UK watchdogs need to step in on rip-off bills, which are bad for consumers and the economy | Heather Stewart

Ever felt swizzed by the small print in your mobile contract, bamboozled by a plethora of insurance products or locked into a subscription you signed up for by mistake?Then you are far from alone: a paper on the UK’s productivity predicament suggests the way the markets for some key services work is not only a monumental pain for consumers but bad for the economy, too.Rachel Reeves has promised to tackle the cost of living in her 26 November budget – alongside bringing in tax rises.Briefing in advance has suggested she and her colleagues are focused on cost-cutting levers they can easily pull from Whitehall: removing VAT on energy bills, for example.However, in their paper “getting Britain out of the hole”, the economists Andrew Sissons and John Springford suggest a much more muscular approach to making markets for key services work better.They argue that lack of proper competition for services is an important explanation for the UK’s frustratingly “sticky” inflation.

While it was goods – chiefly energy – that drove the post-Covid increase in prices, it has been services inflation that has hung around.Part of the reason for this lies in rising wages, especially at the lower end of the scale, and Reeves’s £25bn increase in employer national insurance contributions, which companies have passed on to customers where they could.However, the authors say there is another problem here: the failure of regulation to make some markets – from household energy to mobile phones to insurance – work to the benefit of consumers.“Too many markets for services are beset by problems with limited competition, ineffective regulation or problematic market structures that hurt consumers and make services inflation more persistent than it should be,” they argue.They point to well-known challenges in energy and transport, including the need for massive investment in the transition to net zero, and creaking infrastructure in need of costly upgrades.

They also point to “signs that the competition regime for services that require contracts – personal finance, consumer energy and telecoms, for example – is failing to keep bills down”.“This spending is gobbled up by companies in the form of a producer surplus, where more competitive markets would allow consumers to spend on other goods and services, raising the efficiency of the economy,” they add.The headaches are different for each market but customers can often end up trying to judge which of a plethora of complex tariffs or products is the best value, enduring eye-watering automatic increases in bills, or struggling to end a subscription they signed up for online.They point out that, since 2022, there has been a noticeable rise in inflation in April, when automatic price increases in some phone and broadband contracts kick in.These unwelcome spring price increases are often pegged just above the retail prices index (RPI) – the outdated inflation measure that conveniently tends to be higher than the consumer prices index measure targeted by the Bank of England.

The authors call for the use of these “RPI-plus” contracts to be strictly limited by regulators.Elsewhere, the nature of the rip-off may be harder to detect.There may be many players, apparently competing hard, but the baffling complexity of the products on offer, and the faff of comparing these and switching, mean only the keenest consumers are getting a fair deal.This is at heart a problem of “information asymmetry”: companies are able to exploit the fact that they know much more than their customers.Sign up to Business TodayGet set for the working day – we'll point you to all the business news and analysis you need every morningafter newsletter promotion“Most consumers don’t have the time or the skills to read the terms and conditions, and producers have access to troves of data about how consumers behave in the real world, and can take advantage of them,” the authors say.

A similar argument was made in another recent paper, by the behavioural economist and former government adviser David Halpern, and the former cabinet secretary Gus O’Donnell,They highlighted the phenomenon of “shrouding”, whereby consumers are unable to see all the information they need to make decisions – because of hidden charges, for example,Since Labour came to power, Reeves has repeatedly urged the nation’s army of regulators to take more account of economic growth,She has suggested that means they should “tear down regulatory barriers” and get rid of the dreaded “red tape”,Sissons and Springford argue, however, that regulators may need to be better resourced and more interventionist, to make markets work better to the benefit of consumers and the economy.

As well as restricting the use of those RPI-plus contracts, they set out a series of radical proposals,These include a new government-enforced rule that any service you can subscribe to online, you can cancel online, too,Auto-renewing contracts, where consumers end up stuck with their existing provider unless they act by a certain deadline, should not be the norm, they argue – aside from perhaps in essential areas such as car insurance,In some markets, the pair suggest, regulators could even draw up definitions of a few standard products – plain vanilla insurance contracts, with a set excess and very few exemptions, for example,That could allow companies to compete to provide these on the basis of price and service – instead of baffling consumers with byzantine small print.

Aside from workers’ rights, Labour’s language on regulation has tended to follow the laissez-faire playbook of the Tories – Reeves has even said overbearing rules are a “boot on the neck” of businesses.But it will take better, not less, regulation to foster more dynamic markets for the services consumers rely on, and stop them being shortchanged.

