Stock markets rise to record highs and Apple touches $4tn market value for first time – as it happened

The UK’s FTSE 100 has hit a new intra-day record and Wall Street shares are also at all-time highs – with Apple hit a $4 trillion market value for the first time.The FTSE 100 has hit a record peak of 9,715.22, and is currently trading 0.5% higher at 9,698.4.

US stocks also hit new peaks after the opening bell on Wall Street, with gains of between 0,3% and 0,7% for the S&P 500, tech-heavy Nasdaq and Down Jones,The Apple share price rose by around 1% to $269,86, taking the company’s market cap to $4tn, boosted by the popularity of its latest iPhone models.

It has dipped just below that level again,The tech company is due to report quarterly results on Thursday,Microsoft jumped as much as 4% to a market value of $4,06tn after announcing a deal with OpenAI, and ahead of its earnings report tomorrow,Other tech companies such as Google owner Alphabet, Amazon and Facebook and Instagram parent Meta are also reporting earnings this week.

Investors have been willing to take more risks after signs of easing trade tensions and ahead of a likely interest rate cut from the Federal Reserve at the end of its two-day meeting tomorrow.Stock markets in the UK, US and Europe have hit fresh record intra-day highs today.The FTSE 100 in London, Wall Street and Spain’s Ibex have scaled new all-time peaks, and Apple briefly touched a market value of $4tn for the first time, boosted by the popularity of its new iPhone models.Microsoft also topped that level as its share price jumped as much as 4% at the open, taking its market cap to $4.06tn, after announcing a new deal with OpenAI.

Both companies report quarterly results in the next couple of days.Rachel Reeves has expressed confidence that a trade deal with Gulf countries can be done quickly, saying she had “really good” meetings in Riyadh.“I am really confident we can get that deal over the line,” the UK chancellor said at Saudi Arabia’s flagship investment summit held in the Saudi capital, adding she was hopeful that the agreement could be reached “very soon”.The UK government hopes to deepen its relationship with Saudi Arabia, even though it has been widely criticised for human rights abuses.Our other main stories today:Thank you very much for reading.

We’ll be back tomorrow with the latest business news.Take care! – JKThe UK’s FTSE 100 has hit a new intra-day record and Wall Street shares are also at all-time highs – with Apple hit a $4 trillion market value for the first time.The FTSE 100 has hit a record peak of 9,715.22, and is currently trading 0.5% higher at 9,698.

4.US stocks also hit new peaks after the opening bell on Wall Street, with gains of between 0.3% and 0.7% for the S&P 500, tech-heavy Nasdaq and Down Jones.The Apple share price rose by around 1% to $269.

86, taking the company’s market cap to $4tn, boosted by the popularity of its latest iPhone models.It has dipped just below that level again.The tech company is due to report quarterly results on Thursday.Microsoft jumped as much as 4% to a market value of $4.06tn after announcing a deal with OpenAI, and ahead of its earnings report tomorrow.

Other tech companies such as Google owner Alphabet, Amazon and Facebook and Instagram parent Meta are also reporting earnings this week.Investors have been willing to take more risks after signs of easing trade tensions and ahead of a likely interest rate cut from the Federal Reserve at the end of its two-day meeting tomorrow.Wizz Air is using artificial intelligence to help cut its fuel consumption, as the new tech monitors weather patterns and calculates optimal speeds and altitudes for its planes.Michael Delehant, chief commercial and operations officer at the budget airline, told reporters that AI and machine learning now saves it 4 kilograms of fuel per flight.He said:How do you constantly manage a web of never-ending movements, day and night? It’s 24/7, all weekends, no time off.

AI in the middle of our operations has been a significant step forward.The budget airline, which is headquartered in Hungary and listed on the London Stock Exchange, carries tens of millions of passengers every year.It operates short-haul flights from nine UK airports including London Gatwick, Birmingham, Edinburgh and Luton.However, it has ranked among the lowest scores for customer satisfaction for short-haul economy airlines.This year the consumer group Which? found it had an overall customer score of 51%, just above Ryanair in bottom place at 49%.

