NEWS NOT FOUND

Foxtons shares drop sharply after it warns of ‘subdued’ pre-budget sales

The estate agency Foxtons has warned of weak sales for the rest of the year as economic uncertainty and potential property tax changes in next month’s budget deter buyers, sending its shares sharply lower.The London-focused company, known for its green-and-yellow Mini cars, said buyers had been holding off ahead of the budget on 26 November, which is a month later than usual.Slower-than-expected interest rate cuts from the Bank of England are also having an impact by affecting the cost of mortgages, it said. As a result, “sales are likely to remain subdued for the rest of the year”, with a risk that revenues in the fourth quarter could fall below management’s expectations.Guy Gittins, the chief executive who started his career at Foxtons in 2002 and returned to lead the company three years ago, said: “Macroeconomic uncertainty and speculation surrounding the delayed autumn budget has resulted in a subdued sales market as some buyers adopt a ‘wait and see’ attitude to purchases

Aerospace groups link up to create European rival to Musk’s SpaceX

Airbus, Leonardo and Thales have struck a deal to combine their space businesses to create a single European technology company that could rival Elon Musk’s SpaceX.The deal is expected to create a company with annual revenue of about €6.5bn (£5.6bn). The French aerospace company Airbus will own 35% of the new business, with Leonardo and Thales each owning stakes of 32

Lloyds profits plunge 36% as it feels impact of UK car finance scandal

Lloyds Banking Group profits have been sent plunging by more than a third by the car loans commission scandal, as the lender steels itself for a surge in compensation payouts to drivers.The high street bank took the 36% hit in the third quarter after putting aside a further £800m to cover the prospective costs of a redress scheme proposed by the Financial Conduct Authority (FCA).The additional charge, announced last week, brings Lloyds’ total compensation pot to £1.95bn.Lloyds is the UK’s biggest car lender through its Black Horse division and is expected to foot the largest bill among its peers

Thames Water ranked worst supplier in England as firms’ ratings hit record low

England’s water company ratings have fallen to the lowest level on record after sewage pollution last year hit a new peak, with eight of nine water companies rated as poor and needing improvement by the Environment Agency.The cumulative score of only 19 stars out of a possible 36 is the lowest since the regulator began auditing the companies using the star rating system in 2011.Only one company, Severn Trent, achieved full marks. It did so despite having been responsible for 62,085 sewage spills, averaging seven hours each, in 2024.Struggling Thames Water was the only company to be awarded one star for its performance

Groceries via delivery apps like Uber Eats, DoorDash and Milkrun can be up to 39% more expensive

Convenience can come at a steep price, Choice has found, with Australian consumers paying up to 39% more for groceries ordered through rapid delivery apps.Choice compared in-store prices of 13 common grocery items available at Coles, Woolworths and Aldi with their equivalents on third-party apps Uber Eats, DoorDash and Woolworths-owned Milkrun.They found that items including pasta, milk and fresh vegetables cost on average 11% more on third-party apps and delivery charges of between $5 and $11 significantly drove up bills.Seven out of 13 items at Aldi were priced higher on DoorDash than in store, while Milkrun charged more for 11 out of 13 items from Woolworths.“Not all items are increased in price,” said the editorial director at Choice, Mark Serrels, but “the majority of them are”

Barclays can afford Tricolor loss but risks remain in the private credit market

“I’m not an entomologist,” said CS Venkatakrishnan, the Barclays chief executive, dodging the question everybody is asking: how many cockroaches are about to crawl out of the woodwork in the private credit market?The good news – sort of – for Barclays is that it had only one insect to point to. A £110m loss from lending to Tricolor, the US sub-prime auto lender that has failed amid allegations of fraud, doesn’t look good but Venkatakrishnan could simultaneously trumpet that Barclays avoided that other rotten private credit beast First Brands. Barclays was asked to lend to the stricken autoparts supplier, but didn’t. JP Morgan, taking its own $170m (£127m) hit on Tricolor, said the same last week.One could regard these developments as mildly reassuring after a week in which both the International Monetary Fund and the Bank of England have warned about risks that may be emerging in the world of private credit, AKA the shadow banking sector

