Gambling addicts risk losing ‘life-saving’ help due to funding overhaul, say UK charities

Gambling addicts are at risk of missing out on “life-saving” help unless the government provides emergency support, charities have warned, after an overhaul of funding left treatment providers facing a cash crunch.Until this year, money for problem gambling research, education and treatment had been provided on a voluntary basis by casinos and bookmakers who contributed about 0.1% of their takings.Under new plans, put forward by the previous government and implemented by Labour since April this year, the £12.5bn-a-year gambling sector instead pays a mandatory levy of up to 1.

1%, aimed at raising about £100m a year,The NHS will be the main conduit for distributing the money to clinics and external organisations directly treating addicts, taking on the role of commissioning these services from the charity GambleAware,The new levy system, overseen by the Department for Culture, Media and Sport, has been beset by delays, according to two of the UK’s leading gambling charities, GamCare, which runs the National Gambling Helpline, and Gordon Moody, which specialises in addiction counselling and residential treatment programmes,Both warned that dozens of organisations, such as specialist clinics and support groups, may soon be unable to deliver services unless the government provides interim funding,The two charities blamed a lack of clarity over what the government and the commissioning bodies, including the NHS, expect from charities bidding for funding.

Victoria Corbishley, the chief executive of GamCare, which refers helpline callers to more than 30 other organisations, said: “The uncertainty is causing challenges,“We don’t know what commissioners want from us from April onwards,It runs the risk of potential disruption to some of the services, particularly smaller organisations that we rely on,“We need to know that the organisations we refer on to have funding secure and will be in a position to provide support, or who do we signpost to?”Gordon Moody, which treats about 2,000 people a year and specialises in longer, residential treatment courses, provides its services free of charge to addicts thanks to funding from the gambling levy,Alex, a 41-year-old former teacher, said treatment with Gordon Moody had turned his life around after addiction drove him to try to take his own life.

“I would not be here if it wasn’t for Gordon Moody, there is no other service like it,” he said.“I believe suicide rates would go up [if funding is disrupted].”A spokesperson for the charity said the funding crisis had struck partly because criteria for commissioning treatment services had been changed at short notice, “shifting the goalposts”.“This approach is leaving longstanding, expert and proven organisations like Gordon Moody uncertain about their future beyond March 2026, and is already impacting on frontline services and the people with the most severe gambling harms,” the spokesperson said.“We are calling on the government to approve interim funding for charities delivering essential treatment and prevention activities for the next 12 months and to initiate a comprehensive evaluation of all treatment providers.

”Corbishley echoed the call for a short-term cash injection to ensure the continuity of treatment,“We need to make sure there’s clarity on commissioning intentions as soon as possible,If that’s going to come later, we may need interim funding arrangements to make sure there is no disruption to services,”A government spokesperson said: “A smooth transition to the new levy system is vital, which is why we are working with GambleAware to ensure people can continue to access treatment while the new system is put in place,” In the UK, support for problem gambling can be found via the NHS National Problem Gambling Clinic on 020 7381 7722, or GamCare on 0808 8020 133.

In the US, call the National Council on Problem Gambling at 800-GAMBLER or text 800GAM.In Australia, Gambling Help Online is available on 1800 858 858 and the National Debt Helpline is at 1800 007 007.In the UK and Ireland, Samaritans can be contacted on freephone 116 123, or email jo@samaritans.org or jo@samaritans.ie.

In the US, the National Suicide Prevention Lifeline is at 988 or chat for support.You can also text HOME to 741741 to connect with a crisis text line counselor.In Australia, the crisis support service Lifeline is 13 11 14.Other international helplines can be found at befrienders.org

Bill Kingdom obituary

My husband, Bill Kingdom, who has died aged 69, was a global leader in water supply and sanitation. He worked for 20 years with the World Bank, based in Washington DC from 1999 to 2019, where he led urban and rural water supply and sanitation projects. He developed innovative financial and governance frameworks in south and east Asia, southern Africa, and the Middle East. His work provided access to clean and affordable water for some of the poorest people in the world.Bill’s early career was with Mott MacDonald, the engineering consultants based in Cambridge, from 1978 to 1986

