Fossil-fuel billionaires bought up millions of shares after meeting with top Trump officials

Two fossil-fuel billionaires with close ties to Donald Trump bought millions of shares in the company they co-founded just days after a meeting with senior White House officials, who then issued a key regulatory permit that helped expand the company’s fortunes in Europe,Robert Pender, an energy lawyer, and Michael Sabel, a former investment banker, are the founders and co-chairs of Venture Global, a Virginia-based company that develops and operates liquefied natural gas (LNG) export terminals,Sabel was among around 20 people who attended an event in April 2024 at Trump’s private club, Mar-a-Lago, when he reportedly requested $1bn in campaign donations from the fossil fuel industry in return for favorable legislation,Venture Global was among the “top donors” to Trump’s inauguration, donating $1m, according to the Wall Street Journal,On his first day back in the White House, Trump issued an executive order rolling back regulations to favor fossil fuel production, including LNG export licences, while revoking existing climate and clean energy policies.

Three days after Trump’s inauguration, Venture Global issued an IPO – an initial public offering of shares, becoming a publicly traded company.The share prospectus highlighted the Unleashing America Energy executive order, and the following day, Sabel and Pender rang the opening bell at the New York stock exchange.Despite the IPO being billed by Reuters as a “blockbuster” event, the shares opened nearly 4% below the original asking price at just over $24 each, valuing the company at $58.2bn.While substantially below the $110bn Venture Global had hoped for, Sabel and Pender – who between them still owned more than 80% of the firm – pocketed a paper fortune of $24bn each, according to Bloomberg.

Senior executives’ share purchases since the IPO have been reported to the US Securities and Exchange Commission and posted on its website,Since the company went public, there has been no significant additional share-buying by Sabel and Pender, aside from during one noteworthy week in March,On 6 March, Venture Global announced a $18bn expansion to its vast LNG export terminal in Plaquemines Parish in Louisiana, situated on the Mississippi River just south of the New Orleans terminal,Among the high-profile guests to the event in Plaquemines Parish were Chris Wright, Trump’s energy secretary, who has regulatory oversight of Venture Global’s operations, and Doug Burgum, secretary of the interior, who leads Trump’s National Energy Dominance Council,The Republican Louisiana governor, Jeff Landry was also there.

“I’m proud to be among you.I cannot overstate how important what you’re doing is and how aligned it is with the agenda of President Donald Trump,” said Wright.Burgum said Sabel and Pender were “amazing”, adding that there was “nothing more patriotic than an American worker that’s working to build energy dominance for this country”.On 10 March, Sabel and Pender went on a share-buying spree.The Venture Global share price that week was a relatively low $9.

37, falling after a disappointing fourth-quarter results.Every day for a week, the pair bought thousands or hundreds of thousands of shares.By the end of the week on 14 March, they had amassed just under 1.2m shares each, worth little under than $12m each.The only other share acquisition since the IPO was 1,226 shares bought by Pender on 26 June.

The following week on 19 March, Wright granted an export license to another Venture Global LNG project, the Cameron Parish 2 (CP2) terminal, which Joe Biden had paused amid widespread protests from climate scientists, environmental groups and local fishers.CP2 has the capacity to produce 28m tonnes of LNG a year, with the company now on track to be the largest supplier of gas to Germany.“Thanks to President Trump’s leadership, we are cutting the red tape around projects like CP2, unleashing our energy potential and ensuring the US can continue to meet growing energy demand for decades to come,” said Wright.“We are grateful for the Trump administration’s return to regular order and regulatory certainty that will allow us to further expand US LNG exports,” said Sabel on behalf of Venture Global.Individuals connected to Venture Global spent $860,000 on lobbying on Capitol Hill in 2024, and another $810,000 so far this year, according to Open Secrets, a nonprofit campaign financial watchdog.

The previous high was $70,000 in 2019.“Both the timing and amount invested raise serious red flags.It does require a subpoena and an investigation,” said Craig Holman, from Public Citizen, an expert on ethics, lobbying, and campaign finance rules.All parties deny any wrongdoing.“Venture Global has regularly engaged with government officials on a bipartisan basis across four different presidential administrations.

We strictly adhere to all laws, rules and regulations relating to our interactions with government officials, and support policymakers who recognize both the economic and environmental benefits of the US LNG industry,” a company spokesperson said in a statement.“Mr Sabel’s and Mr Pender’s acquisitions of shares fully complied with SEC rules and regulations and Venture Global’s Policy Concerning Trading in Company Securities.The timing of these acquisitions had no connection to any meeting or regulatory action.Any suggestion otherwise is false,” the spokesperson added.White House spokesperson Karoline Leavitt: “The media’s continued attempts to fabricate conflicts of interest are irresponsible and reinforce the public’s distrust in what they read.

