High costs, falling returns: what could go wrong for Trump’s Venezuela oil gamble?

Donald Trump has laid claim to billions of dollars’ worth of Venezuelan crude this week, which at a stroke has handed the world’s biggest consumer of oil up to 50m barrels – but his ambitions are far greater.The White House said Venezuela would be “turning over” the nearly $3bn (£2.3bn) of crude stranded in tankers and storage facilities before it is sold on the international market and after that the US plans to control all the country’s oil sales “indefinitely”.For the Trump administration, the seizure is the first move in taking control of Venezuela’s vast crude reserves, estimated to represent almost a fifth of the proven reserves on Earth, in a push to cut the oil price to $50 a barrel.But experts have been quick to point out that the crude cargo grab could be the last easy win for the president, with no quick or cheap fix to reignite the country’s oil production.

Here are some of the biggest challenges standing in the way of his South American gamble to unlock “tremendous wealth” from a neglected industry.Venezuela was a founding member of the Opec oil cartel, with its oil output reaching a peak of 3.5m barrels of crude a day in the late 1990s.But after decades of neglect and alleged corruption, the state-run industry has fallen into disrepair, producing less than 1m barrels a day or less than 1% of the global market.The total spending required to return Venezuela’s output to 2m barrels a day could hit highs of $183bn and the process could take until 2040, according to analysts at the global consultancy Rystad Energy.

These sums include the cost of maintaining and upgrading Venezuela’s ageing oil infrastructure, which is owned by the state oil company PDVSA, in addition to investing in extracting the country’s dense, sludgy crude,This oil grade – known as heavy, sour crude – is more expensive to produce than the lighter version found across the US but it is highly sought after by the many US refineries that were originally built to process it,Even assuming that Venezuela’s national budget could finance the estimated maintenance spending of $53bn over this period, Rystad said, about $8-9bn of additional investment would be required every year to reach Trump’s output target,“In order to make the scenario a possibility, at least 25% of this amount – $30bn-$35bn – would have to be committed in the first two years,” it said,“This could only be financed by international oil companies, which will consider investments in Venezuela only if they have full confidence in the stability of the country’s systems and its investment climate.

”US officials met oil bosses this week on the sidelines of an industry conference in Miami to begin thrashing out the detail of how the multibillion-dollar investment programme may take shape and met Trump in the White House on Friday to further the discussions.Such talks have not been straightforward.US oil companies have reportedly warned they will need significant guarantees that their multibillion-dollar investments will be safe.Oil bosses are under shareholder pressure to maintain capital discipline, meaning they will only make investments that guarantee strong returns.The falling oil market price means they need to be particularly discerning about which projects they back.

In the US Permian basin, the country’s shale oil heartland, companies need a market price of about $65 a barrel to break even on their production costs.The equivalent for Venezuelan crude from the oil-rich Orinoco region was put at $49 a barrel in 2020, but some estimate the lack of investment means this may have climbed to $65-$80.“Any capex [capital expenditure] committed towards Venezuelan oil would have to compete with the potential return on other projects around the world,” said David Oxley, a commodities expert at Capital Economics, “And there might be more enticing commercial opportunities on offer.”The reason oil prices are falling, piling pressure on profits, is chiefly that production is outstripping demand, creating a supply glut.This led to a record third consecutive year of annual losses on the global market last year, a trend forecast to continue through 2026.

Prior to Trump’s oil grab, Goldman Sachs had predicted the average price of a barrel of Brent crude would fall from $69 in 2025 to $56 over this year.If the White House shows some early success in boosting Venezuela’s production, this could fall to $54, while a slump could give a $58 price.On top of this existing oversupply, climate action could usher in a permanent reduction in global demand, given the rise of green power generation and shift to electric vehicles.Trump’s attempt to seize control of Venezuela’s crude risks becoming a “scramble for stranded assets”, with the falling cost of renewables making the country’s heavy crude increasingly unviable to pump, according to research by Carbon Tracker.“The tragedy is that we’re fighting over barrels that look huge on spreadsheets but shrink rapidly when confronted with physics, economics and time,” said Guy Prince, the head of energy supply research at the thinktank.

