Wall Street hits new highs as Nvidia becomes world’s first $5tn company – as it happened

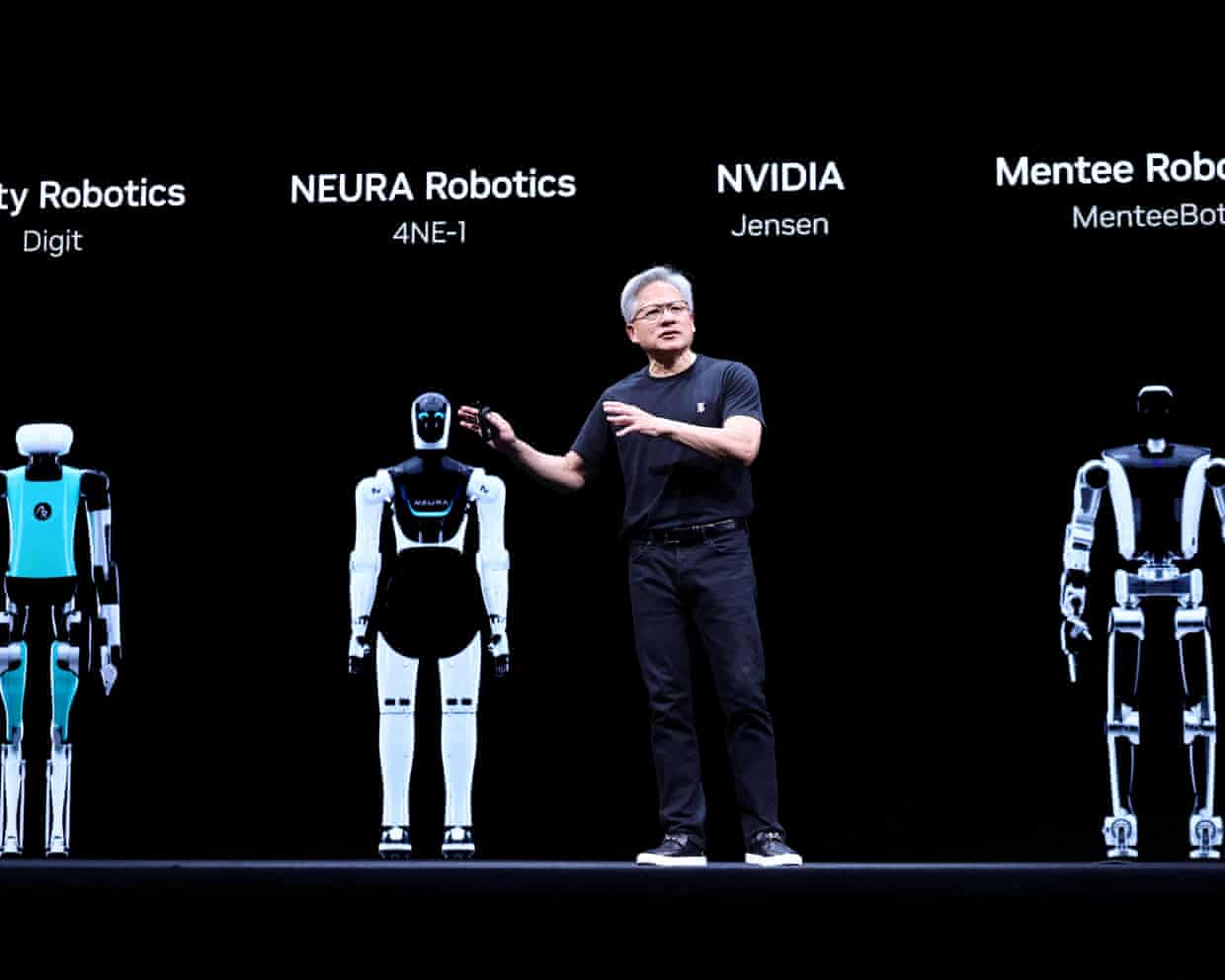

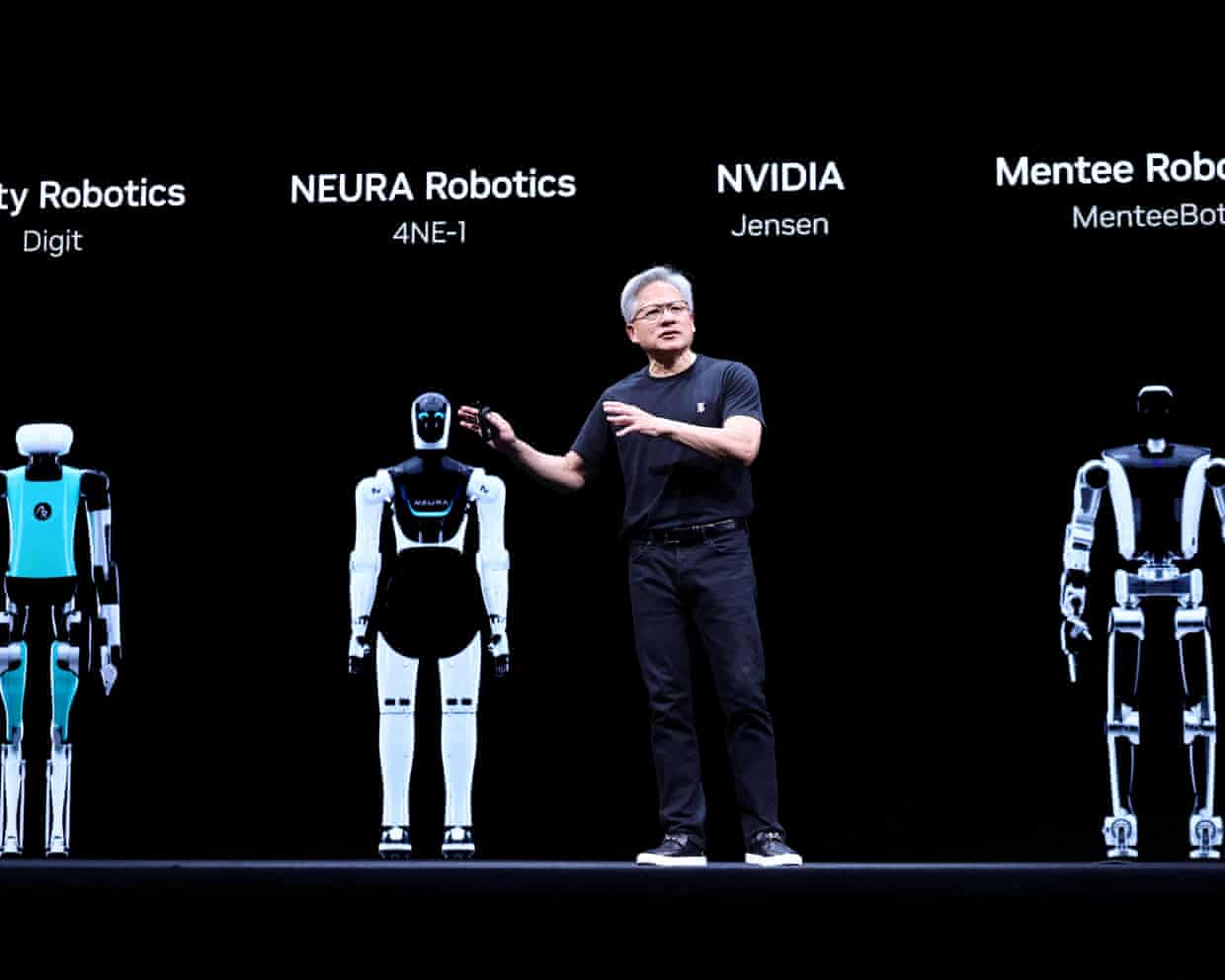

Wall Street’s main indices hit new record highs, as Nvidia become the first company ever to surpass a $5tn stock market valuation.This comes amid a wave of big tech earnings reports, and as investors are waiting for the US Federal Reserve’s interest rate decision later today – it is widely expected to cut rates by a quarter point to 4%.Art Hogan, chief market strategist at B.Riley Wealth Management, told Reuters:While the $5tn milestone seems unfathomable in a historic context, it comes in the wake of a company that has managed to outperform on all metrics.Nvidia shares rose as much as 5% and are now up 4.

