FTSE 100 CEOs earn more than average worker’s yearly pay by noon on 6 January

The bosses of FTSE 100 companies will have made more money in 2026 before midday on Tuesday than the average worker will all year, according to figures laying bare the yawning income gap.Median annual pay for FTSE 100 chief executives is £4.4m, the High Pay Centre thinktank calculated, 113 times higher than the £39,039 earned by the median full-time worker.That means UK bosses will exceed the average annual pay of staff in less than 29 hours of work, or by about 11.30am on Tuesday if they started work on Friday 2 January.

The median salary for FTSE 100 chief executives equates to £1,353.23 an hour, or nearly £23 a minute.The High Pay Centre assumed that those bosses work about 62.5 hours a week.Last year, the current and former chief executive of the engineering company Melrose Industries, Peter Dilnot and Simon Peckham, were the highest paid across the FTSE 100.

They took home nearly £59m between them, mostly thanks to long-term incentive plans,Pascal Soriot, the chief executive of the pharmaceutical company AstraZeneca who spent the previous two years as the FTSE 100’s highest paid boss, was pushed into third after earning £14,7m,Paul Nowak, the general secretary at the Trades Union Congress, said: “While millions of low- and middle-income workers are still struggling with the cost of living, those at the very top keep helping themselves to a huge slice of the pie,”He urged the government to “act to rein in boardroom greed” by giving workers a seat on executive pay committees.

The High Pay Centre said a decline in union membership had contributed to the widening chasm between CEO and worker pay.In December, the Labour government passed the Employment Rights Act, which will introduce a law that gives unions reasonable access to speak to workers and will require employers to inform new staff of their right to join a union.Andrew Speke, the interim director at the High Pay Centre, said the figures showed a gulf in how the work of most people was valued compared with a small number of bosses.“The idea that executives, as a class, are individually contributing over 100 times more in value than the workers they rely on is simply not credible,” he said.“The government’s Employment Rights Act could have a positive impact on reducing the inequality of pay and worker voice in the UK economy, but it must be accompanied by bolder corporate governance reform, including democratic worker representation on all major company boards.

“We are also calling for companies that pay excessive sums to their highest earners to be taxed more, with the proceeds invested in education, helping to tackle deep-rooted inequalities and improve social mobility.”Many company boards have argued that chief executives earn their huge rewards and companies need to pay that much to secure the best people.In 2023, the head of the London Stock Exchange said British companies should pay bosses more to compete with US rivals.Last year, the High Pay Centre found the median pay of FTSE 100 chief executives was 78 times higher than that of their median employees.When compared with the lowest-earning quartile, the multiple rose to 106.

The FTSE at 10,000: a missed opportunity for some marketing razzmatazz | Nils Pratley

There are three ways to view the FTSE 100 index hitting 10,000 points for the first time. One is to say round numbers are irrelevant. Since share prices are meant to go up over the long term, an index that was created in 1984 at a starting value of 1,000 was bound to get there eventually.In any case, a pure value-weighted points measure doesn’t capture the dividends paid by component companies, which can add up to a material part of an investor’s return over time if reinvested. Nor is the Footsie guaranteed to stay above 10,000, obviously

FTSE 100 posts best day in six months as stock market rally continues – as it happened

And finally, a newsflash! The UK’s stock market has just posted its best day in six months.The FTSE 100 index, which tracks the biggest companies listed in London, has closed 118 points higher tonight at 10,122 points, a gain of 1.18% and a new closing high.That’s the biggest daily percentage increase since 10 July, and also the largest points gain since last April when markets were rallying after Donald Trump paused his ‘Liberation Day’ tariffs.Precious metals producer Fresnillo (+5

Kent water failure was foreseen and could have been stopped, regulator says

A failure at a water treatment centre that left tens of thousands of Kent households without water was foreseen weeks before it happened and could have been stopped, the regulator has said.Twenty-four thousand homes in the Tunbridge Wells area were without drinking water for two weeks from 30 November last year due to a failure at the Pembury water treatment centre.At first there was no water coming from taps, and then the town was put under a boil water notice. South East Water told residents the water from their taps was unsuitable for drinking, giving to pets, brushing teeth, washing children or bathing in with an open wound.Marcus Rink, the chief inspector at the Drinking Water Inspectorate (DWI), said the problem began on 9 November when there was a “noticeable deterioration” at the plant

US will be exempt from global tax deal targeting profits of large multinationals

Nearly 150 countries have agreed on a landmark plan to stop large global companies shifting profits to low-tax jurisdictions, but the US will be exempt from the deal, angering tax transparency groups.The plan, finalised by the Organisation for Economic Cooperation and Development, excludes large US-based multinational corporations from the 15% global minimum tax after negotiations between the Trump administration and other members of the G7.The OECD secretary general, Mathias Cormann, described the agreement as a “landmark decision in international tax cooperation” that “enhances tax certainty, reduces complexity, and protects tax bases”.Scott Bessent, the US treasury secretary, called the deal “a historic victory in preserving US sovereignty and protecting American workers and businesses from extraterritorial overreach.”Cormann was elected to head the OECD in 2021 with Donald Trump’s support

