Ministers urged to close £2bn tax loophole in car finance scandal

Ministers are being urged to close a loophole that will allow UK banks and specialist lenders to avoid paying £2bn in tax on their payouts to motor finance scandal victims.Under the current law, any operation that is not a bank can deduct compensation payments from their profits before calculating their corporation tax, reducing their bill.UK banks have been blocked from claiming this relief since 2015, but it has now emerged that those due to pay redress as part of the pending £11bn car loan compensation scheme can exploit it because their motor finance arms are considered “non-bank entities”.The Guardian has learned this includes the operations of big high street names including Barclays and Santander UK, and Lloyds Banking Group, which is the UK’s biggest provider of car loans through its Black Horse division.Specialist lenders in the scandal, which include the lending arms of car manufacturers such as Honda and Ford, also fall outside this taxation rule.

The loophole means taxpayers will lose out on £2bn in corporation tax over the next two years, the Office for Budget Responsibility (OBR) confirmed.The block on banks being able to remove compensation payouts – and any related expenses – before corporation tax bills were calculated was introduced in 2015 to ensure “past misconduct and management failure” did not impact state revenues.It meant that taxpayers did not lose out when banks paid out compensation for controversies such as the payment protection insurance (PPI) scandal.Bobby Dean, a Liberal Democrat MP on the Treasury committee, is now urging the government to intervene to ensure the rule applies to payouts for car loan mis-selling.“It’s not right that that the taxpayer is set to lose out on billions due to a loophole in compensation rules,” Dean said.

“The UK banned banks from deducting payouts from tax bills for good reason and it seems that those caught up in the motor finance scandal are going to dodge their responsibilities by operating through spin-off companies.“I hope the government will intervene and ensure that the spirit of the compensation payout rules are maintained.”OBR documents released alongside the autumn budget showed that corporation tax takings would be offset by a £2bn loss linked to the Financial Conduct Authority’s proposed motor finance compensation scheme over 2025-26 and 2026-27.The scheme, which is out for consultation, is meant to compensate borrowers who were overcharged as a result of unfair commission arrangements between lenders and car dealers.When asked for clarification, the OBR told the Guardian the forecasts were made on the basis that the compensation payouts by non-bank entities – in both banking and non-banking groups – were “expected to be deductible for corporation tax purposes”.

Dean said he is planning to write to ministers to raise the matter this week, days before the FCA’s consultation on the compensation scheme is due to close on Friday.Sign up to Business TodayGet set for the working day – we'll point you to all the business news and analysis you need every morningafter newsletter promotionIf maintained, however, it will provide another relief for banks which narrowly escaped a tax raid in the budget last month amid heavy sector lobbying.Darren Smith, managing director of claims law firm Courmacs Legal, which is representing 1.5 million car finance victims said: “Following a budget that will lead to millions of people’s tax bills going up, it’s hard to understand why the Labour government is not closing this loophole, allowing big banks to profit from a £2bn tax break for their own historic misconduct.”Lenders have continued to rail against their expected £11bn car finance compensation bill and have pushed for government support, with Rachel Reeves, the chancellor, already having tried to influence the direction of the car finance scandal this year, trying to intervene in a supreme court hearing in January.

The Guardian later revealed that Reeves was considering overruling the supreme court’s decision with retrospective legislation, in order to help save lenders billions of pounds in the event that it ruled in favour of consumers.The court largely sided with lenders in the end, and Reeves did not step in.The Financing and Leasing Association (FLA) lobby group, which represents car lenders, has been pushing for the FCA’s compensation scheme terms to be narrowed, claiming the scheme’s terms are “so broad that they will compensate customers who suffered no loss – effectively ignoring the requirement for proportionality on the part of the regulator”.Commenting on the loophole, the FLA’s director of motor finance, Adrian Dally, said: “Focus the scheme on loss, therefore it’ll cost less than proposed.That will have less of an impact on profits and lenders will pay more corporation tax as a result.

”The Treasury did not directly comment on the tax relief.A spokesperson said: “It is vital that consumers have access to motor finance to enable them to spread the cost of a vehicle in a way that is manageable and affordable.“We want to see this issue resolved in an efficient and orderly way that provides certainty for consumers and firms.”

