UK economy beats forecasts with 0.3% growth in November; Ofwat investigating South East Water over outages – as it happened

Newsflash: The UK economy has returned to growth, and more vigorously than expected.UK GDP expanded by 0.3% in November, new data from the Office for National Statistics shows, after shrinking a little in October.That’s faster than expected; City economists had expected growth of just 0.1%In another boost, September’s growth figures have been revised higher, showing that the economy didn’t shrink that month after all.

The ONS says:Monthly GDP is estimated to have grown by 0.3%, following an unrevised fall of 0.1% in October 2025 and a growth of 0.1% in September 2025 (revised up from our initial estimate of a fall of 0.1%).

More to follow….Time to wrap up….The UK economy grew by a stronger-than-expected 0.3% in November despite uncertainty around Rachel Reeves’s budget, official figures show.Figures from the Office for National Statistics (ONS) on Thursday showed the improvement, up from a 0.

1% fall in October.Forecasters had expected a more modest 0.1% expansion.The better-than-expected data will be good news for the chancellor, who hopes an economic turnaround will help Labour’s fortunes.Economic output earlier in 2025 was hit by the cyber-attack on the carmaker Jaguar Land Rover, which depressed vehicle production.

The company’s recovery appears to have contributed to November’s growth, with a 25.5% improvement in motor vehicle manufacture during the month.Regulator Ofwat is investigating South East Water after repeated outages since November left tens of thousands of households and businesses across Kent and Sussex without drinking water.News of the probe came as The Guardian revealed that David Hinton, the chief executive of South East Water, is in line for a £400,000 long-term bonus regardless of his performance, if he stays on until July 2030.Donald Trump has imposed a 25% tariff on certain AI chips, such as the Nvidia H200 AI processor and a similar semiconductor from AMD called the MI325X, under a new national security order released by the White House.

A company linked to financier Lex Greensill “failed to act in good faith” by lending £250m more than it should have to businesses owned by steel magnate Sanjeev Gupta during the pandemic, the high court has been told.Britain’s stock market has ended the day at a new closing high.The FTSE 100 index has closed at 10,238.94 points, having hit a new intraday high of 10,250 during the day.The better-than-expected UK GDP data seemed to lift the mood in the market today.

Neil Wilson, Saxo UK investor strategist, writes:There’s actually been some good news today (!) as the British economy grew more than expected in November – though ironically it could be that people were just spending a lot on accounting and tax advice ahead of the Budget - monthly GDP data should always be taken with a pinch of salt.Even better news is that gilt yields – borrowing costs for the government – keep falling as markets bet on weaker inflation and more cuts by the Bank of England, albeit they have ticked up a tad today on the GDP print.I don’t think this print will change the narrative much as it’s about much more than just a few bps of growth here and there.Markets seem relieved that fiscal policy is a bit more certain after the chancellor raised her headroom in the Budget.Lower gilt yields mean of course more headroom and scope later on to cut taxes, should the government seek to win an election again.

On the other hand, the construction sector is having its worst slump in more than two years with output down more than 1% in the three months to November.At the end of last year, Rachel Reeves was under fire for the impact of budget speculation on Britain’s economy.All of the noise about fiscal holes, tax increases and spending cuts before her late November budget was having a real-world effect on the spending decisions of households and businesses.The latest official figures will therefore come as a boost for the chancellor.Britain’s economy grew more strongly than expected in November, up 0.

3%, despite the fog of uncertainty in the lead up to her critical tax and spending speech at the end of the month.Much of the increase was outside Reeves’s direct control.After manufacturing output was crushed by the Jaguar Land Rover cyber-attack earlier in the autumn, a recovery was always anticipated.With the return of its production lines close to capacity, factory output in November raced ahead.Elsewhere there were signs of the budget speculation hitting output.

Real estate activity slumped in November, as property owners and house hunters put things on hold while awaiting the outcome of the chancellor’s tax decisions,Consumer-facing businesses also struggled, partly fuelled by the uncertainty sapping household confidence,However, the UK’s dominant service sector was stronger than anticipated despite these headwinds…,,More here:There’s a surprise shake-up at the top of Britain’s anti-fraud operation.

