‘A stomach of steel’: amateur investors ride out dips amid talk of an AI bubble

It was more than just a hunch, says Jacob Foot of his first foray into US tech stock investments back in 2020.The 23-year-old says he played around with artificial intelligence tools in his first job and thought to himself: this technology is going to be a big deal.Foot put his savings each month into US shares and in particular the biggest investors in AI, the Magnificent Seven (M7).For several years the list has included the chipmaker Nvidia, Amazon, Apple, Microsoft, Tesla, Alphabet (the owner of Google) and Meta (the owner of Facebook, Instagram and WhatsApp).Five years on, Foot expects to complete the purchase of a “bigger house in London than I expected”, a dream he could not have realised without his stock market bets paying off.

What marks out Foot and his generation of young stock market investors is their bravery.When shares slide, they refuse to sell.Instead they sit tight and wait for the upturn, or treat the dips as a buying opportunity.The week before last, shares dropped on both sides of the Atlantic.In the US the S&P 500, which tracks the largest listed companies in the US, lost more than 200 points.

The drop came amid dire warnings of a major stock market correction, if not a full-blown financial crash.The Bank of England, the International Monetary Fund (IMF) and the boss of the US bank JP Morgan were among those raising fears that popular investments, including tech company shares, gold, crypto and bonds, were over-valued and could implode.Yet despite the dire warnings, the stock market panic was shortlived and the loss of value was shallow, with the FTSE 100 and Wall Street again hitting record highs.The rises followed a boom month in September, when shares often go sideways or fall.The S&P rose by more than in any previous September in the last 15 years.

The increases over the past 12 months are even starker, with shares in the M7 surging almost 37%, outstripping the 15% racked up by the rest of the S&P 500, according to FactSet data.The M7 now accounts for more than a third of the entire S&P 500 and Nvidia has a share price to earnings ratio of 54; investors would normally begin to twitch at a ratio of 25.Microsoft and Apple both passed $4tn valuation on Tuesday, joining Nvidia as the only companies to pass that threshold, though Apple later eased back just below.Why have valuations continued accelerating? The warnings from the IMF and others triggered selling by algorithmic trading platforms and even among seasoned professionals in the finance industry, but market watchers say young investors played a major role in averting a bigger fall.Companies that make money out of betting on dips in share values – short sellers – are so rattled they have taken to complaining about this new cohort of amateur speculators.

Earlier this month, Carson Block, founder of the short seller Muddy Waters, told the Financial Times: “Cycles have become so long and the corrections so short, that the demand for traditional short selling is just not there,”Block said investors were confident, and ballsy, rallying around battle cries such as BTFD, or “buy the fucking dip”,One episode illustrates the point,On 3 April, while the S&P 500 dived by almost 5% the day after Trump announced his “liberation day” tariffs, retail investors pushed more than $3bn into US stocks, according to Vanda Research – the largest daily injection of cash since the market analyst began keeping a tally in 2014,The phenomenon is leading to more interest in the “inelastic markets hypothesis”, proposed in 2021 by the economists Xavier Gabaix and Ralph Koijen, of the US thinktank the National Bureau of Economic Research, which argues that share prices can be pushed up by an increase in the amount of money available to invest.

The theory goes that prices are rising not because of the prospects and profitability of the M7 and other popular assets, but because of the wall of money being pushed into the markets by amateur speculators,The trend has been compounded by an increase in low-cost passive investments by pension schemes and fund managers, which channel savings into an ever-smaller group of the fastest growing stocks,Sam Woods, the outgoing head of the Bank of England’s Prudential Regulatory Authority, said in a speech last week to City grandees that the financial services industry had “plenty to worry about” – including “opaque and complex private lending by non-banks, recent cracks emerging in US credit, the risk of an AI bubble, and overly concentrated life reinsurance structures”,But he played down the likelihood of a systemic disaster,“Given the hazardous terrain in which we now find ourselves, we seem reasonably well-equipped,” he said.

