Bank of England compares collapse of US private credit firms to 2007 subprime crisis - business live

Top Bank of England policymakers have warned that the collapse of two US firms, First Brands and Tricolor, last month has highlighted the risks in the private credit market, and compared it to the subprime mortgage failures that preceeded the 2008 financial crisis,Governor Andrew Bailey compared the failures of sub-prime auto lender Tricolor and the car parts supplier First Brands, which have left US banks nursing losses, to the subprime mortgage crisis that predated the financial crisis of 2008,Testifying to the House of Lords Financial Services Regulation Committee this morning, Bailey explains that the big, and open, question today is whether the two failures are idiosyncratic or “the canary in the coalmine”,Bailey explains:Are they telling us something more fundamental about the private finance, private asset, private credit, private equity sector, or are they telling us that in any of these worlds there will be idiosyncratic cases that go wrong?I think that is still a very open question, it’s an open question in the US,[Reminder: Last week, the boss of JP Morgan, Jamie Dimon, has warned over further losses linked to the private credit sector, saying more “cockroaches” could emerge’…]Bailey then explains that the Bank has to take this question very seriously, and incorporate it into its existing work on private finance.

He then warns:I don’t want to sound too foreboding, but the added reason this question is important is if you go back to before the financial crisis when we were having this debate about subprime mortgages in the US, people were telling us, no it’s too small to be systemic, it’s ideosyncratic in that sense.That was the wrong call.I’m not saying the call should be the same this time, but it underlines why the question is aposite.There’s a lot we dont know about First Brands and Tricolor at this time.BoE deputy governor Sarah Breeden weight in too, saying the First Brands and Tricolor collapses illustrate some of the risks the Bank has been talking about in this market for some time.

Breeden says:It’s about high leverage, it’s about opacity, it’s about complexity and it’s about weak underwriting standards.Those are things that we were talking about in the abstract as a source of vulnerability in this bit of the financial system, and those appear to have been at play in the context of these two defaults.Q: To what extent is Brexit culpible for the sluggish performance of the economy?BoE governor Andrew Bailey says he doesn’t take a position on Brexit, a public official.But, he suggests, there have been some negative economic consequences, telling the House of Lords Financial Services Regulation Committee:In so far as Brexit has made the economy less open to trade, that will have a negative effect for a period.Over time, trade adjusts….

but in the initial phase that would have an effect on productivity by reducing the openness of the economy, the ability to exploit the division of labour….Bailey also points out that uncertainty delays investment decisions.He’s then challenged by former Conservative MP Lord Lilley, who points to growth in services exports to the EU since Brexit.Bailey replies that policymakers have managed to “offset” many of the more pessimistic predictions after the 2016 referendum about the impact on financial services.Q: Is there a risk of a liquidity crunch, if a private equity firm finds themselves with a lot of hard-to-sell assets?…BoE deputy governor Sarah Breeden says an important aspect about private equity is that its funding is long-term – it doesn’t hold “runable liabilities” like banks.

Deputy bank governor Sarah Breeden, appearing alongside Bailey, said the Bank would be carrying out a war game exercise in these markets, to test the linkages between private credit and other sectors,It will “shine a light on what is opaque”, she explains,The voluntary exercise will involve banks, insurers, private equity companies, and pension fund investors,Andrew Bailey says the Bank will act as the ‘hub’, and tell participants to work out how they would react to a particular stress, then the Bank can identify stress points in the system,Q: When you were in Washington last week, did other countries share the same anxieties about private finance?Yes, BoE governor Andrew Bailey replies.

Q: Was there any output from that meeting?Bailey jokes that he has enough work to do already, before reminding the Lords that he now chairs the Global Financial Stability Board – private finance will now be an “even more important part” of their workplan.Andrew Bailey then argues that the Bank of England must use the collapse of First Brands and Tricolour as “another reason to have more drains up, frankly”.He tells the Lords Financial Services Regulation Committee we need inspection of how the private credit market is structured, and what the connections to the banking world are.Bailey then reveals he met with “people from the private equity and private credit world” some months ago, who told him that everything was fine in their world apart from the role of the ratings agenciesHe adds:“I said, we’re not playing that movie again, are we?”Good movie, though….Bank of England governor Andrew Bailey then warns that we are beginning to see the “slicing and dicing and tranching of loan structures” in the financial markets.

