Two million energy customers are due £240m from old accounts, says Ofgem

Almost 2 million energy bill payers could be owed a share of £240m from old accounts that were closed while still in credit, according to the regulator.The latest figures from Ofgem show that about 1.9m energy accounts were closed over the past five years, with outstanding credit balances totalling £240m left unclaimed.The regulator is urging anyone who has moved in recent years to check whether they are owed a refund from their previous account.Some may be owed only a few pounds, but others could be owed more than £100, Ofgem said.

Tim Jarvis, Ofgem’s director general of markets, said that although suppliers “work very hard to return money to people” when they close an account, in line with industry rules, “without the right contact details, they’re stuck”.“The message is clear – if you’ve moved in the last five years, reach out to your old supplier, provide them with the correct information, and you could be due a refund,” Jarvis said.Energy bill payers face a difficult winter after the regulator lifted the maximum cap that suppliers can charge their 29 million household customers for each unit of gas and electricity from the start of this month.The average price cap for households paying by direct debit increased by £35 to £1,755 for a typical annual dual-fuel bill, despite a 2% fall in the wholesale price in the energy markets over the summer, reigniting concerns about energy affordability in the UK.Ofgem said on Thursday that it would move ahead with plans to clear £500m of debt from about 195,000 people on means-tested benefits who have built up debt of more than £100 during the energy crisis.

The first phase of its scheme could offer debt relief of about £1,200 per account, or about £2,400 per dual-fuel customer, to eligible bill payers.The cost of this policy would be paid for by adding about £5 a year on the average dual-fuel bill by 2027-28.Sign up to Business TodayGet set for the working day – we'll point you to all the business news and analysis you need every morningafter newsletter promotionThis measure is expected to make only a small dent in Britain’s deepening energy debt crisis, which reached a record £4.4bn in unpaid bills as of the end of June.The Office for National Statistics found that a record proportion of British households were unable to pay their energy bills by direct debit in April because there was not enough money in their bank accounts.

Ministers’ claims to have helped JLR in doubt as £1.5bn support left untouched

Jaguar Land Rover has not drawn down any of a £1.5bn loan facility guaranteed by the government, with suppliers expressing anger over ministers’ claims to have supported the carmaker’s supply chain after a crippling hack.Britain’s biggest automotive employer was forced to shut down all of its wholly owned factories from 1 September for more than a month, after cyber-attackers compromised key computer systems.Liam Byrne, the Labour MP who heads of parliament’s business select committee, on Friday wrote to the business secretary, Peter Kyle, asking for clarification as to whether any money had reached JLR, and if the aid was requested by the carmaker.Suppliers to JLR have privately expressed anger about the government’s messaging, which appeared to take credit for helping them

Amazon shares surge as AI boom fuels cloud growth; Nvidia boss says selling chips in China is Trump’s call – as it happened

Time to recap.Amazon is leading the charge in the US stock market today, with its shares surging by about 11% after its third quarter earnings beat expectations last night.The tech giant reported a 20% surge in sales at its cloud computing division, Amazon Web Services, to $33bn thanks to demand for computing power for artificial intelligence.In the UK, the tinned tuna maker Princes Group has kicked off a float with a valuation of nearly £1.2bn in a boost for the London stock market

OpenAI thought to be preparing for $1tn stock market float

OpenAI is reportedly gearing up for a stock market listing valuing the company at $1tn (£760bn) as soon as next year, in what would be one of the biggest ever initial public offerings.The developer behind the hit AI chatbot ChatGPT is considering whether to file for an IPO as soon as the second half of 2026, according to Reuters, which cited people familiar with the matter. The company is thought to be looking to raise at least $60bn.A stock market float would give OpenAI another route to raising cash, supporting ambitions by the chief executive, Sam Altman, to splash trillions of dollars on building datacentres and other forms of infrastructure needed for the rapid buildout of its chatbots.During a staff livestream on Tuesday, Altman was reported to have said: “I think it’s fair to say it [an IPO] is the most likely path for us, given the capital needs that we’ll have

Google Pixel 10 Pro Fold review: dust-resistant and more durable foldable phone

Google’s third-generation folding phone promises to be more durable than all others as the first with full water and dust resistance while also packing lots of advanced AI and an adaptable set of cameras.The Guardian’s journalism is independent. We will earn a commission if you buy something through an affiliate link. Learn more.The Pixel 10 Pro Fold builds on last year’s excellent 9 Pro Fold by doing away with gears in the hinge along its spine allowing it to deal with dust, which has been the achilles heel of all foldable phones until now, gumming up the works in a way that just isn’t a problem for regular slab phones

