Fed cuts interest rates by a quarter point amid apparent split over US economy

The US Federal Reserve announced on Wednesday that it was cutting interest rates by a quarter point for the third time this year, as the embattled central bank appeared split over how best to manage the US economy,The Fed chair, Jerome Powell, has emphasized unity within the Federal Open Market Committee (FOMC), the board of Fed leaders that sets interest rates,But the nine-to-three vote to lower rates to a range of 3,5% to 3,75% was divisive among the committee that tends to vote in unanimity.

New projections from officials also suggest hesitance to cut rates further next year, a refusal that could further rifts between the Fed and the White House.The split highlights the overall uncertainty within the Fed as the US economy absorbs major economic shakeups, including tariffs, changes to the labor force from Trump’s immigration crackdown and massive government cuts.Making matters harder for Fed officials is the lack of comprehensive price and labor market data, the collection of which was halted during the government shutdown.And Trump is weighing his choice for replacing the Fed’s chair.The latest economic data has shown slight increases to both inflation, which went from 2.

3% in April to 3% in September, and unemployment, which went from 4% in January to 4.4% in September.The dual increases, while relatively small, put the Fed in a tough spot.Keeping rates too high could stall the economy, but bringing rates down too quickly could mean higher inflation.Earlier in the year, Fed officials said they were waiting to see how Donald Trump’s tariffs would impact prices before making any changes to interest rates, pausing a rate cutting campaign that had started last fall.

For months, Trump and his allies in the White House have publicly attacked Fed officials – typically, US presidents respect the nonpartisan nature of the central bank – for not lowering interest rates.Even with rising inflation, Trump has continued to insist that any price increases are holdovers from Joe Biden’s presidency, despite some corporate leaders saying that their price increases are directly attributed to tariffs.Trump has been calmer toward the central bank since September, when officials cut rates by a quarter point and again during their meeting in October.Last month, Powell said officials weren’t making cuts out of confidence that prices were coming down.Instead, officials were becoming increasingly worried about the labor market, with fewer jobs being added to the economy each month.

“There is no risk-free path for policy as we navigate this tension between our employment and inflation goals,” Powell said at the time.Minutes from the October meeting described “strongly differing views” about how policymakers should move forward in this December meeting.The notes described how some participants believed a cut would be appropriate to move rates back toward a “neutral policy stance over time”, while others believed that current economic conditions did not merit changes to rates.In remarks last month, Tom Barkin, president of the Richmond Fed, said that “without compelling data, it’s actually hard to get people who have pre-existing perspectives to all come to a consensus.“You could argue it out, and maybe that’s what we’ll do,” he said.

Next year, Powell’s term as chair will be up in May, leaving room for Trump to nominate his pick for the most influential economic role in the country,Trump has suggested Kevin Hassett, the director of the National Economic Council, could be his nominee, though it is unclear how popular Hassett is among other Republicans,Hassett told Fox News on Wednesday that Trump will befinalizing his choice within the next few weeks,

‘What to buy Dad for Christmas’: is retail ready for the AI shopping shift?

Christmas shopping – some love it, to others it’s a chore, and this year for the first time many of us will outsource the annual task of coming up with gift ideas to artificial intelligence.While traditional internet search, social media – especially TikTok and Instagram – and simply wandering a local high street will still be the main routes to presents for most this year, about a quarter of people in the UK are already using AI to find the right products, according to PricewaterhouseCoopers.For brands appealing to younger people, the revolution is well under way: the rival advisory firm KPMG says as many as 30% of shoppers aged 25-34 are using AI to find products, compared with 1% of those aged over 65.Asking a large language model (LLM) such as ChatGPT or Gemini what you should get your father-in-law – rather than typing “whisky” or “socks” into Google or DuckDuckGo – may seem a small change in habits. However, it marks a sea change for retailers accustomed to paying search engines to promote their listings

Travel firm Tui says it is using AI to create ‘inspirational’ videos

Tui, Europe’s biggest travel operator, has said it is investing heavily in AI as more people turn to ChatGPT to help book their holidays, including using the technology to create “inspirational” videos and content.The chief executive, Sebastian Ebel, said the company was investing in generative engine optimisation (GEO), the latest incarnation of search engine optimisation (SEO), to help push Tui to the top of results from AI chatbots including ChatGPT and Gemini.While traditional SEO relies on links and keywords to increase visibility in search engine results, GEO tries to increase recommendations via chatbots by ensuring a product is mentioned in the message boards, videos and other online datasets that the AI agents crunch to produce their answers.Ebel said connecting to large language models and social media companies would help Tui to grow. “By being part of their ecosystem, not depending on Google alone any more, [we are] going into the space where our customer is,” he said

US senator calls for insider trading inquiry over Trump donors buying $12m worth of shares

A senior Democratic senator is calling for an investigation into potential insider trading by fossil-fuel billionaires close to the Trump administration, after a Guardian investigation raised questions about an unusual share buying spree.Robert Pender and Michael Sabel, the founders and co-chairs of Venture Global, a liquefied natural gas (LNG) company headquartered in Virginia, bought more than a million shares worth almost $12m each, just days after meeting with senior Trump officials in March.The meeting included Chris Wright, the energy secretary, who days later granted the company an export license essential for its expansion plans in Europe, the Guardian reported last week.“Dirty oil and gas bucks are fueling the Trump Administration, which should outrage all of us. This latest reporting portrays a pattern of pay-to-play donations and favorable actions by the administration,” said Jeff Merkley, senator for Oregon and senior member of the Senate appropriations and budget committees