“Alarm bells start going off at that point” if you were involved in regulating the sector before the 2008 financial crisis, he points out,Top Bank of England policymakers have warned that the collapse of two US firms, First Brands and Tricolor, last month has highlighted the risks in the private credit market, and compared it to the subprime mortgage failures that preceeded the 2008 financial crisis,Governor Andrew Bailey compared the failures of sub-prime auto lender Tricolor and the car parts supplier First Brands, which have left US banks nursing losses, to the subprime mortgage crisis that predated the financial crisis of 2008,Testifying to the House of Lords Financial Services Regulation Committee this morning, Bailey explains that the big, and open, question today is whether the two failures are idiosyncratic or “the canary in the coalmine”,Bailey explains:Are they telling us something more fundamental about the private finance, private asset, private credit, private equity sector, or are they telling us that in any of these worlds there will be idiosyncratic cases that go wrong?I think that is still a very open question, it’s an open question in the US.

[Reminder: Last week, the boss of JP Morgan, Jamie Dimon, has warned over further losses linked to the private credit sector, saying more “cockroaches” could emerge’…]Bailey then explains that the Bank has to take this question very seriously, and incorporate it into its existing work on private finance.He then warns:I don’t want to sound too foreboding, but the added reason this question is important is if you go back to before the financial crisis when we were having this debate about subprime mortgages in the US, people were telling us, no it’s too small to be systemic, it’s ideosyncratic in that sense.That was the wrong call.I’m not saying the call should be the same this time, but it underlines why the question is aposite.There’s a lot we dont know about First Brands and Tricolor at this time.

BoE deputy governor Sarah Breeden weight in too, saying the First Brands and Tricolor collapses illustrate some of the risks the Bank has been talking about in this market for some time.Breeden says:It’s about high leverage, it’s about opacity, it’s about complexity and it’s about weak underwriting standards.Those are things that we were talking about in the abstract as a source of vulnerability in this bit of the financial system, and those appear to have been at play in the context of these two defaults.Over in parliament, Bank of England governor Andrew Bailey, and deputy governor Sarah Breeden, are appearing before the House of Lords Financial Services Regulation Committee.They’re being questioned for an inquity into the growth of private markets in the UK following reforms introduced after the 2008 financial crisis.

You can watch it here.It’s a timely issue, given concerns about the growth of non-bank lending, and concerns about potential systemic risks, regulatory gaps, and the risks to market stability.The committee explains:In particular, the inquiry will examine whether the regulatory capital and liquidity reforms introduced after 2008 have reduced banks’ ability or willingness to lend, pushing risk away from the banking sector and towards private markets.It will also look into how much visibility the Bank of England has on the size of these private markets, their interconnections with the banking sector, and any potential spillover risks.Back in the markets, gold and silver prices are sliding back from their recent record highs.

SPOT GOLD EXTENDS DECLINES, LAST DOWN NEARLY 2% TO $4,267.79/OZSPOT SILVER EXTENDS DECLINES, LAST DOWN OVER 5% TO $49.62/OZKathleen Brooks, research director at XTB, says:After a stunning rally, the gold price is unwinding on Tuesday.The yellow metal is down nearly $90 per ounce, and silver is also faltering, it was down more than 5% at some stage.The reversal has been abrupt, there was no single event that has caused today’s sell off, instead it is most likely caused by a confluence of factors including stretched valuations and signs that US CPI [inflation], which will be released at the end of this week, could come in softer than expected.

Wealth manager Rathbones also predicts, like Berenberg, that Rachel Reeves is likely to need to raise £25bn or more in taxes in next month’s budget,John Wyn-Evans, head of market analysis at Rathbones, says:“The latest public sector borrowing figures continue to show strain on the country’s finances,Even allowing for some positive revisions to August’s dreadful borrowing, the government’s deficit so far this tax year amounts to £99,8bn, some £7bn higher than the projections of the Office of Budget Responsibility,When we factor in the probable downgrade to long-term growth estimates from the OBR which will inform the Chancellor Rachel Reeves’s Budget decision-making, it looks as though taxes will need to rise somewhere in the order of £25bn or more.

Much as many would like that number to be lowered by spending cuts, the mood within the Labour Party does not appear to support much hope on that front.Andrew Wishart, senior UK economist at Berenberg, predicts Rachel Reeves may need to announce at least £25bn of tax rises and spending cuts in the November budget to address the “leaky finances”.Having analysed today’s public finances, Wishart explains:The government borrowed £13bn more than official forecasts predicted to fund day-to-day spending in the first six months of the fiscal year which began in April.The government’s economic forecaster, the Office for Budget Responsibility (OBR), will almost certainly have to assume that much of that overshoot gets repeated in future years.Higher spending and borrowing than anticipated this year will add to several other factors pushing up the OBR’s borrowing forecast for 2029-30, the fiscal year by which the government has pledged to fund current spending (i.

e.excluding investment) entirely with tax revenue.Getting back on track to meet this target will likely require about £25bn of tax hikes and/or spending cuts in the 26th November Autumn Budget with another £10bn necessary to build a reserve for unexpected shortfalls, similar to the £10bn margin that was included in the March 2025 budget.Recent briefings suggest that, if anything, the Chancellor may even go further.In the utilities world, Thames Water’s appeal to be allowed to raise bills by more than the regulator allows has been delayed again.

