UK house prices unexpectedly fell at end of year, Nationwide says

UK house prices fell unexpectedly in December, according to a top mortgage lender, with the market finishing the year with the weakest annual growth in more than 18 months.The average property price slumped by 0.4% to £271,068 compared with November, according to Nationwide, confounding City forecasts of a 0.1% rise.The UK’s biggest building society also said that the rate of annual house price growth slowed to 0.

6% in December, the weakest year-on-year reading since April 2024,Ian Futcher, a financial planner at the wealth management company Quilter, said that while December was usually a quieter month, “this year, that seasonal slowdown was amplified by the timing of the budget”,He added: “With key fiscal decisions pushed later into the year, many prospective buyers and movers chose to put plans on ice until they had clarity on the policy landscape, before then allowing those plans to slip further as attention turned to the festive period,”Nationwide noted that while house prices ended last year on a “softer note”, overall the market had shown resilience through a turbulent 2025,Changes to stamp duty introduced in April created volatility in the market through the spring and summer, and the November timing of the budget created uncertainty in the final quarter of the year.

“Even though consumer sentiment was relatively subdued, with households reluctant to spend and mortgage rates around three times their post pandemic lows, mortgage approvals remained near pre-Covid levels,” said Robert Gardner, the chief economist at Nationwide.The building society said the first-time buyer share of house purchases is above the long-run average, with the share of loans against a deposit of 15% or less at its highest level for a decade.Last month, Halifax said that buyers attempting to get on the property ladder were in the best position to snap up a home in a decade.The UK’s biggest mortgage lender said when property prices were compared with average incomes, affordability was at its strongest since late 2015.In December, the Bank of England cut interest rates from 4% to 3.

75%, with the market expecting further cuts this year to boost activity.“The Bank of England’s decision to cut rates in December marks an important turning point after a prolonged period of tight monetary policy,” Futcher said.“With the budget now behind us and greater clarity on the direction of interest rates, we may finally see at least some of the housing plans that were shelved late last year being dusted off.”

FTSE 100 hits 10,000 point milestone for first time, after best year of gains since 2009 – as it happened

Time to wrap up…The FTSE 100 hit the 10,000 point milestone for the first time, after finishing its best year of gains since 2009. The FTSE 100 jumped on Friday morning to a high of 10,046, a new peak for the index, before easing back slightly. The milestone marks a stellar 12 months for the “Footsie”, which rose by 21.5% over the course of last year.The Chinese car-maker BYD has overtaken Tesla as the top seller of electric cars around the world

Ørsted files legal challenge against US government over windfarm lease freeze

Europe’s biggest offshore wind developer is taking the Trump administration to court over its decision to suspend work on a $5bn project on the north-east US coast.Denmark’s Ørsted filed a legal challenge on Thursday against the White House’s decision 10 days ago to suspend the lease for its Revolution Wind site as part of a sweeping move halting all construction of offshore wind.The attempted injunction is the latest in a series of legal volleys between the renewables industry and Donald Trump, whose administration has sought to block major offshore wind projects from moving ahead since his re-election.Trump, a vocal supporter of the fossil fuel industry, opposes renewable energy, and wind in particular, saying he finds turbines ugly, costly and inefficient.On 22 December, officials from the Department of the Interior suspended the leases for five large offshore wind projects that are under construction in US waters over unspecified “national security risks”

UK house prices unexpectedly fell at end of year, Nationwide says

UK house prices fell unexpectedly in December, according to a top mortgage lender, with the market finishing the year with the weakest annual growth in more than 18 months.The average property price slumped by 0.4% to £271,068 compared with November, according to Nationwide, confounding City forecasts of a 0.1% rise.The UK’s biggest building society also said that the rate of annual house price growth slowed to 0

FTSE 100 breaks 10,000 mark for first time, capping stellar year for UK market

The UK’s blue-chip share index has broken through the 10,000-point level for the first time, as London shares continued to rise after a bumper 2025.The FTSE 100 jumped on Friday morning - the first trading day of the year - to a high of 10,046, a new peak for the index, before easing back slightly.The milestone marks a stellar 12 months for the “Footsie”, which rose by 21.5% over the course of last year.The index of the UK’s biggest listed companies was lifted on Friday by the engineering company Rolls-Royce and the luxury fashion group Burberry, which were among the top risers of the day, up about 4%

Mini-revival of London stock market listings is relief to Rachel Reeves | Nils Pratley

It wasn’t quite a downpour after the drought, but the weather changed for stock market listings in London during the course of 2025. The first half of the year was properly parched as President Trump’s tariff agenda upset everything: fundraisings from flotations, or initial public offerings (IPOs), were the lowest in a miserable run that started in 2022. But data from Dealogic show there was a notable pick-up in activity in the second half, albeit still billions away from that of 2021, the last strong year.The mini-revival will have come as a relief for both the London Stock Exchange and Rachel Reeves. For the former, the dearth of new listings – as opposed to fundraisings by companies already on the exchange – has become an embarrassment in recent years, especially after London failed to land Arm Holdings in 2023