The airline said it was using AI to help improve its customer service, as well as hiring more English-speaking call centre agents.Its new chatbot, Amelia, is also taking thousands of calls in a matter of hours, in what would normally take human agents “weeks”, the airline said.Delehant said:The way we look at AI is not about replacing jobs.I know there’s a lot of fear across many industries that AI is going to replace us.You shouldn’t look at it this way: I think what AI’s opportunity really is right now is to make us more bionic.

Wizz Air will also be testing a business class-style booking in December, which allows a passenger to block the middle seat so they can have more room.Delehant said:There will be no big seat or anything like that…But a bit more space by blocking the middle seats...There are so many low cost business travellers.

They own their own businesses, they don’t want to spend first class prices or business class,,,but they’d like a little more space,The bond fund manager Pimco has reportedly sold most of its debt position in Thames Water as the crisis-hit water company edges closer to a private sector rescue deal, aimed at staving off temporary nationalisation.

Sky News reported that Pimco, run by the former Man Group boss Emmanuel Roman, has in recent weeks reduced its exposure to Thames Water’s mountain of debt by selling hundreds of millions of pounds of debt – the majority of its holdings – to fellow investors including Apollo Global Management, Elliott Advisors and Silver Point Capital,Earlier this month, it emerged that Thames Water may not fully comply with rules on pollution of England’s waterways for as long as 15 years, according to a new plan by creditors who are scrambling to avoid the utility being forced into government administration,The group of financial institutions, under the new London & Valley Water holding company, has been locked in talks with Ofwat since May over acceptable terms for the hugely complex restructuring of Britain’s biggest water company,Thames Water has been crippled by huge debts built up over two decades by owners who have been criticised for paying out dividends without investing enough in its leaking pipes and malfunctioning treatment works, leading to repeated sewage spills into Britain’s rivers and seas, and fines from the regulator,The co-founder of Ben & Jerry’s has accused its owner of being part of a movement of “corporate butt kissing” of Donald Trump and says management blocked the ice-cream brand from producing a flavour in support of peace in Gaza.

Ben Cohen told the Guardian that Unilever was pursuing a “corporate attack on free speech” by blocking the development of a special flavour in solidarity with the Palestinian people.It is understood the flavour had been approved by Ben & Jerry’s independent board and first mooted about a year ago.Magnum, the group’s ice-cream arm, confirmed it had not gone ahead with the board’s suggestion for a Palestine product this summer.Cohen has mounted a “Free Ben & Jerry’s” campaign to persuade Unilever to sell the brand to a group of socially minded investors who he says have pledged to allow it to continue its “social mission.”With an increasingly authoritarian Trump in the White House, Cohen says now is the time that “companies and anyone who believes in justice, freedom and peace stands up.

This is the moment when it is most needed for Ben & Jerry’s to be able to raise its voice.“It seems like since Trump got elected anything that Trump is against, DEI, black history, protesters’ rights to free speech, all those things got censored.”Previous Ben & Jerry’s flavours with an activist bent have included “Save Our Swirled” to highlight the need for action at the 2015 Paris climate meetings, “I Dough, I Dough” to celebrate the legalisation of same-sex marriage at a US federal level, and “Home Sweet Honeycomb” in support of resettling refugees in Europe.Cohen’s criticisms are the latest blow in the acrimonious spat between the brand’s founders and owners.Unilever is planning to spin off the Magnum Ice Cream Company into a separate business, which it hopes to list in Amsterdam with secondary listings in London and New York.

Those plans were this week delayed because of the US government shutdown, although they could proceed by the end of the year.Unilever said remained confident of implementing its demerger plans this year.BT is reportedly considering the launch of new a low-cost mobile brand, as the telecoms group explores ways to compete with new rivals in the market including the fintech companies Revolut and Monzo.The group is exploring options to enter the budget market, which could involve creating a new brand in-house or buying an existing virtual network operator, according to the Financial Times.The move would mark a strategy shift from the former state-owned company, which now only offers mobile services through its premium EE brand.

BT owns Plusnet, but decided last year to use the low-cost brand only for its broadband services.However, it is now looking at how it can stay competitive as new rivals, including from the fintech sector, start taking slices of the UK mobile market as virtual network operators, which piggyback on the existing networks of other mobile services.Asked whether higher spending on new drugs will require additional funding for the NHS, Vallance said yes.We’ve discussed the fact that if there’s a rise in price for innovative medicines, that comes with a cost load and that needs to be met.And I’ve described the percentage change of spend on medicines, and there’s an overall budget question, and that’s really for DHSC [department of health and social care] to to consider, how they’re going to deal with that.

