Why thousands are queuing for hours in central Sydney to buy gold

Prakas buys a bit of gold every year, always on a Saturday, for the Hindu festival Diwali.This year, thousands of gold-hungry Australians and a record-breaking price surge got in the way.“I’ve never seen anything like this,” he says.“Maybe I’ll just buy a smaller version … if I can’t afford [it] … just to fulfil the tradition.”The Nepali Australian man made the hour-long trip into Sydney’s CBD on Saturday to buy gold – then turned around when he saw the 400-person queue snaking across Martin Place.

Hoping to skip the queue, he decided to buy online, but was stuck in the two-hour queue of pre-purchasers when he returned to the ABC Bullion store on Tuesday.The price of gold had risen from about US$4,200 an ounce to more than US$4,300 in the intervening three days, continuing a two-month surge that has gained Australians’ attention.About 1,000 people have moved through the ABC Bullion Sydney store each day for over a month, with thousands more buying online, according to the general manager, Jordan Eliseo.They come from all over Sydney every day, some hurrying to arrive before 9am, and queueing for hours.Eliseo has had to extend the store’s trading hours and hire five extra staff members in the last fortnight to keep up with demand.

“That’s the first time that we’ve seen this sustained [an] uptick in demand,” Eliseo says,Sign up: AU Breaking News email“It’s a bit of a gold rush … They’re reading about it on the news and they’re going, ‘Actually, I want some [gold],’”Eliseo began managing the store a little more than three years ago, over which time gold prices doubled from US$1,700 to US$3,400 by April, before leaping nearly $1,000 higher in the last two months,Some of his customers are selling their gold, but many are betting on sustained momentum and looking to buy at record highs,Sayed, a tradesman from Campbelltown, has already benefited from the gold price spike and is looking to buy another ounce – though he admits he has “no idea” whether the price will go up.

“Maybe it could jump again,” he says.Analysts are increasingly siding with Sayed, pointing to continued political intervention in the US economy, unstable governments and conflicts around the world as reasons investors are still flocking to the traditional safe haven.The Royal Bank of Canada singled out global uncertainty as the key driver for upgrading its forecast for gold prices to potentially hit US$5,000 (A$7,700) by early 2026.Sign up to Breaking News AustraliaGet the most important news as it breaksafter newsletter promotionInvestors are also trading out of uncertain investments in shares, as the prospect of an AI bubble hangs over sharemarkets’ record-breaking runs, and currencies, as persistent inflation and falling interest rates cut returns on cash.That extends from investment funds, to central banks, to retail investors like Avtar, a nurse from Sydney’s northern suburbs who was queueing to add to his precious metal purchases on Tuesday.

Avtar took $78,000 out of his retirement savings in a term deposit with major bank ANZ and bought gold in April.That sum is now worth nearly $112,000.But Avtar doesn’t believe those gains are sustainable, and instead queued to buy silver, which has seen even greater price rises than gold in 2025.“Prices have gone scary,” he says.“If you invest now, will it crash, or will it still keep on growing?”Overnight into Wednesday, the price of spot gold fell 5.

5% to a one-week low of US$4,115.26 per ounce – its steepest fall since August 2020.AMP’s chief economist, Shane Oliver, has been warning for two weeks that exploding queues could be a sign the market is becoming speculative and vulnerable to a correction.Since then the queues continued to grow and the price kept soaring, but he has stood by that warning.“The risk of a pullback is rising,” Oliver says.