Nick Ephgrave, the head of Britain’s Serious Fraud Office, is to retire at the end of March after about two-and-a-half years in the post – quite a short tenure.The SFO point out that Ephgrave has spent 38 years in public service, including senior roles in UK law enforcement, with the Metropolitan and Surrey police forces as well as the National Police Chiefs’ Council.Ephgrave said:It is with great pride that I reflect on the enormous progress the SFO has made in the last two and a half years.We have achieved more things, more quickly than even I thought possible thanks entirely to the enthusiasm, commitment and can-do attitude from everyone at the SFO.I am certain that the momentum we have created will continue to propel the organisation forward to bigger and better things.

I would like to thank each and every colleague for their support and hard work, without which none of this could have happened.However, the SFO has also faced criticism during Ephgrave’s tenure; in July 2025, City trader Tom Hayes’s overturned his conviction for Libor rigging after a decade, a month later the SFO admitted that five other convictions could be unsafe too.Working at the SFO is not a glamorous posting either.As my colleague Anna Isaac wrote in 2024:Even to enter Ephgrave’s attic room – a small, corner office looking down on the gun-metal lions beneath Nelson’s Column – he must first go through the security of the Canadian High Commission.Shabby carpet, struggling house plants and chipped mugs give an impression that is more Slough House, in the TV drama Slow Horses, than the UK’s premier anti-fraud squad.

At least he has a view; some of its staff work in its basements, taking vitamin D tablets to compensate for the lack of natural light.There, the majority of the SFO’s historical case files are stored in a former swimming pool.Its dilapidated offices and soundtrack are distractions he could do without.Running the SFO is one of the highest-pressure jobs in law enforcement.His predecessors have faced heavy criticism, so much so that the body was nicknamed “The Nightmare on Elm Street”, referring to a series of failures when it occupied its former offices.

Being forced to set aside £250m for potential damages has earned it a new nickname among some senior Treasury officials: “The Cockups on Cockspur”.Stocks have opened higher in New York, as world markets continue to push higher.The Dow Jones industrial average has gained 132 points, or 0.27%, in early trading to 49,282 points.The broader S&P 500 share index is up 0.

6%, and the tech-focused Nasdaq is 0.9% higher.In news that may enrage the waterless residents of Kent and Sussex, the boss of South East Water is in line for a £400,000 long-term bonus regardless of his performance, if he resists calls for him to resign over the outages.David Hinton, the chief executive of South East Water, is to receive the payout if he stays on until July 2030.Hinton is facing calls to give up his right to the previously unreported “service award”.

The payment, which was disclosed in the company’s annual report, is not performance-related, meaning that as long as he remains, Hinton will receive it whatever the company’s record on water supplies or pollution.Over in the US, the number of Americans filing new claims for unemployment benefits have dropped.Last week, there were 198,000 initial claims, a decrease of 9,000 from the previous week.That suggests US companies continued to hold onto workers, despite recent signs that the labor market was cooling.The National Institute of Economic and Social Research (NIESR) have predicted that the UK economy got off to a good start in 2026.

They say that early estimates point to 0.3% growth in the first quarter of the year, following this morning’s GDP report for November.Yesterday’s UK offshore windfarm auction will support up to 7,000 jobs across the country, the government has annouced.The Department for Energy Security and Net Zero has calculated that the successful renewables auction will bring £3.4bn of private sector investment into the UK, to support factories, ports and domestic supply chainsDESNZ says:Every £1 of public money invested through the government’s new Clean Industry Bonus leverages £17 from industry in an unprecedented vote of confidence in UK’s industrial strategy and clean energy mission.

Investment means factories, ports and supply chains built in Britain, supporting up to 7,000 jobs in the country’s industrial heartlands and most deprived regions, as part of 400,000 new clean energy jobs by 2030.As we reported yesterday, subsidy contracts for enough offshore windfarms to power 12m homes were awarded through the auction for renewable subsidies, after ministers doubled the amount of funding available to developers to help them produce projects.Over on Wall Street, Goldman Sachs has reported a jump in revenues and profits.Goldman grew its revenues by 9% during 2025, to $58.28bn, lifted by higher activity at its global banking and markets division.

