Tech shares slide after SoftBank sells Nvidia stake; UK interest rate cut expected in December – as it happened

Several economists are predicting the Bank of England could cut interest rates as soon as December, following this morning’s weak jobs report.And looking further ahead, the money markets are now indicating they expect 65 basis points of BoE rate cuts by the end of next year, up from 55 bps on Monday.That means two quarter-point cuts by December 2026 are fully priced in, with a third now more likely.Suren Thiru, economics director at ICAEW (the Institute of Chartered Accountants in England and Wales), reckons the odds of a rate cut next month have risen, now that unemployment has jumped to 5% and wage growth has slowed.“These figures suggest that the UK’s labour market is suffering from pre-Budget jitters, as businesses already weakened by April’s rise in national insurance look to cut recruitment further in anticipation of another difficult Budget.

“This weakening in wage growth is likely to accelerate over the winter as the downward pressure from an ailing economy, significant staffing costs and more job losses increasingly restrains pay awards,“The jobs market could bear the brunt of Budget tax rises as weaker customer demand, amid a possible income tax hike and increasing costs on business, may mean higher unemployment than the Bank of England currently predicts,“These underwhelming figures add credence to the more dovish tilt to last week’s policy decision and the current rate at which the labour market is loosening notably increases the chances of a December interest rate cut,”Richard Carter, head of fixed interest research at Quilter Cheviot, points out that BoE governor Andrew Bailey is the ‘swing voter’ on its Monetary Policy Committee, who could be swayed into creating a majority for a cut:“An early Christmas present could come in the form of an interest rate cut from the Bank of England following a rise in unemployment and a softening in wage growth,The monetary policy committee had a tight 5-4 split on whether to hold or cut rates at last week’s meeting, with Andrew Bailey’s deciding vote erring on the side of caution.

“Today’s figures from the Office for National Statistics show wage growth pressures, albeit still relatively high, are slowly easing.Annual growth in regular earnings excluding bonuses saw a decline to 4.6% compared to 4.7% last month, and total earnings including bonuses fell to 4.8% compared to 5%.

Any further signs of easing in the next labour market print could sway a few more on the committee to cut on the 18th December.Thomas Pugh, chief economist at audit, tax and consulting firm RSM UK, points out that problems at the Office for National Statistics do make today’s data somewhat unreliable….“A rise in the unemployment rate to 5.0% in September, the highest level since the pandemic, and a further slowing in private sector pay growth throws the door wide open to a December rate cut – as long as the budget is as deflationary as the Chancellor hinted at last week.“Overall, the labour market appears to still be weakening with the unemployment rate ticking up and employment falling on both the LFS and payrolls measures.

Admittedly, the unemployment rate is being driven up by an erratic looking jump in unemployment on the single month figures.Even though the ONS has made improvements to the Labour Force Survey, which is where the official measures of employment statistics are derived from, it continues to be distorted by a low response rate making it less reliable than in the past.And finally… here’s our news story on SoftBank’s decision to sell its stake in Nvidia:And here’s some of the other major news today:Wall Street is not sharing the festive mood in London.The Nasdaq Composite is down around 0.7% after this morning’s trading session.

Here are the top fallers:Applovin Corp: -10.1%Micron Technology: -4.072%NVIDIA Corp: -3.509%Marvell Technology: -3.411%Lam Research Corp: -3.

409%Arm Holdings: -3.333%Britain’s stock market has closed at a new high, as investors anticipate a cut to UK interest rates next month.Having scaled the 9,900 point mark for the first time in late-afternoon trading, the FTSE 100 slipped back slightly in the closing auction to finish at a new closing high of 9899.6 points.That’s a jump of 112.

5 points, or 1.15%, today.Raffi Boyadjian, lead market analyst at Trading Point, says:European stocks were in a buoyant mood.The UK’s FTSE 100 is leading the gains, hitting record territory on renewed bets that the Bank of England will cut rates at its next meeting.Those bets were boosted by the weak jobless data this morning, which showed UK unemployment has hit its highest level since early 2021.

