The Ashes inspiration, overpreparation and bold tactics: a history of Australia v England two-day Tests | Geoff Lemon

To put in context the surprise that greeted the two-day Boxing Day Test, consider the rarity by arithmetic.The match in Melbourne was Test No 2,615 and the 27th to finish inside two days.You probably don’t need a calculator to see that is roughly 1%.Yet we have had two such matches in this Ashes series, plus another in Australia three years ago.We’ve had half a dozen two-day Tests since 2021.

What gives?Nine two-day Tests – one-third of the total – happened in the 1800s, when pitches could become swamps or shooting galleries.The next few mostly involved weak teams in their early years of development.Australia and England each dished one out to South Africa in the tri-series of 1912 and South Africa was little stronger when ripped up by Clarrie Grimmett and Bill O’Reilly in 1936.Australia also bashed up a West Indies team new to Test cricket in 1932 and New Zealand in 1946.But that was it, from just after the second world war until the new millennium there was not a single two-day match.

In 2000, England demolished a ghostlike West Indies at Leeds to signal the start of the Caribbean’s terminal cricket demise and Australia’s golden era team took apart Pakistan in Sharjah in 2002.Then we were back to weak emerging teams, with five two-dayers involving Zimbabwe, Afghanistan or both.The others were in extreme conditions: India thumping England in Ahmedabad with a pink ball that plunged through the soil from the first over, South Africa greeted with a disastrously underprepared fast pitch at Brisbane, then offering India something similar in Cape Town.The recent two Ashes pitches were the best of the lot.So of the 27 matches in question, eight have been between England and Australia: two in this series, the other six more than a century ago.

These are the two-day Tests between the old rivals that came before,The best of them all isn’t technically an Ashes contest because it’s the match that inspired the Ashes,Like in Melbourne last week, 20 wickets fell on the first day at the Oval, but given the short bowling approaches of the time, the day spanned 151,3 overs,England were well on top in a low-scoring era, with 101 to follow Australia’s 63.

There was, as a match report makes clear by beginning with a display of every English player’s superior batting average, no doubt England was supposed to be better at home.The next morning, though, Australia built a lead.The score was 99 for six when Billy Murdoch was joined by Sammy Jones and the pair added another 15 runs.Worried the lead would climb into triple figures, the ever sharp WG Grace stole in to break the stumps while Jones was patting down the pitch and appealed for a run out.It was given, Australia were bowled out for eight more runs and the lead was 85.

The problem was, Fred Spofforth was next in to bat, and the man known as The Demon was incensed by what he said was Grace’s cheating.He tore strips off the Englishman in the dressing room at the innings break and vowed to make them pay.The vow was upheld in a way to please numerologists: seven Demon wickets in the second innings to match his seven in the first, England were all out for 77 to lose by seven runs.A cremation notice for English cricket was placed in a newspaper and the Ashes were born.If a two-day match is notable, what about an entire series of them in Tests at Lord’s, the Oval and Old Trafford? Several factors conspired.

Of all Test bowlers with at least 50 wickets, the list of best averages starts with George Lohmann, JJ Ferris and Billy Barnes, then skips two places to Charlie Turner, Bobby Peel and Johnny Briggs.All of them played throughout this series.That is, six of the eight most successful bowlers in history played at the same time.Their figures were helped by a wet summer with rain ruining the pitches for the first and third Tests.Only three innings out of 10 exceeded 100.

On the one good pitch, Australia collapsed anyway by lunch on day one,The visitors won the first shootout, but were done by an innings in the next two encounters,At least they made the most of their tour with another 34 first-class fixtures between May and September,Indeed, by the time Australia lost the second Test to square the series it was the middle of August and they had played 25 competitive matches,If anything, they overprepared.

With Lohmann, Ferris, Turner and Barnes still around, it was another sad season for day-three hopefuls at the Oval,The ground was drenched with rain before the match and the bowlers cut loose on the drying mud with 22 wickets on the first day,Australia scratched together 98, England 100, then Australia 102,That left 95 for England to chase and they moved comfortably to within a dozen runs of that target four wickets down, only for a tumble to begin,With Turner and Ferris in tandem, four wickets fell for 10 runs and memories of the Spofforth effort eight years earlier bubbled away.

After a string of maiden overs, with tension abounding, an errant throw from Jack Barrett allowed England to pinch the win, two wickets in hand,In what was until recently the only two-day Ashes Test beyond the morass of the 1800s, this one at Trent Bridge does have the context of an English game still battered by the first world war,It is also the site of a turning point: the proof of concept for the fast-bowling opening pair,Jack Gregory and Ted McDonald had first opened the bowling together in Australia six months earlier,They had been effective in three Tests on flatter pitches without dominating.

