The days of 4% pay rises are behind us – wages are now barely growing faster than inflation | Greg Jericho

The latest wage figures show no sign of wages growth powering inflation, as the real value of private-sector wages fell in the September quarter,Other than inflation, the figures the Reserve Bank of Australia most keeps an eye on are the quarterly wages growth figures,These give us a sense of whether there is so much competition for jobs that employers are offering higher wages and workers can demand higher wages without fear of their hours being cut,The RBA likes to think that the current level of unemployment means the job market is still “tight” (a polite way of saying they would like to see more unemployment),They believe there is too much competition for workers, and so wage growth will be strong and drive up prices.

And yet in the September quarter private-sector wages grew just 0.7%, down from 0.8% in the June quarter and 0.9% in the first three months of this year:If the graph does not display click hereThe annual figures also show that wage growth is slowing and the days of wages rising above 4% are behind us.If the graph does not display click hereThe slowing figures across the board did, however, bring one moment of unintentional hilarity, when the shadow minister for industrial relations, employment and small business, Tim Wilson, decided this was his chance to show off his economic acumen.

He quickly put out a media release noting that while private-sector wage growth was slower than this time last year “wages in the public sector rose to 3.8%, up from 3.7% a year earlier”.That is true but then, displaying a level of comic ignorance that was missing from parliament during his time out of office, he suggested the Albanese government was to blame.He argued that “Australia’s economy is slowly sinking as the private sector is being outpaced by public spending”.

Alas for Wilson, had he read the Australian Bureau of Statistics webpage he would have seen the ABS explain that “state government pay rises contributed 82% of public sector wage growth” and that commonwealth public service pay contributed just 0.04 of a percentage point to quarterly public-sector wage growth – or 3.9% of the increase in public-sector wages.That is the lowest contribution since 2017:If the graph does not display click hereAlso, while public-sector wages outgrew those in the private sector over the past year, that has been very much the exception.Since March 2021, public-sector wages have grown 14.

2% compared with 15.2% wage growth in the private sector.The importance of that, however, is that in that same period prices have gone up 21.8% and the cost of living for employee households (which takes into account mortgage repayments) has risen 26.6%:Sign up to Breaking News AustraliaGet the most important news as it breaksafter newsletter promotionIf the graph does not display click hereWilson may be interested to know that public-sector workers are the ones who have seen their real wages fall the most across the nation since March 2021:If the graph does not display click hereThis is the real problem of the wage figures – yes, wages are now barely growing faster than inflation.

In the September quarter overall wages fell 0.6% in real terms, which wiped away a lot of the gains since March 2023.Since that time the value of real wages has increased 0.95%, but that still leaves real wages 4.6% lower than they were in March 2021.

What does that mean? Back then, average full-time earnings was about $90,000 a year.Now those $90,000 have the purchasing power of $85,862 – a loss of $4,138 worth of spending.Even worse, because the recovery of real wages is expected to be so slow, if the estimates of the RBA in its most recent Statement on Monetary Policy come to fruition, it will take us until the middle of 2044 to get back to having a wage that has as much purchasing power as in March 2021:If the graph does not display click hereSuch a situation is what comes when the policy levers are all geared to treating wage growth as something to prevent – and worries about a “tight labour market” continue to remain even as wage growth slows below that of inflation.Greg Jericho is a Guardian columnist and policy director at the Centre for Future Work