The referral to the Competition and Markets Authority (CMA) has already been deferred twice, while Thames Water tries to hammer out a rescue deal with its creditors.And today, the company and Ofwat have agreed a third delay, while discussions continue between creditors, regulators and the company.This means a longer delay before the CMA can ponder Ofwat’s decision to allow only (!) a 35% bill increase over five years.Thames Water Utilities Limited (TWUL) explains:This deferral is not a withdrawal of the request for the Reference and TWUL remains of the view that the Final Determination does not serve the interests of Thames Water’s customers, communities and the environment.TWUL remains focused on delivering a recapitalisation transaction which delivers for its customers and the environment as soon as practicable.

Earlier this month the CMA allowed five water suppliers to increase bills by more than Ofwat had allowed, but still by not as much as they wanted:The UK’s fiscal watchdog, the Office for Budget Responsibility, has issued its verdict on today’s public finances,They confirm that borrowing so far this financial year (£99,8bn) is £7,2bn over their March forecast, as this chart highlights:But in better news for the chancellor, the OBR point out that newly revised estimates of tax receipts for the year-to-date have reduced the estimated borrowing overshoot compared to last month,The OBR explains:Central government accrued receipts and spending are now both close to the forecast profile for the year-to-date.

Borrowing remains higher than in our March profile because of higher estimated borrowing by local authorities and public corporations.The watchdog also predicts borrowing will be lower in the second half of this financial year (October-March), due to “a sharp rise in capital gains tax expected around the end-January due date, lower debt interest payments in the second half of the year, and lower growth in central government net social benefits which were unusually backloaded last year.”The Crown Estate has bought a chunk of farmland next to a major science hub in Oxfordshire where it plans to build labs, offices and up to 400 homes.This is part of the organisation’s pledge to invest up to £1.5bn in science and technology over the next 15 years.

The site, called Harwell East, could deliver up to 4,5m square feet of laboratory and advanced manufacturing space, offices and new homes,It sits next to the Harwell science campus, where US biotech Moderna has just opened a major new vaccine research and manufacturing centre,More than 200 organisations are now on the site, which forms part of the “golden triangle” of Oxford, Cambridge and London,The Crown Estate oversees the royal family’s ancient portfolio of land and property across England and Wales that includes the seabed around its coasts and £15bn of property, including in London’s West End.

A slice of its profits are used to fund the work of the monarchy.Dan Labbad, chief executive of The Crown Estate, said: “The UK’s science, innovation and technology community is pushing the boundaries of progress in areas from AI to advanced manufacturing.But they need the specialised lab facilities and housing to realise potential.“The ambition of Harwell East is to create the space for great science to flourish, and to fuel growth and success not just in the region but for the benefit of the whole country.” This comes after the Crown Estate came under mounting criticism.

Last week, Greenpeace threatened to sue King Charles’s property management company, accusing it of exploiting its monopoly ownership of the seabed and driving up the cost of offshore wind.There could be a surge of company insolvencies if the artificial intelligence boom bursts, a new report today warns.Allianz Trade, the trade credit insurer, has calculated that thousands of firms could be at risk across Europe and the US, if the enthusiasm about AI were to unravel.In their latest Global Insolvency Outlook, Allianz Trade predict:If the current AI-induced boom were to burst in a shock similar to the dotcom bubble of 2001-2002, we expect a surge of bankruptcies by +4,500 companies in the US, +4,000 in Germany, +1,000 in France and +1,100 in the UK.Over the last few years, business creation has accelerated, particularly in Europe where new registrations were 9% higher in 2021-2024 compared to 2016-2019, and in the US, where business applications are 36% higher.

Allianz Trade is concerned that the recent proliferation of new businesses, particularly in the tech sector, significantly heightens insolvency risks, through “multiple interrelated mechanisms”.Firstly, startups and younger firms intrinsically face higher financial vulnerability and insolvency risk compared to established businesses that possess greater resources to weather economic downturns.Secondly, these new market entrants often intensify competition through aggressive pricing strategies or innovative offerings designed to capture market share, creating pressure across entire sectors.Third, a higher number of firms often leads to more fragile firms when the economic and financial cycle is weakening.Allianz Trade also forecast that global business insolvencies will rise by +6% in 2025, and again by +5% in 2026, before a modest decline by –1% in 2027.

