How could Reeves hit gambling firms – and are they fearmongering over impact?

Gambling companies don’t lose very often but nor are they usually playing a game of poker against the chancellor of the exchequer,At next week’s budget, Rachel Reeves is widely expected to announce an increase in the duties that bookies and casinos pay to the Treasury, ending months of speculation and frenzied lobbying designed to sway the government,The tax rise could cost the industry anything between about £1bn and £3bn, depending on how far Reeves turns the screw,To some, that would be fair recompense for an out-of-control industry grown fat on misery,To others, it would be an anti-growth tax that will backfire, costing thousands of jobs and fuelling the illicit market.

The devil is in the detail.It’s complicated but, in essence, it works like this.When customers win, they aren’t taxed at all.For companies, there are three main rates of duty:Remote gaming duty (RGD), applied to online games of chance, is levied at 21% of profits applied to what they win from punters.Machine games duty (MGD) applies to physical slot machines, mostly at 20%.

General betting duty (GBD) is taxed on bookmakers’ winnings from sports such as football and horse racing, mostly at 15% in betting shops and online,Together, these duties raised about £2,5bn last year, paid out of total industry revenues of about £11,5bn,The Treasury has consulted on harmonising the varying tax rates but almost nobody wants this to happen or thinks it will.

Two influential thinktanks, the IPPR and SMF, recommend increasing all of the rates significantly, to raise £3.2bn and £2bn respectively.Both say that RGD, the largest of the duties because it is charged on the fast-growing online sector, should be more than doubled to 50%.The former prime minister Gordon Brown has swung his political heft behind the higher figure, which he and the IPPR say could pay for an end to the two-child cap on state benefits.They claim increases on this scale would cause huge job losses, drive punters to unregulated illicit operators that put customers at greater risk and would ultimately be counter-productive, resulting in lower tax receipts.

A report by the accounting firm EY, commissioned by the industry’s trade body, the Betting and Gaming Council (BGC), suggests the IPPR’s proposal could result in the loss of 40,000 jobs and cost the UK economy £3bn a year.The IPPR has described this analysis as “deeply flawed”.The boss of Betfred, the billionaire Tory donor Fred Done, has claimed would have to close all of his 1,287 bookmakers if taxes go up, at a loss of 7,500 jobs alone.That is the accusation levelled at gambling companies in a report by MPs on the Treasury select committee, after a testy evidence session with the chief executive of the BGC, Grainne Hurst.She sparked gawps of incredulity among MPs when she claimed that gambling did not cause any “social ills”.

The committee did not find this credible and applied the same scepticism to the industry’s doomsaying about tax rises.There appears to be a playbook.Stewart Kenny, the retired co-founder of Paddy Power who now campaigns for tougher gambling regulation, told the committee that he too used to raise the spectre of the illicit market when he was an industry advocate trying to lobby against higher taxes.It is also worth looking back at what the industry claimed when the government unveiled plans to cut the £100-a-spin stake on fixed odds betting terminals (FOBTs) in 2018.Back then, a KPMG report for the industry claimed more than 4,000 bookmakers would close.

In the end, about half that number did and much of that was down to the pandemic and the long-term shift to online gambling, encouraged by gambling companies themselves.The Betfred billionaire’s apocalyptic predictions should also be taken with a pinch of salt.Back in 2018, he said FOBT curbs would force 500 of his 1,644 shops to shut.Two years later the Done family paid themselves a £10m dividend and the chain still has 1,287 shops.It has been intense.

During a summer charm offensive by the BGC the industry hosted senior Labour staffers at a darts-themed evening, while BGC chair, Michael Dugher, boasted of his many meetings with senior MPs, including one of his oldest and closest friends in politics, who happens to be Rachel Reeves.A source close to the chancellor said she had no formal meeting with the BGC and would not ever have discussed the tax changes with him.The media played its part too.The Sun, for instance, ran a front-page campaign headlined “Save Our Bets” that urged Reeves to “shelve crackdown on fun”.The Sun Bingo website’s revenues from its shared betting partnership with the gambling software company Playtech increased 7% to €78.

9m (£69,4m) last year,SunBets is to be relaunched next year,Yes,First, the illicit market isn’t a total paper tiger.

It is growing and there is some reason to believe that raising taxes too steeply risks contributing to that.Alun Bowden, a leading industry analyst at Eilers & Krejcik Gaming, explains that one of the biggest pulls for customers is being offered “bonuses”, such as free bets given on opening an account.“It’s the main way of attracting and retaining players.It’s buy one get one free at Tesco, or the loyalty card at Pret,” he says.These “free” bets aren’t customers’ real cash, they are notional “house” money.

However, when punters lose these bets, the sums still count towards the duties levied on operators,“[If taxes rise] the sensible thing is to slash that bonus because you’re giving more of your own money to the government,The black market would not do that,If anything they’d increase it,”This, says Bowden, means that the threat of an exodus to the parallel market cannot be ignored.

