Verdict on the start of F1’s new era: five talking points from the Australian GP

The pre-season favourites had done their level best to play down their expected advantage in the buildup to the Australian Grand Prix, but it was impossible to hide. A dominant one-two by the best part of a second for George Russell and Kimi Antonelli in qualifying was followed by a similarly assured one-two finish in the race.Russell had to fight in the opening phases against Ferrari’s Charles Leclerc, but once he had been extricated from that battle and could return to what engineers consider the “optimal” lap according to the new diktats of power deployment and recharging he had as much as 0.3sec to 0.4 on Ferrari

Zac Lomax exits limbo via defection as latest NRL star lured by Wallabies jersey | Angus Fontaine

After a tough two decades, Australian rugby’s luck is suddenly on the up. The defection of NRL flyer Zac Lomax gives the Wallabies a powerful new weapon in the moonshot quest to win a home World Cup in 2027. The 26-year-old NSW State of Origin and Kangaroos star on Monday signed a two-year deal with Rugby Australia (RA) to join the Perth-based Western Force and could debut in Super Rugby Pacific later in March.“Zac is a superb athlete with a proven record at representative level in rugby league and we believe he has the talent and drive to make a successful transition to rugby,” RA chief executive Phil Waugh said on Monday, as he welcomed the 133-game international winger back to rugby union. “He brings a unique set of experiences and skills to our environment and is motivated by the challenge of competing on the global stage

Russia flag raised and national anthem played after first gold at Winter Paralympics

The Russian national anthem has been played at the Paralympics for the first time since 2014 as the skier Varvara Voronchikhina claimed gold in the women’s super-G standing.A tearful Voronchikhina received her medal on Monday afternoon, and the Russian flag was raised, after a dominant performance on the slopes of the Tofane Alpine Skiing Centre. A watching crowd of international fans responded only with polite applause, but Voronchikhina’s success has already been celebrated by Russia’s sports minister.Voronchikhina finished 1.96sec clear of the French racer Aurélie Richard in the giant slalom event

Sky Brown wins second skateboarding world title at rain-hit event in Brazil

Briton, 17, wins her second park crown in São PauloEvent was cut at halfway due to recurrent rainfallBritain’s Sky Brown celebrated International Women’s Day by becoming a skateboarding world champion for the second time at a rain-curtailed park competition in São Paulo.The two-time Olympic bronze medallist was leading in Brazil after two runs, the halfway point, at which World Skate deemed “adverse weather conditions and recurrent rainfall” to have called time on proceedings.World Skate had given a 7pm (11pm GMT) deadline for Sunday’s competition to recommence, stating that “if any weather-related interruption occurs, the activity will not resume”.Only one competitor, Cocona Hiraki of Japan, managed to start a third run, before more falling rain forced officials to end the competition.Brown’s score of 88

England handed tough Six Nations 2027 opener with Friday night trip to Dublin

England will begin their Six Nations campaign on a Friday for the first time in 12 years in 2027 after they were handed an opening night trip to Dublin to face Ireland by tournament organisers.Ireland will also host the final match of next year’s Super Saturday with organisers pitching Andy Farrell’s side against France in the 8.10pm kick-off. Ireland and France have won the last four editions of the Six Nations between them and both are in the hunt, along with Scotland, for the title this year with one round remaining.In 2015, England overcame Wales in Cardiff in a fraught Friday-night encounter that is memorable for a tunnel stand-off before kick-off when the captain Chris Robshaw refused to lead his team out on to the field until Wales were ready to avoid being left standing around

‘He had to shoulder tragedy alone’: how Larry Bird’s rise almost ended before it began

How otherworldly was Larry Bird during his memorable season for Indiana State in 1978-79? At one point he made an assist while sprawled on the floor: from his end of the court, he made a one-armed throw to a teammate, who streaked coast-to-coast for a quick bucket.That season ended with an epic showdown in the NCAA championship game against Magic Johnson and Michigan State. Magic got the better of Bird in that game, but the contest had wider repercussions. Not only did it spark interest in the NCAA Tournament, but Bird and Magic would help revitalize the NBA, after Bird joined the Boston Celtics and Magic the Los Angeles Lakers. But none of this was preordained, especially Bird’s trajectory

We may not be running out of gas but we still need a serious strategic gas reserve | Nils Pratley