With a December rate cut now seen as a 74% chance, shares in UK housebuilders rose today.Vodafone were the top riser, as investors welcomed its decision to increased its dividend for the first time in eight years and upgraded its profit guidancePharmaceuticals firm AstraZeneca gained 2.5%, hitting a new record high today.Back in London, the stock market has hit a new record high in late trading.The FTSE 100 has climbed over the intraday high set this morning, and is now trading over 9,900 points for the first time – at 9,907 points.

Nvidia’s share price is continuing to dip – it’s now down 3.1% at $192.88.SoftBank’s decision to sell out of Nvidia is “a major event for markets”, says AJ Bell investment director Russ Mould.“People are looking for clues that the tech rally is close to the top, and SoftBank’s profit-taking in the chip giant is significant.

“Investors typically sell out of positions when they believe the valuation is too rich, the growth prospects for the company are less attractive than before, or they’ve found something better to back and need cash to make that investment.“SoftBank is an active investor and has a deal to invest billions of dollars into OpenAI, which suggests that it still sees massive opportunities to make money from the AI revolution.Selling out of Nvidia while also trimming its position in T-Mobile helps to top up the war chest for the next wave of AI-related investments.“Nvidia has had a storming run on the markets and SoftBank might think it is prudent to cash in while the going is good.“Nvidia’s role in an AI world is already well known, yet OpenAI’s position is still evolving, so it might simply be that SoftBank sees the latter as a better way of profiting from the tech explosion going forward, rather than sticking with yesterday’s trailblazer.

“What’s important for markets is the fact that SoftBank’s exit from Nvidia isn’t the Japanese group washing its hands completely of all things AI.”The tech-focused Nasdaq index has dropped by 0.6% in early trading.Marketing firm Applovin (-5,6%) are the top faller, followed by semiconductor maker Micron (-3.8%) and chip designer ARM (-3.

