Marks & Spencer’s cyber-trauma is bad, but clearly manageable

You can tell Marks & Spencer is recovering from its cyber-attack trauma because Stuart Machin, the chief executive, now has time to indulge in some chancellor-baiting,Rachel Reeves’ pre-budget speech on Tuesday was a “nothing” announcement, said Machin, that will just make consumers more worried,Even his mum had been calling him to debate what it meant,He makes a fair point,The warmup to the budget has been far too drawn-out and the chancellor’s clunky exercise this week in trying to manage expectations, even if it was primarily aimed at the bond market, only added to the sense of confusion.

The budget should have happened a month ago.Still, back in the day job, Machin can reasonably claim “the incident” – the Easter cyber-attack that took out the website for six weeks and had M&S employees resort to pen and paper for stock-keeping – will be viewed as just “an extraordinary moment in time”.The food side of operation has been quicker to recover, which always seemed likely because its supply chains are more UK-focused and move faster anyway.Food sales in the half were up 7.8%, maintaining the multi-year run of outpacing inflation.

The cyber-pain showed in lower profit margins as manual stock control meant more waste.The clothing and home division has been a slower slog in restoring availability – and slower than expected, conceded Machin.Losing data for weeks means losing forecasting ability, which affects everything from ordering garments to the personalisation of emails to Sparks loyalty card holders.Sales declined by 16.4% in the half, with the website obviously being the major drag.

But May’s preliminary estimate of the trading damage to profits has proved roughly accurate.Machin suggested £300m-ish back then; now he’s talking £324m, of which £100m is covered by insurance.The City viewed that as reassuring.The lingering hangover should clear fully by early next year.At that point, everybody can look again at the story of more expansion in food, where the aim is to double sales over the long term, and the churn in the estate of “full line” stores.

The latter is an exercise in closing smaller units and opening a few bigger, and more efficient, stores and still has many more laps to run.So it feels highly likely that, after this year’s whack to profits, M&S’s numbers for the 2026-27 financial year should be what it would have achieved anyway.The round number of £1bn of pre-tax profits may follow the year after, think City analysts.The stock market was never overly worried by the cyber-attack, it should be said.It took the clinical view that, ultimately, one lost year of profit progress does not seriously alter the value of a business worth £8bn if the medium-term trajectory is intact, which it is, and if the balance sheet is conservative, which is also the case.

Over the course of the year, M&S’s shares have gone roughly sideways.In the cyber-damage stakes, the severity was not at Jaguar Land Rover levels.Reeves’ budget, as it affects the spending power of consumers, does indeed loom larger.

