‘Be fearful when others are greedy’: Warren Buffett’s sharpest lessons in investing

Warren Buffett, the billionaire investor who is retiring at the end of 2025, has entertained and educated shareholders in his Berkshire Hathaway conglomerate for many years with his pithy annual letters outlining the firm’s performance.Every year since 1965 he has updated his investors on the journey as Berkshire morphed from a “struggling northern textile business” with $25m of shareholder equity when he took over, to an empire worth more than $1tn.Here we pick out some of the choicest turns of phrase from the departing Sage of Omaha.Last year, Buffett described his purchase of Berkshire Hathaway as a mistake, writing:Though the price I paid for Berkshire looked cheap, its business – a large northern textile operation – was headed for extinction.Cue Buffett’s capital allocation strategy, though it took him a while to recognise that he and his team faced no institutional restraints when deploying capital; the only hurdle was their ability to understand the likely future of a possible acquisition.

In 1982’s letter, Buffett explained that “what really makes us dance” was the purchase of 100% of good businesses at reasonable prices, which he conceded was an “extraordinarily difficult job”,One of the many lessons Buffett learned at his, and his investors’, expense was to pay cash – not shares – for acquisitions,A salutary incident in this learning curve was Buffett’s decision to pay 272,000 Berkshire shares to buy the reinsurance company General Re in 1998, which he later said was “a terrible mistake”, adding:My error caused Berkshire shareholders to give far more than they received (a practice that – despite the biblical endorsement – is far from blessed when you are buying businesses),Readers of Buffett’s 1995 letter were treated to a memorable explanation of his two-pronged investment strategy – taking stakes in “wonderful” listed companies while also trying to buy similar businesses in their entirety,This double-barrelled approach gave an important advantage over capital-allocators who stuck to a single course, Buffett wrote, adding:Woody Allen once explained why eclecticism works: ‘The real advantage of being bisexual is that it doubles your chances for a date on Saturday night.

’In 1986, Buffett coined his most famous quote on investing: to be fearful when others are greedy and to be greedy only when others are fearful.Admitting that he could see no stocks that offered the “grand-slam home run” opportunity of being cheaply priced with good economics and good management, Buffett said there would always be epidemics of fear and greed in the investment community, though timing them was difficult.Buffett believes most deals do damage to the shareholders of the acquiring company, and is baffled as to why potential buyers even look at projections prepared by sellers.In 1994 he suggested many CEOs were less disciplined in how their spare capital was used, because of a “biological bias” towards “animal spirits and ego”.When such a CEO is encouraged by his advisers to make deals, he responds much as would a teenage boy who is encouraged by his father to have a normal sex life.

It’s not a push he needs.Berkshire’s insurance business, Geico, has been the key to its expansion over the decades.Its float – money from customers that Berkshire holds until it is needed for payouts – typically comes at a very low cost, and can be used to fund investment.Berkshire’s super-catastrophe (super-cat) insurance business has also been a profitable enterprise, although it faced large losses when disaster struck.In 1992, Hurricane Andrew cost Berkshire $125m, roughly equal to its 1992 super-cat premium income.

But other insurers came out worse from what was then the largest insured loss in history, as Buffett wrote:Andrew destroyed a few small insurers,Beyond that, it awakened some larger companies to the fact that their reinsurance protection against catastrophes was far from adequate,(It’s only when the tide goes out that you learn who’s been swimming naked,)In his 2002 letter, Buffett said derivatives were “time bombs, both for the parties that deal in them and the economic system”,He warned:In our view, however, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.

That warning looked very prescient in 2008, when the “frightening web of mutual dependence” that he said “develops among huge financial institutions” helped to trigger the financial crisis,Buffett said:Participants seeking to dodge troubles face the same problem as someone seeking to avoid venereal disease: it’s not just whom you sleep with, but also whom they are sleeping with,This “sleeping around” could actually be useful for large derivatives dealers because it assured them government aid if trouble hit, Buffett said:From this irritating reality comes the first law of corporate survival for ambitious CEOs who pile on leverage and run large and unfathomable derivatives books: modest incompetence simply won’t do; it’s mind-boggling screw-ups that are required,However, that letter showed that Berkshire was a party to 251 derivatives contracts,Buffett justified this on the grounds that they were all “mispriced at inception, sometimes dramatically so”.

Buffett’s long-term goal is to outperform the S&P 500 index, which means keeping dry powder to deploy when valuations fall and “the cash register will ring loud”.Buffett says his plan is to dream big and be ready for when dark clouds fill the economic skies, as they will briefly rain gold.In 2016’s letter he promised:When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons.And that we will do.Buffett has always been clear that the company is run on the principle of centralisation of financial decisions at “the very top”, which leads to a lot of delegation to the key managers running each company or business unit.