Earnings per share swelled too – to $51.32 for the year ended December 31, 2025, up from $40.54 a year earlier.David Solomon, chairman and ceo of Goldman Sachs, says:We continue to see high levels of client engagement across our franchise and expect momentum to accelerate in 2026, activating a flywheel of activity across our entire firm.While there are meaningful opportunities to deploy capital across our franchise and to return capital to shareholders, our unwavering focus remains on maintaining a disciplined risk management framework and robust standards.

”Green Party leader Zack Polanski is calling on Sir Keir Starmer to take South East Water into public ownership through the special administration regime, following the company’s failure to provide water to customers in Kent and Sussex since November.In a letter to the prime minister, Polanski says South East Water has “clearly failed” to make the necessary investments in infrastructure in order to continue meeting its duty to customers, spending less on repairs than it handed to shareholders and bond holders.Polanski insists that the threshold for special administration has been cleared, writing:There is a clear alternative: bringing water back into public hands by placing failing water companies into special administration.In special administration, the government can refuse to pay shareholders compensation.Crucially, it can also refuse to pay debtholders if this would interfere with water company performance.

In the case of South East water the government would be entitled to say that the repair costs exceed the debt, so the debt need not be repaid (that the ‘appropriate value’ for debtholders to get is zero),In September 2025, Minister Emma Hardy set an exceptionally high bar for special administration, telling the Defra select committee they would only put a water company into special administration if ‘fundamentally water does not come out of the tap and your toilet does not flush and sewage does not go away,’Even this extremely high threshold set by the government, far beyond what the law requires in order to put a water company into special administration, has been met,Water this week did not come out of the taps in 25,000 homes around the south of England,Britain’s stock market has hit a new record high this morning, as City traders welcome the UK’s forecast-beating growth in November.

The FTSE 100 has hit a new alltime high of 10,235 points this morning, adding to its gains since it broke through the 10,000-point mark at the start of this year.Asset management firm Schroders (+6.8%) after lifting their profit guidance this morning.Joshua Mahony, chief market analyst at Scope Markets, says:The FTSE 100 once again remains a leader in Europe, although the pullback in oil and precious metals has meant that commodity stocks are lagging behind as financials take the lead.Strong gains for the likes of HSBC, Barclays, and NatWest bring a recovery from a sector that has been hit by Trump’s recent move to limit credit card interest rates to 10%.

However, today has seen a positive update out of the UK, with GDP posting a surprise monthly gain of 0.3% for the month of November.This comes after an October contraction, which had been heavily impacted by a 27% slump in car production following a cyber-attack on Jaguar Land Rover.The snapback in manufacturing highlights how volatile monthly data can be, and why not every piece of data should be seen solely through a political prism.That being said, the underlying picture remains soft in the UK.

Construction continues to deteriorate, with output falling again in November and now almost 3% lower since July.There’s also celebration in Germany today after the country’s economy returned to growth.Germany’s Federal Statistics Office has reported that German GDP grew by 0.2% in the final quarter of last year and also increased by 0.2% over the full-year 2025

BP accused of ‘insidious’ influence on UK education through Science Museum links

Campaigners have accused BP of having an insidious influence over the teaching of science, technology, engineering and maths (Stem) in the UK through its relationship with the Science Museum.Documents obtained under freedom of information legislation show how the company funded a research project that led to the creation of the Science Museum Group academy – its teacher and educator training programme – which BP sponsors and which has run more than 500 courses, for more than 5,000 teachers.Campaigners say the documents reveal the extent of control the company had over the research project, called Enterprising Science. The contract setting out the collaboration states that major decisions would not be “validly passed … unless the representative of BP votes in its favour”.Chris Garrard of the campaign group Culture Unstained said: “BP’s toxic influence over young people’s learning is calculated and insidious

