Oil surges after Israel’s attack on Iran, risking ‘stagflationary shock’ – as it happened

The jump in the oil price today, following Israel’s attack on Iran, is a “bad shock for the global economy at a bad time”.That’s the warning from Mohamed El-Erian, President of Queens’ College, Cambridge, and advisor to insurance giant Allianz.Speaking to Radio 4’s Today programme, El-Erian explains that a higher oil price can lead to a “classic stagflationary shock”, undermining economic growth and fuelling inflation.El-Erian says:For the average consumer, they will be looking at more income uncertainty.They will be looking at higher petrol prices, and in the UK, they’re probably looking now at higher risk of taxation in October.

[reminder: economists are already warning that Rachel Reeves may need to raise taxes in the autumn budget, to keep within her fiscal rules]He also suggest that the probability of interest rate cuts has fallen, which will disappoint president Trump who has been demanding lower borrowing costs.The fact the US says it was not involved in Israel’s attacks means they are “another shock to the stability of the US-led the global economic order”, which was already facing questions, El-Erian adds, saying:So whatever way you look at it, it’s negative short term, it’s negative longer term.Time to wrap up.The price of oil and gold has soared and stock markets have fallen after Israel’s strikes against targets in Iran.The escalation of the conflict in the Middle East, the focal point of global oil production, prompted a sharp increase in prices.

Brent crude initially jumped by more than 10%,But in late trading, it has slipped slightly – still up 5,7% today at $73,29 per barrel, on track for its biggest daily rise since April 2023,Mohamed El-Erian, economic advisor to Allianz, warned that rising oil risks creating a ‘stagflationary shock’.

He says:For the average consumer, they will be looking at more income uncertainty,They will be looking at higher petrol prices, and in the UK, they’re probably looking now at higher risk of taxation in October,Matt Gertken, chief geopolitical strategist at BCA Research, says tonight:These attacks on Iran are most likely the first steps toward all-out conflict in the Middle East – but there is still a 25% chance of a diplomatic resolution and de-escalation,“We’ve already seen a minor oil price spike, yet Israel has not finished its campaign and Iran has not fully retaliated,In the worst-case scenario, which now has 45% odds, we could see Iran retaliate, the US enter the fray, and oil prices double as Iran strikes regional oil supply.

“Any oil supply shock would have global implications, reminding the world of the US’s inherent advantages, weighing on European and Chinese economies, and playing into Russia’s hands in Ukraine.Shares in airlines fell sharply today, as the rising oil price pushes up their fuel costs.Gold rose closer to its recent record high, and there was a small flight to safety into the US dollar.But equity markets fell, with the UK’s FTSE 100 losing 0.4% and most other European markets down over 1%.

Here’s the full story:Back on Wall Street, the US stock market has recovered some of its earlier losses.The Dow Jones industrial average is now down 0.9%, or 401 points, at 42,566.The S&P 500 is 0.44% lower.

European market have also ended the day in the red.Both France’s CAC and Germany’s DAX lost a little over 1%, with Italy’s FTSE MIB and Spain’s IBEX down around 1.3%.Britain’s stock market has closed for the week, with many share prices hit by the conflict in the Middle East.The FTSE 100 index of blue-chip shares ended the day down 34 points at 8850, 0.

4% below yesterday’s record closing high.IAG, parent company of British Airways, was the top faller, down 3.7%, with budget airline easyJet (-2.7%), investment firms Schroders (-3.4%) and International Capital Group (-2.

5%) also losing ground.Bucking the selloff were precious metal producers Endeavour Mining (+2.9%) and Fresnillo (+2.2%), who benefitted from the rising golf price today, and defence companies BAE Systems (+2.8%) and Babcock (+1.

9%),“This is a dangerous situation,” said Francois Savary, chief investment officer at Genvil Wealth Management in Geneva, summing up why shares have fallen today, while oil has jumped,“This is one of those situations where everything is under control and then everything is not under control,”US defence stocks are climbing in morning trading in New York, as geopolitical risks rise,Lockheed Martin are up 3.