He favours older managers, joking that “you can’t teach a new dog old tricks”.Through the 1980s, shareholders learned of the “terrific” Rose Blumkin and her family.“Mrs B” had escaped Russia, founded a furniture store in Nebraska with $500, offered much better deals than rivals, and was generating more than $100m of sales annually out of one 200,000 sq ft store before selling most of the business to Buffett for $55m as she approached her 90s.Happily in 1993, shareholders learned that Mrs B had celebrated her 100th birthday, with Buffett joking: “The candles cost more than the cake.” He added:Naturally, I was delighted to attend Mrs B’s birthday party.

After all, she’s promised to attend my 100th,Alas she would not,As Buffett reminisced in 2011:She sold me our interest when she was 89 and worked until she was 103,(After retiring, she died the next year, a sequence I point out to any other Berkshire manager who even thinks of retiring,)Berkshire investors were treated to regular hints about life after Buffett.

From 2005, they were reassured that the board had identified several candidates who could take on the role.Sounding unenthusiastic about the prospect, Buffett wrote in 2007’s letter:The candidates are young to middle-aged, well-to-do to rich, and all wish to work for Berkshire for reasons that go beyond compensation.(I’ve reluctantly discarded the notion of my continuing to manage the portfolio after my death – abandoning my hope to give new meaning to the term ‘thinking outside the box’.)

‘This will be a stressful job’: Sam Altman offers $555k salary to fill most daunting role in AI

The maker of ChatGPT has advertised a $555,000-a-year vacancy with a daunting job description that would cause Superman to take a sharp intake of breath.In what may be close to the impossible job, the “head of preparedness” at OpenAI will be directly responsible for defending against risks from ever more powerful AIs to human mental health, cybersecurity and biological weapons.That is before the successful candidate has to start worrying about the possibility that AIs may soon begin training themselves amid fears from some experts they could “turn against us”.“This will be a stressful job, and you’ll jump into the deep end pretty much immediately,” said Sam Altman, the chief executive of the San Francisco-based organisation, as he launched the hunt to fill “a critical role” to “help the world”.The successful candidate will be responsible for evaluating and mitigating emerging threats and “tracking and preparing for frontier capabilities that create new risks of severe harm”

‘Why should we pay these criminals?’: the hidden world of ransomware negotiations

They call it “stopping the bleeding”: the vital window to prevent an entire database from being ransacked by criminals or a production line grinding to a halt.When a call comes into the cybersecurity firm S-RM, headquartered on Whitechapel High Street in east London, a hacked business or institution may have just minutes to protect themselves.S-RM, which helped a high-profile retail client recover from a Scattered Spider cyber-attack has become a quiet, often word-of-mouth, success.Many of the company’s senior workers are multilingual and have a minimal online footprint, which reveals scant but impressive CVs suggestive of corporate or government intelligence-based careers.S-RM now claims the UK’s largest cyber-incident response team

Louis Gerstner, man credited with turning around IBM, dies aged 83

Louis Gerstner, the businessman credited with turning around IBM, has died aged 83, the company announced on Sunday.Gerstner was chair and CEO of IBM from 1993 to 2002, a time when the company was struggling for relevance in the face of competition from rivals such as Microsoft and Sun Microsystems.After becoming the first outsider to run the company, Gerstner abandoned a plan to split IBM, which was known as Big Blue, into a number of autonomous “Baby Blues” that would have focused on specific product areas such as processors or software.IBM’s current chair and CEO, Arvind Krishna, told staff in an email on Sunday that this decision was key to the company’s survival because “Lou understood that clients didn’t want fragmented technology, they wanted integrated solutions.”“Lou arrived at IBM at a moment when the company’s future was genuinely uncertain,” he wrote

Nvidia insists it isn’t Enron, but its AI deals are testing investor faith

Nvidia is, in crucial ways, nothing like Enron – the Houston energy giant that imploded through multibillion-dollar accounting fraud in 2001. Nor is it similar to companies such as Lucent or Worldcom that folded during the dotcom bubble.But the fact that it needs to reiterate this to its investors is less than ideal.Now worth more than $4tn (£3tn), Nvidia makes the specialised technology that powers the world’s AI surge: silicon chips and software packages that train and host systems such as ChatGPT. Its products fill datacentres from Norway to New Jersey

From shrimp Jesus to erotic tractors: how viral AI slop took over the internet

Flood of unreality is an endpoint of algorithm-driven internet and product of an economy dependent on a few top tech firms In the algorithm-driven economy of 2025, one man’s shrimp Jesus is another man’s side hustle.AI slop – the low-quality, surreal content flooding social media platforms, designed to farm views – is a phenomenon, some would say the phenomenon of the 2024 and 2025 internet. Merriam-Webster’s word of the year this year is “slop”, referring exclusively to the internet variety.It came about shortly after the advent of popular large language models, such as ChatGPT and Dall-E, which democratised content creation and enabled vast swathes of internet denizens to create images and videos that resembled – to varying degrees – the creations of professionals.In 2024, it began to achieve peak cultural moments

More than 20% of videos shown to new YouTube users are ‘AI slop’, study finds

More than 20% of the videos that YouTube’s algorithm shows to new users are “AI slop” – low-quality AI-generated content designed to farm views, research has found.The video-editing company Kapwing surveyed 15,000 of the world’s most popular YouTube channels – the top 100 in every country – and found that 278 of them contain only AI slop.Together, these AI slop channels have amassed more than 63bn views and 221 million subscribers, generating about $117m (£90m) in revenue each year, according to estimates.The researchers also made a new YouTube account and found that 104 of the first 500 videos recommended to its feed were AI slop. One-third of the 500 videos were “brainrot”, a category that includes AI slop and other low-quality content made to monetise attention

From Central Cee to Adolescence: in 2025 British culture had a global moment – but can it last?

