‘A stomach of steel’: amateur investors ride out dips amid talk of an AI bubble

It was more than just a hunch, says Jacob Foot of his first foray into US tech stock investments back in 2020.The 23-year-old says he played around with artificial intelligence tools in his first job and thought to himself: this technology is going to be a big deal.Foot put his savings each month into US shares and in particular the biggest investors in AI, the Magnificent Seven (M7).For several years the list has included the chipmaker Nvidia, Amazon, Apple, Microsoft, Tesla, Alphabet (the owner of Google) and Meta (the owner of Facebook, Instagram and WhatsApp).Five years on, Foot expects to complete the purchase of a “bigger house in London than I expected”, a dream he could not have realised without his stock market bets paying off.

What marks out Foot and his generation of young stock market investors is their bravery.When shares slide, they refuse to sell.Instead they sit tight and wait for the upturn, or treat the dips as a buying opportunity.The week before last, shares dropped on both sides of the Atlantic.In the US the S&P 500, which tracks the largest listed companies in the US, lost more than 200 points.

The drop came amid dire warnings of a major stock market correction, if not a full-blown financial crash,The Bank of England, the International Monetary Fund (IMF) and the boss of the US bank JP Morgan were among those raising fears that popular investments, including tech company shares, gold, crypto and bonds, were over-valued and could implode,Yet despite the dire warnings, the stock market panic was shortlived and the loss of value was shallow, with the FTSE 100 and Wall Street again hitting record highs,The rises followed a boom month in September, when shares often go sideways or fall,The S&P rose by more than in any previous September in the last 15 years.

The increases over the past 12 months are even starker, with shares in the M7 surging almost 37%, outstripping the 15% racked up by the rest of the S&P 500, according to FactSet data,The M7 now accounts for more than a third of the entire S&P 500 and Nvidia has a share price to earnings ratio of 54; investors would normally begin to twitch at a ratio of 25,Microsoft and Apple both passed $4tn valuation on Tuesday, joining Nvidia as the only companies to pass that threshold, though Apple later eased back just below,Why have valuations continued accelerating? The warnings from the IMF and others triggered selling by algorithmic trading platforms and even among seasoned professionals in the finance industry, but market watchers say young investors played a major role in averting a bigger fall,Companies that make money out of betting on dips in share values – short sellers – are so rattled they have taken to complaining about this new cohort of amateur speculators.

Earlier this month, Carson Block, founder of the short seller Muddy Waters, told the Financial Times: “Cycles have become so long and the corrections so short, that the demand for traditional short selling is just not there.”Block said investors were confident, and ballsy, rallying around battle cries such as BTFD, or “buy the fucking dip”.One episode illustrates the point.On 3 April, while the S&P 500 dived by almost 5% the day after Trump announced his “liberation day” tariffs, retail investors pushed more than $3bn into US stocks, according to Vanda Research – the largest daily injection of cash since the market analyst began keeping a tally in 2014.The phenomenon is leading to more interest in the “inelastic markets hypothesis”, proposed in 2021 by the economists Xavier Gabaix and Ralph Koijen, of the US thinktank the National Bureau of Economic Research, which argues that share prices can be pushed up by an increase in the amount of money available to invest.

The theory goes that prices are rising not because of the prospects and profitability of the M7 and other popular assets, but because of the wall of money being pushed into the markets by amateur speculators,The trend has been compounded by an increase in low-cost passive investments by pension schemes and fund managers, which channel savings into an ever-smaller group of the fastest growing stocks,Sam Woods, the outgoing head of the Bank of England’s Prudential Regulatory Authority, said in a speech last week to City grandees that the financial services industry had “plenty to worry about” – including “opaque and complex private lending by non-banks, recent cracks emerging in US credit, the risk of an AI bubble, and overly concentrated life reinsurance structures”,But he played down the likelihood of a systemic disaster,“Given the hazardous terrain in which we now find ourselves, we seem reasonably well-equipped,” he said.