But the captain, Warwick Armstrong, liked the concept and wanted more.When he rolled it out for the first Test of the series in England, it was devastating.Gregory did the damage in the first innings, three wickets off the top and six by the close, but there was no respite at the other end.Most teams in those days used at least one slow bowler with the new ball, so this was something unfamiliar.Armstrong sent down three overs of leg-spin and Gregory and McDonald bowled the rest, taking nine wickets between them.

When they went again the next day they added seven more and it was McDonald’s turn for a five-wicket haul.The match was done and the game was changed.

DIY shops enjoy bumper year as UK property market slows

Retailers of home improvement products are having a glittering year on the London stock market, as cash-strapped UK consumers turn to DIY projects after being priced out of moving home or undertaking expensive renovations.Publicly listed retailers including the B&Q owner, Kingfisher, as well as Topps Tiles, Wickes and the sofa seller DFS are on track for double-digit percentage share price increases of as much as 56% this year.Kingfisher and Topps Tiles have posted share price increases of 26.5% and 13% respectively, their best annual gains since the pandemic, while a 23% year-to-date rise at DFS is its strongest year since 2019.Kingfisher, which also operates in France and Poland, has issued two profit upgrades since September on the back of the company’s strong performance in the UK

Copper price on track for biggest rise in 15 years amid global shortage fears

Copper, the metal that underpins the fast-growing renewable energy industry, is on course for its biggest annual price rise in more than 15 years as traders react to fears of global shortages.As one of the main beneficiaries of the “electrification of everything”, copper has soared by more than 35% in value this year, spurred by US tariff uncertainty and concerns about mining disasters that could restrict supply.Analysts said copper had also joined silver and gold as a safe haven asset for investors wanting to hedge against the falling value of the dollar.Silver reached a record high on Monday, pushing the value of the Mexican mining company Fresnillo, which is listed on the London stock market, to a record high this month. The price of gold has jumped above $4,400 (£3,263) an ounce, up more than 70% since the beginning of January

Nearly half of Americans believe their financial security is getting worse, poll finds

Twice as many Americans believe their financial security is getting worse than better, according to an exclusive new poll conducted for the Guardian, and they are increasingly blaming the White House.The poll, conducted by Harris, will be a further blow to Donald Trump’s efforts to fight off criticism of his handling of the economy and contains some worrying findings for the president.Nearly half (45%) of Americans said their financial security is getting worse compared to 20% who said it’s getting better.57% of Americans said the US economy is undergoing a recession, up 11% from a similar poll that was conducted in February.The US is not experiencing a recession, which is typically defined as two quarters of negative growth