“It’ll happen slowly and then all at once,” he says, addding that it is also true that there is a level of tax that would result in a much smaller online gambling industry, or even wipe out profitability,For RGD, Bowden says, this falls somewhere between 35% and 40%,There are undoubtedly many people who campaign for gambling reform who would be happy to see a smaller UK industry,Horse racing relies heavily on income from bookmakers, through media rights deals, fees for data, and the horse racing levy, worth about £100m a year (effectively an extra 10% tax on racing bet income),Both the SMF and IPPR have recommended a carve-out for horse racing that would mean lower duties and mitigation measures.

The SMF recommended increasing the levy to mitigate any negative consequences.Elements of the horse racing industry, many of whom have no affection for online casino games, have broken ranks with the bookies, saying they would be happy with higher duties on that part of the industry, as long as they are left alone.Thebookmakers argue you cannot separate the two like that.If their income is curbed, they will have less to contribute to racing through media rights deals, so racing will suffer.Chatter in the industry and in Westminster suggests the Treasury will probably end up opting for a middle ground, raising between £1bn and £2bn without triggering significant job cuts.

Most of the rise will probably apply to RGD, given the relative unpopularity of online casino and slot machines games with the general public,To raise an extra £1bn without increasing GBD), RGD and MGD would have to go up by more than 10 percentage points each,

After 10 years talking to knights, squires and wizards, I understand why ren fairs are booming

“I dunno what to tell ya, mate,” a young knight once told me through his helm’s lifted visor. “Gettin’ shield bashed just feels good.”For the knaves among thee, a “shield bash” is what it sounds like: to bash, or be bashed, with a shield. It’s simple and to the point, like a mace to the face or an arrow to the knee. Witnessing a shield bash, you understand the “haha yesss” that the basher must feel upon bashing, just as you empathetically presume a long “oh noooooo” on behalf of the bashee

Seth Meyers on Epstein files: ‘It’s obvious why Trump fought so hard to stop this bill from passing’

Late-night hosts reacted to the congressional vote sending the bill to release all files related to late pedophile Jeffrey Epstein to the desk of his former friend Donald Trump.It was a tough Tuesday for Trump, who lost his months-long battle to stop the release of the Epstein files on Tuesday after Congress passed a bill forcing the justice department publish them. “So now Trump is doing a 180,” said Seth Meyers on Wednesday’s Late Night.“He says he’ll sign the bill that forces him to release the files he could’ve released on his own but wouldn’t, thus requiring a bill to force him to do the thing he didn’t want to do that he’ll now be forced to do because of the bill he was against that he will now sign.”“It’s obvious why Trump fought so hard to stop this bill from passing,” Meyers later added

My cultural awakening: I moved across the world after watching a Billy Connolly documentary

I was 23 and thought I had found my path in life. I’d always wanted to work with animals, and I had just landed a job as a vet nurse in Melbourne. I was still learning the ropes, but I imagined I would stay there for years, building a life around the work. Then, five months in, the vet called me into his office and told me it wasn’t working out. “It’s not you,” he said, “I just really hate training people