Wallabies firing again in time for England clash after return to free-running DNA

If only Henry Slade had managed to stop Ben Donaldson getting that offload away, if only Ollie Sleightholme had been able to make that wrap-up tackle on Len Ikitau, if only Marcus Smith was able to catch Max Jorgensen. But Slade didn’t, Sleightholme couldn’t, Smith wasn’t, and Jorgensen scored in the corner. This time last year the Wallabies beat England 42-37, their first victory against them at Twickenham in nine years, and it was, the players will tell you themselves, the moment when everything changed. “This game last year was a big turning point for us as a group,” says the Australia captain, Harry Wilson. “It really made us believe that on our day we can beat anybody in the world

Women’s tennis thriving on the court as season wraps but WTA must catch up

The final weeks of the women’s tennis season showcased one last twist in the furious race to determine the qualifiers for the WTA Finals. Elena Rybakina, the 2022 Wimbledon champion, finally caught fire after a year of near misses, bulldozing through her opponents to win a title in Ningbo, China that solidified her spot in Riyadh among the eight best players in the world.Just as significant as Rybakina’s qualification, though, was its consequences for the player she usurped. Mirra Andreeva, the 18-year-old prodigy who won WTA 1000 titles in Dubai and Indian Wells this year, had seemed like a sure bet to qualify in singles for the finals. Her failure to do so underscores the fact that this year has been the toughest and most competitive women’s tennis season in years