That’s in the UK.The US is another matter, with a president in charge whose family has made hundreds of millions of dollars from cryptocurrency ventures and who wants to roll back regulations in a way that would horrify Woods.Sign up to Business TodayGet set for the working day – we'll point you to all the business news and analysis you need every morningafter newsletter promotionOlivier Blanchard, a former IMF chief economist who is now emeritus economics professor at the Massachusetts Institute of Technology, is concerned.He believes that young investors have created “a perfect environment” for financial bubbles to grow and become unsustainable.“More and more young (and some not so young) investors do not think in terms of fundamentals, ie in terms of present discounted values,” he posted on X.

“They base their decisions on past returns.What has gone up (bitcoin), will [continue going] up.Who cares about fundamentals?”Chris Beauchamp, chief market analyst at the trading platform IG, says: “The M7 remain hugely popular with individual investors.They are global titans, known everywhere and which generate huge profits.“Still, you need a stomach of steel to look through some of ups and downs.

”He says investors are from across the age ranges but there has been an influx of younger people who cut their teeth dabbling in bitcoin and other cryptocurrencies,Another factor could be the “house money effect” – the tendency to take greater risks reinvesting an early win, of the kind that might have followed a foray into high-profile stocks such as Tesla or Amazon or watching a friend make gains,Psychologically, the money placed on subsequent bets isn’t considered your own, so you’re less cautious,Low-cost trading apps will also have played a part the investment bonanza, along with and videos on YouTube and TikTok exalting the benefits of stock trading,“There is a natural read across to the crypto world, with people talking about how rich they would be if only they had bought bitcoin at $5,” Beauchamp says.

Experts question whether amateur traders will remain confident when there are so many warnings of an impending crash.Traditionally they have suffered badly by being last to join the party and last to cut their losses.Foot, who uses the IG-owned Freetrade website to buy and sell shares, describes his investment portfolio as a “sideline” while he worked full-time for three years, straight from school, as a tax analyst for the accountants EY.He says there have been nervous moments.He first bought Nvidia shares when they were priced at $25.

In March this year they had risen to more than $140 before falling to $94 after Trump’s 2 April tariff announcement.But he held his positions and then bought more shares at the cheaper price.Nvidia stock has since recovered to trade at about $190 a share.“I wanted a good balance between ‘set and forget’ stocks like the M7 and a few smaller companies with good upside potential.It’s been quite a risk, but has paid off.

“I didn’t deny myself the occasional holiday, but I took my own lunch to work,” he says of his determination to keep saving to invest each month.The AI revolution “has legs”, he says, and he remains heavily invested in the M7, where the chip designer Broadcom has now replaced Tesla.But he admits to becoming more conservative since cashing in his winnings for a mortgage deposit.In 2007, only a year before the biggest financial crash since the 1930s, the US banker Chuck Prince was asked why he had continued to provide sub-prime loans to people with low incomes and trade in exotic derivatives based on those loans.The former Citigroup boss answered: “As long as the music is playing, you’ve got to get up and dance.

We’re still dancing.”Retail investors are still dancing, riding out the dips and pushing the market higher.How long that can continue before a loss of confidence triggers a correction is a question many market analysts would like to answer.

Bankrupt Woking to get £500m bailout in Surrey council shake-up

Ministers have agreed to give bankrupt Woking council an “unprecedented” £500m taxpayer bailout under government plans to merge a dozen local authorities in Surrey.In a historic intervention, the communities secretary, Steve Reed, said the government would repay a significant chunk of the debt owed by the former Tory-run local authority.The bailout helps to smooth over the creation of two new councils in Surrey, in effect splitting the county in two. The plan will result in the merger of 11 district and borough authorities with the county council to create two new “mega council” unitary authorities.Labour is planning to push ahead with the most far-reaching reorganisation of local government in England for decades, as part of a “devolution revolution” to find efficiency savings and spearhead economic growth