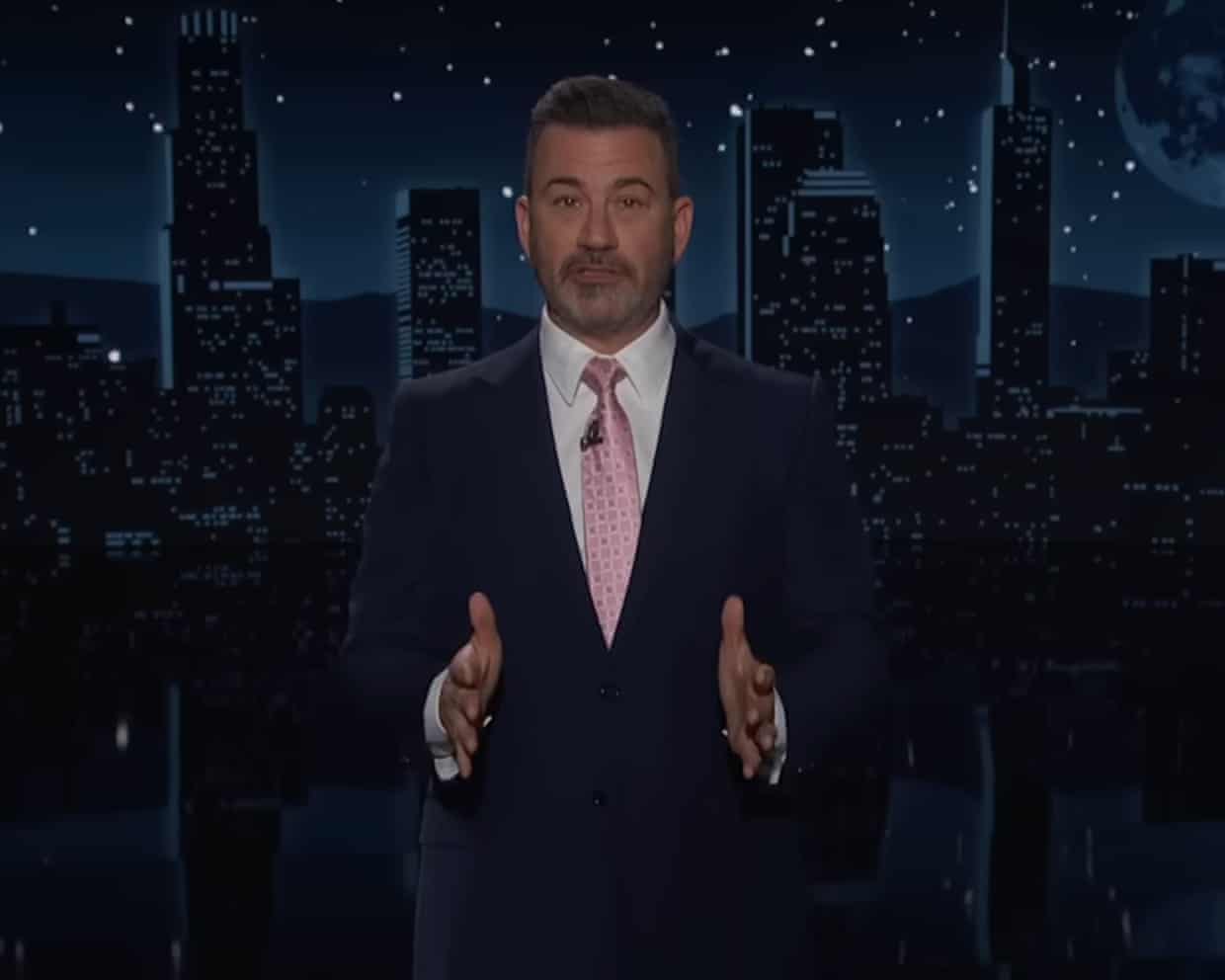

Jimmy Kimmel on Epstein files congressional vote: ‘Make no mistake – this isn’t over’

Late-night hosts celebrated the congressional votes to release the Epstein files and decried Donald Trump’s warm meeting with the Saudi crown prince, Mohammed bin Salman.Tuesday was “a very big day” in Washington DC, said Jimmy Kimmel on Tuesday evening, as both the House and Senate voted near unanimously to authorize the justice department to release investigative files related to the late pedophile Jeffrey Epstein.“Ultimately even [speaker] Mike Johnson voted yes on releasing the files,” Kimmel noted, meaning that the bill now heads to the White House, where it will probably66 be signed by Trump.“The goal was to have the bill pass by such a large margin that Trump can’t put his little orange thumb on the scale and give it the old Cheeto veto,” he explained. “But make no mistake: this isn’t over

British Museum ends ‘deeply troubling’ sponsorship from Japanese tobacco firm

The British Museum has ended a controversial sponsorship deal with a Japanese tobacco firm after reports that the government had raised questions about the deal, which some critics said was “deeply troubling”.The Guardian understands that the museum’s board chose to not renew the 15-year partnership with Japan Tobacco International (JTI), which ended in September.The pressure group Culture Unstained submitted a freedom of information request earlier this year, which it says revealed correspondence sent in January in which the government raised questions about the details of the deal.The Times reports that the Department of Health and Social Care told the Department for Culture, Media and Sport that the deal could be a breach of the World Health Organization’s framework convention on tobacco control (FCTC).The framework bars states from advertising and promoting smoking products

Why don’t Conservatives get credit for culture funding? | Letter

Helen Marriage, a hugely respected cultural leader, writes that “there is no political party that will commit to the kind of investment needed to keep a living art and culture ecology alive” (Durham’s Lumiere festival was a beacon of hope and togetherness – we cannot let the lights go out on the rest of the arts, 11 November). But she also places the responsibility on all of us. She wants the culture sector to make a better case. But can it?As commissioner for culture in the last government, I remain surprised that large funding decisions directed at culture have been forgotten, devalued and ignored, perhaps because the sources were then from a Conservative government.During Covid, culture was the only economic sector to receive its own rapid, specially designed, comprehensive rescue package

‘He’s the real thing’: Longley feels Chicago connection as Josh Giddey brings Bulls back to the big time | Jack Snape

Wales 26-52 New Zealand: Autumn Nations Series rugby union – as it happened

Tom Rogers makes hat-trick history in vain as New Zealand surge past Wales

Travball 1-0 Bazball: Head’s big numbers add up to a damning zero for England | Geoff Lemon

‘Shellshocked’ Stokes urges England to move on from mauling in first Ashes Test

Australia v England: Head blasts hosts to eight-wicket Ashes win in first Test inside two days – as it happened