That’s in the UK.The US is another matter, with a president in charge whose family has made hundreds of millions of dollars from cryptocurrency ventures and who wants to roll back regulations in a way that would horrify Woods.Sign up to Business TodayGet set for the working day – we'll point you to all the business news and analysis you need every morningafter newsletter promotionOlivier Blanchard, a former IMF chief economist who is now emeritus economics professor at the Massachusetts Institute of Technology, is concerned.He believes that young investors have created “a perfect environment” for financial bubbles to grow and become unsustainable.“More and more young (and some not so young) investors do not think in terms of fundamentals, ie in terms of present discounted values,” he posted on X.

“They base their decisions on past returns.What has gone up (bitcoin), will [continue going] up.Who cares about fundamentals?”Chris Beauchamp, chief market analyst at the trading platform IG, says: “The M7 remain hugely popular with individual investors.They are global titans, known everywhere and which generate huge profits.“Still, you need a stomach of steel to look through some of ups and downs.

”He says investors are from across the age ranges but there has been an influx of younger people who cut their teeth dabbling in bitcoin and other cryptocurrencies.Another factor could be the “house money effect” – the tendency to take greater risks reinvesting an early win, of the kind that might have followed a foray into high-profile stocks such as Tesla or Amazon or watching a friend make gains.Psychologically, the money placed on subsequent bets isn’t considered your own, so you’re less cautious.Low-cost trading apps will also have played a part the investment bonanza, along with and videos on YouTube and TikTok exalting the benefits of stock trading.“There is a natural read across to the crypto world, with people talking about how rich they would be if only they had bought bitcoin at $5,” Beauchamp says.

Experts question whether amateur traders will remain confident when there are so many warnings of an impending crash,Traditionally they have suffered badly by being last to join the party and last to cut their losses,Foot, who uses the IG-owned Freetrade website to buy and sell shares, describes his investment portfolio as a “sideline” while he worked full-time for three years, straight from school, as a tax analyst for the accountants EY,He says there have been nervous moments,He first bought Nvidia shares when they were priced at $25.

In March this year they had risen to more than $140 before falling to $94 after Trump’s 2 April tariff announcement.But he held his positions and then bought more shares at the cheaper price.Nvidia stock has since recovered to trade at about $190 a share.“I wanted a good balance between ‘set and forget’ stocks like the M7 and a few smaller companies with good upside potential.It’s been quite a risk, but has paid off.

“I didn’t deny myself the occasional holiday, but I took my own lunch to work,” he says of his determination to keep saving to invest each month.The AI revolution “has legs”, he says, and he remains heavily invested in the M7, where the chip designer Broadcom has now replaced Tesla.But he admits to becoming more conservative since cashing in his winnings for a mortgage deposit.In 2007, only a year before the biggest financial crash since the 1930s, the US banker Chuck Prince was asked why he had continued to provide sub-prime loans to people with low incomes and trade in exotic derivatives based on those loans.The former Citigroup boss answered: “As long as the music is playing, you’ve got to get up and dance.

We’re still dancing.”Retail investors are still dancing, riding out the dips and pushing the market higher.How long that can continue before a loss of confidence triggers a correction is a question many market analysts would like to answer.

Tightening Pip benefit eligibility could save £9bn a year, says Reform

Reform UK has set out plans for changes to personal independence payments (Pip) that the party says could save up to £9bn a year, with Lee Anderson, one of its MPs, saying he used to “game the system” to help people become eligible for the benefit.In Reform’s third consecutive Westminster press conference of the week, Anderson and the head of policy, Zia Yusuf, said the party would bar people with less serious psychological conditions such as anxiety from claiming Pip and would ensure anyone getting the payments would first receive a face-to-face assessment.“We are betraying our young people,” said Yusuf, who was formerly the party chair. “Reassessments are basically not happening any more. These young people are being labelled