5%, boosted by chief executive Jensen Huang’s spree of deals, $500bn in AI chip orders, and plans to build seven supercomputers for the US government.The S&P 500 tech index gained 1.4% while the wider S&P 500 rose by 0.3%, the Nasdaq added 0.7% and the Dow Jones was up 0.

6%.The three main US stock indices have been hitting record highs in recent days, driven by the AI boom, positive company earnings and expectations of rate cuts from the US central bank.Nvidia has become the world’s first $5tn company as the artificial intelligence industry and wider US stock market boom.Just three months ago, the Silicon Valley chipmaker was first to break through the barrier of $4tn in market value.In comparison, Nvidia’s value is greater than the GDP of India, Japan and the United Kingdom, according to the International Monetary Fund (IMF).

Shortly after US stock markets opened on Wednesday, Nvidia’s shares touched $207.86 with 24.3bn shares outstanding, putting its market cap at $5.05tn.Ravenous appetite for Nvidia’s chips, seen as the most cutting edge in powering artificial intelligence products and software, is the main reason that the company’s stock price has increased so rapidly since early 2023.

The US stock market has reached multiple record highs this week, buoyed up by expansive investment in artificial intelligence.Our other main stories:Thank you for reading! We’ll be back tomorrow.Take care – JKPrivate credit bosses have played down fears raised by the IMF and Bank of England, saying the sector is “safer” and offers more stability to the financial system than traditional, regulated banks.Senior bosses at private credit giants Apollo, Ares and Blackstone were adamant, during a session with the Lords Financial Services Regulation Committee on Wednesday, that there was ultimately ‘nothing to see’ in terms of heightened risk following the exponential rise of the private credit industry.Even the recent collapse of Tricolour and First Brands - two US firms serving the auto-industry - was wrongly pegged on the private credit industry, when in fact only a small portion of those firms’ loans came from the sector.

This amounted to “misinformation,” they said.However, they suggested it was natural for regulators to be poking around the private credit industry - now worth nearly $3tn globally - but that regulators were unlikely to find any problems.It comes as the Bank of England confirmed last week that it was preparing to run stress tests to check on potential systemic risks, particularly as a result of interconnectivity with the banking industry, which often provides loans to private credit firms that issue loans directly to businesses.Daniel Leiter, senior managing director at Blackstone and head of international and global head of liquid credit strategies at Blackstone Credit and Insurance said: I think they will come to the conclusion that what is happening in private credit, is fundamentally safer to happen in private credit, rather than on banks balance sheets.He claimed that this was partly because private credit was funded through institutional investors like pension funds and insurers - rather than being backed by consumer deposits - which could lock in their money for longer, and that the private credit industry maintained close relationships with businesses they lend to, following rigorous due diligence.

He also argued that if borrowers went bust, the private credit firm would take the loss, and it would not result in contagion to other funds in the firm let alone the wider financial system.Furthermore, banks borrowed much more per pound, in order to issue loans, than private credit firms, he said.The regulators will do this work, and will come to the conclusion that the system is going to be more stable whenever we do go through economics hocks, because now, away from just relying on the banking system, private credit can provide a source of financing through difficult times.Leiter said this justified what many claim is a lack of close supervision by regulators: “it should be regulated differently.” It comes a week after Bank of England’s governor, Andrew Bailey, said the recent failures of Tricolour and First Brands had worrying echoes of the sub-prime mortgage crisis that kicked off the global financial crash of 2008.

Meanwhile, the IMF warned that a downturn could have ripple effects across the financial system, given that banks were increasingly exposed to a largely unregulated private credit industry.There are concerns that a downturn could destabilise traditional banks that issue loans to the shadow banking sector.The Bank of Canada has cut interest rates by a quarter point to 2.25%, as expected.This has taken the policy rate to the bottom of its 2.