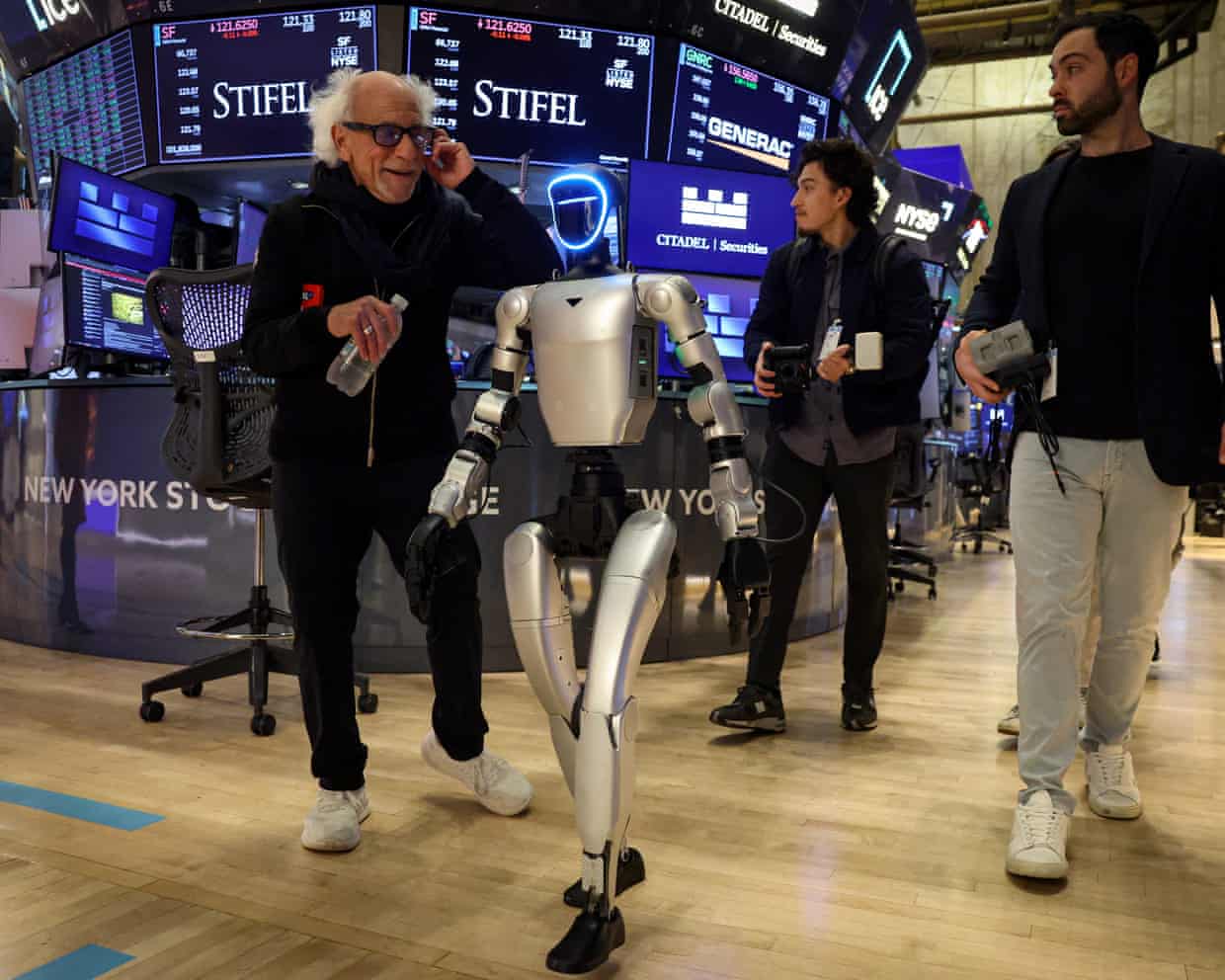

6%),The US stock market has opened slightly lower,The S&P 500 index dipped by 0,25% at the open, with Nvidia (-2,3%) among the fallers following SoftBank’s sale of its stake in the chipmaker (see earlier post).

Fellow tech companies Oracle (-2.5%) and Dell (-2.4%) are leading the fallers.As well as concerns over technology valuations, investors will have noted today’s warning that US companies cut jobs at the end of last month (see earlier post).Shares in chip giant Nvidia have fallen by over 2% at the start of trading in New York, after one of its major shareholders revealed it had sold its stake.

Japan’s SoftBank disclosed this morning that it had sold its entire shareholding in Nvidia in October, for $5.83bn.Analysts said SoftBank, a powerful tech investor, appears to be raising money to fund other investments in artificial intelligence groups such as OpenAI.But… the sale of the stake in Nvidia, which has been very profitable for SoftBank, could fuel concerns that AI valuations have risen too high.Nvidia’s stock has dropped by 2.

3%, to $194.70, but is still up over 45% so far this year (and around 1,300% over the last five years!).SoftBank’s chief financial officer Yoshimitsu Goto told investors that the salw as part of the firm’s strategy for “asset monetization,” explaining:“We want to provide a lot of investment opportunities for investors, while we can still maintain financial strength.”“So through those options and tools we make sure that we are ready for funding in a very safe manner.The jump in the UK unemploymen rate is a blow to the Government’s tax take.

Robert Salter, a director at audit, tax and business advisory firm Blick Rothenberg, explains:“4.2% of people were unemployed when the Government came to power in 2024, and today’s figures from the Office of National Statistics (ONS) reveal it has increased to 5%.Each additional individual who is unemployed represents both a reduction in the Government’s tax take and an increase in cost of providing social support.”“There has been a lot of speculation and commentary on the size of the UK’s ‘fiscal black hole’ in recent weeks and the increase in the unemployment rate will only compound the challenges faced by the Chancellor, Rachel Reeves as the Budget looms ever closer.”Just in: We also have a weak-looking jobs report from the US.

