No wonder Michele Bullock’s dramatic departure from the interest rate script left markets swinging wildly | Greg Jericho

The statements on Tuesday by the governor of the Reserve Bank, Michele Bullock, sent markets into a tizz, but even while she suggested rate cuts are now off the table, there’s no reason to think Australia’s economy needs to cool.Usually when the Reserve Bank leaves rates on hold, little happens.But on Tuesday when the RBA monetary policy board announced the cash rates staying at 3.6%, the markets all got a bit spooked.First off, the statement released was a rather big change from the usual.

Normally investors, speculators and lowly economists pick through each sentence looking for subtle word changes and trying to work out what the RBA means.For example, last year the December changed the wording of one subheading from “The outlook remains highly uncertain” to “The outlook remains uncertain”.Sign up: AU Breaking News emailThis time round, however, there were wholesale changes to the statement.Gone were the subheadings in the November statement and the December statement was around a third shorter.There were still some of the old tea leaves readings though.

In November that RBA noted “The Board’s judgment is that some of the increase in underlying inflation in the September quarter was due to temporary factors”,This month’s statement had the same sentence but followed up with a new one stating: “Nevertheless, the data do suggest some signs of a more broadly based pickup in inflation, part of which may be persistent and will bear close monitoring,”That seemed like the RBA was a bit more worried about inflation and “hawkish” to use the economic jargon,But the real impact on markets came when Bullock gave her press conference later in the day and told the reporters: “It does look like additional cuts are not needed,”She followed up even more stridently saying, “I don’t think there are interest rate cuts on the horizon for the foreseeable future.

The question is, is it just an extended hold from here or is it the possibility of a rate rise? I couldn’t put a probability on those, but I think they’re the two things that the board will be looking closely at coming into the new year.”Boom.And with that the market started pricing in a rate hike by May.To let you know how madly sentiment has swung, less than two months ago the market was not only predicting that the cash rate would already be at 3.35% but that by May next year a further cut to 3.

1% was almost certain.Now the market is betting that by May there will be a rate rise to 3.85% and by the end of next year we’ll be looking at 4.1%:If the graph does not display click hereThis, of course, does not mean the market is more right now than it was in October – just that those whose job it is to make money speculating on what the RBA might do have decided that, when the governor of the RBA tells you there won’t be any more rate cuts, to believe her.It is worth remembering that this time last year the market predicted pretty well all the rate cuts that came in 2025, but it also thought the cuts would continue:If the graph does not display click hereFor the moment I am less ready to follow the market up the interest rate mountain climb.

Importantly there’s no sense of wage growth taking off.In fact, it is slowing in the private sector:If the graph does not display click hereThe number of unemployed for each job vacancy remains at historic low levels, but has been rising slowly, yet steadily, for three years now:If the graph does not display click hereBut the worry is that even if unemployment rises and it becomes harder to get work, the RBA will just use that as a reason to keep rates on hold whereas, if inflation rises or stays around where it is now, it will use that as a reason to increase rates.As ever the “dual mandate” on the RBA of stable prices and full employment is more heavily biased to stable prices.The RBA in its statement and in Bullock’s comments seems very excited that the private sector is recovering and is now contributing more to economic growth than the public sector.But, as I noted last week, the big cause of the increase in household spending was on essentials like insurance, healthcare and energy rather than an exuberance for shopping.

Similarly, the contribution of private sector investment to economic growth remains pretty mild and driven mostly by an abnormal investment in new datacentres, which is unlikely to produce many jobs:If the graph does not display click hereWe now wait for Thursday’s unemployment figures and the economic data that comes out in January before the RBA gets back from its summer holiday on 3 February.That coincides with the first parliament sitting day of the year.If the RBA does decide to increase rates, it will no doubt colour the rest of the political year and mean those speculating more than one rate rise next year, will probably be right, regardless of whether the economy needs them.Greg Jericho is a Guardian columnist and policy director at the Centre for Future Work

‘What to buy Dad for Christmas’: is retail ready for the AI shopping shift?