25% to 3.25% neutral range estimate.The move had been close to 90% priced in by financial markets.Stephen Brown, deputy chief North America economist at Capital Economics, said:With the Bank of Canada’s decision to cut today widely anticipated, the key development was that it signalled that it now thinks the policy rate is “at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment”.That is a sure sign that it is likely to keep interest rates unchanged in December, as we anticipate, although we still think the Bank will eventually be forced to cut interest rates by another 50bp next year…We’ve always assumed that the bar to additional cuts would be higher once the policy rate reached the bottom of the Bank’s neutral range estimate, however, with those cuts unlikely to come until the middle of 2026.

While the Bank is still concerned that cutting interest rates too far in the face of a structural shock to supply would risk pushing up inflation, we judge that the much bigger shock from changes to US tariff policy have been to demand.The Bank of Canada said on X:📣 Our Monetary Policy Report is out! Explore key #economy and inflation trends in our quick video.🔗 Check out the full report: https://t.co/TlF7NSqzsy#cdnecon #EconomicTrends pic.twitter.

com/dkfsLJmhbDWall Street’s main indices hit new record highs, as Nvidia become the first company ever to surpass a $5tn stock market valuation.This comes amid a wave of big tech earnings reports, and as investors are waiting for the US Federal Reserve’s interest rate decision later today – it is widely expected to cut rates by a quarter point to 4%.Art Hogan, chief market strategist at B.Riley Wealth Management, told Reuters:While the $5tn milestone seems unfathomable in a historic context, it comes in the wake of a company that has managed to outperform on all metrics.Nvidia shares rose as much as 5% and are now up 4.

5%, boosted by chief executive Jensen Huang’s spree of deals, $500bn in AI chip orders, and plans to build seven supercomputers for the US government.The S&P 500 tech index gained 1.4% while the wider S&P 500 rose by 0.3%, the Nasdaq added 0.7% and the Dow Jones was up 0.

6%.The three main US stock indices have been hitting record highs in recent days, driven by the AI boom, positive company earnings and expectations of rate cuts from the US central bank.The US chipmaker Nvidia has passed the threshold to become the world’s first $5tn company shortly after trading began on Wall Street.Shares rose by 4.6% after the tech company received a boost from Donald Trump remarks and amid an AI boom.

It comes a day after Microsoft rejoined the $4tn club and Apple briefly crossed that threshold before easing back.It has only been four months since Nvidia passed the $4tn mark, and the rally has been boosted by chief executive Jensen Huang’s spree of deals.He has forged new agreements to supply chips to companies including Finland’s Nokia and South Korea’s Samsung Electronics Co.and Hyundai Motor Group.Car manufacturers in the EU are “days away” from closing production lines because of dire shortages of chips, after China banned exports from Nexperia following the factory’s takeover by the Dutch government two weeks ago, the industry has said.

The crisis warning and call on European leaders to strike a deal with China immediately comes just a day before Donald Trump and Xi Jinping are expected to seal a trade deal, easing the US’s chip and rare earth supply chain.Caught in the cross fire between the two superpowers, the EU will hold urgent talks with a senior delegation from China in Brussels on Friday.But the car industry warns it may be too late to avert production line closures.Sigrid de Vries, director general of the European Automobile Manufacturers’ Association, said:Assembly line stoppages might only be days away.We urge all involved to redouble their efforts to find a diplomatic way out of this critical situation.

The ACEA said the industry “is currently working through reserve stocks but supplies are rapidly dwindling.From a survey of our members this week, some are already expecting imminent assembly line stoppages.”While alternative suppliers exit, it could take “months to build up additional capacity” it said and the “industry does not have that long before the worst effects of this shortage are felt.”While the political dispute that has led to the prohibition of Nexperia chip exports from China remains unresolved, the situation becomes more critical daily for global automotive manufacturing.The resulting shortage of supply of the type of simple chips used in the control car electric system including magnets for opening windows and car boots.