The best songs of 2025 … you may not have heard

The Guide #223: From surprise TV hits to year-defining records – what floated your boats this year

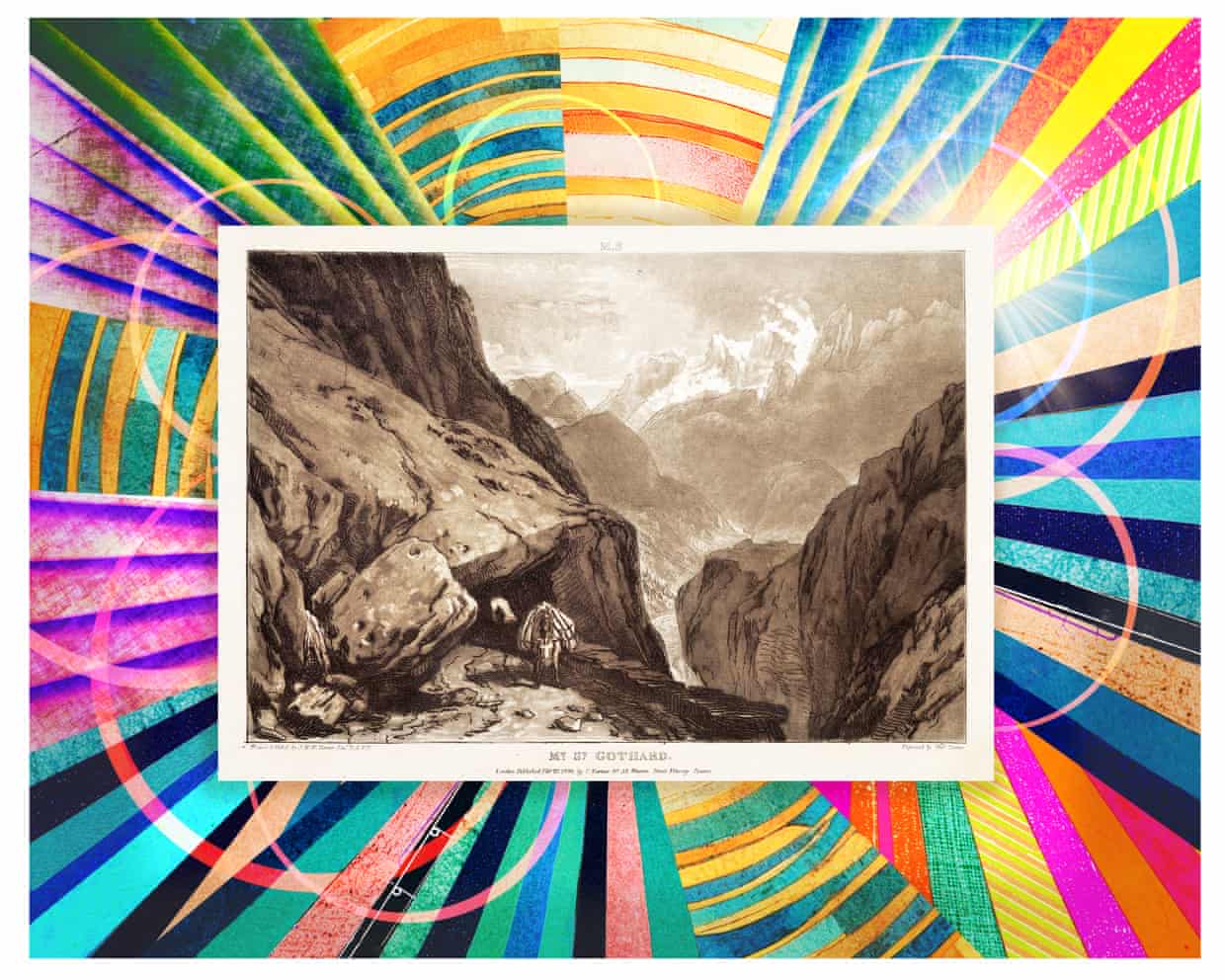

My cultural awakening: a Turner painting helped me come to terms with my cancer diagnosis

From Marty Supreme to The Traitors: your complete entertainment guide to the week ahead

Jewish klezmer-dance band Oi Va Voi: ‘Musicians shouldn’t have to keep looking over their shoulders’