Let it be: Paul McCartney urges EU to drop ban on veggie ‘burgers’ and ‘sausages’

Paul McCartney has joined calls for the EU to reject efforts to ban the use of terms such as “sausage” and “burger” for vegetarian foods.The former Beatle has joined eight British MPs who have written to the European Commission arguing that a ban approved in October by the European parliament would address a nonexistent problem while slowing progress on climate goals.The new rules would spell the end the use of terms such as steak, burger, sausage or escalope when referring to products made of vegetables or plant-based proteins. Suggested alternatives include the less appetising “discs” or “tubes”.McCartney said: “To stipulate that burgers and sausages are ‘plant-based’, ‘vegetarian’ or ‘vegan’ should be enough for sensible people to understand what they are eating

Forcing UK banks to support credit unions would help keep loan sharks at bay | Heather Stewart

Nikhil Rathi, chief executive of the Financial Conduct Authority, made a pilgrimage on Friday from its glass and steel HQ in east London to the Pioneers Museum in Rochdale – the spiritual home of the co-operative movement.His unlikely day trip aimed to highlight the City watchdog’s role in opening the way to a doubling of the size of the mutuals sector – a Labour manifesto pledge.Among these customer- or worker-owned organisations, including huge companies such as John Lewis and Nationwide building society, are the 350 credit unions.These are locally based lenders whose interest rates are capped by law and whose clients tend to include the low-income consumers left behind by the big banks. Holding assets of £4

The K-shaped Christmas: wealthy few drive holiday spending splurge while many struggle to get by

A soaring stock market rewards the already well-off but Trump’s handling of the economy has caused his approval ratings to plungeEntering Printemps in downtown New York City feels like an escape. A slight smell of musk hangs in the air as shoppers weave carefully around racks of coats and shelves of handbags and shoes. For the holidays, the store set up a small ice rink on its second floor where skaters perform on weekends.The French luxury retail emporium opened its first New York outlet earlier this year and has said it wants shoppers to feel so comfortable that it feels like their own chic “French apartment”. The store has a bar upstairs, along with a roving champagne cart, and encourages shoppers to sip on their drinks while they browse

Ministers urged to close £2bn tax loophole in car finance scandal

Ministers are being urged to close a loophole that will allow UK banks and specialist lenders to avoid paying £2bn in tax on their payouts to motor finance scandal victims.Under the current law, any operation that is not a bank can deduct compensation payments from their profits before calculating their corporation tax, reducing their bill.UK banks have been blocked from claiming this relief since 2015, but it has now emerged that those due to pay redress as part of the pending £11bn car loan compensation scheme can exploit it because their motor finance arms are considered “non-bank entities”.The Guardian has learned this includes the operations of big high street names including Barclays and Santander UK, and Lloyds Banking Group, which is the UK’s biggest provider of car loans through its Black Horse division.Specialist lenders in the scandal, which include the lending arms of car manufacturers such as Honda and Ford, also fall outside this taxation rule

Cloudflare admits ‘we have let the Internet down again’ after outage hits major web services – as it happened

Technical problems at internet infrastructure provider Cloudflare today have taken a host of websites offline this morning.Cloudflare said shortly after 9am UK time that it “is investigating issues with Cloudflare Dashboard and related APIs [application programming interfaces – used when apps exchange data with each other].Cloudflare has also reported it has implemented a potential fix to the issue and is monitoring the results.But the outage has affected a number of websites and platforms, with reports of problems accessing LinkedIn, X, Canva – and even the DownDetector site used to monitor online service issues.Last month, an outage at Cloudflare made many websites inaccessible for about three hours