De Vries said:We know that all parties to this dispute are working very hard to find a diplomatic solution.At the same time, our members are telling us that part supplies are already being stopped due to the shortage.The US chipmaker Nvidia is on track to become the first $5tn company when Wall Street opens later, after receiving a boost from Donald Trump remarks and amid an AI boom.The shares rose by 3.9% in premarket trading, and if this is sustained, Nvidia will top a $5tn market cap at the official open on Wall Street.

It has only been four months since the company reached the $4tn mark, and the rally has been boosted by chief executive Jensen Huang’s spree of deals.He has forged new agreements to supply chips to companies including Finland’s Nokia and South Korea’s Samsung Electronics Co.and Hyundai Motor Group.British lenders approved more mortgages in September than any month so far in 2025, according to Bank of England data.Mortgage approvals for home purchases totalled 65,944, the highest figure since December 2024, monthly Bank of England figures showed.

This was higher than economists had expected.The increase comes after other data, from lender surveys, indicated a slowdown in the housing market, with buyers wary ahead of the late budget on 26 November.Rachel Reeves, the chancellor, is expected to raise taxes in her budget to balance the books, with higher levies on property purchases or home ownership among mooted measures.The Bank of England data also showed net consumer borrowing rose by nearly £1.5bn last month, in line with City forecasts.

While this was less than August’s £1.7bn rise, consumer credit grew by 7.3% from September 2024, the fastest annual pace of growth since October 2024.Other official data published last week showed retail sales unexpectedly rose by 0.5% in September.

Alex Kerr, UK economist at the consultancy Capital Economics, said:Overall these figures are consistent with our view that consumer spending growth will strengthen over the coming quarters.But the risk is that tax rises on households in the budget dampen activity next year.The pound has been sliding since news broke yesterday of the government’s official forecaster’s productivity downgrade over the next five years, expected on Friday.Worries over the state of the UK’s public finances are driving sterling lower, as Rachel Reeves, the chancellor, faces an increasingly difficult balancing act.The pound tumbled to a two-and-a-half year low against the euro and a three-month low against the dollar this morning.

It fell by 0.4% against the euro and the dollar earlier, to €1.13 and $1.32, following steep falls on Tuesday.This comes after it emerged that the Office for Budget Responsibility (OBR) is planning to cut its trend productivity growth prediction by 0.

3 percentage points, after a downgrade of the UK’s economic momentum since the 2008 financial crash.This means the UK chancellor will have to account for a bigger-than-expected £20bn hit to the UK public finances in next month’s budget, increasing the likelihood that she will breach a key Labour’s manifesto pledge not to raise income tax.Each percentage point downgrade would translate into £7bn of extra borrowing.As ministers are drawing up proposals to increase the amount the NHS spends on new medicines, potentially by up to 25%, with an announcement expected as soon as the end of this week, GSK boss Emma Walmsley said she was “hopeful and ambitious” that the standoff with the pharma industry can be resolved.Without pricing reform, the UK will struggle to be a life sciences superpower, she warned.

She told reporters:We are great supporters of the life sciences industrial strategy in the UK.And I’ve been very consistent on our view that it’s key to execute against that in terms of the opportunity for clinical trials and the opportunity for having translational facilities, all of the work that can be done with the data, but it is absolutely key that we have a competitive, commercial environment that recognises the value of innovation.Obviously we’re engaging, watching, contributing as we can.And, I would say: hopeful and ambitious.She added:What everyone is putting the energy into, hopefully resolving, is how we make sure this country creates the right commercial environment

Tightening Pip benefit eligibility could save £9bn a year, says Reform

Reform UK has set out plans for changes to personal independence payments (Pip) that the party says could save up to £9bn a year, with Lee Anderson, one of its MPs, saying he used to “game the system” to help people become eligible for the benefit.In Reform’s third consecutive Westminster press conference of the week, Anderson and the head of policy, Zia Yusuf, said the party would bar people with less serious psychological conditions such as anxiety from claiming Pip and would ensure anyone getting the payments would first receive a face-to-face assessment.“We are betraying our young people,” said Yusuf, who was formerly the party chair. “Reassessments are basically not happening any more. These young people are being labelled

