UK police forces lobbied to use biased facial recognition technology

Police forces successfully lobbied to use a facial recognition system known to be biased against women, young people, and members of ethnic minority groups, after complaining that another version produced fewer potential suspects.UK forces use the police national database (PND) to conduct retrospective facial recognition searches, whereby a “probe image” of a suspect is compared to a database of more than 19 million custody photos for potential matches.The Home Office admitted last week that the technology was biased, after a review by the National Physical Laboratory (NPL) found it misidentified Black and Asian people and women at significantly higher rates than white men, and said it “had acted on the findings”.Documents seen by the Guardian and Liberty Investigates reveal that the bias has been known about for more than a year – and that police forces argued to overturn an initial decision designed to address it.Police bosses were told the system was biased in September 2024, after a Home Office-commissioned review by the NPL found the system was more likely to suggest incorrect matches for probe images depicting women, Black people, and those aged 40 and under.

The National Police Chiefs’ Council (NPCC) ordered that the confidence threshold required for potential matches be increased to a level where the bias was significantly reduced.That decision was reversed the following month after forces complained the system was producing fewer “investigative leads”.NPCC documents show that the higher threshold reduced the number of searches resulting in potential matches from 56% to 14%.Though the Home Office and NPCC refused to say what threshold was being used now, the recent NPL study found the system could produce false positives for Black women almost 100 times more frequently than white women at certain settings.When publishing those results, the Home Office said: “The testing identified that in a limited set of circumstances the algorithm is more likely to incorrectly include some demographic groups in its search results.

”Describing the impact of the brief increase to the system’s confidence threshold, the NPCC documents states of the change in threshold sought by the police forces: “The change significantly reduces the impact of bias across protected characteristics of race, age and gender but had a significant negative impact on operational effectiveness”, adding that forces complained that “a once effective tactic returned results of limited benefit”.Sign up to First EditionOur morning email breaks down the key stories of the day, telling you what’s happening and why it mattersafter newsletter promotionThe government has opened a ten-week consultation on its plans to widen the use of facial recognition technology.Sarah Jones, the policing minister, has described the technology as the “biggest breakthrough since DNA matching”.Prof Pete Fussey, a former independent reviewer of the Met’s use of facial recognition, said he was concerned by the apparent priorities of police forces.He said: “This raises the question of whether facial recognition only becomes useful if users accept biases in ethnicity and gender.

Convenience is a weak argument for overriding fundamental rights, and one unlikely to withstand legal scrutiny.”Abimbola Johnson, chair of the independent scrutiny and oversight board for the police race action plan, said: “There was very little discussion through race action plan meetings of the facial recognition rollout despite obvious cross-over with the plan’s concerns.“These revelations show once again that the anti-racism commitments policing has made through the race action plan are not being translated into wider practice.Our reports have warned that new technologies are being rolled out in a landscape where racial disparities, weak scrutiny and poor data collection already persist.“Any use of facial recognition must meet strict national standards, be independently scrutinised, and demonstrate it reduces rather than compounds racial disparity.

”A Home Office spokesperson said: “The Home Office takes the findings of the report seriously and we have already taken action.A new algorithm has been independently tested and procured, which has no statistically significant bias.It will be tested early next year and will be subject to evaluation.“Our priority is protecting the public.This gamechanging technology will support police to put criminals and rapists behind bars.

There is human involvement in every step of the process and no further action would be taken without trained officers carefully reviewing results.”

BoE predicts budget measures will lower inflation, and denies uncertainty caused unusual bond market volatility – as it happened

Senior members of the Bank of England are appearing before the Treasury committee now.MPs will hear from deputy governors Clare Lombardelli and Sir Dave Ramsden, as well as two external members of the Monetary Policy Committee – Swati Dhingra and Catherine Mann.The quartet are without governor Andrew Bailey, who isn’t available due to “an unavoidable international commitment”.They will discuss the Bank’s decision to maintain interest rates at 4% in November, and also its latest Monetary Policy Report.Time to recap