But in the UK, business insolvencies are forecast to dip slightly this year, to 26,750, and then ease again to 25,900 in 2026.Japan’s stock market has risen to a new record high today, on relief that pro-stimulus politician Sanae Takaichi will become the nation’s first woman prime minister.The Nikkei 225 index rose 0.3% to close at 49,316 points, a new peak, after Takaichi won a parliamentary vote to become PM.Shares were lifted by expectations that Takaichi will push for looser fiscal policy, echoing Shinzo Abe, her former predecessor who was killed in 2022.

Ipek Ozkardeskaya, senior analyst at Swissquote, explains:She will push for looser monetary policy and larger fiscal stimulus — if – of course - markets will let her,Because note that long-term Japanese yields are already near multi-decade highs, which suggests she and Abe (to whom she’s compared) do not share the same margin to manoeuvre,

UK borrowing reaches five-year high for September at £20.2bn

UK government borrowing was the highest for five years in September after rising debt interest costs and higher welfare payments pushed the public finances deeper into the red.Figures from the Office for National Statistics (ONS) showed public sector net borrowing – the difference between public spending and income – hit £20.2bn last month, up £1.6bn from the same month last year and the highest September borrowing since 2020.The ONS said a rise in tax receipts was unable to offset the jump in debt interest costs this year and a rise in welfare costs, which have mostly increased in response to rising inflation

Reeves has mountain to climb in budget after borrowing rise

Rachel Reeves has already seen the most significant numbers setting the backdrop for next month’s budget – the Office for Budget Responsibility’s (OBR) forecasts for five years’ time, when her fiscal rules are judged.But September’s public finances data, published on Tuesday, will hardly have lightened the mood in No 11 as she draws up plans for tax rises and spending cuts.Even before the impact of the U-turns on winter fuel payments and disability benefits hits, the Office for National Statistics (ONS) found that the deficit in the first six months of the fiscal year was £7.2bn higher than the OBR predicted at its last forecast in March, at £99.8bn

Garmin Fenix 8 Pro review: built-in LTE and satellite for phone-free messaging

The latest update to Garmin’s class-leading Fenix adventure watch adds something that could save your life: phone-free communications and emergency messaging on 4G or via satellite.The Guardian’s journalism is independent. We will earn a commission if you buy something through an affiliate link. Learn more.The Fenix 8 Pro takes the already fantastic Fenix 8 and adds in the new cellular tech, plus the option of a cutting-edge microLED screen in a special edition of the watch