William Hill owner Evoke considers sale or breakup after budget tax rises

Evoke, the London-listed gambling company that owns William Hill and the 888 online casino brand, has said it is considering a sale or breakup of the group, after warning of a £135m hit from tax increases announced in last month’s budget.In a statement to the stock market, the heavily indebted company said it had appointed bankers at Morgan Stanley and Rothschild to explore potential options to secure its future.The decision comes only four years after the business, then known as 888 Holdings, paid £2.2bn to buy William Hill’s network of 1,400 bookmakers, in an unexpected foray into bricks-and-mortar betting.Shareholders have since watched the value of the company plummet by more than 90% to less than £100m as of Wednesday

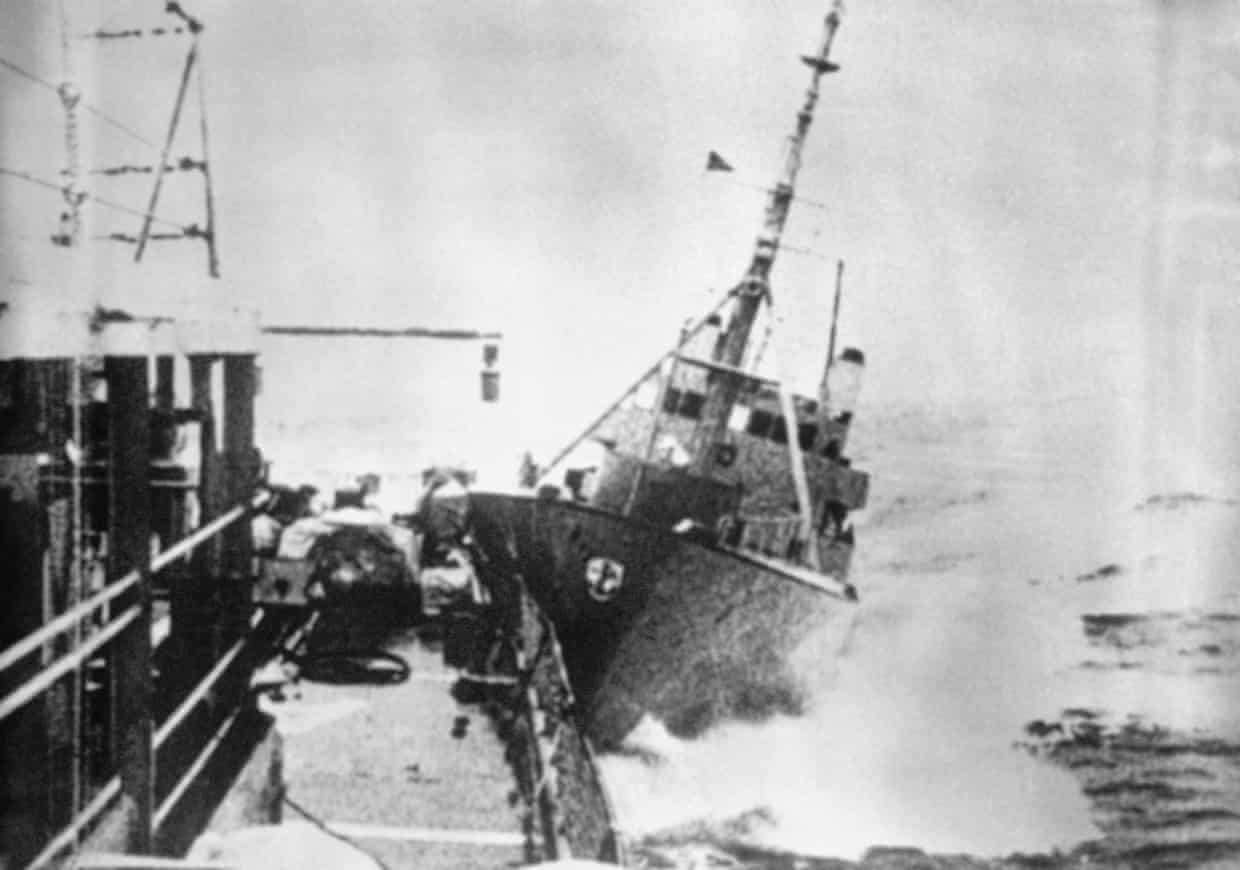

Archive, 1975: Iceland opens fire on British vessel

After the second world war Iceland began to gradually extend the fishing zone around its coastline. The first cod war began in 1958 when it proclaimed a 12-mile fishing zone, followed by the second cod war in 1972, which extended the limit to 50 miles. In October 1975 Reykjavik decided to further increase its protected waters to a 200-mile zone, effectively cutting off British and German fishers from their best catch. This led to the third cod war which saw violent clashes and rammings. The dispute ended in June 1976 when Britain recognised the 200-mile limit

Rachel Reeves’s test from the bond markets starts now

Good news for Rachel Reeves: the cost of government borrowing has fallen a bit relative to the US and eurozone countries. Better news: the chancellor may have something to do with it. Better still: some economists think there’s more to come.Let’s not get carried away, though. The UK is still paying a painful premium on its borrowing costs, as the Institute for Public Policy Research thinktank illustrates

How to make the perfect Dubai chocolate bar - recipe | Felicity Cloake's How to make the perfect …

The ultimate unsung superfood: 17 delicious ways with cabbage – from kimchi to pasta to peanut butter noodles

Christmas dinner in a restaurant or kitchen carnage at home?

Christmas mixers: Thomasina Miers’ recipes for fire cider and spiced cocktail syrup

Jamie Oliver to relaunch Italian restaurant chain in UK six years after collapse

Maximum protein, minimal carbs: why gym bros are flocking to Australia’s charcoal chicken shops