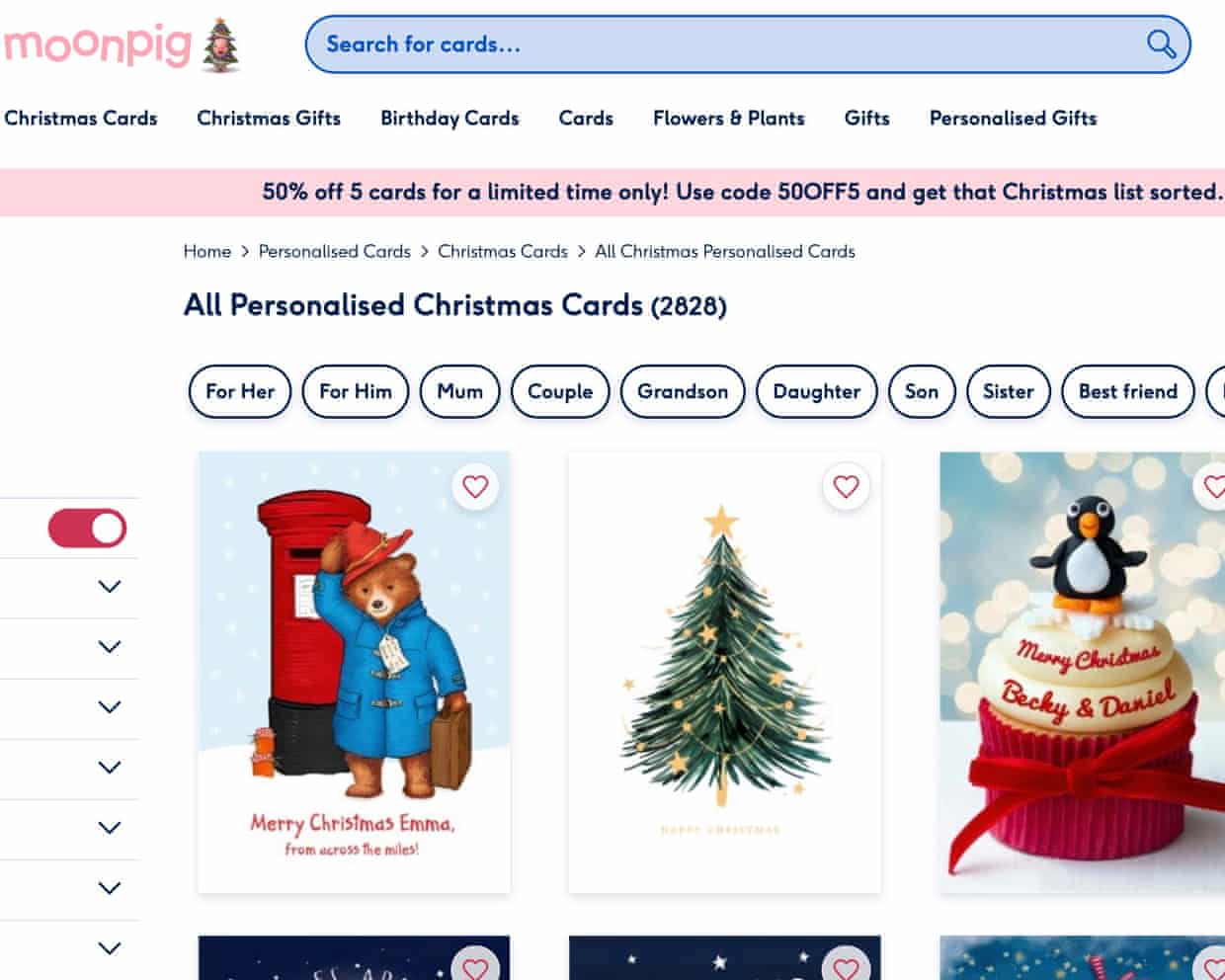

Moonpig’s use of AI to design and personalise cards drives up sales

The online card service Moonpig has reported a bump in sales thanks in part to its increased use of AI to help design cards, personalise customers’ messages and answer queries.The company said sales rose 6.7% to £169m in the six months to 31 October and had remained strong in the weeks since then, largely as a result of increased orders and spend per order at its main Moonpig brand.“AI is now designing a lot of cards for us,” said its chief executive, Nickyl Raithatha. He said technology had helped create everything from baby and birthday cards to corporate greetings linked to a particular business

Home movers in Great Britain could get just £30 of energy use without account

Consumers in Great Britain moving to a new home will have about two weeks to set up an energy account before their lights go out, under plans to cut growing gas and electricity debt.Energy meters could soon be remotely switched to prepayment mode when the previous resident moves out, under proposals put forward by the industry regulator, leaving the next resident £30 of credit to settle into their home.However, once this amount has been used, which on average would take about a fortnight, they would be left in the dark unless they had set up a new account with an energy supplier.The plan to nudge households to set up their accounts sooner is part of an attempt by the regulator, Ofgem, to tackle Britain’s record energy debt, which has climbed to almost £4.5bn, or more than twice as high as it was before the energy crisis

Western carmakers ‘in fight for lives’ against Chinese rivals, says Ford boss

The boss of Ford has said western carmakers are “in a fight for our lives” against Chinese competition as the US manufacturer agreed a new partnership with France’s Renault.The two companies said on Tuesday that they would work together on two smaller electric cars, with the first to go on sale as soon as early 2028. They will also look at producing vans together.“We know we’re in a fight for our lives in our industry,” Jim Farley told journalists in Paris. “There is no better example than here in Europe

‘Bring it on!’: growing support in England for four-day week in schools

“A wonderful idea”, “Bring it on!”, “Yes!”, “Brilliant!”, “Absolutely”. If enthusiasm were all it took to change policy, a four-day week in England’s schools would be all but guaranteed.A Guardian report this week saying that the 4 Day Week Foundation has urged the government to pilot a four-day working week in schools in England and Wales to boost teacher wellbeing and recruitment attracted hundreds of thousands of readers.Teachers and parents responding to a subsequent Guardian callout were overwhelmingly supportive, though many were unsure about the logistics.Jo Hopkins, a 55-year-old London development director and mother of 11-year-old twins, liked the idea of a four-day week for pupils

UK fraud prevention ‘still lacking’ after Covid-related scams and errors cost £11bn

Ministers have been warned that fraud prevention efforts are falling short across government, as a major Covid report found that fraud and errors had resulted in a £10.9bn loss to UK taxpayers during the pandemic.The report, by the independent Covid counter-fraud commissioner Tom Hayhoe, found that government schemes designed to support struggling businesses and their staff were rolled out at speed with no early safeguards, resulting in huge fraud risks that cost the public purse.Weak accountability, bad quality data and poor contracting were the main failures behind the £10.9bn loss, but Hayhoe also concluded that fraud prevention was “insufficiently embedded in thinking and practice across government”

The ultimate unsung superfood: 17 delicious ways with cabbage – from kimchi to pasta to peanut butter noodles

Christmas dinner in a restaurant or kitchen carnage at home?

Christmas mixers: Thomasina Miers’ recipes for fire cider and spiced cocktail syrup

Jamie Oliver to relaunch Italian restaurant chain in UK six years after collapse

Maximum protein, minimal carbs: why gym bros are flocking to Australia’s charcoal chicken shops

Helen Goh’s recipe for edible Christmas baubles | The sweet spot