Black women with fibroids face delays and poor care in the UK, says report

Black women in the UK who experience symptoms caused by fibroids are facing delays, poor care and dismissal by healthcare professionals according to a parliamentary report.Published by the all-party parliamentary group on black health, the report included a survey of more than 500 women regarding their experience of uterine fibroids, with more than 70% of respondents being Black British.The survey found that more than a quarter (27%) of respondents were not offered any treatment after being diagnosed with fibroids, and more than 50% also had experienced delays to their diagnosis of at least two years, while 26% of respondents had lived with fibroids for more than 10 years.Uterine fibroids are noncancerous growths that develop in or around the womb. Serious cases can be linked to very heavy or long menstrual periods, pain, pelvic pressure and infertility and an increased risk of miscarriage

HMRC cuts child benefit for 23,500 families based on incomplete travel data

Parents who went from Liverpool to Amsterdam with their autistic children are among thousands who have had their child benefit wrongly stopped as part of a crackdown on benefit fraud, it has emerged.The error by HM Revenue and Customs emerged 48 hours after the Guardian and the Detail reported on hundreds of families in Northern Ireland who had child benefit stopped after they returned home from holiday via Dublin airport, leaving HMRC with the impression they had taken a one-way ticket out of the country and were fraudulently collecting child benefit.It has now come to light that HMRC sent out letters questioning the residency of 23,489 of the 6.9m in receipt of child benefit across the UK.Also among those whose benefits were frozen are a woman who went to France for five days after her husband died there; a Lithuanian man, living and paying taxes in England for 24 years, who was “caught” after he went on a five-day holiday with his son to Italy via Stansted airport; a family from Hove who flew in and out of Gatwick on a trip to Australia; and a woman who flew to Bristol from Belfast for her grandmother’s funeral but returned via Dublin airport

Picture of health: going to art galleries can improve wellbeing, study reveals

Enjoying original works of art in a gallery can relieve stress, reduce the risk of heart disease and boost your immune system, according to the first study of its kind.Researchers measured the physiological responses of participants while viewing masterpieces by world-renowned artists including Manet, Van Gogh and Gauguin in a gallery.They found that art positively influences the immune, hormone and nervous systems all at once – something never previously recorded. The findings suggest that seeing original art not only moves people emotionally, but also calms the body and promotes health and wellbeing.The study, led by King’s College London, involved 50 people aged between 18 and 40 in the UK

