AI is indeed coming – but there is also evidence to allay investor fears

The message from investors to the software, wealth management, legal services and logistics industries this month has been clear: AI is coming for your business,The release of new, ever more powerful AI tools has coincided with a stock market slide, which has swept up sectors as diverse as drug distribution, commercial property and price comparison sites,Advances in the technology are giving increasing credulity to predictions that it could render millions of white-collar jobs obsolete – or, at least, eat into the profits of established companies,Carl Benedikt Frey, the author of How Progress Ends and an associate professor of AI and work at the University of Oxford, says investors are reassessing the value of companies that rely heavily on selling software or specialist knowledge,“AI turns once-scarce expertise into output that’s cheaper, faster, and increasingly comparable, which compresses margins long before whole jobs disappear.

”Fears over widespread job losses were amplified this week by a viral essay, penned by AI entrepreneur Matt Shumer, titled: Something big is happening,In it, Shumer purports to explain to the world outside Silicon Valley that new models will come for coding jobs and then “everything else”, comparing the present moment with the February just before the Covid pandemic,The post was viewed 80m times on X, triggering fear and fury – including from people pointing out that Shumer has a history of AI hype,(He previously excited the internet by announcing the release of the world’s “top open-source model”, which it was not,)Shumer and the markets were reacting to the capabilities of recently released models such as Anthropic’s Claude Opus 4.

6 and OpenAI’s GPT-5.3-Codex, both improvements on previous, powerful AI products.But there are other reasons for the febrility of the moment, not least the companies that are building these models.AI “hyperscalers” – the term for the big US tech players in the field – collectively plan to spend $660bn (£484bn) this year.This follows a year of colossal, often circular deals between the world’s biggest tech companies.

However, cracks have appeared in these numbers, as well as questions about what they actually mean.Nvidia and OpenAI recently appeared to drop a $100bn deal, replacing it with an as yet unknown, smaller commitment.Meanwhile, none of the AI model-builders – not OpenAI, xAI or Anthropic – have a clear path to the enormous revenue that would justify this spend; the revenue from the entire global software sector this year is projected to be just $780bn.It has appeared this week that both arguments about AI – that it is an unsustainable boom or heralds a destructive revolution in white-collar work – have been entertained by some investors, after shares in Google’s parent company, Alphabet, and Mark Zuckerberg’s Meta were affected by apparent concerns about a spending bubble.Bluntly, investors expect these companies to recoup their investment via hordes of individuals and businesses paying for their tools, because they allow certain tasks and jobs to be carried out by fewer people or over fewer hours.

Or in economic jargon, a productivity boom.“The two themes are inherently linked but not necessarily contradictory,” says Jason Borbora-Sheen, a portfolio manager at investment management firm Ninety One.At first, investors backed expenditure by the “hyperscalers” in the initial phase of the AI gold rush.Those concerns have now flipped to cash burn and the sheer scale of investment needed to stay competitive, says Borbora-Sheen, while at the same time the share prices of wealth managers and others have been affected by the perception that AI is “now here, will evolve and can displace”.Companies have cited AI as an influence on job-cutting plans, including British American Tobacco this week, but there has not been a wave of wholesale disruption yet.

Greg Thwaites, a research director at the UK thinktank the Resolution Foundation and an associate professor at the University of Nottingham, says evidence of a tangible AI jobs impact on large western economies is “quite ambiguous so far”,Not all white-collar work will be affected, he says, although AI might test axioms around the age-old capitalist concept of “creative destruction”, which involves entirely new jobs replacing outdated ones, such as car mechanics replacing farriers,Will AI be a different case because the change has come so fast or because it will be good at absolutely everything?He adds: “There are some jobs that are going to look very different quite quickly,But the idea that there are going to be bands of unemployed lawyers and accountants roaming around London within a few years seems like a stretch to me,”Alvin Nguyen, an analyst at Forrester, says the fears that shook the stock market are based on sentiment and not evidence: no one has had time to evaluate the performance of an Opus 4.

6-powered wealth manager.“It’s a kneejerk reaction,” he said.“How true is it? Look, there’s plenty of leaders out there who thought, I can replace people with AI at the beginning.And a lot of people acted on that.And I think one of the things that’s being found out is that for a lot of cases, no, it hasn’t panned out.