South East Water boss lasting weeks in post would be a surprise | Nils Pratley

Can David Hinton, the chief executive of South East Water, stay in his job long enough to bag a £400,000 bonus for turning up to work? With four and a half years to go, one can’t say his chances of landing the retention payment – or “service award” – are good. In fact, it will be surprising if he’s still infuriating the residents of Tunbridge Wells four and a half weeks from now.In the latest episode of this long-running double saga of outages that has left thousands of households in Kent and Sussex without running water for days, Ofwat has opened a first-of-its-kind investigation into whether South East complied with its obligation to provide “high standards of customer service and support”. That comes a day after Emma Reynolds, the environment secretary, called for the regulator to review the company’s operating licence.Meanwhile, even the company’s shareholders, who normally shun the spotlight on these occasions, are spluttering into their bottled water

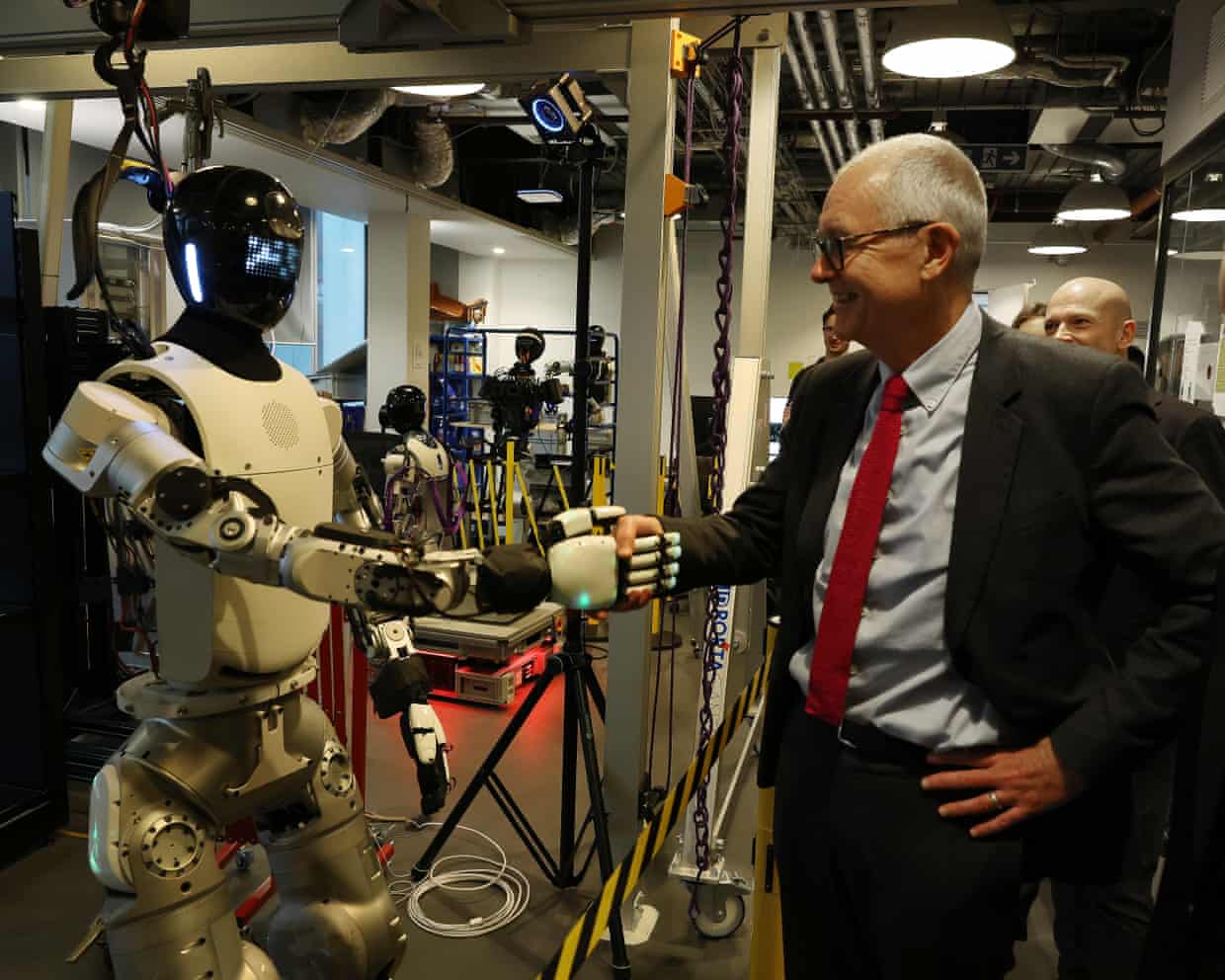

AI will transform the ‘human job’ and enhance skills, says science minister

Advances in AI and robotics will transform human jobs, starting with roles in warehouses and factories, the UK science minister has said, as the government announced plans to reduce red tape for robot and defence tech companies.Patrick Vallance said technological progress was creating a “whole new area” for robots to work in. “What’s really changing now is the combination of AI and robotics. It is opening up a whole new area, particularly in the sorts of things like humanoid robotics. And that will increase productivity, it will change the human job,” he told the Guardian

Elon Musk’s xAI datacenter generating extra electricity illegally, regulator rules

A US regulator ruled on Thursday that Elon Musk’s artificial intelligence company had acted illegally by using dozens of methane gas turbines to power massive data centers in Tennessee.xAI has been fighting for a year and a half over truck-sized gas turbines the company had parked near its Colossus 1 and 2 facilities, arguing to local authorities that the electricity-generating turbines were exempt from requirements for air quality permits.The Environmental Protection Agency (EPA) declared on Thursday that the generators were not exempt. In its ruling, the agency revised the policies around gas turbines, saying that the operating the machines still requires air permits even if they are used on a portable or temporary basis, as had been the case.When xAI first installed the portable turbines at Colossus 1, it took advantage of a local county loophole allowing the operation of generators without permits so long as the machines did not sit in one place for more than 364 days