The president has never engaged, and will never engage, in conflicts of interest.”The Guardian’s requests for comment to Chris Wright at the department of energy, Doug Burgum at the interior department and the transition committee went unanswered.After Wright gave the green light to the export license, the company’s share price rose slightly over the next two days, before falling again.The company is currently valued at $19.6bn, with the share price at $7.

90 on the New York stock exchange in mid-November – a 67% decrease since the IPO.Sabel and Pender continue to hold on to their collective 2.37m shares, currently worth almost $19m.The fall in stock prices comes despite recent long-term deals with Greece and Germany, and the company’s close ties to the Trump administration.The global energy watchdog, the IEA, recently warned of oversupply, saying in its World Energy Outlook that “questions still linger about where all the new LNG will go”.

Mike Wirth, the Chevron boss, said there was “more supply coming into the market than demand will be able to absorb.That probably results in lower spot prices.”Analysts have also warned that Venture Global’s business model is particularly exposed to market fluctuations because it signs fewer long-term contracts than some rivals.The company recently lost a billion-dollar arbitration case against BP.

Budget uncertainty triggers plunge in UK construction activity; Trustpilot shares slump after short-seller claims – as it happened

Newsflash: Britain’s construction sector has suffered its sharpest downturn since the first Covid-19 lockdown forced building sites to shut five and a half years ago.Activity across housebuilding, commercial building work and civil engineering all tumbled last month, a new survey of puchasing managers at building firms has found.Construction firms are blaming fragile market confidence, delays with the release of new projects and a lack of incoming new work.The report, by data firm S&P Global, shows there was “a sharp and accelerated reduction in output levels across the construction sector”. Many builders reporting that market conditions were challenging, with new orders slumping at the fastest rate in five and a half years, and job cuts rising

Rachel Reeves will not be investigated over pre-budget briefing, FCA says

The UK’s financial regulator has decided not to immediately investigate Rachel Reeves and the Treasury over pre-budget briefings but left the door open for further examination of what the Conservatives claimed amounted to market manipulation.In a letter addressed to the chair of the Treasury committee, Meg Hillier, the the chief executive of the Financial Conduct Authority (FCA) said the regulator had turned down requests by politicians including the shadow chancellor, Mel Stride, to open an inquiry into briefings made before last week’s announcement by the chancellor.Nikhil Rathi said the FCA had “not commenced an enforcement investigation” into potential market abuse, but added that the regulator would consider the findings of a Treasury inquiry into pre-budget leaks.On Wednesday, the Treasury minister James Murray said the department’s permanent secretary, James Bowler, would review “security processes” to inform future events. He said the inquiry had the “full support” of Reeves and the “whole Treasury team”

Irish authorities asked to investigate Microsoft over alleged unlawful data processing by IDF

Irish authorities have been formally asked to investigate Microsoft over alleged unlawful data processing by the Israeli Defense Forces.The complaint has been made by the human rights group the Irish Council for Civil Liberties (ICCL) to the Data Protection Commission, which has legal responsibility in Europe for overseeing all data processing in the European Union.It follows revelations in August by the Guardian with the Israeli-Palestinian publication +972 Magazine and the Hebrew outlet Local Call that a giant trove of Palestinians’ phone calls was being stored on Microsoft’s cloud service, Azure, as part of a mass surveillance operation by the Israeli military.The ICCL alleges that the processing of the personal data “facilitated war crimes, crimes against humanity, and genocide by Israeli military”. Microsoft’s European headquarters are located in Ireland