”Aaron Rosenberg, a partner at venture capital firm Radical Ventures, – whose investments include leading AI firm Cohere – and former head of strategy and operations at Google’s AI unit DeepMind, says the impact of AI is being underestimated in the long term but adoption of groundbreaking models will not be uniform.“History shows a repeated pattern of there being a significant lag between a technology working in a lab and it permeating the wider economy, as well as a chasm between early adopters and the majority of users,” he says.More new models will come; other huge AI deals could wobble as well.Meanwhile, this month there were low-level rumblings of discontent from high-profile tech workers; a slew of departures from AI companies for reasons as various as boredom, AI doomerism and concerns over the prospect of adult content in ChatGPT.There is a nervous, unfocused energy afoot.

As Borbora-Sheen says: “There is a strong winners versus losers dynamic,”

Bank bosses get huge pay rises in sign top City salaries back to pre-crash highs

A trio of bank bosses have been given huge pay packets in the latest sign that the vast salaries and bonuses handed to Wall Street and City of London executives in the run-up to the 2008 financial crisis have started to return.NatWest on Friday revealed a £6.6m pay package for its boss Paul Thwaite, marking the largest payout for a chief executive of the banking group since his disgraced predecessor Fred Goodwin took home £7.7m in 2006.That was 33% higher than his £4

Shares in trucking and logistics firms plunge after AI freight tool launch

Shares in trucking and logistics companies have plunged as the sector became the latest to be targeted by investors fearful that new artificial intelligence tools could slash demand.A new tool launched by Algorhythm Holdings, a former maker of in-car karaoke systems turned AI company with a market capitalisation of just $6m (£4.4m), sparked a sell-off on Thursday that made the logistics industry the latest victim of AI jitters that have already rocked listed companies operating in the software and real estate sectors.The announcement about the performance capability of Algorhythm’s SemiCab platform, which it claimed was helping customers scale freight volumes by 300% to 400% without having to increase headcount, sparked an almost 30% surge in the company’s share price on Thursday.However, the impact of the announcement sent the Russell 3000 Trucking Index – which tracks shares in the US trucking sector – down 6