3%, RTX Corporation has gained 2,2%, and Northrop Grumman has risen 3,2%,Italian bank UniCredit have suggested oil prices could surge toward $130 per barrel, if the Israel-Iran crisis leads to a prolonged blockade of the Strait of Hormuz, the world’s most important oil artery,UniCredit’s says:In our risk scenario, Brent prices would move towards and above $100/bbl.

How much above, depends on how lasting and serious the damage to global oil supply is.In the worst-case scenario, especially if there is a prolonged blockade of the Strait of Hormuz, Brent prices might jump to wards $130/bbl.But in UniCredit’s baseline scenario, where there are no major disruptions to the oil market, Brent crude stabilises at $75-$80 – up from its previous forecast of $65/bbl.In March 2022, after Russia’s invasion of Ukraine, Brent briefly jumped over $130/barrel, before falling back.It hasn’t traded over $100/barrel since August 2022.

Travel companies are among the big fallers on Wall Street.Cruise operator Carnival (-4.7%), United Airlines (-4.4%) and Delta Air Lines (-4%) are among the top fallers on the S&P 500 share index.The New York stock market has dropped at the start of trading, following losses in Europe and Asia-Pacific markets.

The news that Israel attacked Iran overnight has sparked a wave of selling, pushing the main indices into the red,Dow Jones industrial average: down 480 points or 1,1% at 42,487 pointsS&P 500: down 41 points or 0,7% at 6,003 pointsNasdaq Composite: down 156 points or 0,8% at 19,505 points.

As in the UK, airline stocks are falling sharply, but oil company shares are higher, tracking the rise in crude oil prices today,The surge in the oil price (currently up 8% today) means crude prices are on track for their 19th largest weekly rise since 1988, according to Deutsche Bank’s Jim Reid,He’s kindly created this chart, putting this week’s rise in the oil price in context:Reid writes:There were previous direct attacks between Iran and Israel in April and October of 2024, but this is much bigger in scale, with several senior Iranian military officials widely reportedly to have been killed,For markets, the focus is now turning to how the situation might escalate, given that Iran have pledged to retaliate, and President Trump has said that without a deal “it will only get worse!” This is raising genuine fears about a wider conflict, with the risk that the United States is also dragged in,From a market point of view, this is highly significant, although as the chart shows, the oil move today doesn’t look quite as big in historic terms.

On a weekly basis, Brent crude is on track for the 19th largest climb since 1988 and as it stands is hovering around the top 50 in terms of single-day moves over the same period.Although at just before 4am London time we were at the 12th biggest daily jump.In a year of shocks, high volatility, but very strong performance in many areas (especially for non-US equities), it’s another curveball to throw into the mix.It’s probably yet another weekend to keep an eye on the news!As I type, Brent crude is changing hands at $74.90 per barrel, up from $66.

47 at the end of last week.Greece and Britain have advised their merchant shipping fleets to avoid sailing through the Gulf of Aden and to log all voyages through the Strait of Hormuz after Israel’s large-scale attacks on Iran on Friday, documents seen by Reuters showed.Greek ship owners were urged to send details of their vessels sailing through the Strait of Hormuz to Greece’s maritime ministry, according to one of the documents issued by Greece’s shipping association, which was sent on Friday.It says:“Due to developments in the Middle East and the escalation of military actions in the wider region, the (Greek) Ministry of Shipping..

.urgently calls on shipping companies to send...the details of Greek-owned ships that are sailing in the maritime area of the Strait of Hormuz”.

All UK-flagged vessels, which include the Gibraltar, Bermuda and Isle of Man ‘red ensign’ registries, were advised to avoid sailing through the southern Red Sea and the Gulf of Aden, a separate document issued by the UK’s transport ministry said.If transiting these areas, vessels must adhere to their highest level of security measures and limit the number of crew on deck during transits, said the advisory, seen by Reuters.Airlines were the worst-performing sector in Europe, after several countries in the Middle East close their airspace to commercial flights today.In Europe, Air France-KLM (-4.5%), Deutsche Lufthansa (-3.

4%) and British Airways parent IAG (-4.2%) are all among the big fallers today.In Asia, Japan Airlines Co.dropped 3.7%.