Boris Johnson approved China’s London super-embassy proposal in 2018

Boris Johnson approved the China’s super-embassy proposal in 2018 and welcomed the fact it would represent “China’s largest overseas diplomatic investment” anywhere in the world, the Guardian can disclose.In a letter to Wang Yi, China’s top diplomat, Johnson gave his consent for Royal Mint Court to house a sprawling diplomatic complex in May 2018. The Chinese government bought the 20,000 sq metres site for £255m that same month.The disclosure demonstrates that the Conservatives under Theresa May gave Beijing assurances that it could proceed with the proposal, which is still in limbo seven years later after attracting huge political and local backlash.Johnson’s letter, sent while he was foreign secretary, was a response to Wang setting out details of the planned project in April

Your Party to launch legal action against three of its ‘rogue’ founders, sources say

Your Party, the leftwing party steered by Jeremy Corbyn and Zarah Sultana, says it is preparing legal action against a group of its own founders after a final deadline to hand over at least £800,000 in donations passed without payment, the Guardian understands.Figures close to the party accused directors of MoU Operations Ltd (MoU) of having “gone rogue”, holding supporters’ funds to ransom and undermining its founding process “despite direct pleas from Jeremy and Zarah”.Party insiders say they “reluctantly” agreed to initiate legal proceedings after “exhausting every possible alternative” to recover the money still held by the directors of MoU.MoU is run by Andrew Feinstein, the anti-apartheid activist who ran as an independent candidate in Keir Starmer’s constituency; Jamie Driscoll, the former North of Tyne mayor; and Beth Winter, the former Labour MP for Cynon Valley. The three helped shape the movement’s early structure before relations broke down

Should the Home Office be broken up into two units?

“It’s not that the Home Office is too big. It’s that the brains of many of the people who run it are not big enough,” says one former departmental insider.Unwieldy, dysfunctional and plagued by poor morale, the Home Office is once again the subject of debate about whether it is beyond repair and should simply be chopped up into two more manageable units.No 10 is so far showing no appetite for a big restructure, but Shabana Mahmood, the new home secretary, has acknowledged that she has a turnaround job on her hands along with the new permanent secretary, Antonia Romeo.Politicians have been calling for the Home Office to be split up every couple of years when a major scandal shines a light on its persistent problems, such as those exposed in the Windrush and immigration centre abuse scandals

Reform wheels out Danny Kruger, the ‘brains’ of Nigel Farage’s operation | John Crace

Nigel Farage too Marmite for you? Lee Anderson too Lee Andersony? Richard Tice too smooth? Sarah Pochin a bit too racisty? Don’t worry. These things happen. But all will be well, because Reform have just the MP for you. Someone who can be passed off as a safeish pair of hands. Someone who won’t frighten the horses