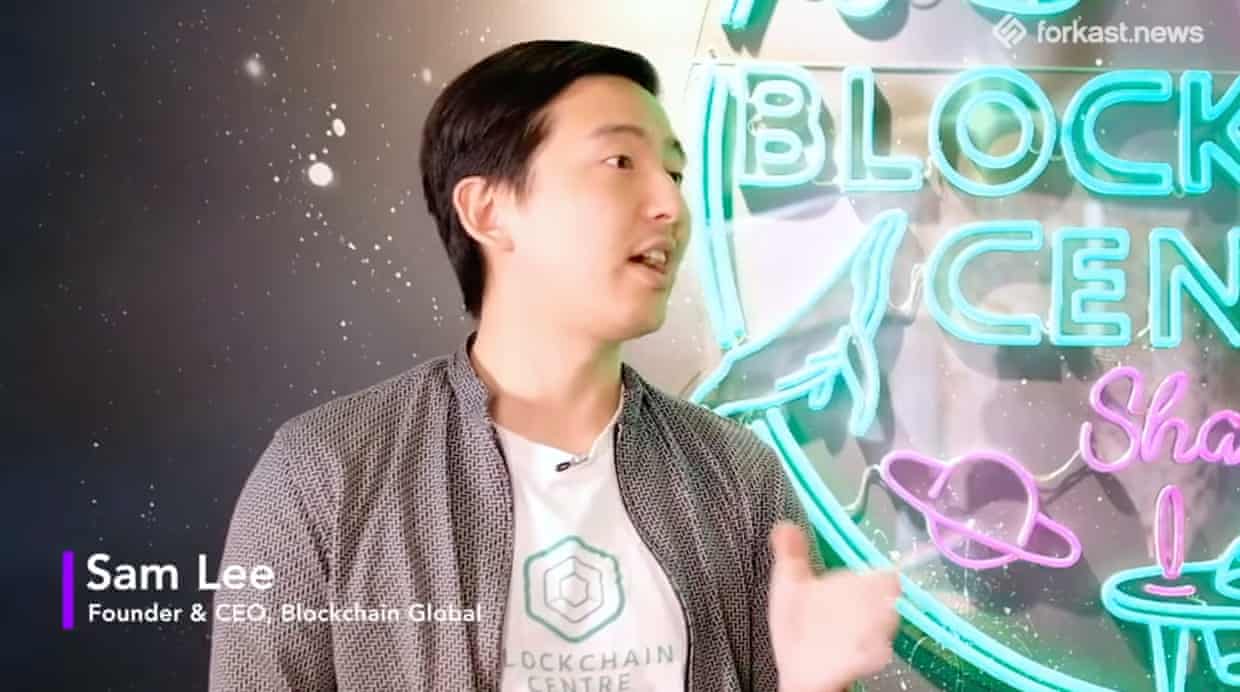

HyperVerse promoter ‘Bitcoin Rodney’ accuses Australian Sam Lee in US court of duping him with ‘elaborate deception’

A key promoter of an alleged global $3bn Ponzi scheme claims in newly filed US court documents he was trapped by an “elaborate” fraud orchestrated by Australian Sam Lee, and should be released from custody.Rodney Burton – known as Bitcoin Rodney – was charged in the US in early 2024 for his alleged part in the HyperVerse scheme, which swept the globe from 2020 and allegedly defrauded investors of US$1.89bn (A$2.9bn at current rates).Burton’s lavish lifestyle was regularly flaunted in his promotional videos, including his fleet of luxury cars and branded Lamborghini, diamond-encrusted watches and meals of steak and sausages enrobed with real gold

Report takes aim at Fifa and IOC over policies for athletes convicted of sexual assault

With the draw for the 2026 Fifa World Cup set to take place on Friday, a report examining the participation of athletes convicted of sexual offences at major sporting events has highlighted significant distrust of international sports governing bodies in how they deal with these situations.The report, titled No One Wants to Talk About It, is the result of interviews with elite athletes directly affected by sexual abuse and is intended to gauge attitudes around the eligibility and accreditation criteria for athletes with prior criminal sexual convictions and their participation at mega sporting events.The athletes highlighted “institutional inaction, silence, or complicity” in a lack of regulation by Fifa and the International Olympic Committee (IOC), among other organizations.The report is a collaboration between the Sports and Rights Alliance and Thomas More University in Belgium. The Sports and Rights Alliance is a coalition that includes Amnesty International, Football Supporters Europe, Human Rights Watch, and World Players Union as well as other trade unions and human rights groups

No ‘fire drill’ at TNT after painful loss of Champions League and England rugby | Matt Hughes

It has been a tough couple of weeks for TNT Sports, with the loss of three days of Ashes cricket due to England’s two-day defeat in Perth following on from some bruising rights negotiations.On the eve of the first Test, the Guardian revealed TNT had lost UK rights to the Champions League to Paramount+, with Sky Sports picking up the decent consolation prize of Europa League rights, while this week it emerged that TNT has also lost the rights to international rugby union with ITV having paid £80m for the inaugural Nations Championship.Senior figures at TNT are open about being “absolutely gutted” at losing the Champions League, which has been their biggest property since predecessor BT Sport first bought the rights in 2013, but do not regret the level of their bid, which was gazumped by Paramount. The value of the UK rights has increased from £1.2bn to £2

What has gone wrong at Zipcar – and is UK car-sharing market dead?

UK’s small brewers call for chancellor to think again on business rates

The AI boom is heralding a new gold rush in the American west

Hundreds of Australians complain of wrongful social media account closures but ombudsman can’t help

Lando Norris rules out asking McLaren for team orders to help F1 title bid

Nathan Lyon in ‘filthy’ mood after Test omission as Crawley hails ‘phenomenal’ Root