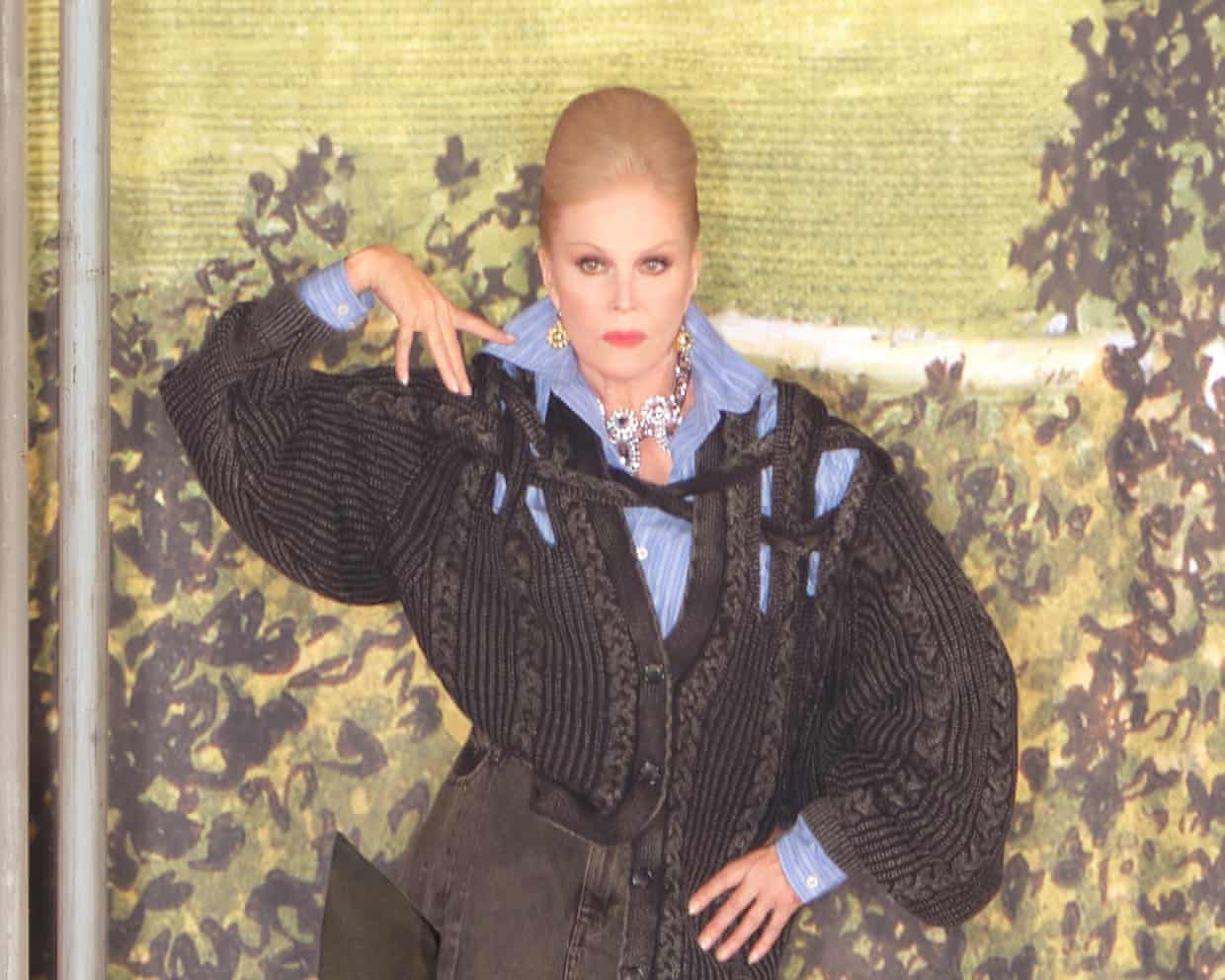

‘A lifeline’: how fashion designers came to love the high street collab

When the boss of Marks & Spencer reported a drop in clothing sales in its latest half-year results on Wednesday, he was keen to stress the problems were down to spring’s devastating cyber-attack and “not due to lack of demand”.Stuart Machin said the once-staid retailer had been “inundated with requests” for its fashion range, which has been revitalised in recent years and was again lifted by last year’s collaboration with designer Bella Freud.On Thursday last week, M&S launched a fresh tie-up, this time with London fashion label 16Arlington. With sequin dresses, statement evening coats and tops with feather detail, it’s set for the festive party season.It came on the same day H&M unveiled a similar venture with Glenn Martens, the Belgian designer about to take over at Maison Margiela

Drax power plant to go on earning ‘over £1m a day’ from burning wood pellets

Britain’s biggest power plant will continue to earn more than £1m a day from burning wood pellets under a new government subsidy contract designed to halve its financial support, according to analysts.The Drax power plant in North Yorkshire is in line to earn £458.6m a year between 2027 and 2031 after the government agreed to extend its subsidies beyond 2026, according to analysts at Ember, a climate thinktank.The earnings are well below the £869m in subsidies handed to the Drax power plant last year for generating about 5% of the UK’s electricity from burning biomass after the government promised to curb the use of biomass in Britain’s power system.Under the contract, Drax will be paid to run just over a quarter of the time, down sharply from almost two-thirds of time currently

European markets down and Asian chipmakers tumble in global stock sell-off amid worries over AI bubble – as it happened

Jim Reid, analyst at Deutsche Bank, said there is talk of whether we are “on the verge of an equity correction”.The last 24 hours have brought a clear risk-off move, as concerns over lofty tech valuations have hit investor sentiment. Markets compounded these losses in the early hours of Asian trading but have been rallying back in the couple of hours prior to going to print with US futures clawing back towards flat with the Kospi rallying back a couple of percentage points from early -5% plus losses.On Wall Street yesterday, the S&P 500 closed down 1.17%, losing ground because of sharp losses among tech stocks, and there was a big slump for Palantir (-7

Ozempic maker struggles as it loses ground to rivals in weight-loss market

The maker of Ozempic and Wegovy has cut its sales and profit forecasts as it continues to fall behind in the competitive market for obesity and diabetes treatments.Novo Nordisk’s chief executive, Mike Doustdar, who took the reins in August, said the reduced guidance was because of “the lower growth expectations for our GLP-1 treatments”.“The market is more competitive than ever more,” Doustdar said in a video message accompanying the company’s third-quarter results.The Danish pharmaceutical firm’s rate of profit growth has slowed and its share price has slid after losing ground to its US rival Eli Lilly, which makes the Mounjaro and Zepbound weight-loss injections. Clinical studies have shown that Mounjaro is more effective in causing weight loss than Wegovy

M&S boss says Reeves made customers more worried with pre-budget speech

The boss of Marks & Spencer has said Rachel Reeves has made his customers “more worried” about rising costs with her pre-budget speech as retailers prepare for the key Christmas trading period.Stuart Machin said his shoppers were “worried about rising costs and they did get more worried” after the chancellor failed to rule out breaking manifesto pledges not to raise key taxes in her speech on Tuesday.The M&S chief executive suggested Reeves’s lack of detail in spelling out her plans had left shoppers and businesses unsure about what new costs they could face in the months ahead.“Shoppers are planning for a good Christmas, but planning for the worst with the budget and hoping for the best,” he said.Expressing frustration about the timing of the fiscal event – just two days before Black Friday on 28 November, the US-inspired discount day which has become one of the year’s busiest shopping days – Machin said: “We are all sitting here waiting for the 26th”

Global stock markets fall sharply over AI bubble fears

Global stock markets have fallen sharply amid concerns that a boom in valuations of artificial intelligence (AI) companies could be rapidly cooling.Markets in the US, Asia and Europe have fallen after bank bosses warned a serious stock market correction could lie ahead, after a run of record stock market highs led some companies to appear overvalued.In the US, the tech-focused Nasdaq and the S&P 500 on Tuesday suffered their largest one-day percentage drop in almost a month.Technology shares pulled the Nasdaq lower, which resulted in it closing 2% down. Meanwhile, there were one-day falls for all of the “magnificent seven” AI-related stocks, including the chipmaker Nvidia, Amazon, Apple, Microsoft, Tesla, Alphabet (the owner of Google) and Meta (the owner of Facebook, Instagram and WhatsApp)

Miscounting to six costs Tory stand-in his gotcha against poppy-shock Lammy | John Crace

Letter: Prunella Scales obituary

Reeves refuses to say she will stick to manifesto pledge on tax rises and insists she must face world ‘as it is’ – as it happened

Reeves wants to talk about the budget, but she’s taken a vow of white noise | John Crace

French taxi driver cleared of stealing from David Lammy after fare dispute

Starmer was briefed on Mandelson’s Epstein links before appointing him, say civil servants