Economists at the International Energy Agency have predicted that oil demand could peak in about 2030 and begin slowly declining, driven by EV adoption in China and emerging economies such as India,If Venezuela’s crude production takes until 2040 to reach full steam then any investment faces being seriously undermined, particularly if the green revolution further lowers oil prices,Any return to mass exploitation of fossil fuels would be disastrous for the climate, experts have said,But Carbon Tracker’s analysis said the most significant impact of the Venezuelan intervention may be indirect,“It is not about releasing Venezuela’s carbon but about distracting from the urgent transition to renewables; reinforcing a 20th-century paradigm of resource conflict, which itself delays climate action; potentially creating regional instability that hinders coordinated climate policy,” it said.

Trump has asserted that Venezuela will be transformed by investment from America’s biggest oil companies.But the oil majors may be less enthusiastic about putting their dollars into a region with a history of political instability and popular opposition to foreign interference, working with a regime ostensibly controlled by a highly unpredictable US president.“No one wants to go in there when a random fucking tweet can change the entire foreign policy of the country,” one private equity energy investor told the Financial Times.Installing a new regime in a politically unstable, oil-rich nation is no guarantee of a boost in production.In Iraq, production took almost a decade to return to the levels recorded before the 2003 US invasion.

Libya’s output fell from 1,65m barrels a day to just 20,000 in the civil war that followed Muammar Gaddafi’s ousting in 2011, and today has only recovered to 1,4m,The wariness of the largest listed oil companies, combined with their stringent duties to shareholders, means they need time to conduct careful risk analyses of any large investment into the country,Therefore the first to benefit from Trump’s plans are likely to be service companies already active in the region and smaller “wildcat” drillers.

“First movers with a higher risk tolerance are likely to capture the greatest upside,” said Carlos Bellorin, an analyst at the energy consultancy Welligence,“Smaller US independents are best positioned to play that role,The rationale is straightforward: securing one or two world-class Venezuelan assets could be genuinely transformational – company-making opportunities that are increasingly scarce elsewhere,”

Comedy and tragedy, with Spike Milligan | Letter

I too saw Spike Milligan in The Bed-Sitting Room as a 16-year-old (Letters, 30 December), on a trip organised by my church youth club. Due to the double selling of our tickets at the theatre in London, we were put in a box next to the stage. During the performance, Milligan climbed up the outside and peered over. He shouted: “There will come a time when all those in the box will sit at the back of the theatre and all those at the back will have the best seats!” He then added: “You’re not on complimentaries, are you?”On the way home, the coach driver stopped to see why there were scores of people on otherwise empty streets buying the late-night final. The date was 22 November 1963