Apple and Google face enforced changes over UK mobile phone dominance

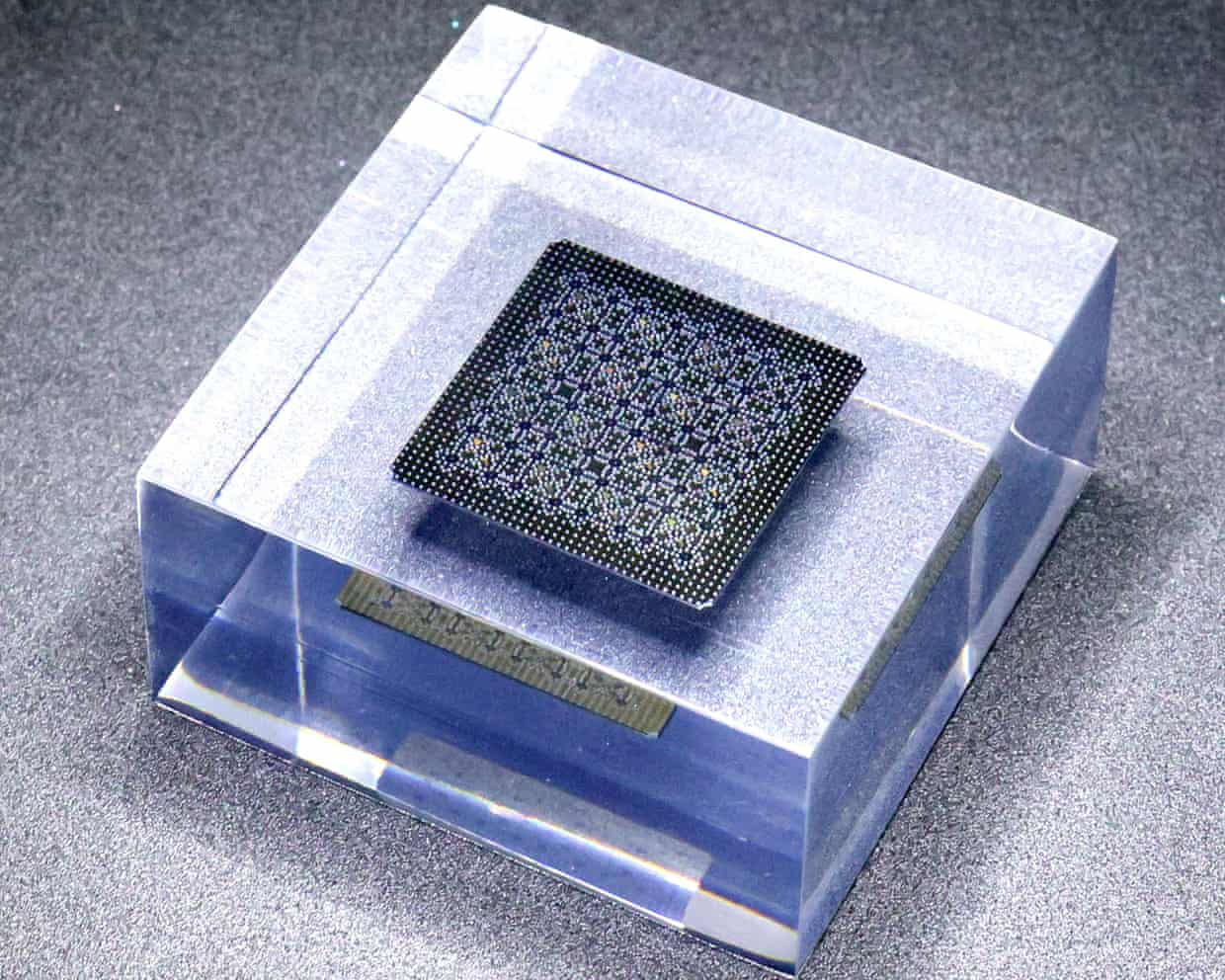

Google hails breakthrough as quantum computer surpasses ability of supercomputers

iPhone 17 review: the Apple smartphone to get this year

Harry and Meghan join AI pioneers in call for ban on superintelligent systems

‘I’m suddenly so angry!’ My strange, unnerving week with an AI ‘friend’

ChatGPT Atlas: OpenAI launches web browser centered around its chatbot