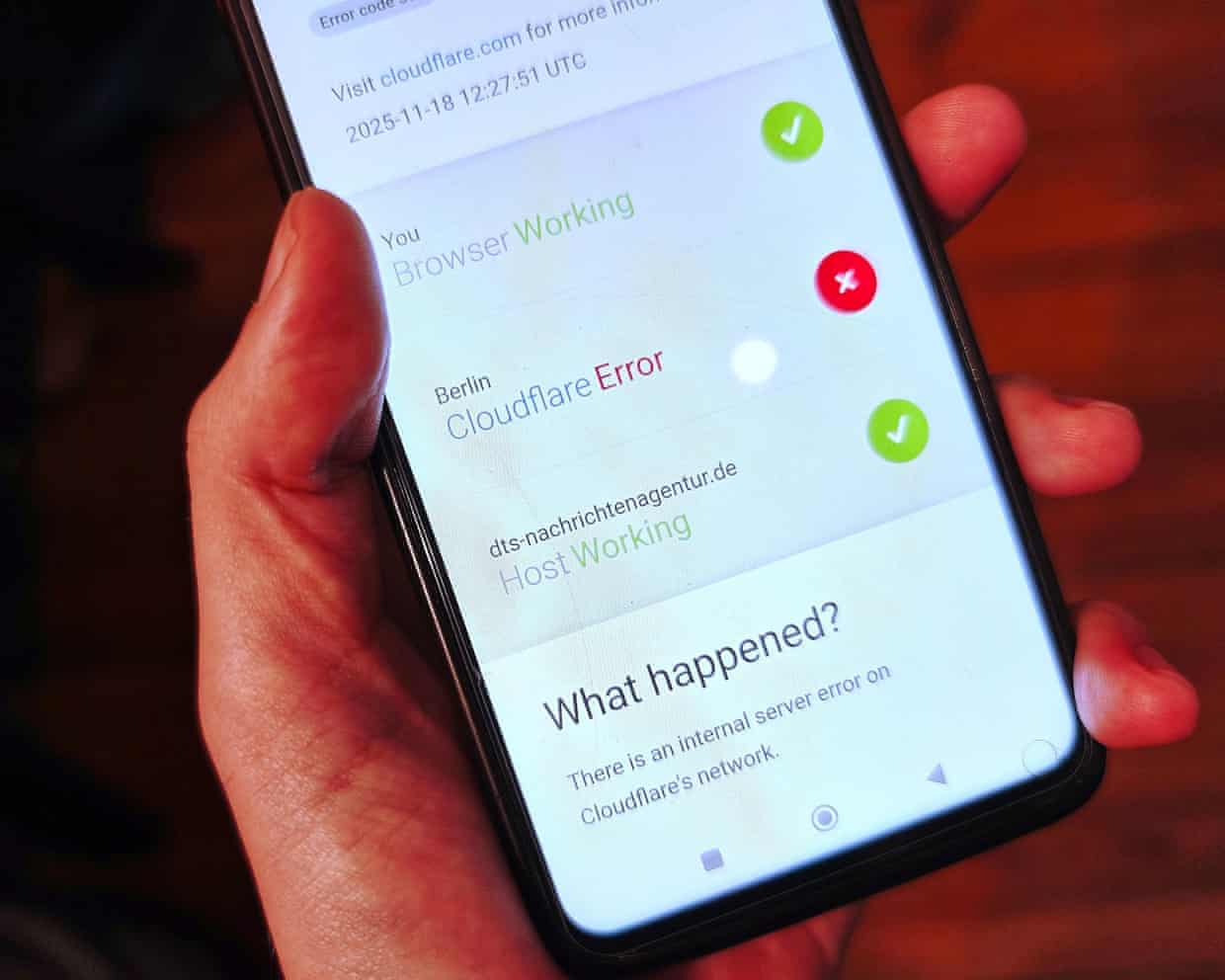

Cloudflare outage causes error messages across the internet

A key piece of the internet’s usually hidden infrastructure suffered a global outage on Tuesday, causing error messages to flash up across websites.Cloudflare, a US company whose services include defending millions of websites against malicious attacks, experienced an unidentified problem that meant internet users could not access some of its customers’ websites.Some site owners could not access their performance dashboards. Sites including X and OpenAI suffered increased outages at the same time as Cloudflare’s problems, according to Downdetector.The outage was reported at 11

Amazon vs Perplexity: the AI agent war has arrived

Hello, and welcome to TechScape. I’m your host, Blake Montgomery.A tech titan and a startup are fighting over who controls the next phase of artificial intelligence.Amazon has sued Perplexity AI, a prominent artificial intelligence startup, over a shopping feature in that company’s browser that allows it to automate placing orders for users. Amazon accused Perplexity AI of covertly accessing customer accounts and disguising AI activity as human browsing

Crypto market sheds more than $1tn in six weeks amid fears of tech bubble

More than $1tn (£760bn) has been wiped off the value of the cryptocurrency market in the past six weeks amid fears of a tech bubble and fading expectations for a US rate cut next month.Tracking more than 18,500 coins, the value of the crypto market has fallen by a quarter since a high in early October, according to the data company CoinGecko.Bitcoin has fallen by 27% over the same period to $91,212, its lowest level since April.Investors around the world are on edge as fears mount over an artificial intelligence bubble in the stock market, with even the boss of Google’s parent company warning that “no company” will be immune if the bubble bursts.The UK’s blue-chip FTSE 100 index fell 1

