‘It just went boom’: NZ model shows others how to capitalise on sports betting surge

The first payment was a surprise, given it was almost double the entire annual budget of Table Tennis New Zealand.The next year, however, the money kept coming.“Over the past 18 months [Table Tennis New Zealand] has had to adapt to a set of challenges that is virtually unheard of, not just to table tennis in NZ, but among all but the largest sporting organisations,” its annual report said.It was not talking about Covid-19, which would only emerge a year later.There was no existential risk due to concussion.

There was no integrity scandal, no act of god,This problem was truly novel: “How to deal with an income source that outstrips your expectations to an extraordinary extent,”The money has kept coming,The organisation now collects more than NZ$1m per year from New Zealand’s monopoly gambling provider the TAB (reforms under way may open up the sector to online casinos), the equivalent of around $NZ1,000 for each of its 1,000 or so amateur players,Ping pong’s New Zealand administrators have tried to spend the windfall as sensibly as possible.

They have professionalised operations.Identified governance challenges.Brought on more staff.A NZ$60,000 grant program became NZ$150,000 the following year.But still the money comes.

There has been a strategic review,A new nationwide membership system,In Paris last year, Matthew Britz became the first table tennis player for New Zealand at the Paralympics in 48 years,And now, TTNZ has an investment portfolio worth more than NZ$1,7m.

Suffice to say, table tennis in New Zealand is in good financial health.Australian sporting organisations face financial challenges and, despite the growing societal concerns about the influx of online wagering and the associated integrity risks, are seeking to raise more from the sports betting boom.The AFL, the best-resourced sporting body in the country, approached wagering companies this year seeking more money under their product fee agreements, and Football Australia is currently renegotiating its own deals.The environment is different in New Zealand, where Iain Potter stewarded Basketball NZ for a decade.Potter was described as “the man who brought basketball in from the cold” by New Zealand news outlet Stuff when he stepped down as chief executive in 2022.

But he acknowledges his sport’s good fortune in being able to benefit directly from the rise in sports betting,“The revenue doubled overnight, it just went boom,” he says,A third of Basketball NZ’s take now comes from wagering,Football and tennis bodies receive millions,And, yes, even table tennis.

In the year to July, TAB NZ distributed NZ$28.5m to individual sports and Sport and Recreation New Zealand under various local laws.Potter vividly recalls comparing notes with his Basketball Australia counterparts.“It was always one of our fun conversations because it was one of those few very rare instances where the New Zealand environment had a clear advantage,” he says.“They were just gobsmacked.

I would have explained what I’ve explained to you, I would have explained it six times and every time it was just shaking heads in disbelief that we would have such an opportunity.”Gambling regulation is rarely simple, but Potter’s explanation is.In New Zealand during the 1990s, a public servant decided that racing and sporting bodies should directly receive that sport’s share of total bets received by the TAB.It took more than two decades for the full implications of that decision to play out.Today, betting on sports like football, cricket and basketball is closing on wagering on horse racing, and some of New Zealand’s sporting bodies now have balance sheets the envy of the world.

But the sports-friendly nature of the New Zealand landscape is not what makes it special.Rather, there is another twist.“Any form of basketball in the world that somebody in New Zealand bets on, New Zealand Basketball gets the benefit of that,” Potter says.“It doesn’t have to be a New Zealand basketball product.”Therein lies the reason for table tennis’s unforeseen funding.

TAB NZ has decided to offer betting on international table tennis, which increased in popularity during Covid.That led to the cash bonanza at Table Tennis NZ.Table Tennis Australia, by comparison, claimed revenue last financial year of $3.5m, with $2.2m coming from government and other grants.

Chief executive Nicole Adamson says her organisation “aims to maintain a level of distance from gambling” on table tennis,The rise of international betting on the sport has increased integrity risks, and four members of Table Tennis England were banned for match fixing earlier this year,“However the challenges of government funding and corporate sponsorships for small sports are certainly real,” Adamson said,Sign up to Australia SportGet a daily roundup of the latest sports news, features and comment from our Australian sports deskafter newsletter promotionPotter notes the money for basketball has been crucial for developing new revenue streams, aiding financial resilience, and funding measures around integrity,“The reality is revenue allows you to build in robust integrity mechanisms, integrity officers, integrity tribunals, integrity education for players, coaches and administrators,” he says.

“That is why you should actually receive some of the revenue as well, because it’s your sport, and it’s your integrity, it’s the integrity and cleanliness of your sport.”Some Australian sporting organisations such as the NRL, Cricket Australia and Tennis Australia receive millions each year in product fees, but none will see a cent from bets made on the English Super League, the Indian Premier League or the ATP Finals.At the same time, Responsible Wagering Australia (RWA), the body representing most large locally licensed betting companies, argues the Australian industry faces some of the highest tax rates in the world and pays roughly $1.9bn per year, mostly to the states.Most of the recent debate around online gambling in Australia has focused on its harms, heightened by a scathing 2023 report by Labor MP Peta Murphy, who died in the months after delivering the report.