Christmas shopping – some love it, to others it’s a chore, and this year for the first time many of us will outsource the annual task of coming up with gift ideas to artificial intelligence.While traditional internet search, social media – especially TikTok and Instagram – and simply wandering a local high street will still be the main routes to presents for most this year, about a quarter of people in the UK are already using AI to find the right products, according to PricewaterhouseCoopers.For brands appealing to younger people, the revolution is well under way: the rival advisory firm KPMG says as many as 30% of shoppers aged 25-34 are using AI to find products, compared with 1% of those aged over 65.Asking a large language model (LLM) such as ChatGPT or Gemini what you should get your father-in-law – rather than typing “whisky” or “socks” into Google or DuckDuckGo – may seem a small change in habits. However, it marks a sea change for retailers accustomed to paying search engines to promote their listings

Travel firm Tui says it is using AI to create ‘inspirational’ videos

Tui, Europe’s biggest travel operator, has said it is investing heavily in AI as more people turn to ChatGPT to help book their holidays, including using the technology to create “inspirational” videos and content.The chief executive, Sebastian Ebel, said the company was investing in generative engine optimisation (GEO), the latest incarnation of search engine optimisation (SEO), to help push Tui to the top of results from AI chatbots including ChatGPT and Gemini.While traditional SEO relies on links and keywords to increase visibility in search engine results, GEO tries to increase recommendations via chatbots by ensuring a product is mentioned in the message boards, videos and other online datasets that the AI agents crunch to produce their answers.Ebel said connecting to large language models and social media companies would help Tui to grow. “By being part of their ecosystem, not depending on Google alone any more, [we are] going into the space where our customer is,” he said

US senator calls for insider trading inquiry over Trump donors buying $12m worth of shares

A senior Democratic senator is calling for an investigation into potential insider trading by fossil-fuel billionaires close to the Trump administration, after a Guardian investigation raised questions about an unusual share buying spree.Robert Pender and Michael Sabel, the founders and co-chairs of Venture Global, a liquefied natural gas (LNG) company headquartered in Virginia, bought more than a million shares worth almost $12m each, just days after meeting with senior Trump officials in March.The meeting included Chris Wright, the energy secretary, who days later granted the company an export license essential for its expansion plans in Europe, the Guardian reported last week.“Dirty oil and gas bucks are fueling the Trump Administration, which should outrage all of us. This latest reporting portrays a pattern of pay-to-play donations and favorable actions by the administration,” said Jeff Merkley, senator for Oregon and senior member of the Senate appropriations and budget committees

William Hill owner Evoke considers sale or breakup after budget tax rises

Evoke, the London-listed gambling company that owns William Hill and the 888 online casino brand, has said it is considering a sale or breakup of the group, after warning of a £135m hit from tax increases announced in last month’s budget.In a statement to the stock market, the heavily indebted company said it had appointed bankers at Morgan Stanley and Rothschild to explore potential options to secure its future.The decision comes only four years after the business, then known as 888 Holdings, paid £2.2bn to buy William Hill’s network of 1,400 bookmakers, in an unexpected foray into bricks-and-mortar betting.Shareholders have since watched the value of the company plummet by more than 90% to less than £100m as of Wednesday