But I mean, yes there will be an increased cost.You can’t escape that.He stressed the importance of “getting the commercial environment right” or you won’t get medicines launched in the UK.It’s worth reflecting that if we’re in a situation where companies don’t want to sell their medicines in the UK, that’s not great for anybody.If you don’t get these things right, the commercial environment right,particularly in the era of comparative pricing going on in the US, then you don’t get medicines launched in the UK, patients suffer.

So that’s why we have to get this price point, this ability to be competitive in the commercial arena, right at the same time as doing all the other things we’re doing on the life sciences plan.Earlier, Sam Roberts, the chief executive of National Institute for Health and Care Excellence (NICE), which assesses which new drugs should be offered on the NHS, said “91% of medicines that NICE looks at we say yes to”.So where does that put us? 91% puts us at sixth in Europe.So six out of 37 countries, top quarter.We’re not the best.

We’re definitely not the worst, and there’s been no deterioration in that over the last five years.NICE has come under heavy criticism from drugmakers for keeping its cost effectiveness thresholds unchanged in recent decades, and ministers have acknowledged that they should be reviewed.Roberts defended the thresholds, sayingSociety thinks that we should pay more for severe disease than for non severe disease.So we were given some freedoms in 2022 that said we can pay about 20% to 70% more.For rare diseases… we’re allowed to pay three to 10 times more.

Steve Bates, executive chairman of the Office for Life Sciences, said “a good US deal” would “quickly resolve” the issue of a lack of confidence of big pharmaceutical companies such as AstraZeneca and MSD in the UK, and its impact on investment decisions.Quizzed by MPs on the science committee, Bates, who took up his new job at OLS in September after running the BioIndustry Association for 13 years, said:So I think a good deal with the USA can quickly resolve it, is the simple answer for that.I’m saying that if the UK can get a fantastic domestic business environment allied to access to global markets, that’s a fantastic base from which any companies would want to grow for the world.MSD, known as Merck in the US, AstraZeneca and other big pharma companies have scrapped or paused investments in the UK, while ramping up investments in the US.The UK head of Novartis called Britain “largely uninvestable” as negotiations between the industry and UK government over a new pricing agreement broke down in late August.

Meanwhile, Donald Trump has been putting pressure on drugmakers to invest more in the US, and to cut drug prices, or face trade tariffs.This means any UK decisions on higher drug pricing and NHS spending are tied to a deal with the US.Varun Chandra, business adviser to Keir Starmer, has been leading negotiations with officials in Washington.Science minister Patrick Vallance, a former GSK executive, said in front of the same committee that “some degree of price increase is inevitable in the UK,” referring to higher NHS spending on new medications that the pharma industry has long called for.I think for brand new, innovative medicines, it’s likely there will be some price increase.

If you go back to 2015 the spend on medicines was about 12% [of total NHS spending] if you go back earlier, it was higher, it was about 14%,It’s now about 9%,So there is a possibility of increasing percentage spend,European shares have eased from all-time highs, after the UK and Spanish stock markets hit new peaks,The pan-European Stoxx 600 index dipped by 0

South Africa claim historic World Cup final spot as Wolvaardt blows England away

South Africa made history in Guwahati on Wednesday, after a phenomenal innings from their captain, Laura Wolvaardt, and remarkable figures of five for 20 from Marizanne Kapp helped them to a 125-run win against England and into their first 50-over World Cup final.Wolvaardt took 115 balls to bring up a maiden World Cup hundred, which was reason enough to celebrate. But with wickets tumbling at the other end, and England looking like they might have an easy-enough chase on their hands, she unleashed a superb display of boundary-striking, adding 69 runs in 28 balls.Wolvaardt slammed four sixes down the ground and slog-swept Linsey Smith for 20 runs off the 47th over. Even when she holed out to Lauren Bell in the 48th, Chloe Tryon and Nadine de Klerk took over, hitting 16 off Smith in the 49th over as England’s best death bowler was made to resemble an amateur