Influx of cheap Chinese imports could drive down UK inflation, economists say

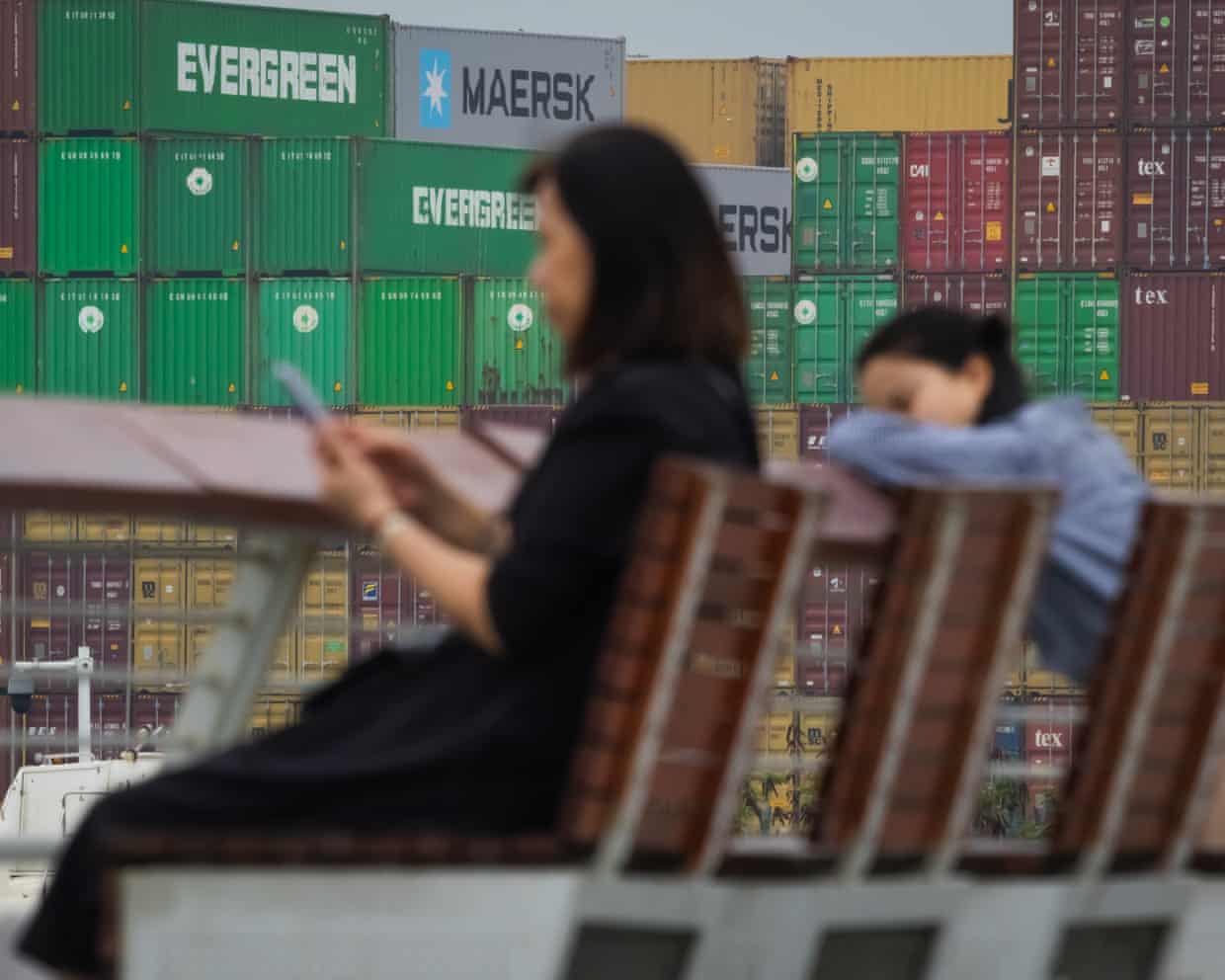

The UK is poised for an influx of cheap Chinese imports that could bring down inflation amid the fallout from Donald Trump’s global trade war, leading economists have said.After figures showed China’s trade surplus surpassed $1tn (£750bn) despite Washington’s tariff policies hitting exports to the US, the Bank of England said the UK was among the nations emerging as alternative destinations for the goods.Stephen Millard, a deputy director at the National Institute of Economic and Social Research, said: “There is an expectation that given the high tariffs the US are imposing on China, that China will divert its trade elsewhere and one of those places will be the UK.”This month Catherine Mann, an external member of the Bank’s rate setting monetary policy committee, told MPs on the Treasury committee there were early signs of trade diversion affecting UK inflation.“Import prices have started to moderate on the back of sterling appreciation and some of the spillover of the diversion of Chinese products from the US tariff burdens to other places, including to our docks