Golf club firm owned by Trump’s sons merges with drone manufacturer

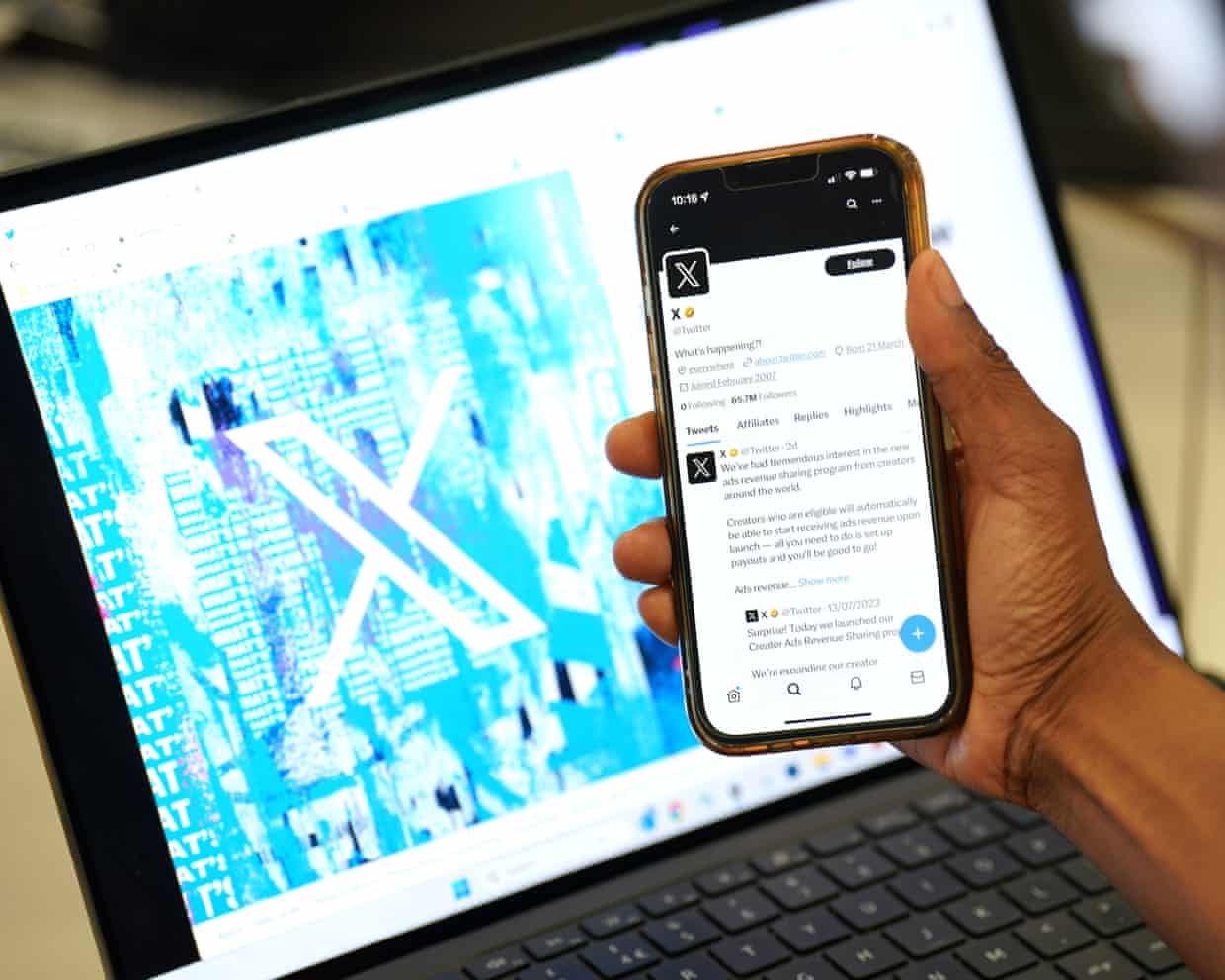

X suspends 800m accounts in one year amid ‘massive’ scale of manipulation attempts

AI firm Anthropic sues US defense department over blacklisting

‘We all believe in the plan,’ says England’s Ben Spencer

Dolphins take $99m hit on Tagovailoa and sign Willis; Tampa’s star WR Evans heads to 49ers