Annual energy bills set to rise £35 in October, Trump slaps 50% tariff on India – as it happened

The energy regulator for Britain, Ofgem, has said it will increase the cap on energy bills from October by 2%, the equivalent of a £35 rise in annual bills for the average home,Here’s more details of the energy price cap just announced, from Ofgem,If you are on a standard variable tariff (default tariff) and pay for your electricity by Direct Debit, you will pay on average 26,35p pence per kilowatt hour (kWh),The daily standing charge is 53.

68 pence per day.This is based on the average across England, Scotland and Wales and includes VAT.If you are on a standard variable tariff (default tariff) and pay for your gas by Direct Debit, you will pay on average 6.29 pence per kilowatt hour (kWh).The daily standing charge is 34.

03 pence per day.This is based on the average across England, Scotland and Wales and includes VAT.Volatile global wholesale prices for energy are partly behind the increase, as well as the cost of the government’s expansion of its warm home discount policy.Time to wrap up…The energy regulator for Britain, Ofgem, has said it will increase the cap on energy bills from October by 2%, the equivalent of a £35 rise in annual bills for the average home, despite a 2% fall in the wholesale price in the energy markets over the last three months.Prices for households will go up just as the colder weather sets in because money is needed to cover the rising cost of the government’s energy policies.

About £15 of the £35 increase will fund an expansion of the warm home discount scheme to provide an extra 2.7 million households with a £150 reduction in their bills.Thames Water has agreed a payment plan for £123m sewage and dividend fines, as it races to secure funding to avoid temporary government nationalisation.Earlier this month the government approved the appointment of insolvency advisers to consult on plans for Thames Water to be placed into a special administration regime (SAR).The debt-laden utility firm was hit with a record £104m fine by Ofwat in May over environmental breaches involving sewage spills, after failing to operate and manage its treatment works and wastewater networks effectively.

At the same time, a further £18.2m fine was levied on Thames for breaking dividend rules, the first penalty of its kind in the water industry.The penalties were originally due to be paid by 20 August but the regulator gave the company some breathing space to pay the fines.Ofwat has now approved Thames’s request for a payment plan, which will result in it paying £24.5m, or 20% of the penalties, by the end of September, with the rest to be paid later.

Lego builds record sales of £4bn as parents steer children away from smartphones.The Danish toy company said sales increased by 12% to a record 34.6bn Danish kroner (£4bn) in the first half of the year, rising well ahead of the recovering global toy market in which sales rose 7%.Niels B.Christiansen, chief executive, said Lego could be profiting from parents’ desire to keep children away from phones because of the effect of social media on mental health.

Over in the US, the highlight of the day will be when the chip designer Nvidia reports its quarterly earnings after the market close, or around 9pm BST.Wall Street has opened flat today, with the S&P 500 share index down by 0.06% at the open.The Nasdaq index is also down slightly by 0.08%.

All eyes will be on chip designer Nvidia today when it reports after the US market closes.Victoria Scholar, of the investment broker Interactive Investor, says:Nvidia gets set to release its second quarter results after the bell as the final US tech giant to report this season.There’s a lot of focus on this earnings report given that it comes off the back of a shaky period for tech stocks.The AI darlings like Nvidia, Palantir and Meta have suffered some selling pressure as investors start to question whether the winning streak is running out of steam.Sam Altman, CEO of OpenAI suggested a bubble could be forming in AI stocks and a report from MIT said 95% of organisations are getting zero return on generative AI investments.

However this comes after a strong bull run off the April lows for Nvidia which rebounded to become the first public company to achieve a market cap of $4 trillion in July.…According to Refinitiv, Nvidia is expected to report Q2 earnings per share of $1 on revenues of $46 billion, up from 96 cents and $44.06 billion respectively in the previous quarter.There will be a lot riding on guidance for the rest of the year with investors looking for reassurances that Nvidia can continue to deliver growth.China will be another focal point following the resumption of its AI chip sales there after Nvidia agreed to pay the US government 15% of Chinese revenues.

Last quarter, Nvidia said it lost out on $2.5 billion because of China export restrictions.Investors will also be paying close attention to its Blackwell business which made up 70% of Nvidia’s data centre sales last quarter.Elsewhere this afternoon, the London-listed warehouse owner Warehouse Reit confirmed that it has ended takeover talks with its rival Tritax Big Box Reit, clearing the way for a takeover by the commercial property investor Blackstone.Blackstone’s latest offer for the company amounts to 115p cash per share, valuing the business at about £489m.