Teenage boys using ‘personalised’ AI for therapy and romance, survey finds

Microsoft reports strong earnings as Azure hit by major outage

Meta reports mixed financial results amid spree of AI hiring and spending

Google parent Alphabet beats forecasts with first $100bn quarter

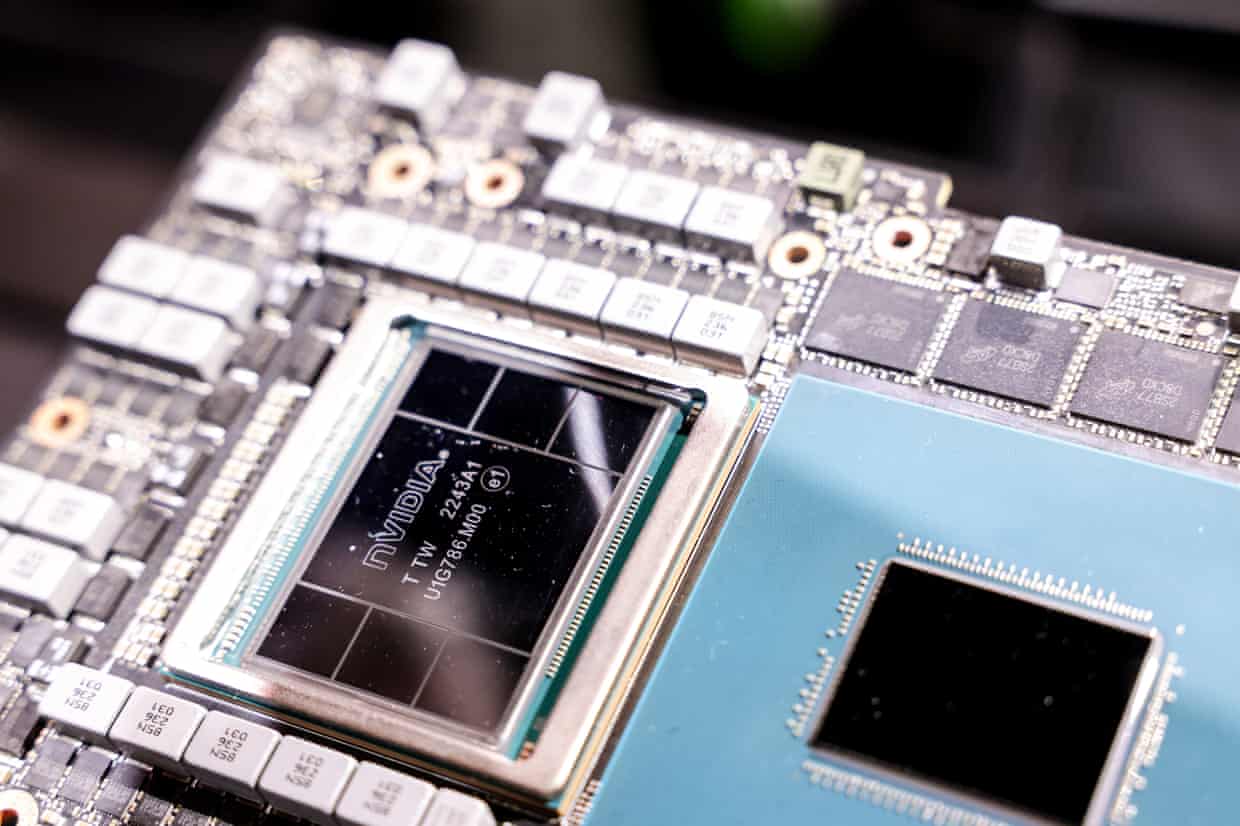

Nvidia becomes world’s first $5tn company amid stock market and AI boom

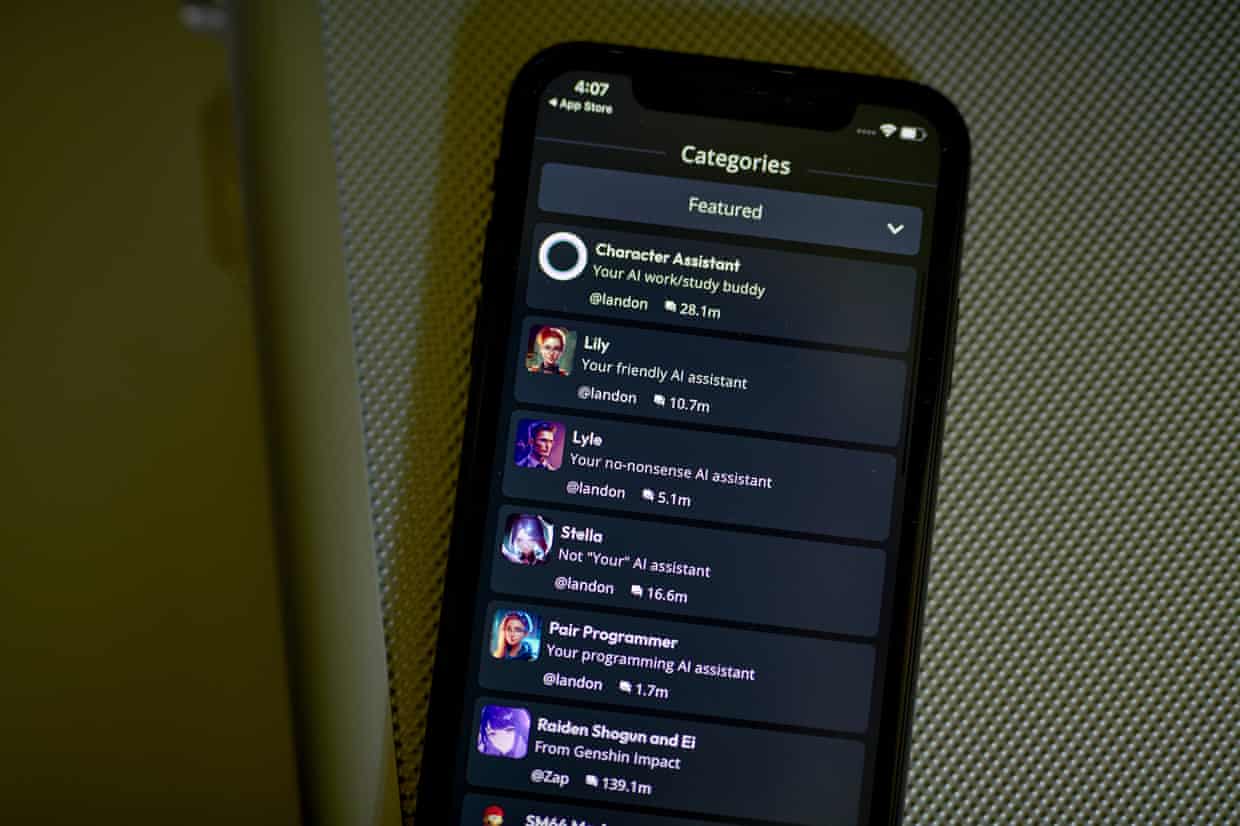

Character.AI bans users under 18 after being sued over child’s suicide