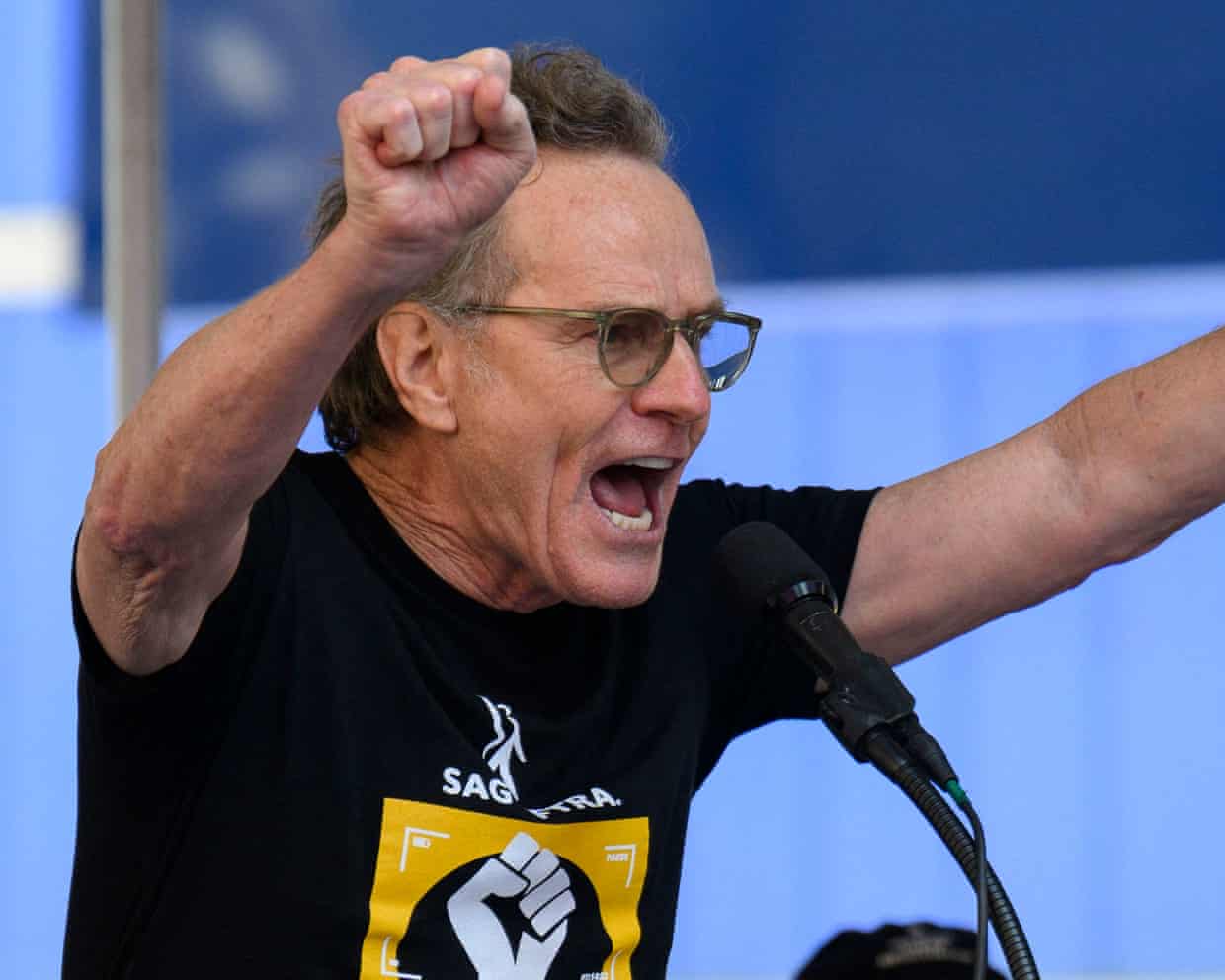

Bryan Cranston thanks OpenAI for cracking down on Sora 2 deepfakes

Bryan Cranston has said he is “grateful” to OpenAI for cracking down on deepfakes of himself on the company’s generative AI video platform Sora 2, after users were able to generate his voice and likeness without his consent.The Breaking Bad star approached the actors’ union Sag-Aftra with his concerns after Sora 2 users were able to generate his likeness during the video app’s recent launch phase. On 11 October, the LA Times described a Sora 2 video in which “a synthetic Michael Jackson takes a selfie video with an image of Breaking Bad star Bryan Cranston”.Living people must ostensibly give their consent, or opt in, to feature on Sora 2, with OpenAI stating since launch that it takes “measures to block depictions of public figures” and that it has “guardrails intended to ensure that your audio and image likeness are used with your consent”.But when Sora 2 launched, several publications including the Wall Street Journal, the Hollywood Reporter and the LA Times reported widespread anger in Hollywood after OpenAI allegedly told multiple talent agencies and studios that if they didn’t want their clients or copyrighted material replicated on Sora 2, they would have to opt out – rather than opt in

The Breakdown | Caluori conundrum adds to Borthwick’s England selection headaches

The lobby of the Pennyhill Park hotel on a Monday evening provides a neat snapshot of English rugby’s fast-changing world. First to amble into view is Noah Caluori, Saracens’s new whiz-kid who has just announced himself with five tries on his first Prem start. He nods a polite greeting and looks every inch a sporting thoroughbred that any national coach would covet.A couple of minutes later a more familiar face appears. It feels faintly bizarre to be bumping into Joe Marler when, on your television, he is sitting in a Scottish castle with Claudia Winkleman but, hey presto, that’s the magic of showbiz right there

NBA 2025-26 predictions: Wemby for MVP? And will Thunder strike twice?

Our writers give their verdicts on the new season, which tips off Tuesday. Can New York or Houston thwart an OKC repeat? And which youngster will make the superstar leap?If we’re lucky, a fully healthy campaign from Victor Wembanyama. He’s already shown flashes of his insane ceiling in his previous two seasons. He’s such a difficult matchup with the ball in his hands, and on defense, he changes the entire calculus of opposing teams’ schemes with his length. Jakub FrankowiczFrom Wembanyama’s looming superstardom (he’s 7ft 5in now?!) to 18-year-old Cooper Flagg’s rookie spark, this season feels like a generational crossroads

Amazon says Web Services are recovering after outage hits millions of users – as it happened

Labour’s clean energy plan needs a revamp: get real on costs and ignore the artificial deadline | Nils Pratley

Pizza Hut to close 68 UK restaurants, putting up to 1,200 jobs at risk

SlimFast’s European arm sold after struggling to compete with weight-loss drugs

Secret Cinema company is bought by Hollywood power broker

China’s economic growth slows amid Trump tariff war and property woes