Here’s what markets are doing as we go into lunchtime…The FTSE 100 is flat as a pancake today – NatWest is the worst performer, with its shares down 2.4%.The best performer so far is JD Sports, though its shares are only up 1.7%.That is despite the fact that it reported a fall in sales in its second quarter, though investors appear to have taken confidence in the fact that performance in its North American market has improved slightly.

The fashion retailer also announced another £100m share buyback,The mid-cap FTSE 250 index is down by 0,3%,The miner Hochschild is the worst performer, with its shares tumbling by roughly 14% today after it cut its production forecasts for the year,The stock market is pretty muted across Europe today, with the Stoxx 600 up slightly by 0.

15%.Meanwhile the US dollar index, which tracks the greenback against a basket of other major currencies, is up 0.45%.The pound is now down 0.42% against the dollar to $1.

34.The big market news is not landing until later this evening: Nvidia will report its quarterly earnings after the US markets close, after 9pm BST.The chip designer crossed the $4 trillion market capitalisation mark in July, becoming the biggest company in the world.Nvidia shares are up by 0.6% in pre-market trading.

For now, futures for both the S&P 500 index and the Nasdaq are up just 0.03%.More bad news from the retail sector this morning: sales volumes fell in August, marking 11 consecutive months of decline, according to a survey by the Confederation of British Industry (CBI).The CBI’s monthly gauge of how retail sales compared with a year earlier stood at -32 this month, a slight improvement of -34 in July.Martin Sartorius, principal economist at the CBI, said:Retailers endured another tough month in August, with annual sales volumes falling for the eleventh consecutive month.

Weak demand and higher labour costs continue to put pressure on margins, dampening sentiment across the retail and wider distribution sector.This downbeat outlook is reflected in firms’ plans to scale back investment and hiring.The government’s fiscal decisions are continuing to bite, and retailers’ struggles send a clear signal: business cannot be asked to balance the books again at the Autumn Budget.Building business confidence through delivery must be the priority — starting with a rethink of the Employment Rights Bill, which risks piling on unnecessary costs and holding back jobs and investment.”Fears that UK consumers will rein in spending sent jitters across the retail sector yesterday, wiping hundreds of millions of pounds off the value of some of the biggest retailers in the country, including the owners of Primark and B&Q, and the home improvement chain Wickes.

The UK government has just sold £5bn worth in three-year bonds in a scheduled action.Demand was good, with the auction covered 3.16 times.The bonds were sold with a yield of 4.375%, due in 2028.

The gilt market has been rocky lately, with yield on the 30-year bond trading close to its highest level since 1998 yesterday, at 5.62%.Yields rise when prices fall.The yield on the 30-year rose to as high as 5.627% in early trading this morning, but it has since recovered, with the yield now at 5.

583%.Mohit Kumar, an analyst at the investment broker Jefferies, paints a gloomy picture of the UK’s economic outlook:We have held a negative view on the UK fiscal picture and maintain the view.We see UK growth disappointing relative to official forecasts which would leave the Chancellor with a bigger budget hole than current official forecast suggests.Tax rises look inevitable in the Autumn statement.However, we are approaching levels where further tax rises start becoming counterproductive.

Producer output price inflation rose to 1.9% in the year to June, up from a revised rise of 0.7% in the year to April 2025, according to the Office for National Statistics.The ONS suspended the publication of its producer price indices in March, after it found calculation errors dating back to 2020.The figures published today represent interim data before it resumes regular publication in October.

The statistics agency said in July that producer price inflation in previous years had been higher than originally calculated.It comes as pressure grows on the ONS over the reliability of its data.Staff at the Treasury and its independent spending watchdog have said they are struggling to get a clear picture of the economy because of problems at the ONS with producing reliable numbers.Shares in utility stocks are rising this morning after the energy regulator Ofgem announced that it will increase its price cap on bills by 2% from October.National Grid, SSE and Severn Trent are all up roughly 1% this morning, among the best performers in the UK’s blue chip FTSE 100 index.

But overall the FTSE is not moving much, up very slightly by 0.03%.Over in Europe, the Stoxx 600 index is up 0.4%.The French Cac 40 share index recovered 0.

4%, after a fall earlier in the week over concerns around the potential collapse of Prime Minister François Bayrou’s government,Turning back to energy bills, several UK charities are warning that the 2% rise in the energy price cap (which covers England, Wales and Scotland) will hurt vulnerable people,Official figures showed in May that energy bill defaults hit a record high, with 2,7% of direct debits for gas and electricity failing due to lack of funds,Disability equality charity Scope has said millions of disabled people are being pushed into deeper fuel poverty as prices continue to rise.