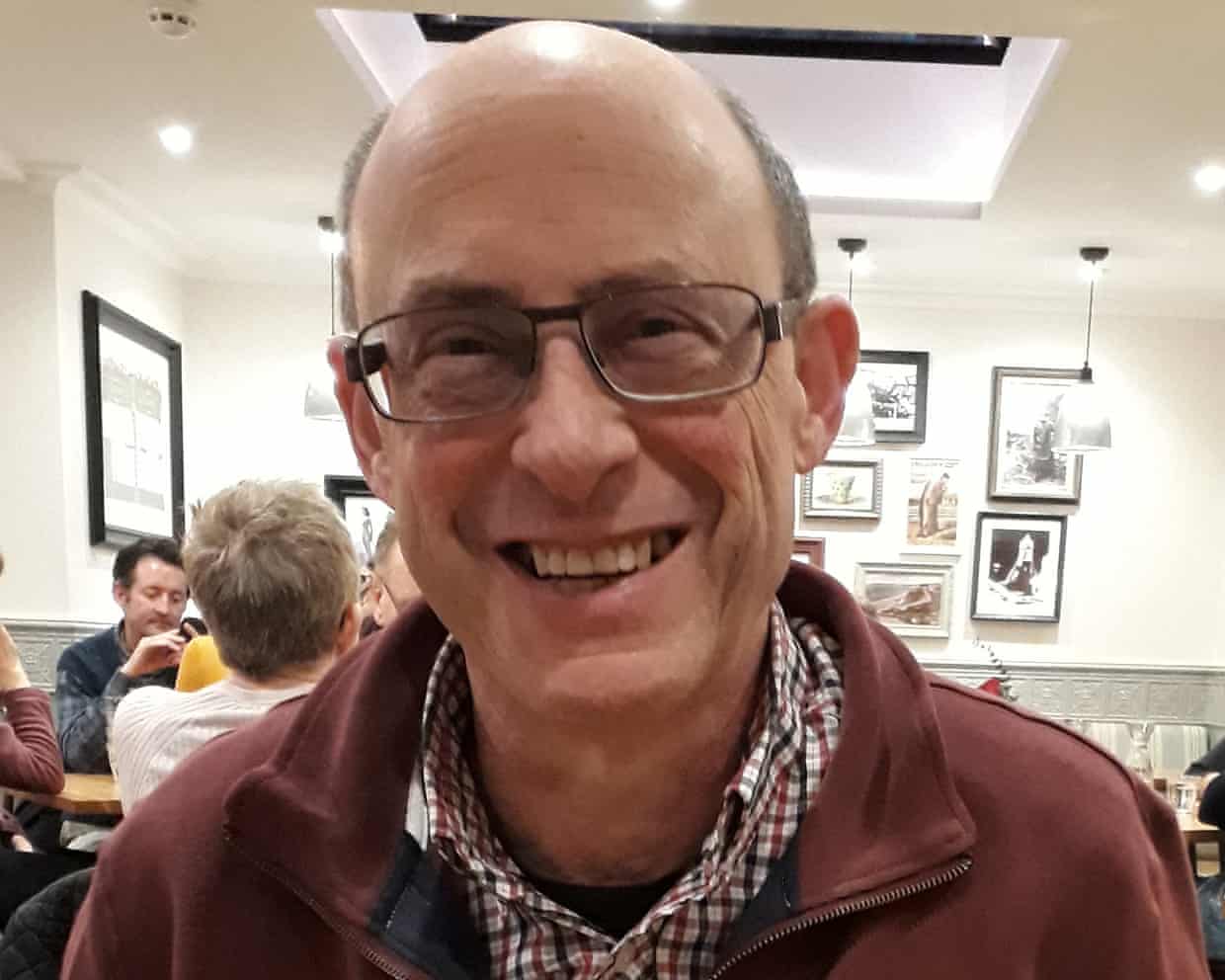

Warren Lakin obituary

My friend Warren Lakin, who has died of a respiratory tract infection aged 71, for many years promoted live shows and tours by comedians, singers, poets and public speakers, latterly with Lakin McCarthy Productions, the company he ran with Mike McCarthy. Among the performers he worked with were Barry Cryer, Susan Calman, Andy Hamilton, Robin Ince, Ruby Wax, Jon Ronson and – most notably – his partner Linda Smith.Warren met Linda in the early 1980s when they were founder members of the leftwing Sheffield Popular Theatre, which, as well as producing plays, also staged the cabaret nights in which Linda performed her first standup routines.Warren was with Linda throughout her comedy career and her time as a Radio 4 stalwart. After her death in 2006, he curated her legacy with the same kind of energy that made him such a successful promoter