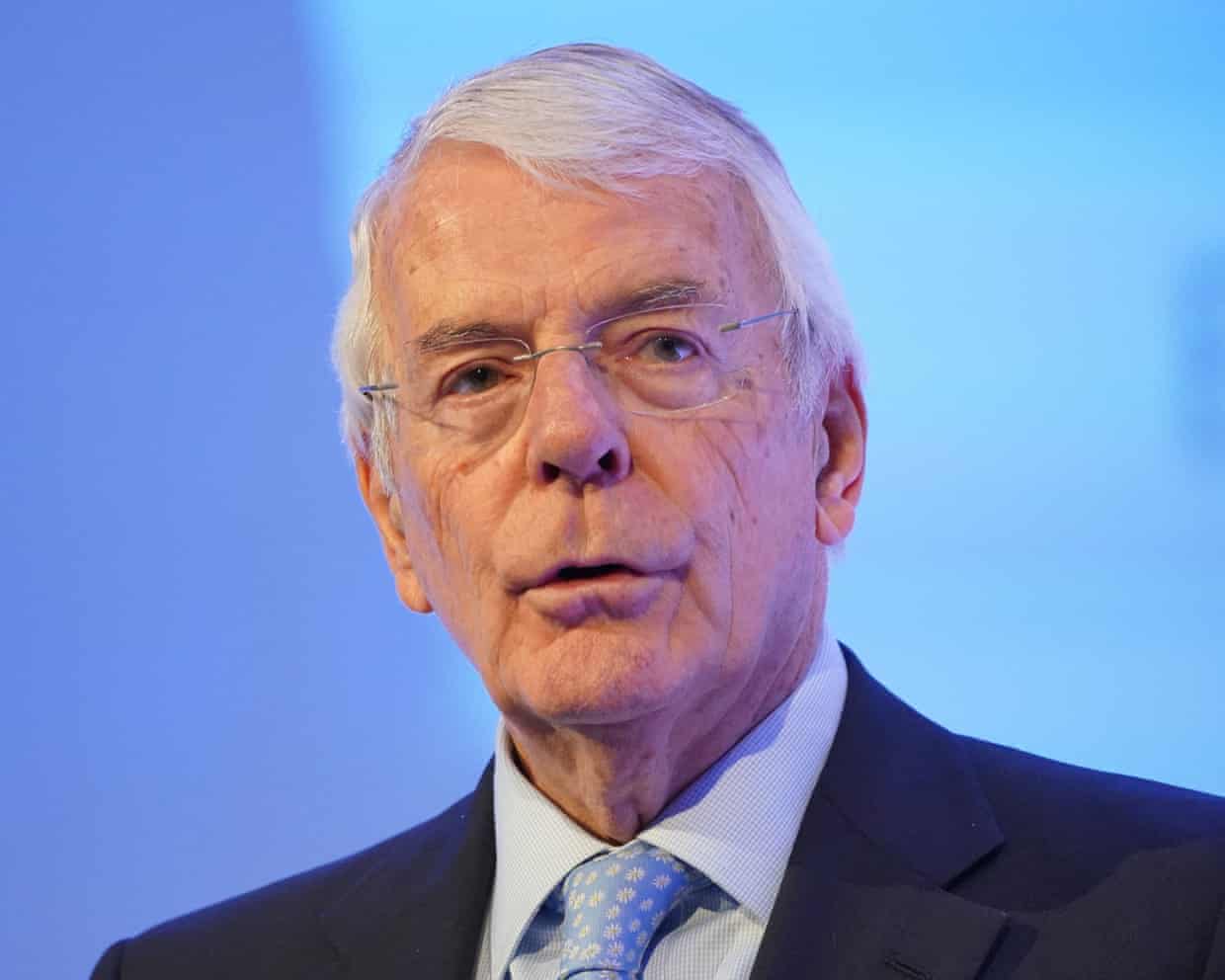

John Major tells Tories alliance with Reform would be ‘beyond stupid’

John Major has told the Conservatives that forming an alliance with Reform UK would “for ever destroy” the party, which he said had already left traditional supporters “politically homeless” by lurching too far to the right.The former prime minister dismissed a pact with Nigel Farage’s party as “beyond stupid”, saying that any Tories tempted to defect to Reform should go now because his own party would be better off without them.As the Tories struggle with the existential threat posed by Reform’s surge in popularity, Major warned far more than the future of the party was at stake with autocracies on the march across the world.“Frustration with democracy should not blind us to the toxic nature of nationalism, or any and every form of populist or authoritarian government,” he said.Addressing a Conservative party lunch on Tuesday, he urged the party not to reject the centre ground of British politics, saying they were “seriously alienating” voters by coming down on the wrong side of public opinion on Europe, climate change and overseas aid

EU carmakers ‘days away’ from halting work as chip war with China escalates

Wall Street hits new highs as Nvidia becomes world’s first $5tn company – as it happened

Apple hits $4tn market value as new iPhone models revitalize sales

OpenAI completes conversion to for-profit business after lengthy legal saga

Dingwall backed to plot course through the midfield maze for England

South Africa beat England by 125 runs: Women’s Cricket World Cup semi-final – as it happened