Not an official report (the shutdown isn’t over yet!).But private payroll operator ADP has crunched its latest data, and found that in the four weeks to 25 October, private employers shed an average of 11,250 jobs a week.That suggests the labor market struggled to produce jobs consistently during the second half of the month, ADP say.This implies a weak jobs market – which might spur the US Federal Reserve into cutting US interest rates.It’s also surprising, as ADP reported last week that private sector employment increased by 42,000 jobs in October.

Unless I'm being a moron this makes no sense - the weekly survey suggests that the economy LOST 45k jobs in Oct, the monthly survey suggests the economy GAINED 42k jobs in Oct...🤷♂️ https://t.co/h6ayjh3u3sThis apparent contradiction could be caused by a sharp deterioration in the jobs market towards the end of October (after the monthly data was collected).

The FTSE 100 has slipped back from this morning’s record high, as investors anticipate a weak start to trading in New York.Wall Street futures indicate the S&P 500 share index could drop by 0.25%, while the Nasdaq tech index is on track for a 0.4% drop.Concerns around elevated technology valuations appear to have resurfaced, while markets watch whether the longest government shutdown in US history is ending.

Vodafone has increased its dividend for the first time in eight years and upgraded its profit guidance, sending shares in the telecoms operator to a more than two-year high.The company, which completed a £16.5bn merger of its UK operations with rival Three earlier this year, was boosted by a return to revenue growth in its biggest market, Germany, which has been struggling for the last two years.Shares rose about 6% on Tuesday, making Vodafone the biggest riser in the FTSE 100 (lifting it to that new record), as the company said it would increase its dividend for the first time since 2018.Margherita Della Valle, who has been carrying out a major transformation programme since being appointed as the company’s first female chief executive two years ago, said that Vodafone is looking to move towards a “progressive dividend policy” to increase returns to shareholders annually.

The group slashed its dividend by about 40% in May 2019 after the cost of buying mobile 5G spectrum caused its debt to balloon.“It’s been a long time since this happened at Vodafone and we are pleased that we are able to share this with our investors,” Della Valle said.The new dividend policy will deliver an expected increase of 2.5% in the year to the end of March.Vodafone said that it now expects to deliver the upper range of guidance for full year earnings of between €11.

3bn and €11.6bn, and adjusted free cash flow of €2.4bn to €2.6bn.In Germany, where Vodafone has lost half of its TV customers between July 2024 and March this year due to a law change that gave customers living in housing association properties the right to choose their own TV provider, the company added 90,000 new customers in the first half of its current financial year.

“The group had quite simply been fighting fires on too many fronts while dealing with an increasingly onerous debt burden, leading to the need for a significant transformation,” said Richard Hunter, head of markets at Interactive Investor,“What is now emerging is a smaller and less geographically diverse, but more focused operation,”Vodafone UK is currently embroiled in a £78m legal claim with more than 60 of its franchise operators,Claimants have accused the company of “unjustly enriching” itself by cutting commission rates paid to franchisees which many have said have led to them running up huge personal debts and fearing for their livelihoods or homes,Vodafone has been offering settlements to some former franchise partners who are not involved in the high court claim

Children being ‘sedated’ by algorithmic YouTube content, MPs hear

Lots of children’s programming made for YouTube is “not entertainment, it’s sedation”, the UK children’s laureate has warned.Frank Cottrell-Boyce said “frictionless” programming in which children are “bombarded with information”, such as CoCoMelon, a YouTube Kids channel with 180 million subscribers, failed to offer the “stimulation and nourishment” that previous generations had enjoyed.Speaking to MPs in the opening evidence session of the culture, media and sport committee’s inquiry into children’s TV and video content, Cottrell-Boyce said research showed that for young children, “repetition is good because you’re building familiarity, and slowness is good because you’re making life navigable”.“I feel very privileged to have grown up in an era when lots of children’s television had those qualities,” he said.The fragmented media landscape meant that children today missed out on the sense of “national unity and national identity” that came with watching the same shows, he said