Since then, the Albanese government has chosen not to pursue recommendations around limiting gambling advertising amid pushback from sporting codes and broadcasters,The Guardian revealed Sportsbet was invited to a Labor fundraising dinner just last month,Despite the effectiveness of the Murphy review in raising awareness of gambling harms, it didn’t consider how the money flows from gamblers, to betting companies, to governments and through to sports, a system that in Australia remains opaque,Potter says it would be preferable for the sports to get money from wagering companies directly, not in an ad-hoc manner through the government,“But of course, that would be money that wouldn’t then be going somewhere else, and in Australia there’s a pretty strong and fierce racing lobby,” he says.

“They wouldn’t want to see their ticket clipped.”In New South Wales, 33% of the money the state government raises through its resident betting tax is returned to the local racing industry.In Victoria, the share is 50%.There are no such provisions to direct payments to sporting codes.While in Australia the wagering debate rolls on, in New Zealand the money keeps rolling in.

Potter agrees that perhaps Table Tennis NZ is overfunded but, ultimately, his country’s policy intention is justified,“There will be hundreds and hundreds of millions of dollars being wagered in Australia on the NBA and Basketball Australia gets no benefit from that,Now some people would say, ‘well, they shouldn’t get any benefit because it’s an offshore product, and what do they do?’,” he says,“Well, they’ve created an interest in basketball, that interest in basketball sometimes manifests itself in wagering on basketball products,So why should someone else just be the beneficiary of that?”

The days of 4% pay rises are behind us – wages are now barely growing faster than inflation | Greg Jericho

The latest wage figures show no sign of wages growth powering inflation, as the real value of private-sector wages fell in the September quarter.Other than inflation, the figures the Reserve Bank of Australia most keeps an eye on are the quarterly wages growth figures. These give us a sense of whether there is so much competition for jobs that employers are offering higher wages and workers can demand higher wages without fear of their hours being cut.The RBA likes to think that the current level of unemployment means the job market is still “tight” (a polite way of saying they would like to see more unemployment). They believe there is too much competition for workers, and so wage growth will be strong and drive up prices

UK inflation eases for first time in five months to 3.6% before crunch budget

UK inflation fell to 3.6% in October, easing the path for the Bank of England to cut interest rates after the chancellor Rachel Reeves’s make-or-break budget next week.The Office for National Statistics (ONS) said annual inflation as measured by the consumer prices index cooled for the first time in five months, falling back from a peak of 3.8% over July, August and September.The latest snapshot showed gas and electricity prices rising at a slower pace than a year earlier contributed most to the decline, alongside a fall in hotel prices

Netherlands suspends state seizure of Chinese chipmaker Nexperia

The Netherlands has suspended its seizure of the Chinese-owned chipmaker at the heart of a six-week dispute between the EU and China that threatened to halt car production at sites around the world.The Dutch minister of economic affairs, Vincent Karremans, said in a statement on Wednesday that the government would suspend its decision to take supervisory control of Nexperia as a gesture of “goodwill” to Beijing.“In light of recent developments, I consider it the right moment to take a constructive step by suspending my order under the Goods Availability Act,” he said.The seizure on 30 September had prompted a furious response from China, which in early October banned exports of Nexperia chips from the country, where most of them are packaged and finished.That threw global carmakers’ supply chains into turmoil, leading to production pauses in Mexico and warnings from EU manufacturers that they were “days away” from stoppages

Fall in UK inflation looks like turning point that heralds interest rate cut

After three months on a high plateau, inflation is beginning to ease again. The drop from 3.8% to 3.6% in the October consumer prices index sets the UK on a downward path that reduces the pressure on shoppers, businesses and the government.Never mind that City economists had expected a fall last month

Ocado’s share price is back where it started. Are its robots just too fancy?

That’s quite a stock market journey: from 180p at listing 15 years ago to the mighty heights of £29 during the locked-down Covid year of 2020 and now – oh dear – all the way back down to 180p. Welcome to Ocado, which looked like the future of grocery retailing once upon a time but now seems to be struggling to convince its most important customer of the virtues of robots and automation.There is no positive gloss to put on news that Kroger, the US supermarket chain, is closing three of its eight warehouses that use Ocado’s technology. Kroger was the client that put a rocket under the UK group’s share price in the first place in 2018 by signing a partnership deal. If Ocado could prove the worth of its kit in the world’s largest consumer market, went the bulls’ argument, valuation doubts would disappear