Australia will target Freeman at centre in England clash, George Gregan warns

The former Australia captain George Gregan says they will target Tommy Freeman’s defending at outside-centre for England on Saturday.Steve Borthwick’s side kick off their autumn campaign at Twickenham against opponents who consigned them to a dramatic late defeat last year, and the head coach has made some notable selectorial calls.George Ford starts at No 10 instead of Fin Smith, Ford’s Sale Sharks colleague Tom Roebuck is on the wing and, most interestingly, Freeman will play at No 13.The in-form Northampton back will line up in midfield for England for the second time, switching from a more familiar role out wide. He scored four tries in the Saints’ win against Saracens last Friday wearing the No 14 jersey, and outside-centre requires a different set of skills, particularly without the ball

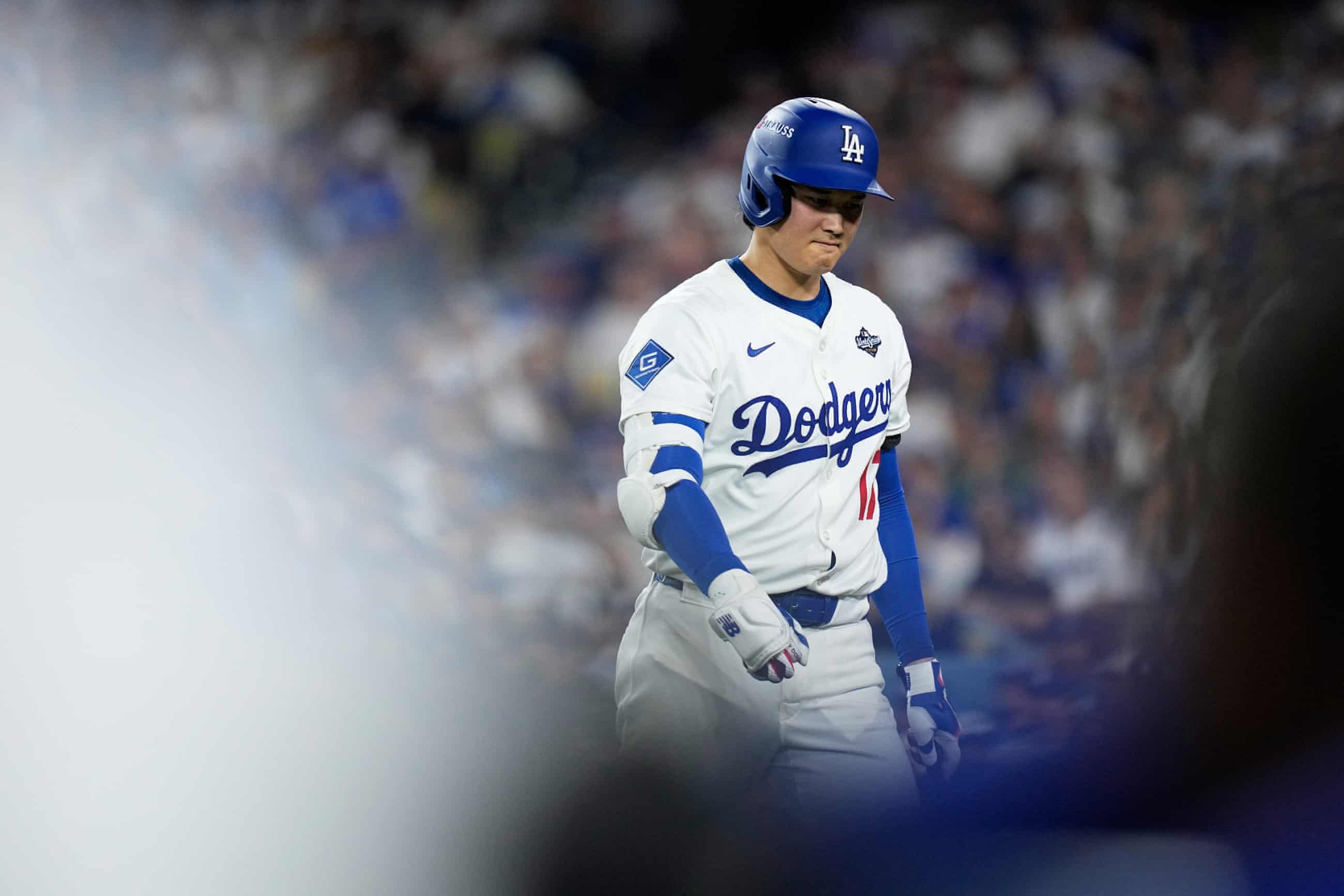

Shohei Ohtani had an off night at the World Series but he still breaks baseball logic