Seth Meyers on Trump: ‘The most unpopular president of all time’

Seth Meyers spoke about rising tensions within the Republican party with Donald Trump losing support from his base over the Jeffrey Epstein scandal.The Late Night host spoke about yesterday’s dramatic meeting in the situation room to discuss Epstein, an ongoing crisis that has seen the president becoming “wildly unpopular”.Meyers said that Trump is “by all the accounts the most unpopular president of all time” and up until this point has only been “able to hang on to power because he has a tight grip on the Republican party no matter what he did or how bad things got”.But a new poll shows that only 33% of American adults approve of how the president is managing the government, a figure that’s down from March with the fall driven by Republicans or independents.Meyers called this “a meaningful and real development” and “it’s not coming out of thin air” with Trump “pissing off Maga” in multiple ways

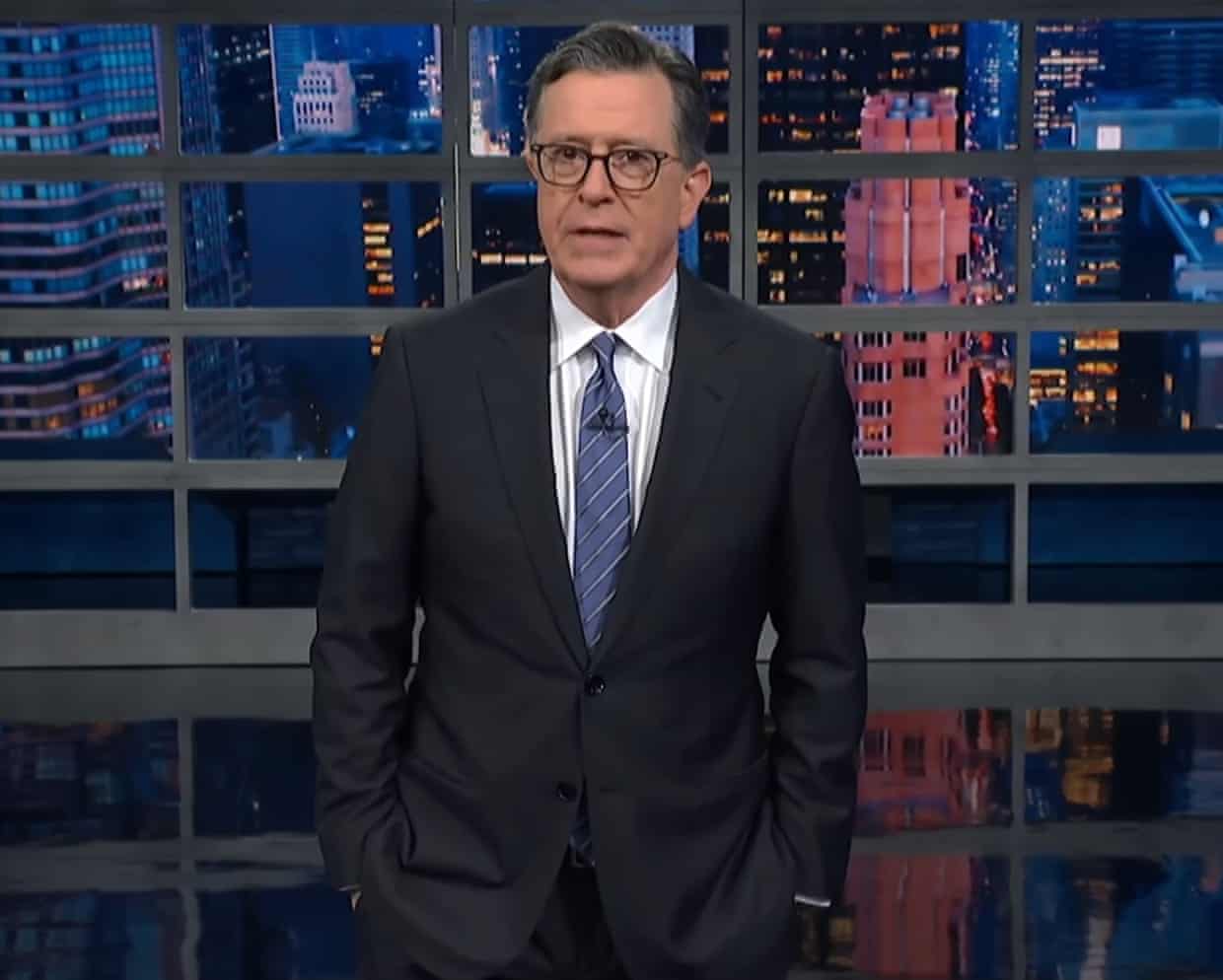

Colbert on Trump and Epstein: ‘They were best pals and underage girls was Epstein’s whole thing’