Katie Boulter hires Sharapova’s former coach to revive career after dismal 2025

Katie Boulter is hopeful that she can rediscover her best form and return towards the top of the WTA Tour this year with the help of Maria Sharapova’s former coach Michael Joyce.Boulter opted to split with her previous longtime coach, Biljana Veselinovic, at the end of last year after an incredibly difficult season in which she fell from her career high ranking of No 23 at the end of 2024 to her current ranking of No 113.She quickly hired Joyce, a former player who has worked with Johanna Konta, Jessica Pegula, Victoria Azarenka and Eugenie Bouchard, with his most recent partnership a four-year tenure with Ashlyn Krueger.“Personally I always really liked him,” said Boulter. “I thought he’s done a really good job with a lot of other players … Jessie, Ashlyn

Australia legend Lockyer hopes new Broncos can buck London’s rugby league resistance

Darren Lockyer has faced some monumental challenges for club and country but this year his trickiest task may be finding the opponents of his new club on a map as he takes on rugby league’s mission impossible.Throughout his illustrious career, Lockyer faced Melbourne Storm, Sydney Roosters and some of the world’s best international teams. This year, Lockyer’s interests will be centred on places like Goole, Swinton and Batley after taking ownership of London Broncos late last year and attempting to make them a rugby league powerhouse.“I’m about to get stuck into all that aspect of finding out more about our opponents: it’s all part of the fun,” he says in the buildup to Sunday’s season opener against Widnes. “I played a lot of rugby in the UK but there are a lot of places I’ve never been or even heard of, so I’m really looking forward to all of that

Maternal death rate in UK rose by 20% over 14 years despite Tory pledge

ADHD care needs better regulation and fewer pills | Letters

Religious tradition, child safety and the law on circumcision | Letters

Woman pulled out of UK ultramarathon after death threats over Afghanistan fundraising

Circumcision kits found on sale on Amazon UK as concerns grow over harm to baby boys

One in four UK teenagers in care have attempted to end their lives, study says