BP to scrap paid rest breaks and most bank holiday bonuses for forecourt staff

BP is ditching paid rest breaks and most bank holiday bonuses for 5,400 workers in its petrol forecourts as it attempts to offset a planned rise in the independent living wage.The company has told workers in its 310 company-run forecourts that it will be changing their benefits in February. Workers at a further 850 BP-branded forecourts run by partners are on different pay deals.BP is an accredited member of the Living Wage Foundation’s fair pay scheme, under which employers commit to pay staff an annually set wage to meet living costs.Hourly pay for BP’s affected workers will rise to a minimum of £13

Financial markets now certain the RBA will hike interest rates in 2026

Financial markets are now pricing in a 100% chance the Reserve Bank will hike rates in 2026, in what would be a blow to mortgage holders but may take some steam out of an overheating property market.The latest forecasts represent a turnaround from just two weeks ago, when traders were factoring in an even chance that the next RBA move would be a cut by its May meeting.It comes as data showed inflation is now moving in the wrong direction, alongside this week’s national accounts and household spending figures which showed the economy is accelerating into the new year.Adam Donaldson, the head of interest rates strategy at the Commonwealth Bank, said “the market has come to the conclusion that the Reserve bank won’t be cutting rates any further”.“Basically, from February onwards, the market is starting to price some risk that rates will go up

New York Times sues AI startup for ‘illegal’ copying of millions of articles

The New York Times sued an embattled artificial intelligence startup on Friday, accusing the firm of illegally copying millions of articles. The newspaper alleged Perplexity AI had distributed and displayed journalists’ work without permission en masse.The Times said that Perplexity AI was also violating its trademarks under the Lanham Act, claiming the startup’s generative AI products create fabricated content, or “hallucinations”, and falsely attribute them to the newspaper by displaying them alongside its registered trademarks.The newspaper said that Perplexity’s business model relies on scraping and copying content, including paywalled material, to power its generative AI products. Other publishers have made similar allegations

I spent hours listening to Sabrina Carpenter this year. So why do I have a Spotify ‘listening age’ of 86?

Many users of the app were shocked, this week, by this addition to the Spotify Wrapped roundup – especially twentysomethings who were judged to be 100“Age is just a number. So don’t take this personally.” Those words were the first inkling I had that I was about to receive some very bad news.I woke up on Wednesday with a mild hangover after celebrating my 44th birthday. Unfortunately for me, this was the day Spotify released “Spotify Wrapped”, its analysis of (in my case) the 4,863 minutes I had spent listening to music on its platform over the past year

BBC showing tennis’s new Battle of the Sexes will just offer up opportunity to belittle women’s sport | Barney Ronay

It’s always best to take a sceptical view of the constant flow of BBC-bashing newspaper stories, which are often simply bogus outrage expressed for commercial gain. Even the war-on-woke, cod-ideological stuff – Clive Myrie INSISTS hamsters can breastfeed human robots – the bits that make you want to smear your face with greengage jam and weep for England, our England, with its meadows, its shadows, its curates made entirely from beef. Even these come from a hard, transactional place.Basically, it’s the licence fee. The BBC is free at the point of delivery, but paid for by a national levy

Five years on: rugby’s brain damaged players wait and wait for the help they need

In 2020 Steve Thompson revealed he could not remember winning the Rugby World Cup and since then his case and others have been caught up in a warren of legal argumentThe Royal Courts of Justice are a warren. They were built piecemeal over 125 years of intermittent construction, wings were added, blocks were expanded and then joined by a web of twisting staircases and long corridors. You navigate your way to whichever corner of it you have business in by checking the tiny print on the long daily case lists that are posted in the lobby early each morning, when the building always seems to be full of people hurrying in the other direction. For the last three years, three separate sets of legal action about brain damage in sport have been slowly making their way through here, lost in the hallways.One is in football, one is in rugby union, one is in rugby league