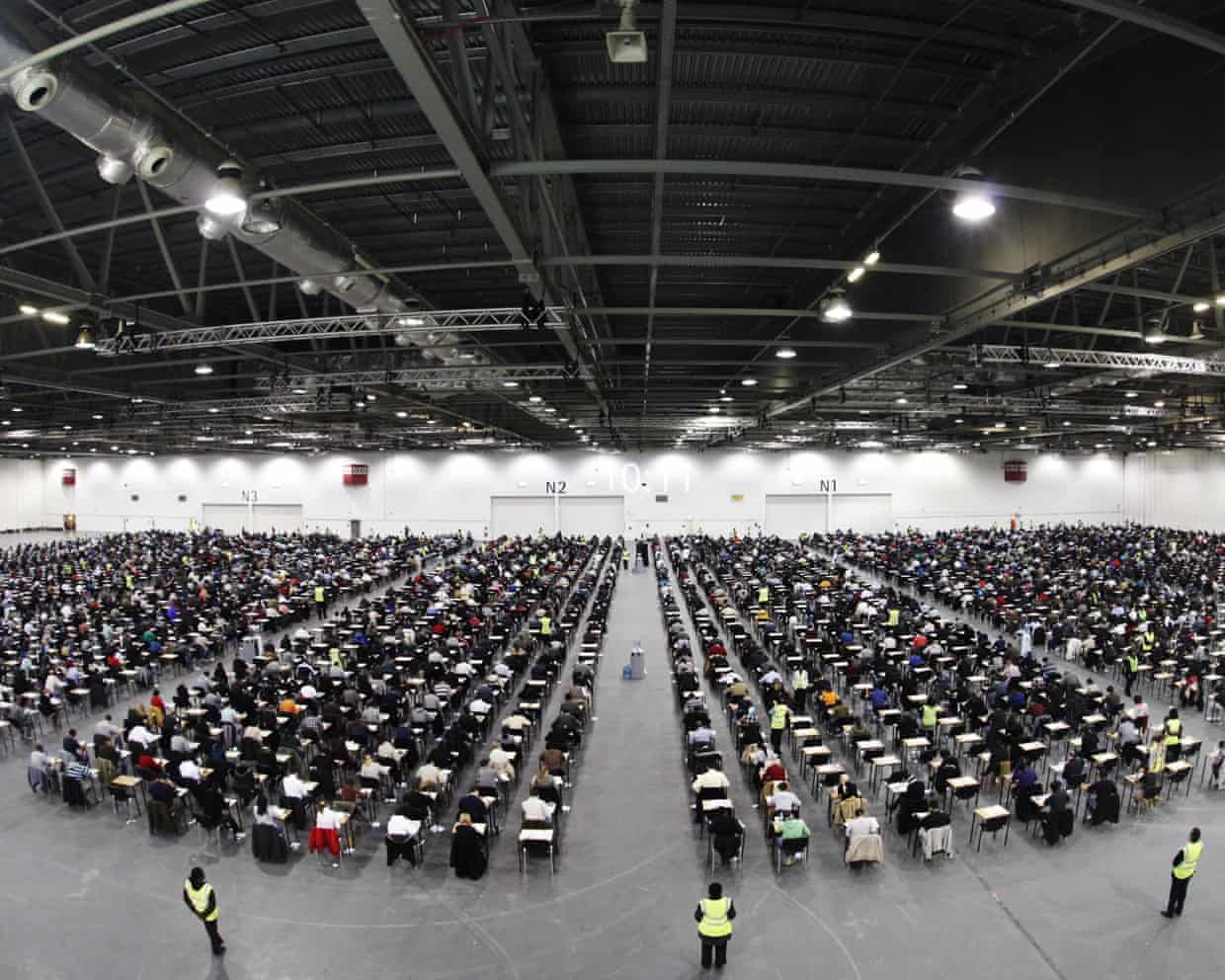

UK accounting body to halt remote exams amid AI cheating

The world’s largest accounting body is to stop students being allowed to take exams remotely to crack down on a rise in cheating on tests that underpin professional qualifications.The Association of Chartered Certified Accountants (ACCA), which has almost 260,000 members, has said that from March it will stop allowing students to take online exams in all but exceptional circumstances.“We’re seeing the sophistication of [cheating] systems outpacing what can be put in, [in] terms of safeguards,” Helen Brand, the chief executive of the ACCA, said in an interview with the Financial Times.Remote testing was introduced during the Covid pandemic to allow students to continue to be able to qualify at a time when lockdowns prevented in-person exam assessment.In 2022, the Financial Reporting Council (FRC), the UK’s accounting and auditing industry regulator, said that cheating in professional exams was a “live” issue at Britain’s biggest companies

Help UK ceramics industry or ‘lose piece of national identity’, government told

Britain will lose a piece of its national identity if the country’s ceramics industry is allowed to descend further into crisis without state assistance, the government has been warned.Ceramics producers including the struggling potteries of Staffordshire have come under huge pressure owing to factors such as the UK’s sky-high energy costs, leading to job losses.In a report, unions and the Green Alliance thinktank urged the government to step in to support the centuries-old sector.“Tens of thousands of working-class jobs rely on the ceramics sector so we cannot afford to leave its future to chance. But so far we aren’t seeing enough action from a government grappling with the unique challenges the sector faces,” said Chris Hoofe of the GMB union

The Las Vegas Raiders and the thin line between tanking and incompetence

The Ashes inspiration, overpreparation and bold tactics: a history of Australia v England two-day Tests | Geoff Lemon

Piastri intrigue, Picklum magic and Gout goes global: reflections on a year of Australian sport | Jack Snape

‘I like No 3’: Bethell always looks the part and now has chance to shine in Ashes

I was there: Europe’s dramatic Ryder Cup win signed off a strange week

Matthew Potts poised to play in fifth Ashes Test after England rule out Gus Atkinson