Turkish Airlines has dropped over 6% in Istanbul,

US Open golf 2025: Sam Burns keeps hold of lead at Oakmont – as it happened

Moving Day took a while to get going, but once it did, it produced some exciting golf. Plenty of players are still in with a shout, so hopefully you’ll join us for the final round tomorrow. Thanks for reading this report!-4: Sam Burns -3: Adam Scott, JJ Spaun -1: Viktor Hovland E: Carlos Ortiz +1: Tyrrell Hatton, Thriston Lawrence +2: Rasmus Neergaard-Petersen +3: Robert MacIntyre, Cameron YoungThe final stroke of the day is made by Sam Burns. He makes his par putt, he remains one of just two players yet to three-putt this week – Ryan Fox is the other – and he’s got sole ownership of the lead going into the final round. A 69 for Burns, which is exactly what his playing partner JJ Spaun shot as well

Caitlin Clark spectacular in return from injury as Fever hand Liberty first loss

Caitlin Clark totaled 32 points, nine assists and eight rebounds in a spectacular return from a left quad injury on Saturday leading the Indiana Fever to a 102-88 victory over the New York Liberty, snapping their season-opening nine-game winning streak.After missing five games, Clark scored 25 points in the first half to help Indiana (5-5) rally from an early 11-point deficit. Clark made 11-of-20 shots and tied a career high by hitting seven threees, including several from well beyond the arc.Clark finished with the second-most points in her career and three shy of her career-high (35) set on 15 September against the Dallas Wings. Clark scored 14 in the first quarter, including three 3s in the final 86 seconds after the Fever trailed by 11

Rory McIlroy says he ‘didn’t really care’ about making US Open cut at Oakmont

Rory McIlroy admitted he was in two minds over whether he wanted to make the US Open cut, in the latest nod to the Northern Irishman’s psychological struggles since winning the Masters in April.McIlroy made birdie on two of his last four holes on Friday evening to survive for the closing 36 holes at Oakmont. Until that point, he was heading for an early exit. McIlroy returned to the course to post 74 on Saturday, leaving him 10 over for the week, before addressing the media for the first time since Tuesday. McIlroy’s body language suggested he would rather be elsewhere

Formula One: Mercedes’ Russell snatches pole for Canadian grand prix – as it happened

Wow! Russell has done it on the medium tyre! After Piastri went ahead Verstappen reclaim the top spot before Russell beat them all with a final surge. That is back-to-back poles for Russell in Montreal.That is all from me today. Join us tomorrow for live updates from Circuit Gilles Villeneuve for the Canadian Grand Prix. Au revoir!George Russell, Mercedes, 1:10