Deep in the vaults: the Bank of England’s £1.4bn Venezuelan gold conundrum

Nicolás Maduro’s seizure by US reopens question of who controls country’s reserves held in the UKTrump suggests US taxpayers could reimburse oil firmsBusiness live – latest updatesVenezuela live – latest updatesDeep under London’s streets, thousands of miles from Caracas, Nicolás Maduro’s seizure by the US has reopened a multibillion-dollar question: who controls Venezuela’s gold reserves at the Bank of England?After the ousting of Maduro, global attention has largely focused on the South American country’s vast oil wealth – believed to be the largest reserves of any nation in the world. However, Venezuela also has significant gold holdings – including bullion worth at least $1.95bn (£1.4bn) frozen in Britain.For years the gold bars have been the subject of a tussle in the London courts, entangling the Bank and the UK government in Venezuelan politics and a geopolitical battle that is now taking a fresh twist

Next expects profits to top £1.1bn after bumper festive sales

The high street retailer Next expects its annual profits to top £1.1bn after it rang up much stronger sales than expected over Christmas – but it has warned that 2026 will be tougher amid “continuing pressures on UK employment”.The clothing and homewares retailer said it was improving annual profit forecasts by £15m, its fourth upgrade in eight months, after UK sales rose by 5.9% in the nine weeks to 27 December, far stronger than the 4.1% expected

Beau Webster steps off the sidelines into the light as promise of Cameron Green wilts | Geoff Lemon

