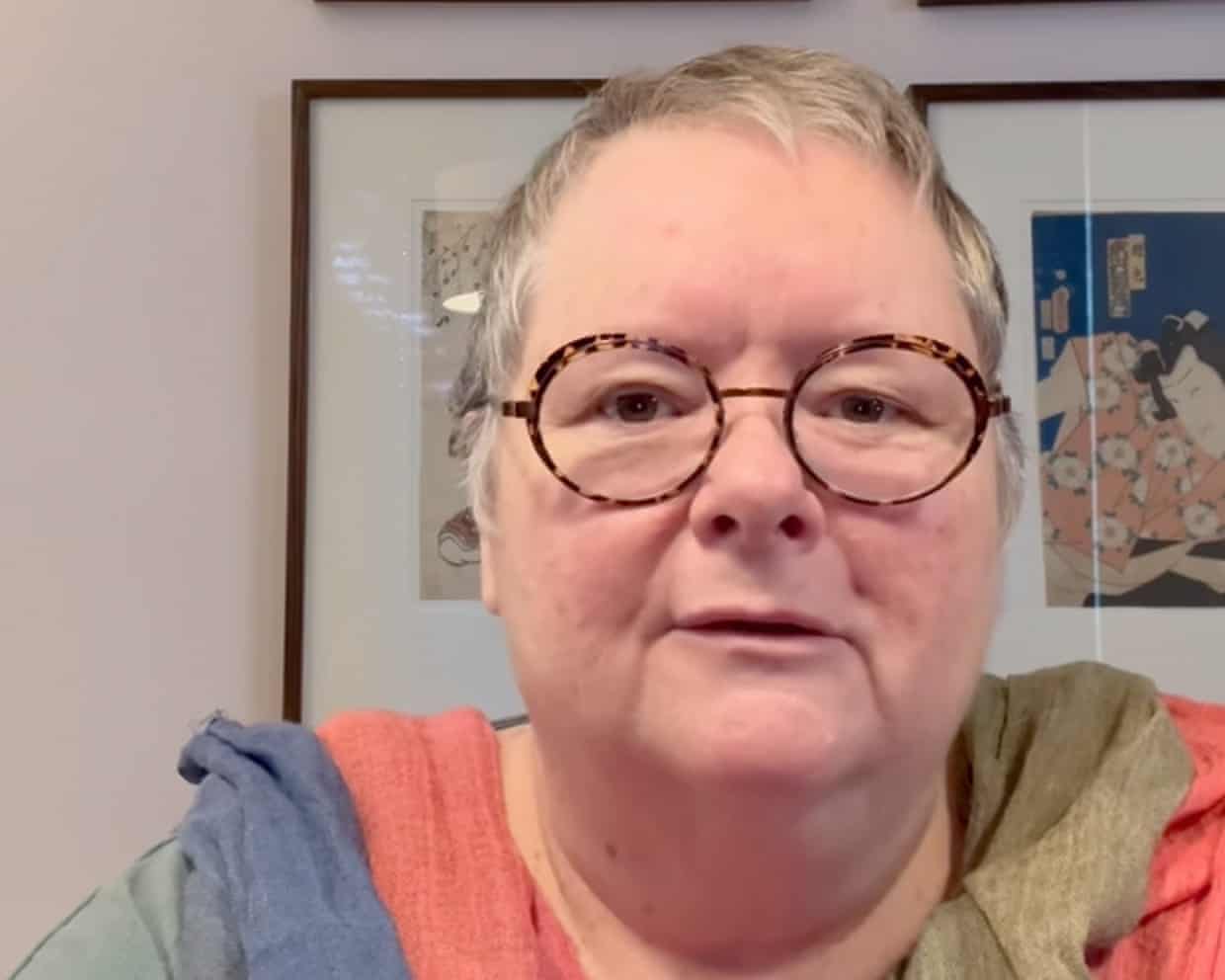

‘Seems I’m not dead’: Magda Szubanski says she is in remission after treatment for stage four cancer

Seth Meyers on Trump’s State of the Union address: ‘A vehicle to attack anyone who doesn’t bend the knee’

‘The sky’s the limit’: Newcastle Art Gallery unveils its ‘divisive’ $48m expansion with a blockbuster opening show

Dead-end boys and West End girls: Lily Allen’s greatest songs – ranked!

Jimmy Kimmel on Trump’s State of the Union: ‘A nutjob wannabe king’

Maxi Shield, beloved Australian drag queen and Drag Race Down Under star, dies aged 51