NEWS NOT FOUND

UK must reform drug pricing to become life sciences superpower, says GSK boss

GSK’s outgoing chief executive, Emma Walmsley, has said Britain will struggle to be a “life sciences superpower” unless it overhauls drug pricing.As ministers draw up proposals to increase the amount the NHS spends on new medicines by up to 25%, Walmsley said she was “hopeful and ambitious” that the standoff with the pharma industry could be resolved.According to the Academy of Medical Sciences, the government’s drug pricing announcement could come by the end of this week.Walmsley, who will hand over the top job to Luke Miels, currently GSK’s chief commercial officer, at the end of the year, said: “What everyone is putting their energy into, hopefully resolving, is how we make sure this country creates the right commercial environment.“Without that, it’s going to be very difficult to be able to be a leading life sciences superpower, which is what we want … and we are not going to secure something else we all want, which is patient access to innovation

Toyota denies promising to invest $10bn in US after Trump announcement

The Japanese auto giant Toyota Motor has denied Donald Trump’s suggestion that it is poised to invest more than $10bn in the United States over the coming years.On a visit to Japan earlier this week, the US president claimed he had been told that the carmaker was going to be setting up factories “all over” the US “to the tune of over $10bn”.“Go out and buy a Toyota,” added Trump.But a senior executive at Toyota – the world’s largest automaker – said that no such explicit promise of investment at that level had been made, although Toyota plans to invest and create new jobs in the US.The firm held talks with Japanese and American officials ahead of Trump’s visit

So it’s goodbye to lower interest rates – to be honest, the RBA was always looking for an excuse not to cut | Greg Jericho

Is there a release of economic data that can more quickly dash people’s hopes than inflation? Prior to Wednesday’s release of the September quarter CPI figures, there was a pretty good chance that on Melbourne Cup day the Reserve Bank of Australia would cut interest rates.Now that hope is gone.The quarterly inflation growth of 1.2% was roughly double what economists and investors were expecting:If the graph does not display click hereSo it’s goodbye to lowering interest rates – but to be honest the Reserve Bank was always looking for an excuse not to cut them.On Monday night, the governor of the Reserve Bank, Michele Bullock, was sanguine about the rise in unemployment

Profit upgrade at Next raises hopes UK shoppers still keen to spend

Next has raised hopes that UK consumers are still willing to spend despite pressures on household budgets, as it revealed sales and profit growth “materially above” expectations.The clothing and homeware retailer said it benefited from a sunny summer, the online shutdown of its rival Marks & Spencer for several weeks after an Easter cyber-attack, and an improvement in clothing supplies from countries such as Bangladesh compared with last year.Next, which now owns the UK rights to the US brands Gap and Victoria’s Secret as well as stakes in a plethora of labels including Reiss and Joules, raised its annual profit guidance by £30m – its fourth upgrade in eight months.Shares rose more than 7% on the news, making Next the top riser on the FTSE 100 on Wednesday morning.Analysts said the retailer, which now expects full-year profits of £1

Santander urges ministers to intervene in UK car finance compensation scheme

Santander UK has urged the government to intervene in the £11bn car finance compensation scheme, claiming that the current proposals could end up inflicting “significant” harm to consumers, jobs and the broader economy.The comments mark some of the strongest criticism to date of the Financial Conduct Authority’s (FCA) redress scheme, which is meant to draw a line under 14m historic car loan contracts that may be deemed unfair because of commission arrangements between lenders and car dealers.The Spanish-owned UK lender has come out swinging, calling on the government to take action and push for “material changes” to the City regulator’s proposals, which are out for consultation following a landmark supreme court hearing in August.The chief executive of Santander UK, Mike Regnier, said: “We believe that the level of concern in the industry and market is such that material changes to the proposed FCA redress scheme should be an active consideration for the UK government.“Without such change, the unintended consequences for the car finance market, the supply of credit and the resulting negative impact on the automotive industry and its supply chain could significantly impact jobs, growth and the broader UK economy

Aston Martin cuts investment plan by £300m as Trump tariffs bite

Aston Martin has slashed £300m from its investment plans after the British carmaker reported a bigger than expected loss in the third quarter because of Donald Trump’s tariffs and weak demand in China.The company said on Wednesday that losses before tax were £112m in the third quarter of 2025, a ninefold increase from £12m a year earlier.The brand, whose products are best known for featuring in the James Bond film franchise, has been buffeted by global pressures during a five-year turnaround effort that has been marked by perennial heavy losses.Aston Martin had already warned earlier this month that this year’s profits would be lower than previously expected because of a decline in sales. It sold 1,430 cars to retailers during the third quarter of 2025, down 13% compared with the period last year

Tightening Pip benefit eligibility could save £9bn a year, says Reform

Boris Johnson approved China’s London super-embassy proposal in 2018

Your Party to launch legal action against three of its ‘rogue’ founders, sources say

Should the Home Office be broken up into two units?