– with Reuters

UK office, shop and warehouse construction plunges to 11-year low as costs soar

Construction of offices, shops and warehouses in the UK has fallen to the lowest level in more than a decade amid rising build costs and general uncertainty.All commercial sectors have been hit, with construction across office, retail and industrial sectors down by 21% to 5.85m sq metres (63m sq ft) in the third quarter compared with a year earlier, according to the latest data from CoStar.This is the lowest commercial construction since 2014 and comes as housebuilding is also slowing, in a blow to the Labour government, which last year announced an ambitious target of building 1.5m new homes over five years

Bank of England chief warns of ‘worrying echoes’ of 2008 financial crisis

The governor of the Bank of England, Andrew Bailey, has warned recent events in US private credit markets have worrying echoes of the sub-prime mortgage crisis that kicked off the global financial crash of 2008.Appearing before a House of Lords committee, the governor said it was important to have the “drains up” and analyse the collapse of two leveraged US firms, First Brands and Tricolor, in case they were not isolated events but “the canary in the coalmine”.“Are they telling us something more fundamental about the private finance, private asset, private credit, private equity sector, or are they telling us that in any of these worlds there will be idiosyncratic cases that go wrong?” he asked.“I think that is still a very open question; it’s an open question in the US.”He added: “I don’t want to sound too foreboding, but the added reason this question is important is if you go back to before the financial crisis when we were having this debate about sub-prime mortgages in the US, people were telling us: ‘No it’s too small to be systemic; it’s idiosyncratic

Pizza Hut administration: the 68 restaurants that will close

The locations have been revealed of 68 Pizza Hut restaurants that will close after the company behind its UK venues fell into administration.They are across the country, from Finchley Lido in London to Carlisle in Cumbria and Rhyl in north Wales.Eleven delivery-only Pizza Hut sites will also close as part of a restructuring, putting 1,210 workers at risk of redundancy.DC London Pie, the company running Pizza Hut’s UK restaurants under a franchise deal, appointed administrators from the corporate finance firm FTI on Monday.The US company Yum! Brands, which owns the global Pizza Hut business as well as KFC and Taco Bell, has bought the UK restaurant operation in a pre-pack administration deal, saving 64 sites and securing the future of 1,276 workers

UK borrowing reaches five-year high for September at £20.2bn

UK government borrowing was the highest for five years in September after rising debt interest costs and higher welfare payments pushed the public finances deeper into the red.Figures from the Office for National Statistics (ONS) showed public sector net borrowing – the difference between public spending and income – hit £20.2bn last month, up £1.6bn from the same month last year and the highest September borrowing since 2020.The ONS said a rise in tax receipts was unable to offset the jump in debt interest costs this year and a rise in welfare costs, which have mostly increased in response to rising inflation

Reeves has mountain to climb in budget after borrowing rise

Rachel Reeves has already seen the most significant numbers setting the backdrop for next month’s budget – the Office for Budget Responsibility’s (OBR) forecasts for five years’ time, when her fiscal rules are judged.But September’s public finances data, published on Tuesday, will hardly have lightened the mood in No 11 as she draws up plans for tax rises and spending cuts.Even before the impact of the U-turns on winter fuel payments and disability benefits hits, the Office for National Statistics (ONS) found that the deficit in the first six months of the fiscal year was £7.2bn higher than the OBR predicted at its last forecast in March, at £99.8bn

Amazon says Web Services are recovering after outage hits millions of users – as it happened

AWS has issued another update, saying that is continues to “observe recovery across all AWS services.”It added that it is succeeding across multiple “Availability Zones in the US-EAST-1 Regions.”AWS went on to say: “For Lambda, customers may face intermittent function errors for functions making network requests to other services or systems as we work to address residual network connectivity issues. To recover Lambda’s invocation errors, we slowed down the rate of SQS polling via Lambda Event Source Mappings. We are now increasing the rate of SQS polling as we experience more successful invocations and reduced function errors

I can’t stop watching videos of people discovering Beds Are Burning by Midnight Oil. Send help

‘London could 100% compete with Cannes’: Aids charity UK gala debut honours Tracey Emin

Champagne, celebs and artefacts: British Museum hosts first lavish ‘pink ball’ fundraiser

My cultural awakening: ‘The Specials helped me to stop fixating on death’

From After the Hunt to the Last Dinner Party: your complete entertainment guide to the week ahead