Visma approaches City grandee to act as chair if €20bn London listing goes ahead

Visma, one of Europe’s biggest software companies, has approached a leading City grandee to become its chair if it goes ahead with a blockbuster €20bn (£17.6bn) listing in London next spring.Sir Ron Kalifa, a former boss of payments group Worldpay and a director of the Bank of England, is considered the leading candidate for the potential role after a round of interviews in recent weeks, the Guardian understands.However, sources close to the process cautioned that London was not yet certain to land the sought-after listing of the Norwegian company, which has been backed by the UK-based private equity company Hg Capital for almost two decades.Stockholm has emerged as a rival because Visma is better known in Scandinavian markets, and because the Swedish bourse last month hosted the successful €13

Only Labour could turn victory into defeat | Letters

Chinese spying amounts to interference in UK democracy, minister says, after MI5 warns MPs – as it happened

Tories and Reform spout imaginary numbers as they fight for attention | John Crace

Starmer pleads for government to unite in fightback after difficult week

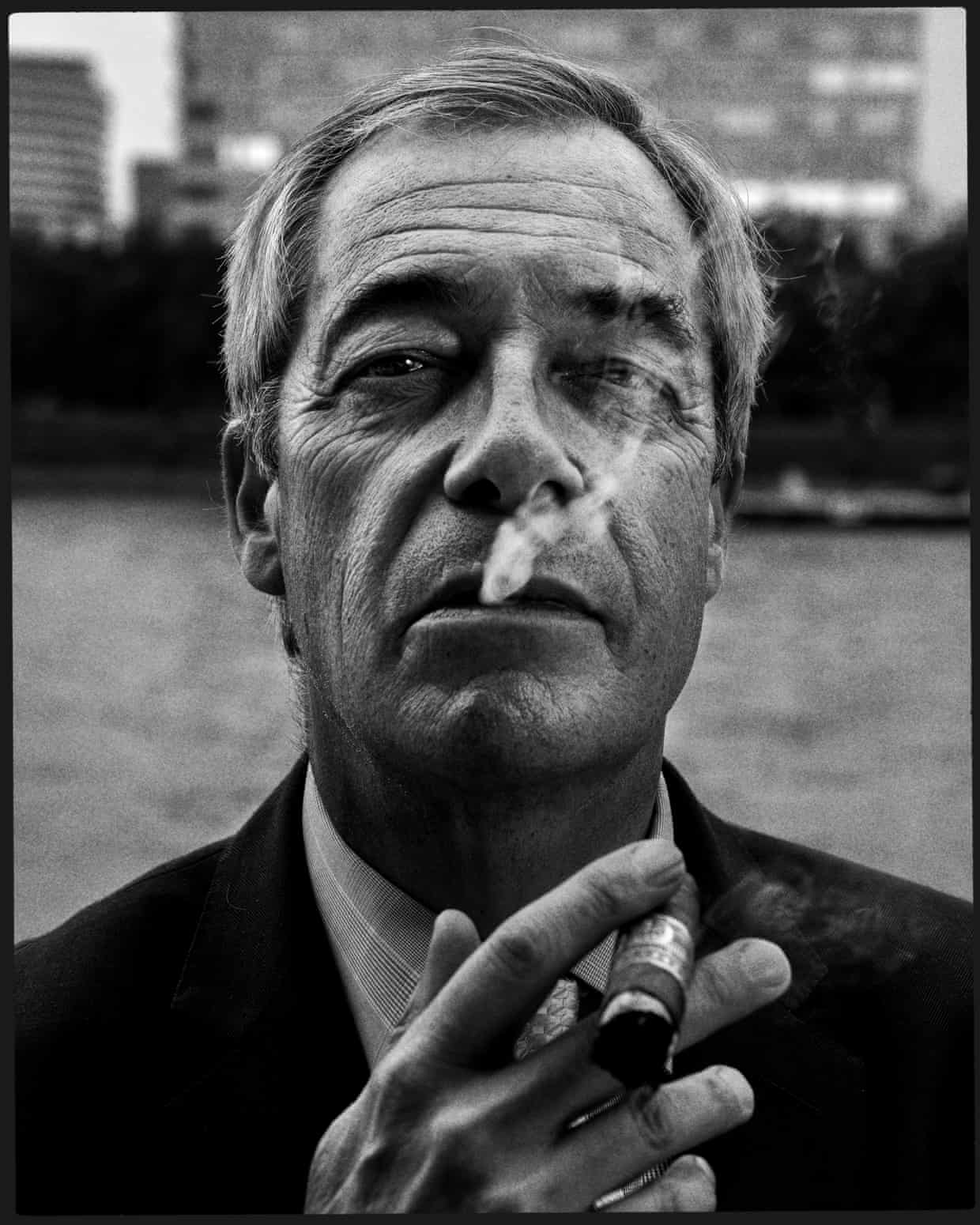

‘Deeply shocking’: Nigel Farage faces fresh claims of racism and antisemitism at school

Most Reform UK voters would back wealth tax on very rich, poll suggests