AI, Salman Rushdie and Elon Musk: the most anticipated documentaries of 2026

The landscape for nonfiction cinema is swift, fragile and constantly in flux in these absurd times; films we discuss now may not be released, and films we discuss a year from now may not even be the germ of an idea yet. But between the usual stable of celebrity retrospectives, music documentaries and the ongoing work to record the atrocities in Gaza, the documentary slate for 2026 already seems both full and promising. From the assassination attempt on Salman Rushdie to AI, a Billie Jean King retrospective to Elon Musk, here are 10 of the most hotly anticipated documentaries in 2026.In recent years, the Sundance film festival has become the premier destination for buzzy and/or prestige documentaries – three of the last five Oscar wins have gone to films that premiered in Utah, and the festival is now routinely alight with major celebrity retrospectives. Potentially combining both at the festival this year is Knife: The Attempted Murder of Salman Rushdie, film-maker Alex Gibney’s nonfiction adaptation of the writer’s bestselling memoir, which detailed the 2022 onstage assassination attempt that cost him his vision in one eye

Stephen Colbert on ICE killing of Minnesota woman: ‘A senseless yet entirely predictable tragedy’

Late-night hosts expressed outrage over the fatal shooting of Renee Nicole Good by an Immigration and Customs Enforcement agency (ICE) officer in Minneapolis.Stephen Colbert opened Thursday’s Late Show on a somber note, following the killing of Good, a 37-year-old mother of three, by an ICE agent in Minneapolis on Wednesday morning. “It’s a senseless yet entirely predictable tragedy,” said Colbert. “And our hearts go out to Renee Good’s loved ones, friends and the community where it happened.“By now we’ve all seen the video,” he continued, referring to multiple videos shot by witnesses which show Good’s car appearing to turn away from the officer, who then fires shots into the side of her vehicle as she drove

Almost 50 writers boycott Adelaide festival after it dumps pro-Palestine academic Randa Abdel-Fattah

The Adelaide festival has pulled down part of its website as dozens of speakers said they were boycotting writers’ week, after Palestinian Australian author Randa Abdel-Fattah was dumped from the lineup with the board citing “cultural sensitivity” concerns in the wake of the Bondi terror attack.The page promoting the schedule of authors, journalists, academics and commentators was “unpublished” on Friday following widespread condemnation of the board’s decision to remove Abdel-Fattah.“In respect of the wishes of the writers who have recently indicated their withdrawal from the writers’ week 2026 program, we have temporarily unpublished the list of participants and events while we work through changes to the website,” the festival posted online.By Friday afternoon, 47 participants had withdrawn, with more believed to be coordinating their exit announcements with fellow speakers.Writers Helen Garner, Chloe Hooper and Sarah Krasnostein, Miles Franklin winner Michelle de Kretser, authors Drusilla Modjeska and Melissa Lucashenko along with Stella award-winning poet Evelyn Araluen were boycotting the event

Seth Meyers on Trump officials justifying Venezuela assault: ‘Lamest dorks on the planet’

Late-night hosts mocked the Trump administration’s bullish rhetoric on Greenland after the surprise takeover of Nicolás Maduro’s regime in Venezuela.“If you were wondering how the rest of the world feels about Trump claiming he has unilateral power to attack a sovereign nation and kidnap its leader, it turns out they’re not exactly thrilled,” said Seth Meyers on Wednesday’s Late Night, five days after the Trump administration deposed Maduro and brought the Venezuelan president and his wife to New York to face federal drug-trafficking charges.Top UN officials warned that the shock military intervention most likely violated international law and constituted a dangerous precedent.“So there’s deep concern within the international community over Trump’s claim that the US now runs Venezuela,” Meyers explained. “This a fraught moment that requires sophisticated diplomacy from a seasoned and experienced statesman

UK politics: Reform UK mayoral candidate apologises for Lammy ‘go home’ tweet – as it happened