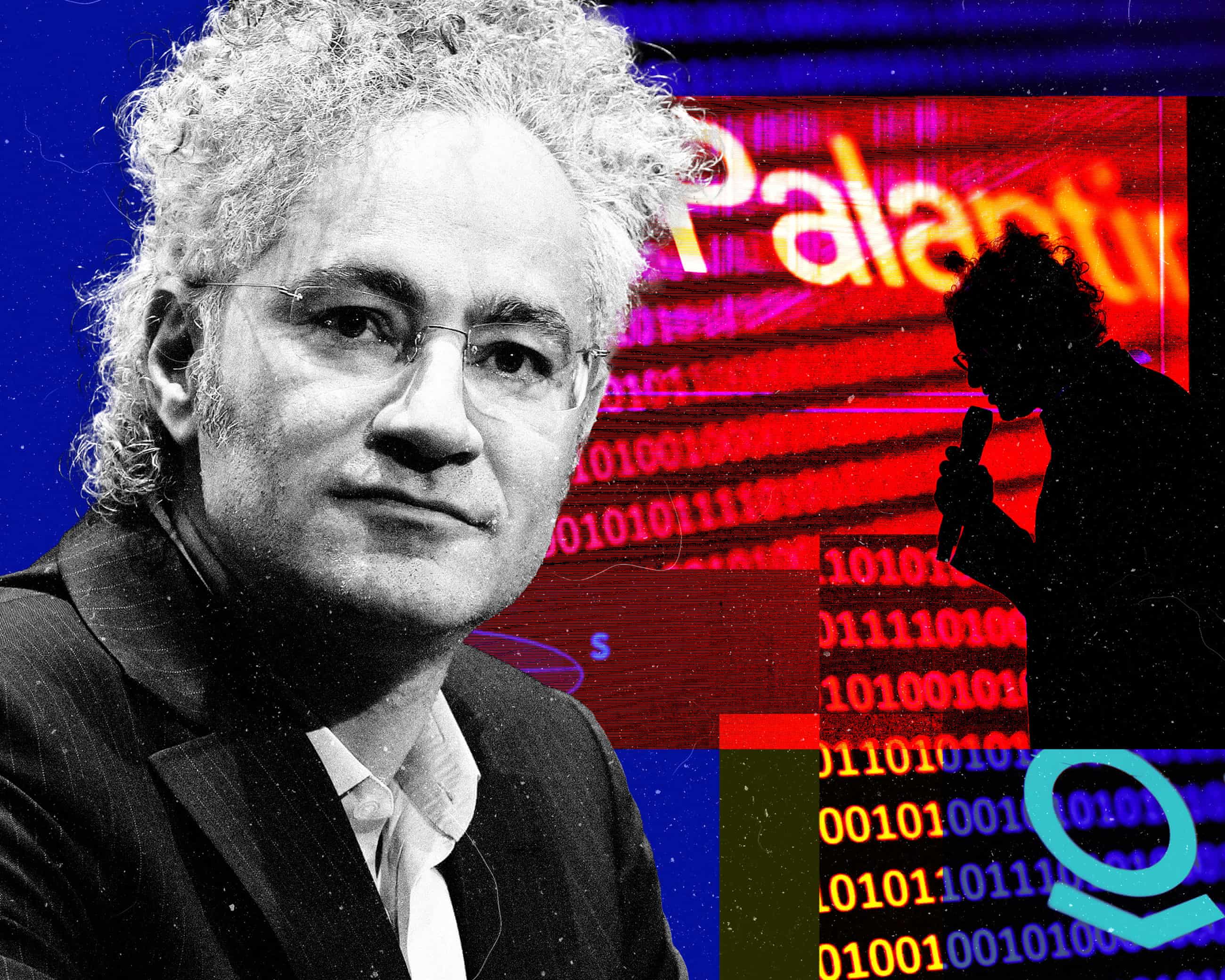

‘Fear really drives him’: is Alex Karp of Palantir the world’s scariest CEO?

His company is potentially creating the ultimate state surveillance tool, and Karp has recently been on a striking political and philosophical journey. His biographer reveals what makes him tickIn a recent interview, Alex Karp said that his company Palantir was “the most important software company in America and therefore in the world”. He may well be right. To some, Palantir is also the scariest company in the world, what with its involvement in the Trump administration’s authoritarian agenda. The potential end point of Palantir’s tech is an all-powerful government system amalgamating citizens’ tax records, biometric data and other personal information – the ultimate state surveillance tool

Don’t blindly trust everything AI tools say, warns Alphabet boss

The head of Google’s parent company has said people should not “blindly trust” everything artificial intelligence tools tell them.In an interview with the BBC, Sundar Pichai, the chief executive of Alphabet, said AI models were “prone to errors” and urged people to use them alongside other tools.In the same interview, Pichai warned that no company would be immune if the AI bubble burst.Since May, Google has introduced an “AI Mode” into its search using its Gemini chatbot, which aims to give users the experience of talking to an expert.Google’s consumer AI model, Gemini 3

UK consumers warned over AI chatbots giving inaccurate financial advice

Artificial intelligence chatbots are giving inaccurate money tips, offering British consumers misleading tax advice and suggesting they buy unnecessary travel insurance, research has revealed.Tests on the most popular chatbots found Microsoft’s Copilot and ChatGPT advised breaking HMRC investment limits on Isas; ChatGPT wrongly said it was mandatory to have travel insurance to visit most EU countries; and Meta’s AI gave incorrect information about how to claim compensation for delayed flights.Google’s Gemini advised withholding money from a builder if a job went wrong, a move that the consumer organisation Which? said risked exposing the consumer to a claim of breach of contract.Which? said its research, conducted by putting 40 questions to the rival AI tools, “uncovered far too many inaccuracies and misleading statements for comfort, especially when leaning on AI for important issues like financial or legal queries”.Meta’s AI received the worst score, followed by ChatGPT; Copilot and Gemini scored slightly higher

WH Smith CEO quits after accounting error that wiped almost £600m off value

Harvard to investigate Larry Summers’s Epstein ties as he exits OpenAI board

What is Cloudflare – and why did its outage take down so many websites?

Cloudflare says ‘incident now resolved’ after outage causes error messages across the internet – as it happened

Australia enter Ashes series with transition abruptly forced upon an ageing squad | Geoff Lemon

Stokes wants to be one of ‘lucky few’ England captains to claim Ashes victory in Australia