Reform wheels out Danny Kruger, the ‘brains’ of Nigel Farage’s operation | John Crace

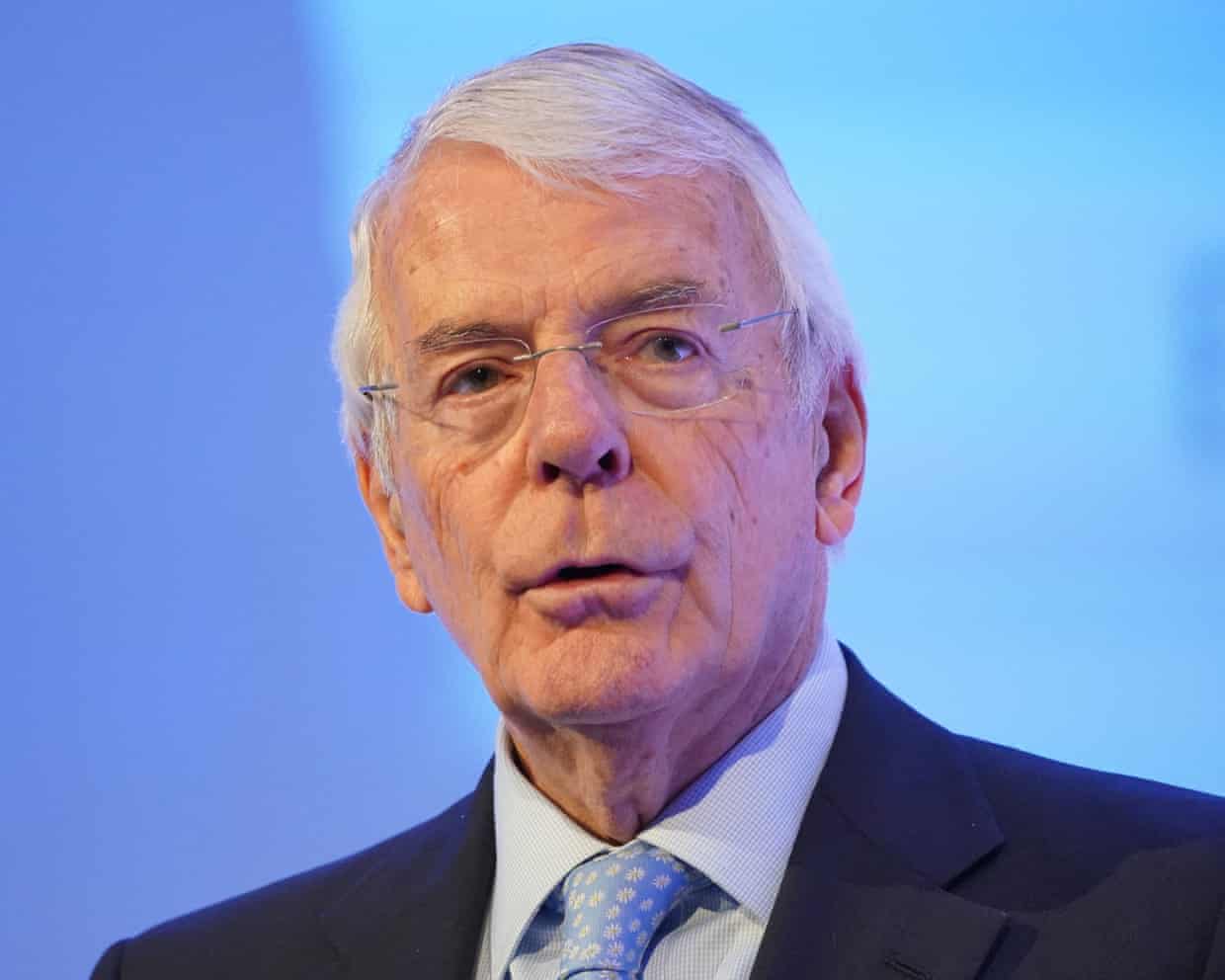

John Major tells Tories alliance with Reform would be ‘beyond stupid’