Sale blow 14-0 lead and slump to home defeat by Glasgow in Champions Cup opener

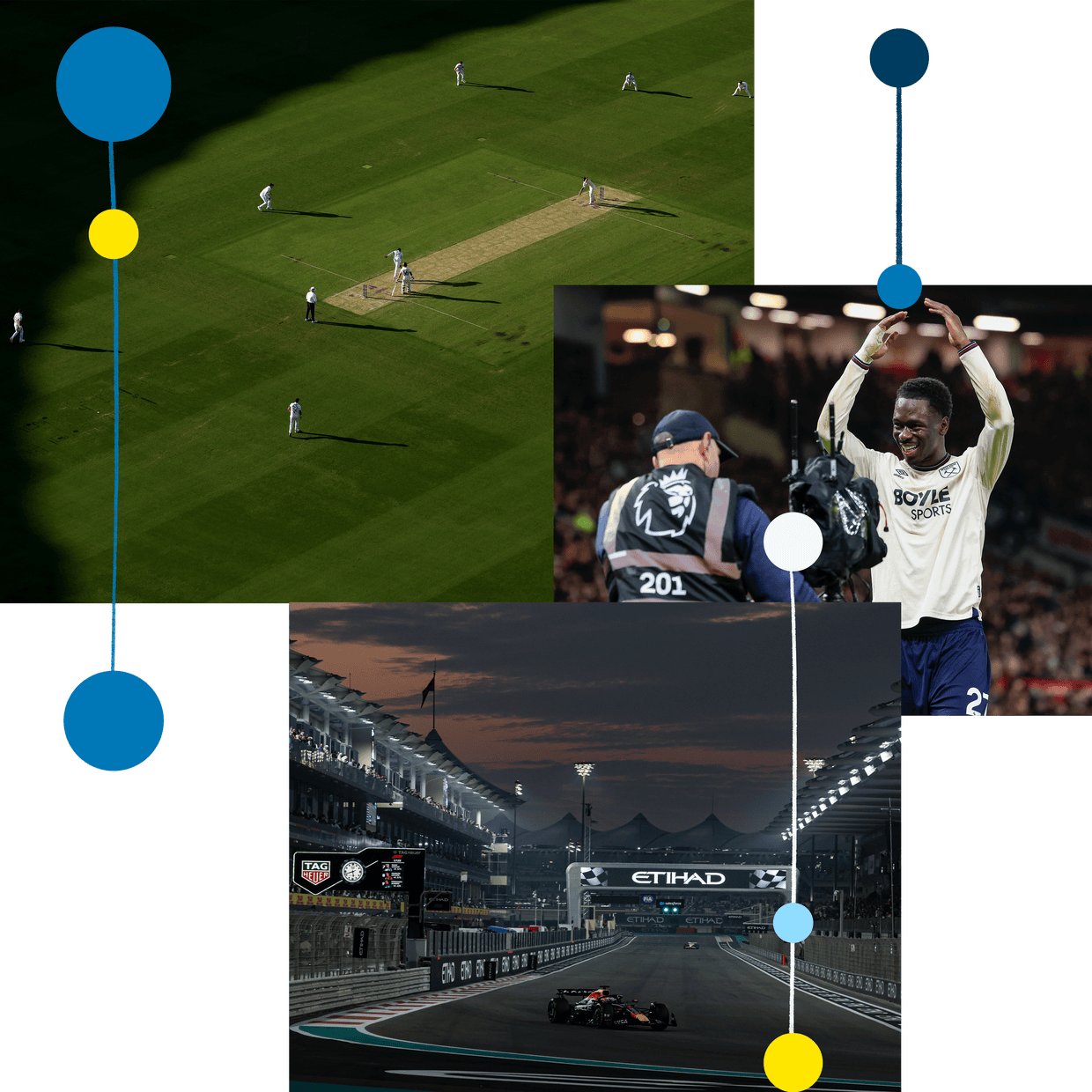

Norris’ date with F1 destiny arrives as he aims to keep Verstappen and Piastri at bay

Your Guardian sport weekend: F1 finale, the Ashes and Premier League

L’Eau Du Sud bids to create history in Tingle Creek for title leader Skelton

Saracens hatch plan to put dent in French dominance against Clermont

McLaren will use team orders in quest for F1 world drivers’ title in Abu Dhabi