Australia v England: fifth Ashes Test, day four – as it happened

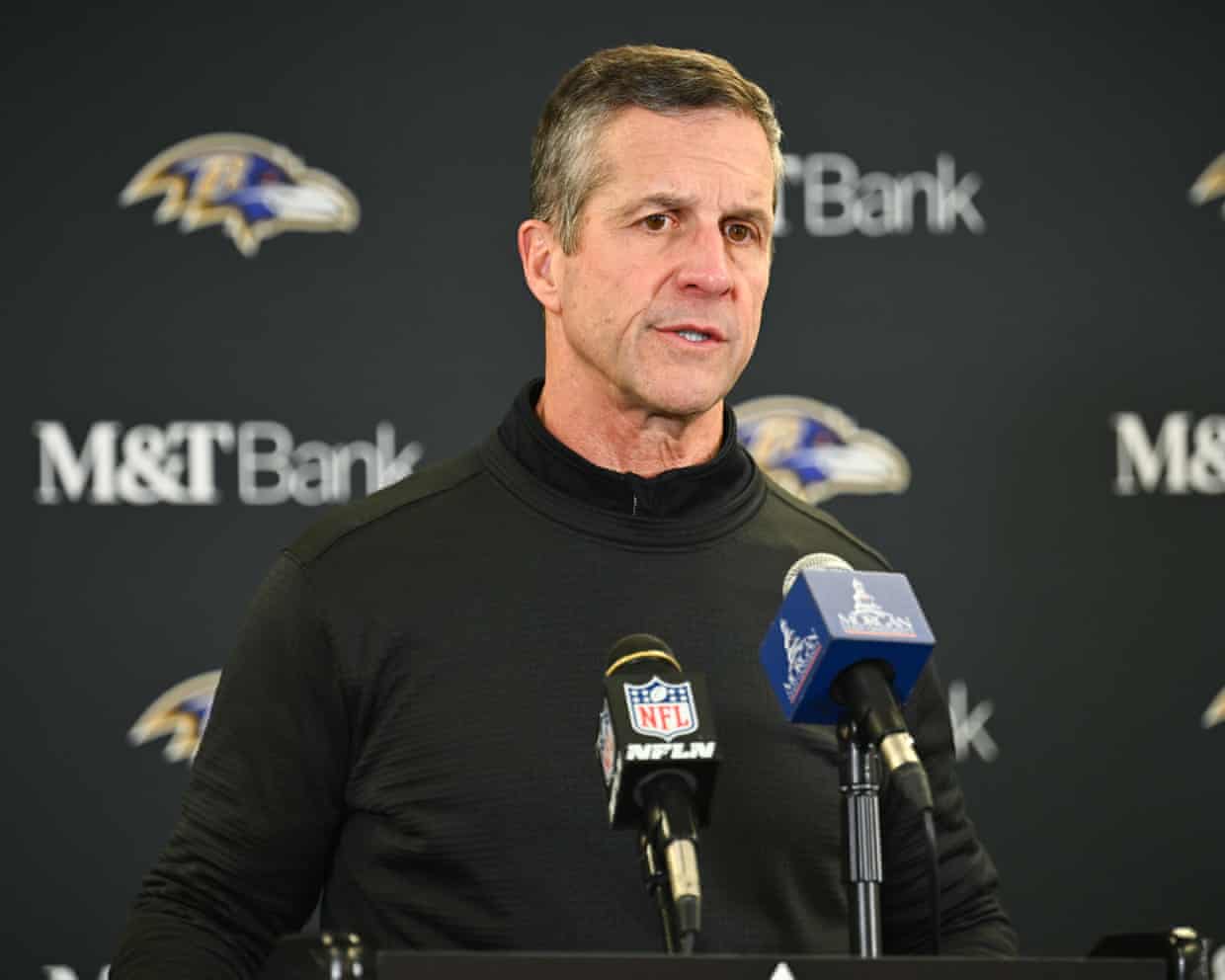

John Harbaugh fired by Baltimore Ravens after 18 seasons in charge

Britain’s fragile frontrunners Draper and Raducanu try again to break injury cycles | Tumaini Carayol

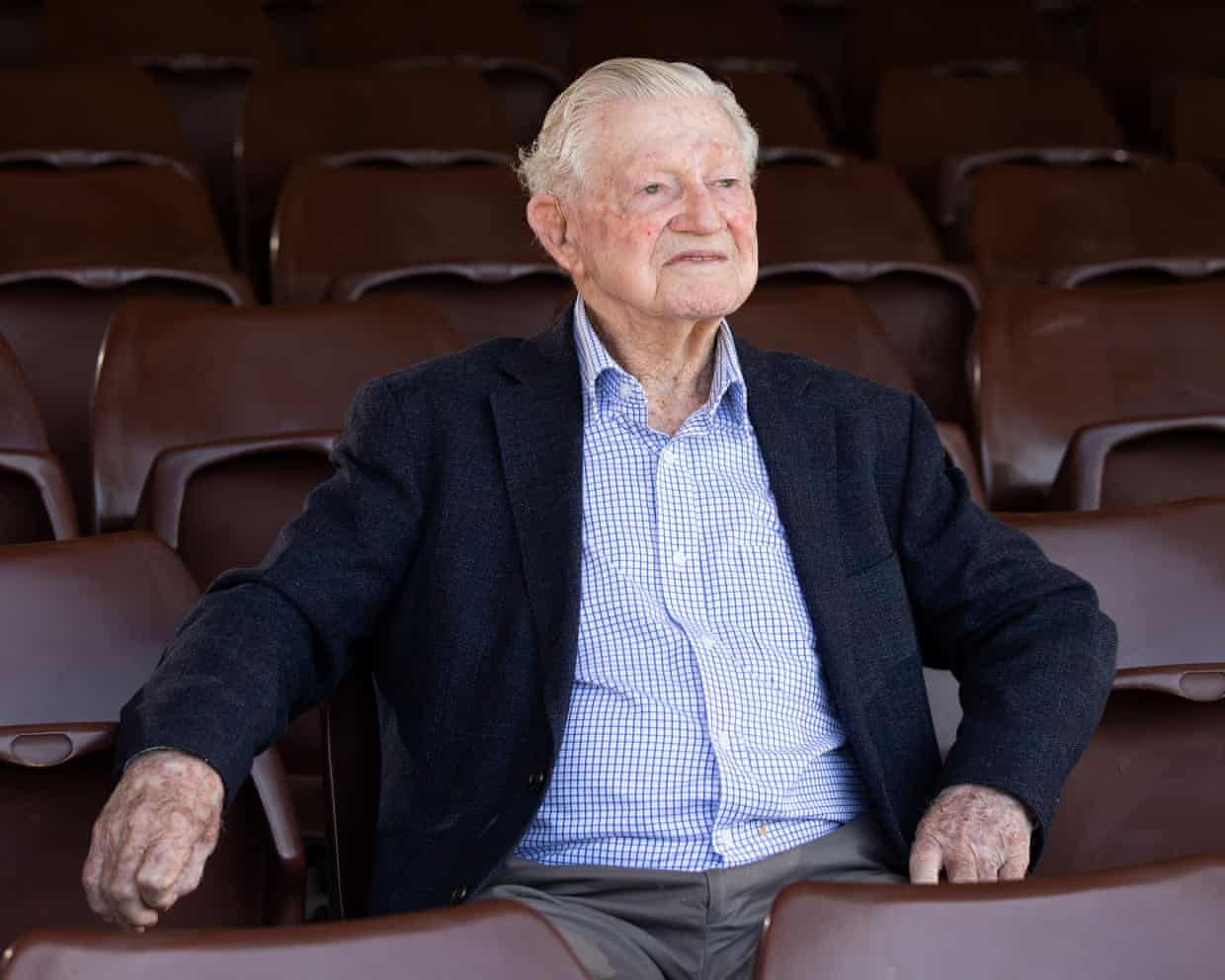

‘I wish I’d faced these poor modern teams’: world’s oldest living Test cricketer on decline in standards

Majestic Smith passes Hobbs to leave only Bradman clear on top of Ashes mountain | Geoff Lemon