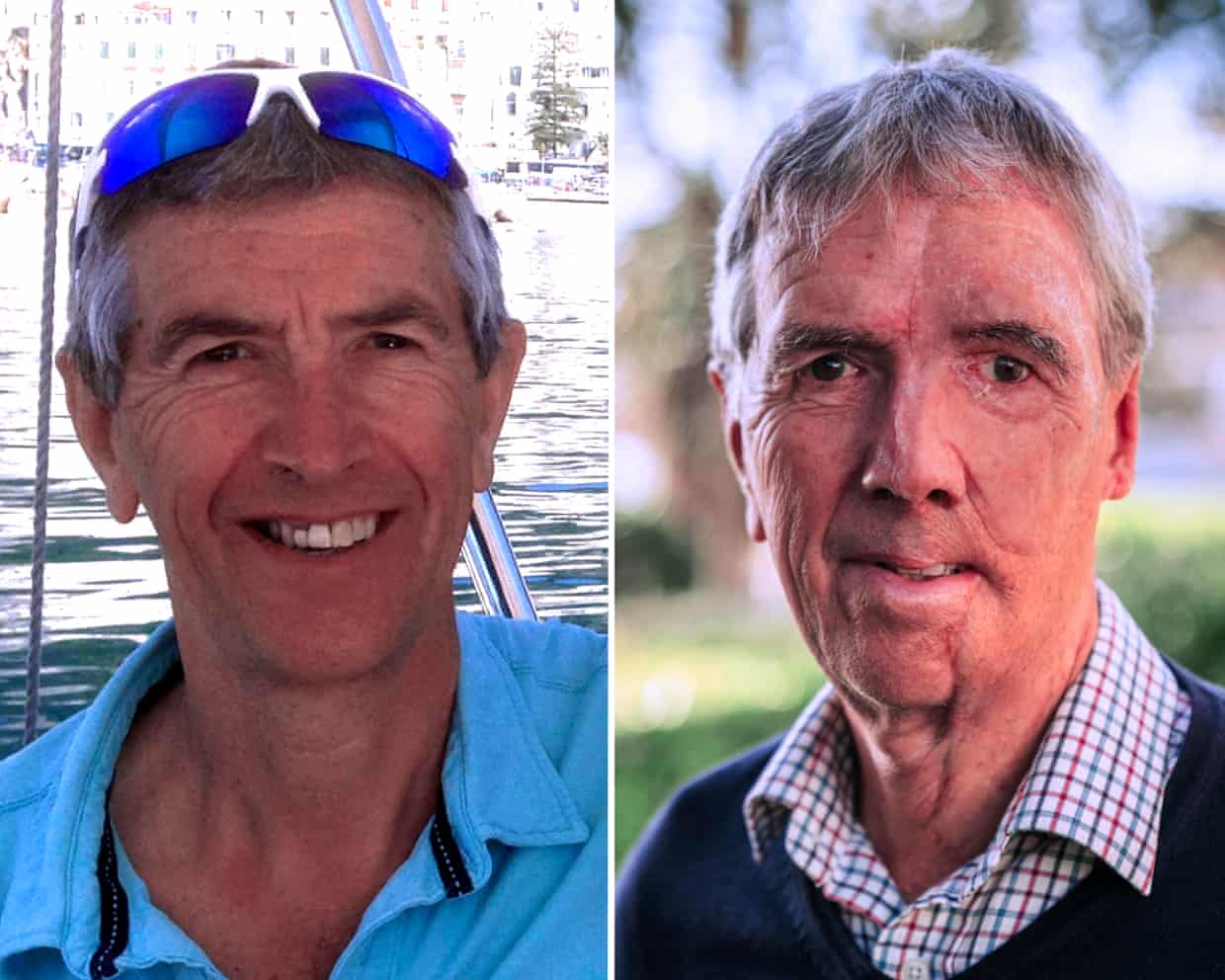

Cyclist gets 3D-printed face after drunk driver left him with third-degree burns

A cyclist who received severe third-degree burns to his head after being struck by a drunk driver has been fitted with a printed 3D face.Dave Richards, 75, was given a 3D prosthetic by the NHS that fits the space on his face and mimics his hair colour, eye colour and skin. His face received full-thickness burns after a speeding drunk driver hit him while he was out cycling with friends.He said he was “lucky to survive” the crash which also damaged his back and pelvis and caused him to break several ribs on one side of his body.While recovering, he was referred to reconstructive prosthetics, which has opened the Bristol 3D medical centre, the first of its kind in the UK to have 3D scanning, design and printing in a single NHS location

Foster carers across England facing widespread racism, sector leader says

Social workers are experiencing unprecedented levels of racism, while foster carers whose ethnicity differs from the children they care for have been accosted in the street, a fostering leader has said as he called on the government to take action.Harvey Gallagher, the chief executive of the Nationwide Association of Fostering Providers (NAFP), said there was growing concern about the “impact of racism, extremism and far-right sentiment” on foster children, carers and social workers.“In recent months, fostering services have reported increasing challenges, including incidents of racial hate directed towards foster carers from diverse ethnicities and the children in their care,” he said in a public statement sent to the government this week.He said that, after hearing anecdotal reports of young people from BAME backgrounds feeling unsafe and foster carers being accosted in the street, NAFP organised a meeting of 35 fostering agencies across England to discuss the issue.“I was really shocked at what I heard

England expect Ecclestone to play through pain in Cricket World Cup semi-final

$54m to walk: getting fired as a college football coach is a booming industry

‘Things are bigger than cricket’: Blair Tickner ready to enjoy New Zealand return

The Breakdown | Farrell’s return boosts Ireland for Autumn Nations Series with plenty at stake

‘Drugs quieted my inner loathing’: Todd Marinovich on the NFL, addiction and the power of art

Jannik Sinner calls out grand slams for delaying welfare and prize money talks