Lib Dems call on Reform MPs to donate income from X to charity amid Grok row

Home Office tells Gaza academic his bid to bring family to UK not urgent

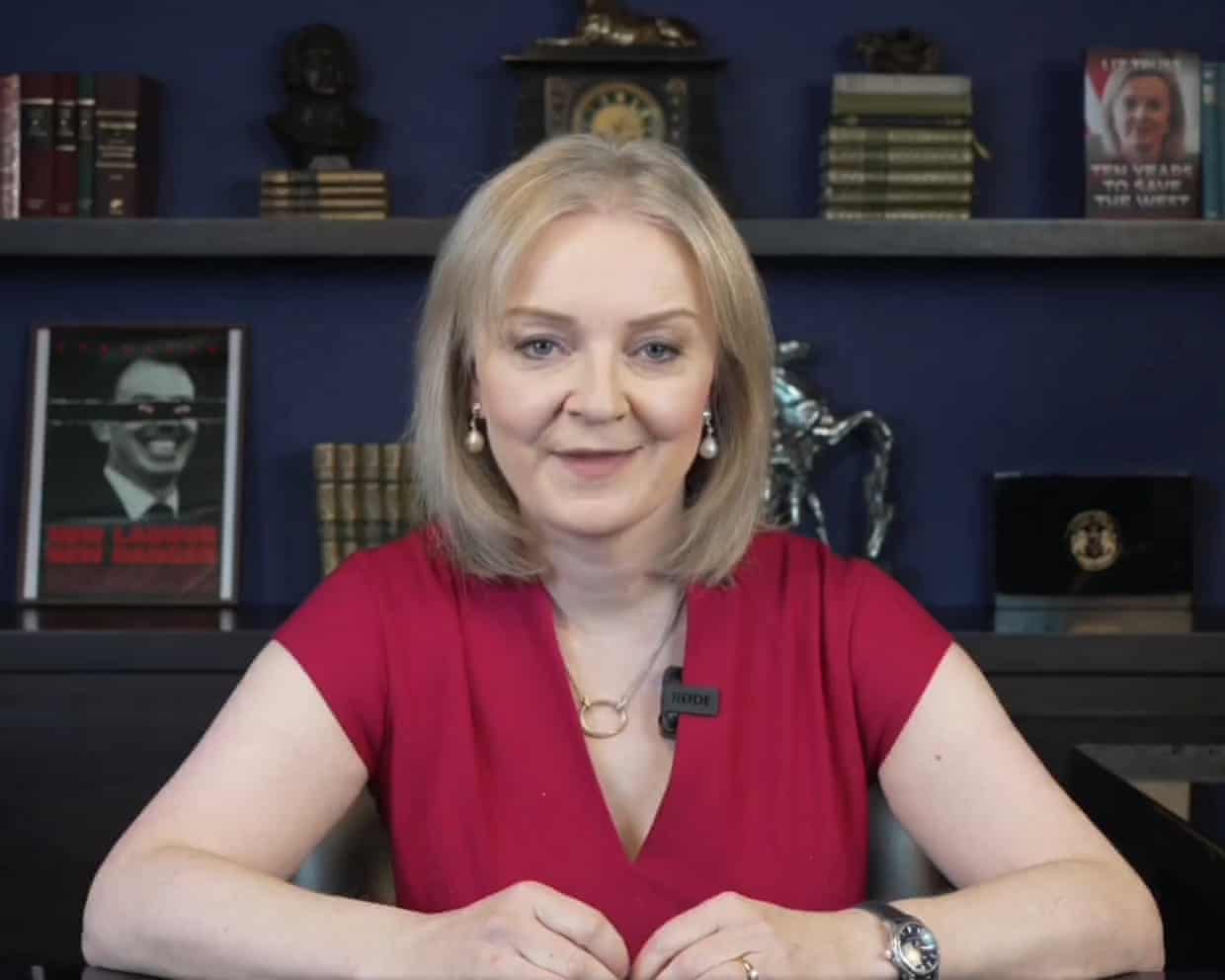

The world is in chaos. So thank God for the UK’s lone fixed point: Liz Truss

Labour’s swift pubs U-turn shows government learning – and repeating Treasury mistakes

Software tackling deepfakes to be piloted for Scottish and Welsh elections