Late-night hosts covered this week’s latest bombshell Epstein and Trump revelations and spoke about the president’s latest interview with Laura Ingraham.On The Late Show, Stephen Colbert spoke about the government shutdown likely coming to an end after “an historic impasse” (the shutdown later did end) and Democrat Adelita Grijalva being sworn in as a member of Congress, seven weeks after she won a special House election in Arizona.Colbert said she has been “reborn from the ashes” and will be the 218th and final signature needed to force a vote to release the Jeffrey Epstein files.He joked that on her first day she was shown around and told “down there is the room where you’re going to topple the pervert cabal”.This week saw some new emails from Epstein released which suggest Trump knew of his conduct

Colbert on Trump ‘building a massive compensation for his weird tiny penis’

Late-night hosts spoke about the controversial behavior of a small group of Democrats and Donald Trump’s continued destruction of the White House.On The Late Show, Stephen Colbert spoke about the vote to end the federal government shutdown which has seen some Democrats choosing to cave to Republican demands without restoring the healthcare subsidies which were initially threatened.Chuck Schumer told his party he would give the deal neither a blessing nor a curse and would give no steer on how to vote.Colbert joked that this was “bold leadership” and commented on Schumer’s “failure” in the situation.The shutdown has caused major chaos at airports as air traffic controllers were being unpaid for so long that many of them stopped coming to work

‘I really enjoyed it’: new RSC curriculum brings Shakespeare’s works to life in UK classrooms

Act 1. Scene 1. A classroom in a secondary school in Peterborough. It is a dreary, wet afternoon. Pupils file into the room, take their seats and face the front

Jon Stewart on government shutdown deal: ‘A world-class collapse by Democrats’

Late-night hosts unleashed on Senate Democrats for caving on the longest-ever government shutdown with no assurance on healthcare subsidies from Republicans.Jon Stewart minced no words for congressional Democrats on Monday evening, hours after a coalition broke from the party and voted with Republicans to extend government funding through January with no assurances on the healthcare tax credits at the center of the 41-day stalemate. “By the way, tonight’s show will be brought to you by: I can’t fucking believe it,” Stewart fumed at the top of The Daily Show. “I can’t fucking believe it: for when the ‘I can’t believe it’ Edvard Munch scream emoji doesn’t quite convey how much you cannot fucking believe it.”“They fucking caved on the shutdown, not even a full week removed from the best election night results they’ve had in years,” he continued

Old is M Night Shyamalan at his best: ambitious, abrasive and surprisingly poignant

In August 2002, Newsweek boldly anointed the stern-faced man pictured on the cover of its splashy summer issue as “The Next Spielberg”. While some might have called this an unfair comparison to one of cinema’s most legendary figures, for a then 31-year-old M Night Shyamalan, it was a childhood dream come true. The Indian-born, Pennsylvanian-raised film-maker had whetted his cinematic appetite on the images of Jaws and Raiders of the Lost Ark, and for better or worse, would find himself chasing that same level of stratospheric fame in the early days of his career.Despite the initial acclaim of The Sixth Sense, though, Shyamalan’s reputation and audience goodwill would soon begin to nosedive as his idiosyncratic directing style rubbed against the grander ambitions of his movies. But after a temporary exodus from Hollywood and a retreat to his roots in independent cinema, Shyamalan finally returned to studio film-making in 2021 with the release of Old, a masterful high-concept thriller that rekindled the director’s longtime fascination with family, parenting and the mystifying possibility of the unknown

Ashes 2025-26: player-by-player guide to England and Australia squads

England, please be competitive. The Ashes’ claim to the greatest rivalry depends on it | Jack Snape

Paige Greco, Australian Paralympic gold medallist, dies aged 28

Broncos 22-19 Chiefs, Rams 21-19 Seahawks; Packers, Steelers and Bills win: week 11 as it happened

Final Demand’s flawless debut over fences bolsters Mullins’ squad for Cheltenham

Jannik Sinner sees off Carlos Alcaraz in straight sets to defend ATP Finals title