UK government should end rail outsourcing ‘racket’, says union

Railway leaders should “think afresh” about outsourcing contracts and try to run services better, the rail minister has said, as union research indicated six major private suppliers made £150m in profits last year.Rail unions are campaigning to end the widespread outsourcing of jobs such as cleaning, security and catering, arguing that staff employed by third-party companies have worse conditions and that profits could be reinvested in the railway.Analysis by the RMT union estimated that six of the biggest UK outsourcing facilities management companies in rail – Mitie, OCS, Bidvest Noonan, Churchill, Carlisle and ABM – have profit margins on contracts averaging 11%, aggregating profits of £152m in the past year across the national railway and the London Underground.The RMT said many contracts have clauses passing on extra costs, such as increases to the minimum wage or employers’ national insurance contributions, back to the government – in effect, it says, meaning “the outsourcing firms’ profits are protected at the expense of the taxpayer”.One of the companies, Carlisle Support Services, is ultimately owned by the former peer, Tory donor and tax exile Michael Ashcroft

We can still rely on the kindness of strangers | Letters

Flu patient numbers in English hospitals fall for second straight week

Coroner calls for circumcision safety measures after baby’s death in London

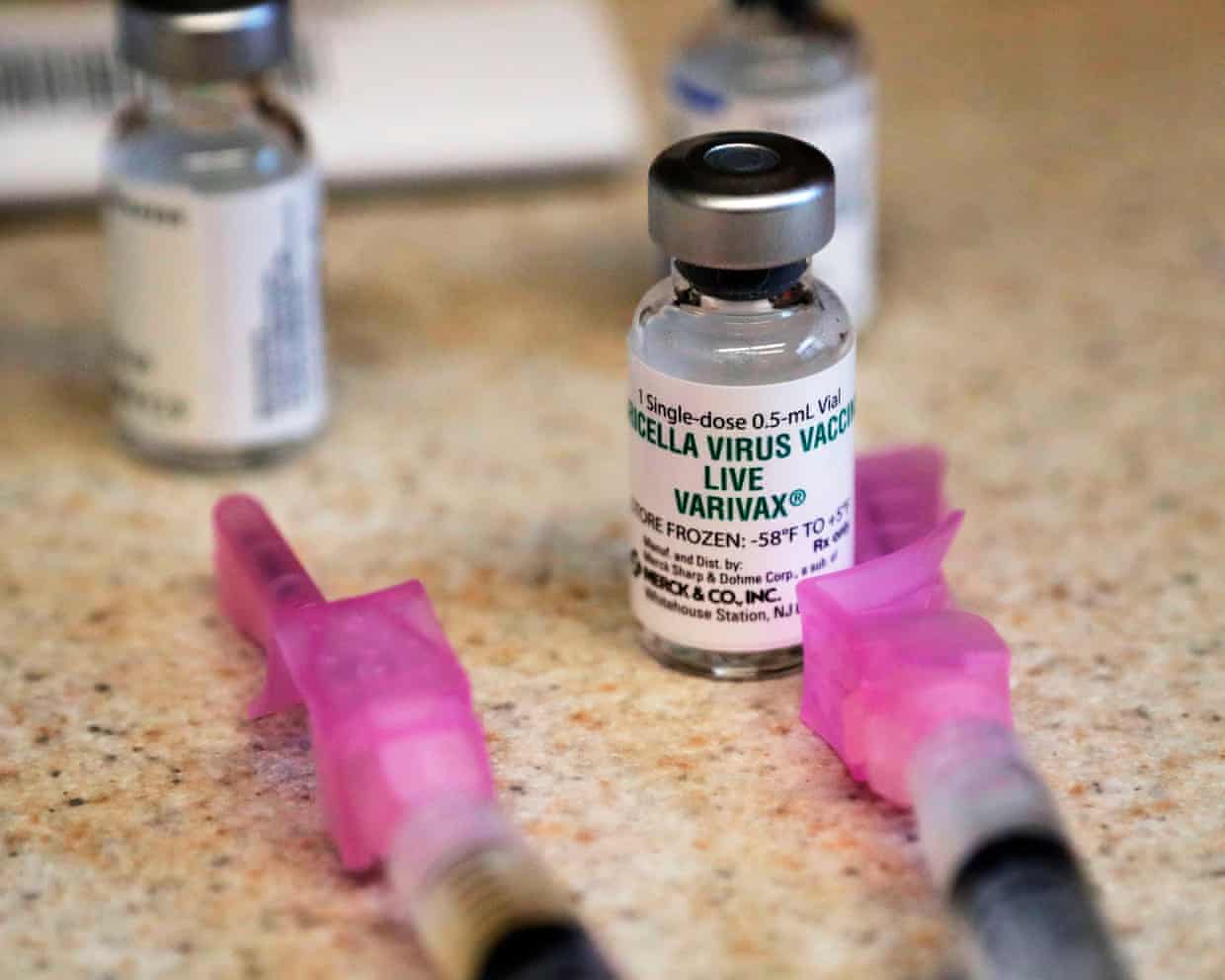

UK children to get chickenpox vaccine with measles, mumps and rubella jab

The reason for Italy’s ‘demographic winter’ | Letters

Two charities that received £1.1m from Sackler Trust kept anonymous to prevent ‘serious prejudice’