Boris Johnson approved China’s London super-embassy proposal in 2018

Boris Johnson approved the China’s super-embassy proposal in 2018 and welcomed the fact it would represent “China’s largest overseas diplomatic investment” anywhere in the world, the Guardian can disclose.In a letter to Wang Yi, China’s top diplomat, Johnson gave his consent for Royal Mint Court to house a sprawling diplomatic complex in May 2018. The Chinese government bought the 20,000 sq metres site for £255m that same month.The disclosure demonstrates that the Conservatives under Theresa May gave Beijing assurances that it could proceed with the proposal, which is still in limbo seven years later after attracting huge political and local backlash.Johnson’s letter, sent while he was foreign secretary, was a response to Wang setting out details of the planned project in April

Your Party to launch legal action against three of its ‘rogue’ founders, sources say

Your Party, the leftwing party steered by Jeremy Corbyn and Zarah Sultana, says it is preparing legal action against a group of its own founders after a final deadline to hand over at least £800,000 in donations passed without payment, the Guardian understands.Figures close to the party accused directors of MoU Operations Ltd (MoU) of having “gone rogue”, holding supporters’ funds to ransom and undermining its founding process “despite direct pleas from Jeremy and Zarah”.Party insiders say they “reluctantly” agreed to initiate legal proceedings after “exhausting every possible alternative” to recover the money still held by the directors of MoU.MoU is run by Andrew Feinstein, the anti-apartheid activist who ran as an independent candidate in Keir Starmer’s constituency; Jamie Driscoll, the former North of Tyne mayor; and Beth Winter, the former Labour MP for Cynon Valley. The three helped shape the movement’s early structure before relations broke down

Should the Home Office be broken up into two units?

“It’s not that the Home Office is too big. It’s that the brains of many of the people who run it are not big enough,” says one former departmental insider.Unwieldy, dysfunctional and plagued by poor morale, the Home Office is once again the subject of debate about whether it is beyond repair and should simply be chopped up into two more manageable units.No 10 is so far showing no appetite for a big restructure, but Shabana Mahmood, the new home secretary, has acknowledged that she has a turnaround job on her hands along with the new permanent secretary, Antonia Romeo.Politicians have been calling for the Home Office to be split up every couple of years when a major scandal shines a light on its persistent problems, such as those exposed in the Windrush and immigration centre abuse scandals

Reform wheels out Danny Kruger, the ‘brains’ of Nigel Farage’s operation | John Crace

Nigel Farage too Marmite for you? Lee Anderson too Lee Andersony? Richard Tice too smooth? Sarah Pochin a bit too racisty? Don’t worry. These things happen. But all will be well, because Reform have just the MP for you. Someone who can be passed off as a safeish pair of hands. Someone who won’t frighten the horses