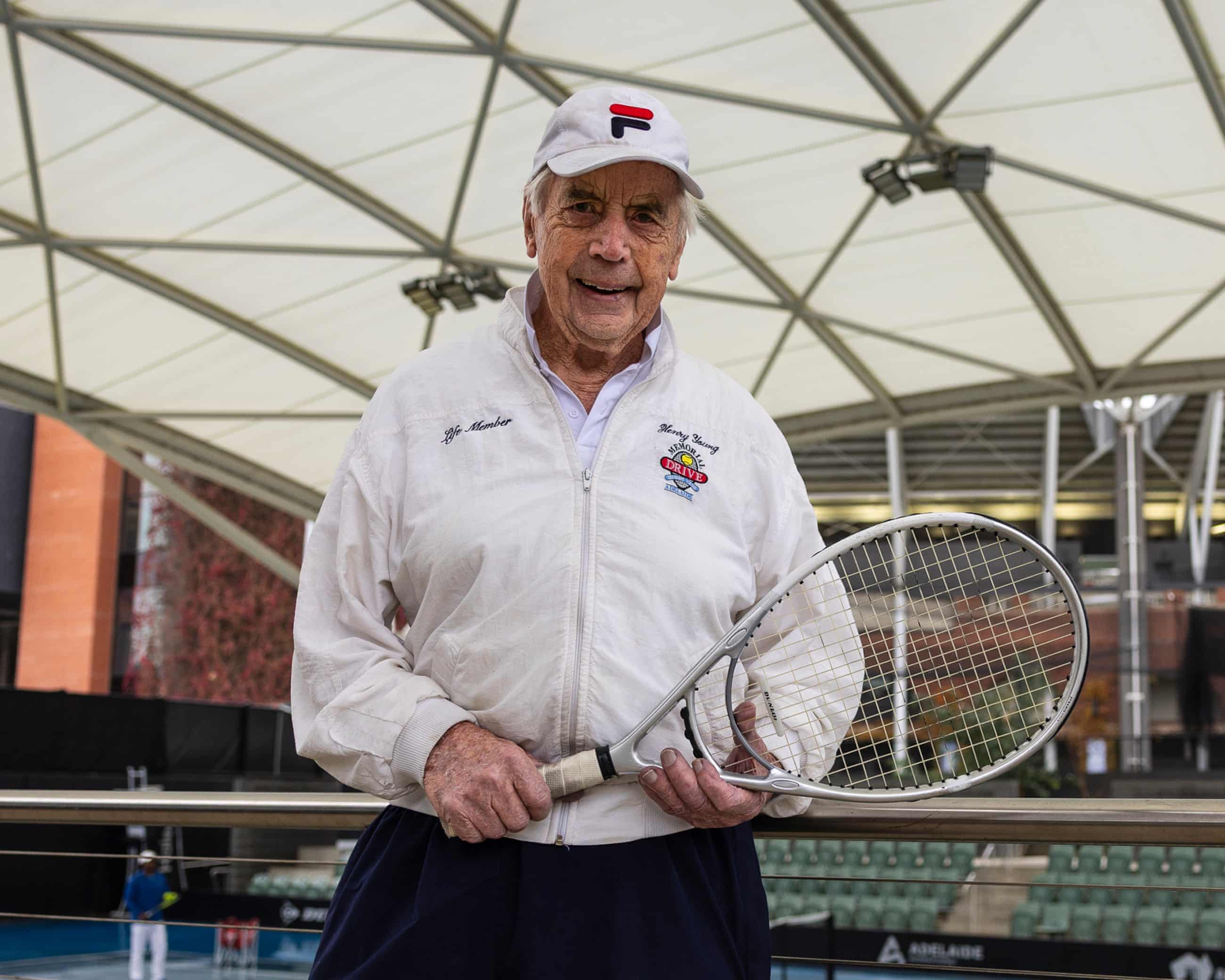

‘Tennis repairs you’: the 101-year-old fuelled by iced coffee who still plays competitively | Jo Khan

Henry Young is proud to have played on centre court during the Australian Open but does not want to be seen as remarkable just for playing at allHenry Young doesn’t mind being asked about his secret to a long, active life – it comes with the territory when you’re a 101-year-old competitive tennis player. It has its perks, like getting to play on centre court during the Australian Open, but what he does mind is that it’s considered so remarkable that he is playing at all. That he is seen as extraordinary and there must be some magic trick that keeps him going.“What bugs me is that people give up their tennis when they have some kind of injury,” Young says. “I’m a monument to the medical profession because I’ve had so many injuries and I just persevere, and then tennis repairs you

Leicester coach Cheika hits out at Cole yellow card after final defeat by Bath

Michael Cheika, the Leicester head coach, took issue with the officiating after his side’s playoff final defeat by Bath, describing the late yellow card shown to Dan Cole after an aerial collision with Finn Russell as “embarrassing for the game” and “hardly even a penalty”.The Australian was also less than impressed with how the scrum was refereed. “I’ve never seen it before in my life, dominating like that and getting nothing, zero. In fact, getting penalised against.“That was a strategical point for us to try and dominate there and in mauls as well

Disney and Universal sue AI image creator Midjourney, alleging copyright infringement

‘They went too far’: Musk says he regrets some of his posts about Trump

Meta to announce $15bn investment in bid to achieve computerised ‘superintelligence’

UK students and staff: tell us your experiences with AI at university

As big tech grows more involved in Gaza, Muslim workers are wrestling with a spiritual crisis

AI can ‘level up’ opportunities for dyslexic children, says UK tech secretary