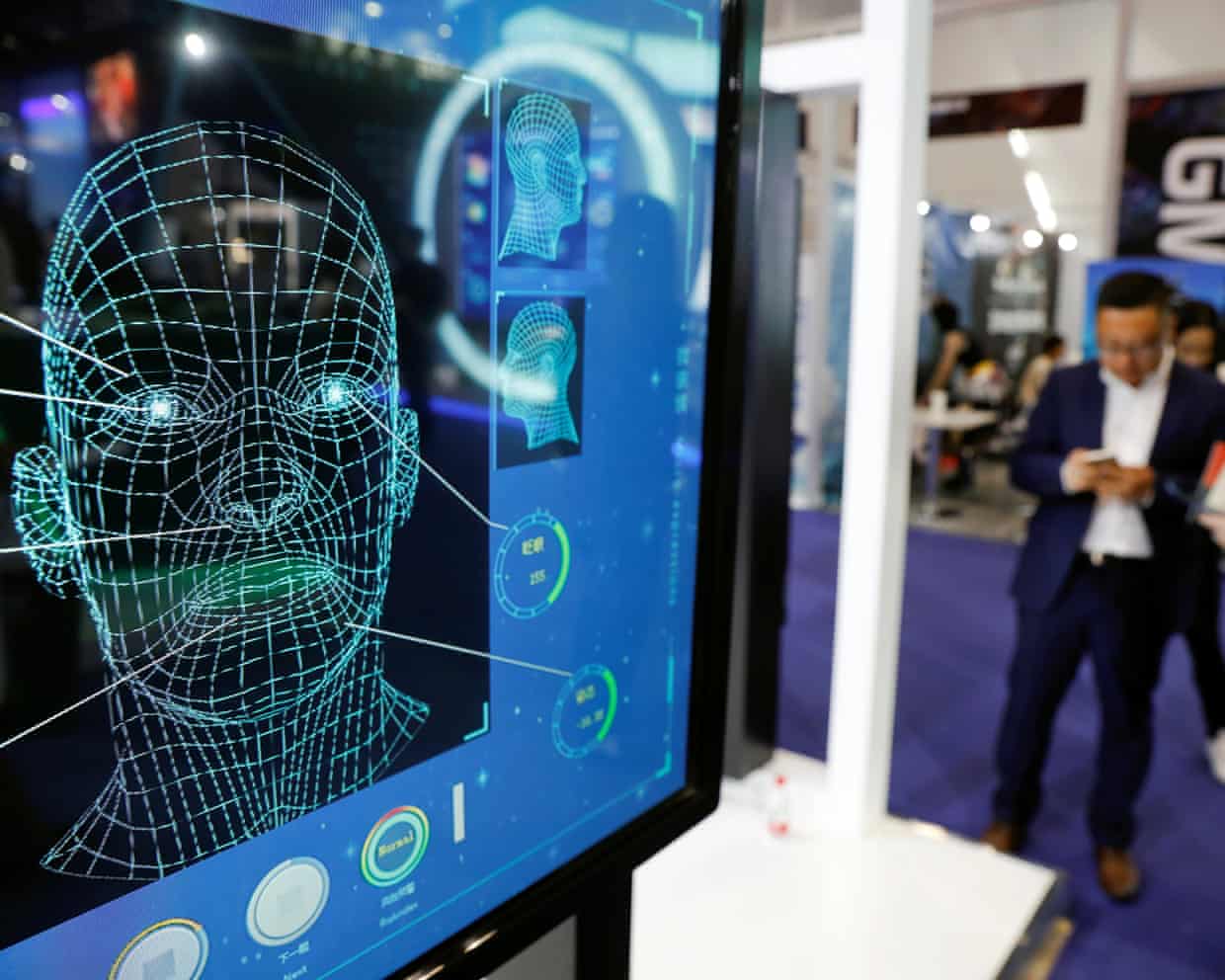

‘Urgent clarity’ sought over racial bias in UK police facial recognition technology

New York Times sues AI startup for ‘illegal’ copying of millions of articles

I spent hours listening to Sabrina Carpenter this year. So why do I have a Spotify ‘listening age’ of 86?

Elon Musk’s X fined €120m by EU in first clash under new digital laws

Home Office admits facial recognition tech issue with black and Asian subjects

Tesla launches cheaper version of Model 3 in Europe amid Musk sales backlash