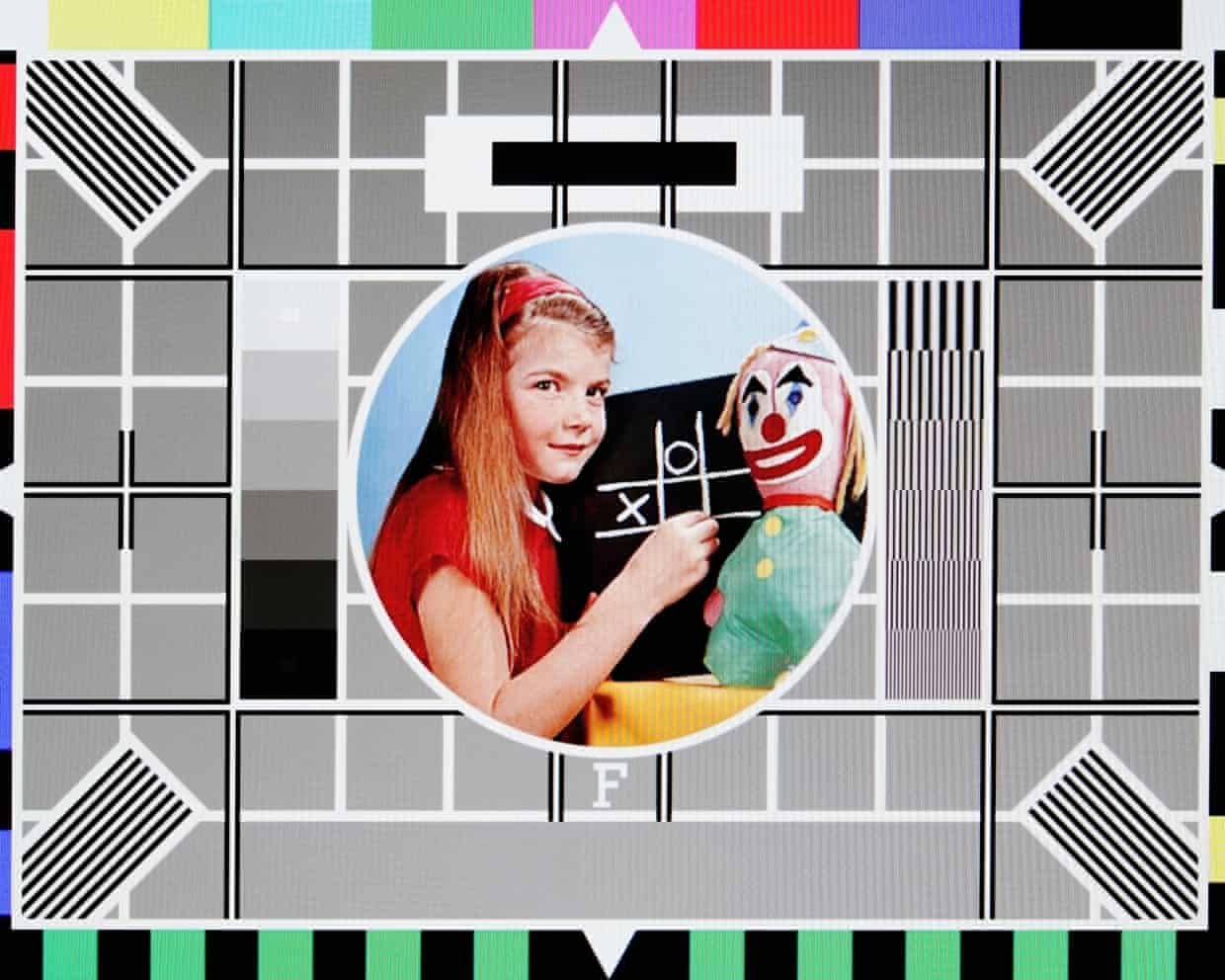

The Guide #213: Should we mourn the demise of TV channels?