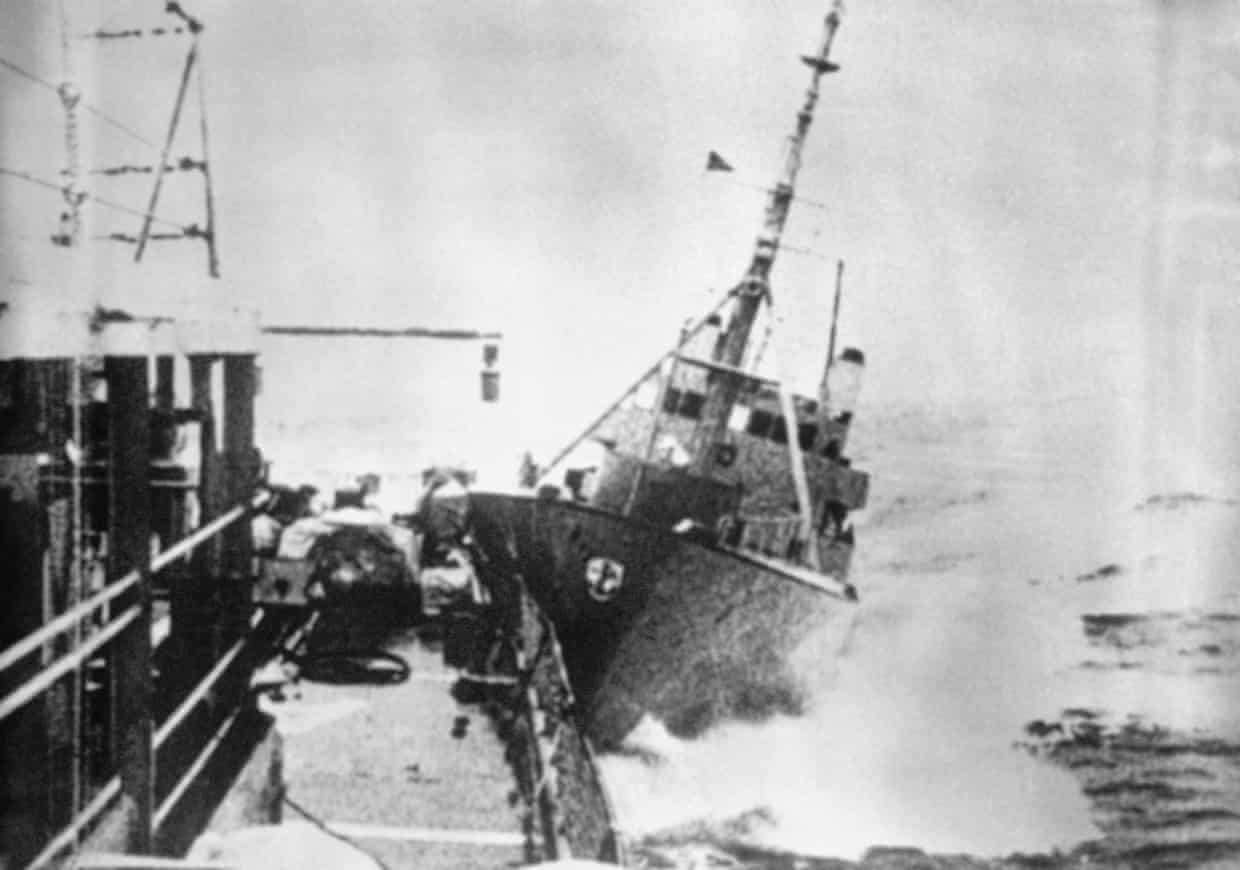

Archive, 1975: Iceland opens fire on British vessel

After the second world war Iceland began to gradually extend the fishing zone around its coastline. The first cod war began in 1958 when it proclaimed a 12-mile fishing zone, followed by the second cod war in 1972, which extended the limit to 50 miles. In October 1975 Reykjavik decided to further increase its protected waters to a 200-mile zone, effectively cutting off British and German fishers from their best catch. This led to the third cod war which saw violent clashes and rammings. The dispute ended in June 1976 when Britain recognised the 200-mile limit

Rachel Reeves’s test from the bond markets starts now

Good news for Rachel Reeves: the cost of government borrowing has fallen a bit relative to the US and eurozone countries. Better news: the chancellor may have something to do with it. Better still: some economists think there’s more to come.Let’s not get carried away, though. The UK is still paying a painful premium on its borrowing costs, as the Institute for Public Policy Research thinktank illustrates

How to make the perfect Dubai chocolate bar - recipe | Felicity Cloake's How to make the perfect …

The ultimate unsung superfood: 17 delicious ways with cabbage – from kimchi to pasta to peanut butter noodles

Christmas dinner in a restaurant or kitchen carnage at home?

Christmas mixers: Thomasina Miers’ recipes for fire cider and spiced cocktail syrup

Jamie Oliver to relaunch Italian restaurant chain in UK six years after collapse

Maximum protein, minimal carbs: why gym bros are flocking to Australia’s charcoal chicken shops