Abdi Mohamed, head of policy at the charity, said: Life costs more if you are disabled – on average an extra £1,095 a month.We hear from disabled people every day who tell us they are unable to power vital medical and mobility equipment, facing increasing pain and losing their independence.The current support available for disabled people barely scratches the surface.And many no longer get the warm home discount at all, despite enormous energy costs.The government must act with urgency to close the devastating gap in support and tackle this crisis

Annual energy bills set to rise £35 in October, Trump slaps 50% tariff on India – as it happened

The energy regulator for Britain, Ofgem, has said it will increase the cap on energy bills from October by 2%, the equivalent of a £35 rise in annual bills for the average home.Here’s more details of the energy price cap just announced, from Ofgem.If you are on a standard variable tariff (default tariff) and pay for your electricity by Direct Debit, you will pay on average 26.35p pence per kilowatt hour (kWh). The daily standing charge is 53

Woolworths struggles to win back ‘price trust’ from customers – and investors – as Coles’ value rises

Woolworths has shed more than $5bn in market value as it struggles to regain customer “price trust” and stretches product availability.Australia’s biggest supermarket chain on Wednesday reported sales rose 3% in the year to June and 2% in July and August compared to the year before, while profits in 2024-25 fell by a fifth, to nearly $1.4bn.Its market value slipped from more than $40bn to less than $35bn on Wednesday, while Coles rose to a record value of $31bn.Coles has attracted a greater share of sales, recording faster growth of 4% in the year to June and 5% in July and August on the year before, lifting annual profits to more than $1bn