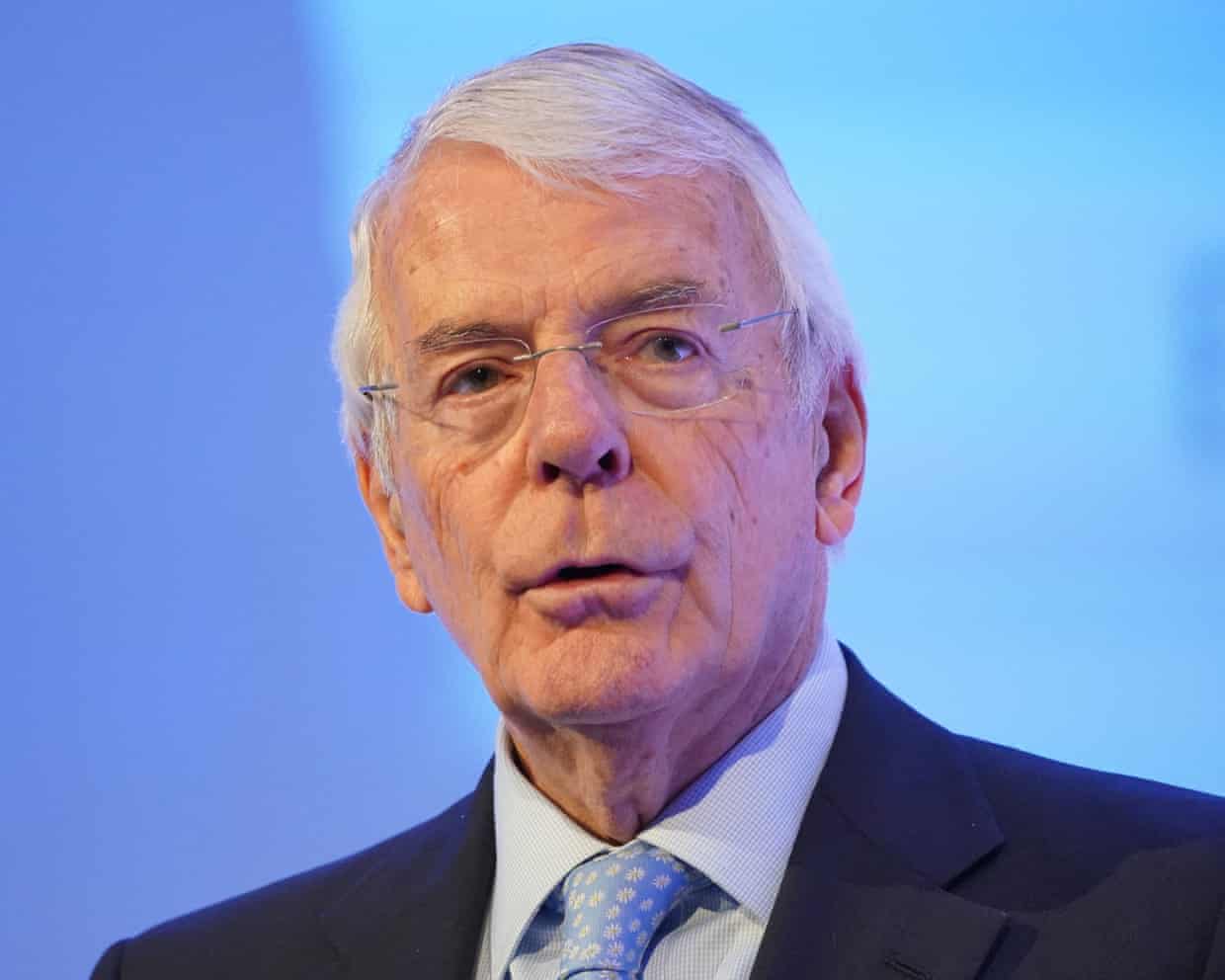

John Major tells Tories alliance with Reform would be ‘beyond stupid’

John Major has told the Conservatives that forming an alliance with Reform UK would “for ever destroy” the party, which he said had already left traditional supporters “politically homeless” by lurching too far to the right.The former prime minister dismissed a pact with Nigel Farage’s party as “beyond stupid”, saying that any Tories tempted to defect to Reform should go now because his own party would be better off without them.As the Tories struggle with the existential threat posed by Reform’s surge in popularity, Major warned far more than the future of the party was at stake with autocracies on the march across the world.“Frustration with democracy should not blind us to the toxic nature of nationalism, or any and every form of populist or authoritarian government,” he said.Addressing a Conservative party lunch on Tuesday, he urged the party not to reject the centre ground of British politics, saying they were “seriously alienating” voters by coming down on the wrong side of public opinion on Europe, climate change and overseas aid

UK must reform drug pricing to become life sciences superpower, says GSK boss

Toyota denies promising to invest $10bn in US after Trump announcement

So it’s goodbye to lower interest rates – to be honest, the RBA was always looking for an excuse not to cut | Greg Jericho

Profit upgrade at Next raises hopes UK shoppers still keen to spend

Santander urges ministers to intervene in UK car finance compensation scheme

Aston Martin cuts investment plan by £300m as Trump tariffs bite