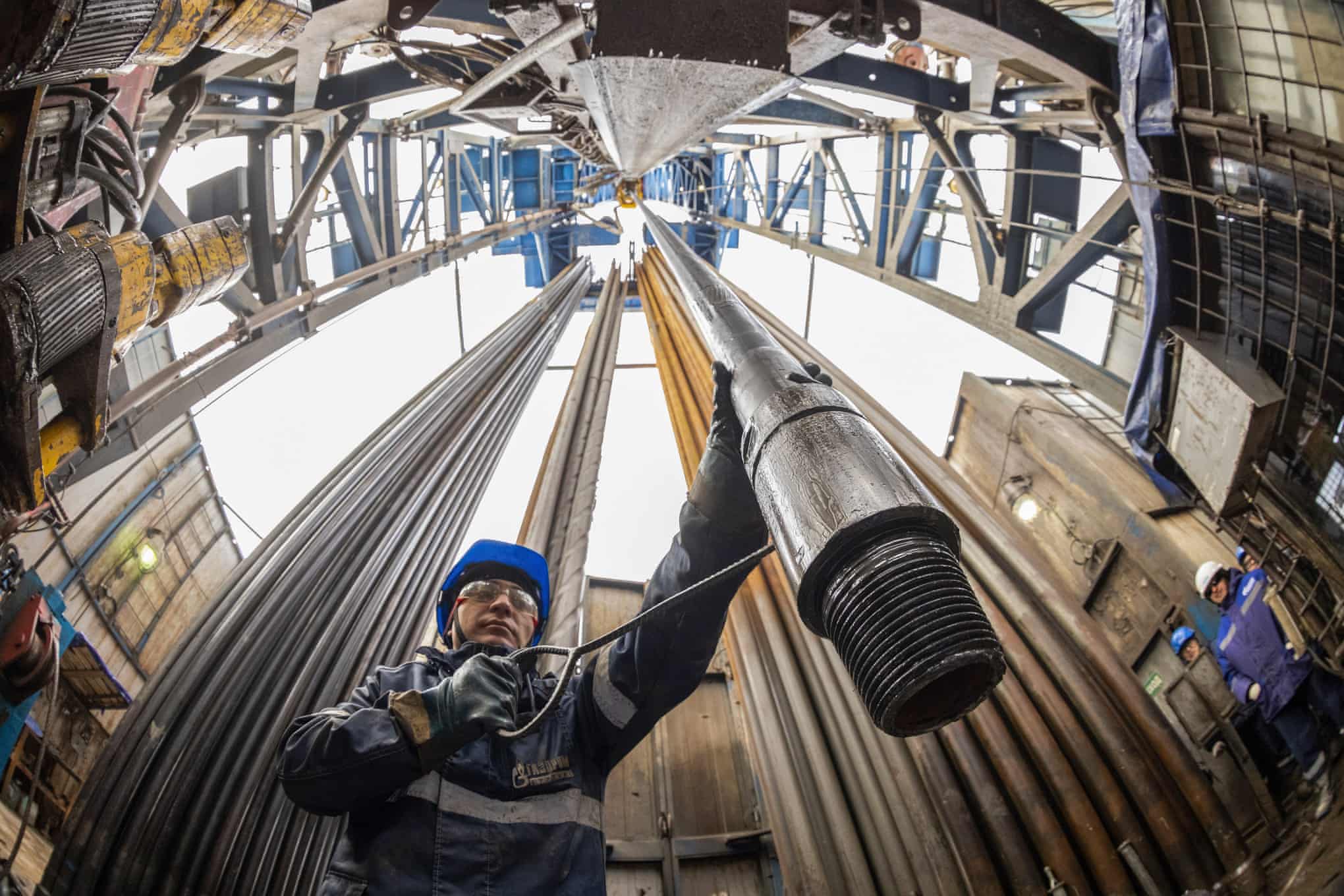

Tony Blair’s oil lobbying is a misleading rehash of fossil fuel industry spin

Ex-PM’s thinktank urges more drilling and fewer renewables, ignoring evidence that clean energy is cheaper and better for billsA thinktank with close ties to Saudi Arabia and substantial funding from a Donald Trump ally needs to present a particularly robust analysis to earn the right to be listened to on the climate crisis. On that measure, Tony Blair’s latest report fails on almost every point.The Tony Blair Institute for Global Change (TBI) received money from the Saudi government, has advised the United Arab Emirates petrostate, and counts as a main donor Larry Ellison, the founder of Oracle, friend of Trump and advocate of AI.The latest TBI report calls for an expansion of oil and gas production in the North Sea, despite the additional greenhouse gas emissions this would generate, and abandoning the UK government’s target to largely decarbonise the electricity sector by 2030, arguing that doing so is necessary to power AI datacentres.The report claims renewable energy is too expensive

UK economy grows by only 0.1% amid falling business investment

The UK economy expanded by only 0.1% in the final three months of last year, according to official data, as falling business investment and weak consumer spending led to little momentum going into 2026.Figures from the Office for National Statistics (ONS) show that the economy grew at the same rate of 0.1% as the previous three months. This was less than a 0

Jim Ratcliffe apologises for ‘choice of language’ after saying immigrants ‘colonising’ UK

Monaco-based billionaire Jim Ratcliffe faced implicit criticism from the football club he co-owns, after widespread condemnation of his claims that the UK is being “colonised” by immigrants.The Manchester United co-owner was forced to issue a heavily qualified apology on Thursday after citing inaccurate immigration statisticsin comments labelled hypocritical and reminiscent of “far-right narratives”. Following a day of censure from the prime minister, football fans, union leaders and anti-racism campaigners, Ratcliffe said he was sorry his “choice of language has offended some people in the UK and Europe”.Just hours after Ratcliffe’s apology, United took the extraordinary step of publicly asserting their “inclusive and welcoming”. In statement that did not name Ratcliffe but clearly referred to his claims that the UK is being “colonised” by immigrants, United affirmed their commitment to “equality, diversity and inclusion”, adding: “Our diverse group of players, staff and global community of supporters reflect the history and heritage of Manchester; a city that anyone can call home

To revive manufacturing we must first change attitudes towards labour | Letter

Re Larry Elliott’s article (How can Britain regain its manufacturing power?, 5 February), the basis for the revival of our manufacturing industry requires first a shift in attitude that brainwork is superior to manual labour.Changes to the curriculum are needed so that technically oriented students can pursue courses that are a first option rather than second best. Part of my training as a designer-pattern cutter involved a placement in a factory, an experience now rarely available to fashion students. In the 1980s, the government set up the Enterprise Allowance Scheme to encourage innovation, but there was no follow-on support to encourage production; successful entrepreneurs had to apply for personal loans from banks, limited to the value of their houses.I wanted to be part of a trade mission to Germany so I could follow up export inquiries, but I was told my business was too small

History hangs heavy over Calcutta Cup but England’s young side can turn tartan tide

From vertigo to Van Gogh: 10 things you may have missed at the Winter Olympics

Patriots’ Stefon Diggs pleads not guilty to assault, strangulation charges

Winter Olympics thrills, FA Cup magic and the Six Nations – follow with us

Skating body defends Olympic judging after French duo’s ice dance gold

Ukrainian athlete’s appeal for Winter Olympics reinstatement dismissed by Cas