The Dodgers star pitched in Game 3 just 18 hours after setting records with the bat. It’s a reminder of how he makes the miraculous seem mundaneEven Shohei Ohtani’s teammates struggle to find the right adjectives to describe him; ones that express how good he is while emphasizing how unlikely his existence is in the first place.After Monday’s Game 3, when Ohtani became the first player in postseason history to reach base nine times in a World Series game, Dodgers first baseman Freddie Freeman opted for “unicorn,” one of the more common Ohtani descriptors. Starting pitcher Blake Snell, meanwhile, put things simple and plain.“He’s going to do spectacular things all the time,” Snell said

Wallabies resume England rivalry with memories still fresh of Twickenham triumph | Angus Fontaine

Smell that? That delicious whiff, sometimes bitter, but all the sweeter for its bluster? ‘Tis the distinctive funk of Australia-England sporting acrimony back on the breeze. The Kangaroos and England battling over rugby league Tests. The Lionesses and the Matildas resuming their World Cup feud. Stuart Broad and the Barmy Army playing at villainy before the Ashes next month. And the green grass of Twickenham twitching at the Wallabies’ return this weekend

NFL’s No 1 draft pick Cam Ward victim of identity theft in $250,000 scheme

Two people armed with a number of false identities managed to fraudulently obtain a quarter of a million dollars’ worth of loans in the name of Cam Ward, the quarterback of the National Football League’s Tennessee Titans, according to authorities.Albert Weber, 42, and Cyntrelle Lash, 39, are facing charges of identity theft, bank fraud and forgery after their arrests in a case whose victims allegedly include the first overall pick in the 2025 NFL draft, his father and the business that loaned out the money in question, said Capt Jason Rivarde of the sheriff’s office in Jefferson parish, Louisiana, outside New Orleans.While attempts to contact Lash for comment were unsuccessful, Weber vehemently denied wrongdoing, suggesting the actions attributed to him were carried out by someone else who falsely assumed his identity.The case in any event highlights how increasingly common fraud involving professional athletes has become amid rises in their endorsement and salary income, as highlighted by a 2021 report from global accounting and consulting firm EY.As Rivarde put it, beginning in March, Weber and Lash worked together to secure multiple loans cumulatively worth at least $250,000 in the name of Ward, whose four-year rookie contract with the Titans is reportedly worth about $48

The Spin | Sophie Devine’s impact on women’s cricket should be measured in more than statistics

The New Zealand legend played with joy and fun, but was also a true fighter who spanned eras in the women’s gameAs the Women’s World Cup has progressed, sanding down the edges and turning up the four semi-finalists you might have predicted from the start, a sideshow has been quietly playing stage left. A down-to-earth sideshow – just like the woman herself – the Sophie Devine farewell.Devine made her New Zealand debut in October 2006, in an ODI and T20 series against Australia. Nineteen years later, still with the same open face and broad smile, she has played her final one-day international – a losing affair against England neither side will polish up for the mantelpiece. The most memorable moment came at the end with the affectionate guard of honour given to Devine by both sides and the Māori tribute led by Melie Kerr and sung by her teary teammates as the stadium emptied

Steve Coogan says Richard III film was ‘story I wanted to tell’ as he agrees to libel settlement

‘We were fitted with remote control penises’: Harry Enfield and Kathy Burke on Kevin and Perry Go Large

From White Teeth to Swing Time: Zadie Smith’s best books - ranked!

Ardal O’Hanlon: ‘I fell asleep on stage once – I could hear someone doing my material, got annoyed and woke up’

My cultural awakening: A Jim Carrey series made me embrace baldness – and shave my head on the spot

From Springsteen: Deliver Me from Nowhere to IT: Welcome to Derry – your complete entertainment guide to the week ahead