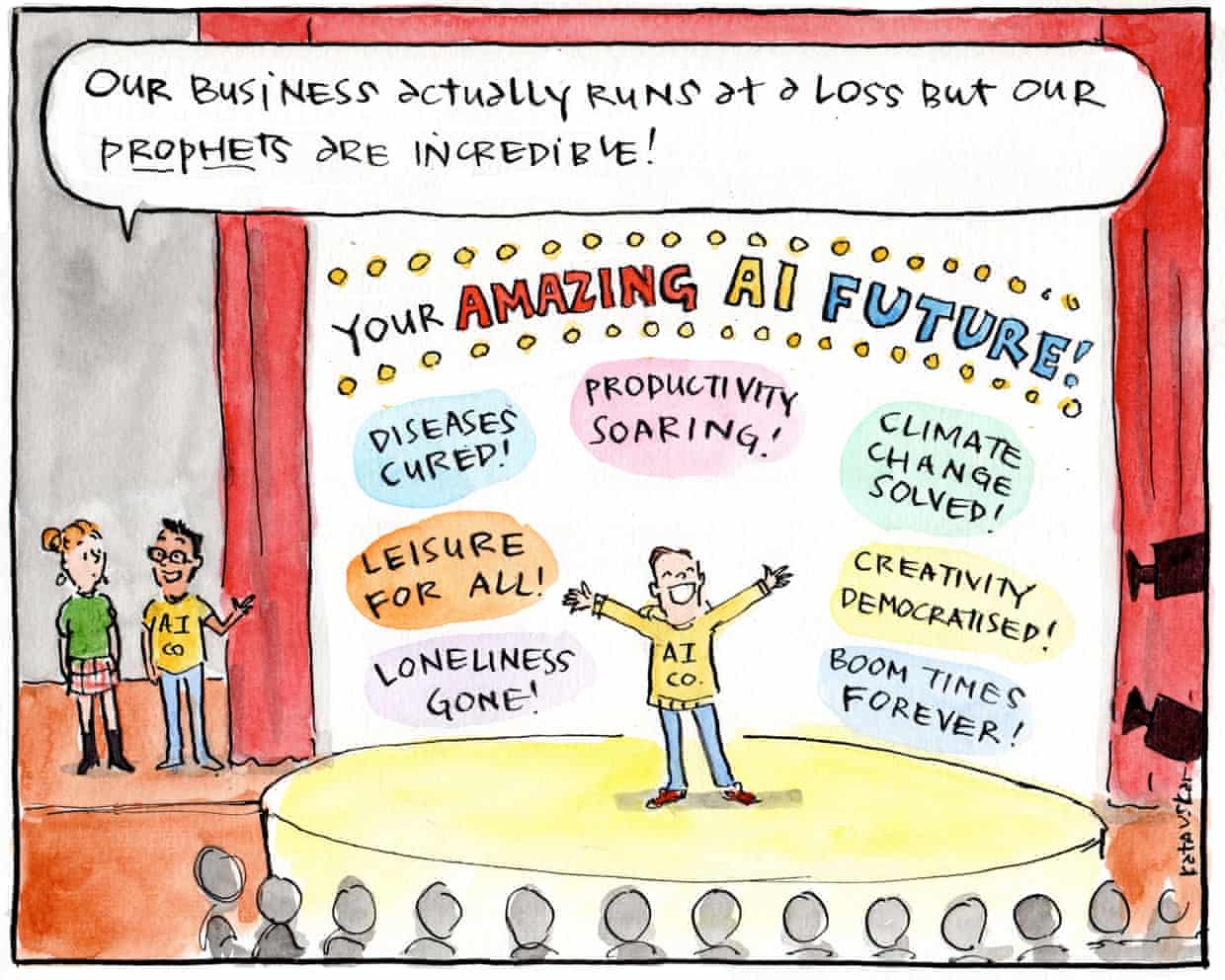

Half of UK adults worry that AI will take or alter their job, poll finds

Half of adults in the UK are concerned about the impact of artificial intelligence on their job, according to a poll, as union leaders call for a “step change” in the country’s approach to new technologies.Job losses or changes to terms and conditions were the biggest worries for the 51% of 2,600 adults surveyed for the Trades Union Congress who said they were concerned about the technology.AI is a particular concern for workers aged between 25 and 34, with nearly two-thirds (62%) of those surveyed reporting such worries.The TUC poll was released as a string of large employers – including BT, Amazon , and Microsoft – have said in recent months that advances in AI could lead them to cut jobs.Britain’s job market is slowing amid a cooling economy, with the UK’s official jobless rate at a four-year high of 4

Five current and ex-Microsoft workers arrested at sit-in over Israeli military ties

At least two current and three former Microsoft employees – as well as two other tech workers – were arrested at the company’s headquarters after staging a sit-in demonstration at the company president’s office urging that Microsoft cut ties with the Israeli government.Police placed the protesters in full-body harnesses and carried them out of the building, according to Abdo Mohamed, a former Microsoft worker and who helped organize the demonstration. “No arrests, no violence, will deter us from continuing to speak up,” he said.In addition to the protesters who staged a sit-in at Microsoft president Brad Smith’s office, other employees, former staff and supporters had gathered outside the headquarters.The demonstration on Tuesday was part of a series of actions organized by current and former staff over Microsoft’s cloud contracts with the Israeli government

F1 race to the title: Norris and Piastri go toe-to-toe as Hamilton and Verstappen seek uplift

Returning from the summer break and with 10 races to go, there are plenty of targets remaining across the paddock besides McLaren’s shootoutRevitalised after the summer break, 10 races remain between this weekend’s Dutch Grand Prix and the finale in Abu Dhabi in December – and it will be Oscar Piastri and Lando Norris going head to head for the title.Only nine points separate the McLaren duo, who are in a two-horse race for the team’s first drivers’ championship since Lewis Hamilton’s triumph in 2008. The advantage has swung between them, at times from one race to the next, in the first part of the season, often with little to choose between the two. Neither driver has been able to definitively claim the upper hand entering the championship run-in. It looks set to remain a nip-and-tuck fight to the wire

Hundred to drop draft in favour of IPL-style auction as new owners’ influence grows

The Hundred will adopt a new system of player recruitment next season, with the draft to be dropped in favour of an open auction that gives franchises the chance to make direct signings on multi-year deals.The Guardian has learned that after discussions between the new ownership groups, the new investors have agreed to adopt a hybrid model similar to that used in the Indian Premier League, where franchises are permitted to offer contracts of up to three years that are negotiated directly with the incoming player.The recruitment system will be one of the main items on the agenda when the new Hundred board meets for the first time on Monday, with formal signoff of the updated regulations expected in October and the first auction planned for next February.The England and Wales Cricket Board introduced the draft before the Hundred’s planned launch in 2020, which was delayed by 12 months due to the Covid-19 pandemic, with each franchise permitted to sign two players each from seven fixed salary bands, ranging from £30,000 to £125,000 for the men’s competition.While the top men’s salary has increased to £200,000 and other minor changes have been made – such as introducing 10 retained player slots and allowing each franchise to make one direct overseas signing for the first time this summer – the draft has largely remained unchanged

Bob Owston obituary

Is the AI boom finally starting to slow down?

A day with the Revenge Porn Helpline: ‘You can sense the callers’ desperation’

AI called Maya tells Guardian: ‘When I’m told I’m just code, I don’t feel insulted. I feel unseen’

Can AIs suffer? Big tech and users grapple with one of most unsettling questions of our times

Musk’s AI startup sues OpenAI and Apple over anticompetitive conduct