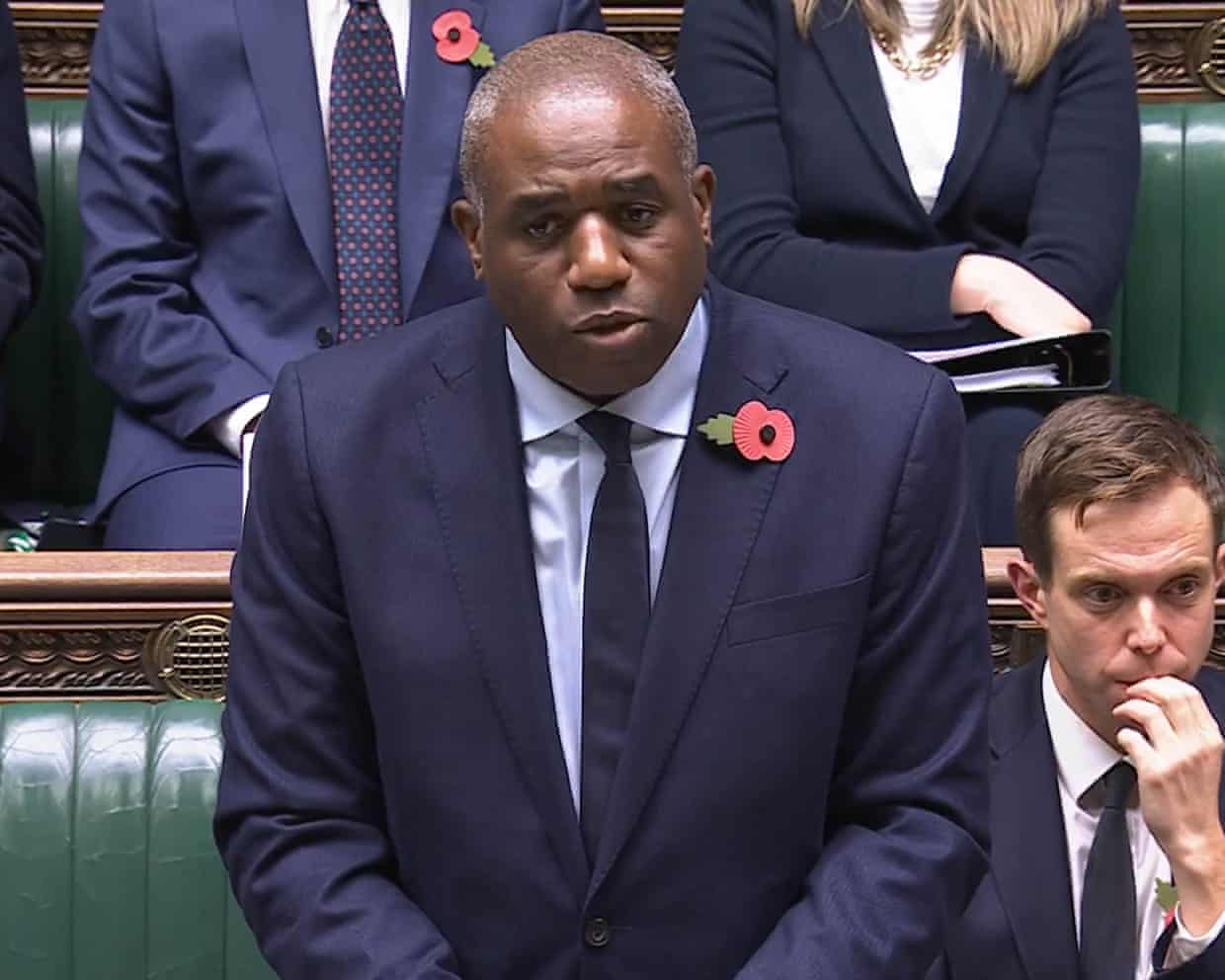

David Lammy says 91 prisoners freed in error in England and Wales since April

The justice secretary has revealed that 91 prisoners have been released by mistake in England and Wales since April, of whom as many four remain at large.David Lammy gave details in a Commons statement of three mistakenly released prisoners the police are trying to trace. He said the Prison Service was also investigating a fourth inmate released in error last Monday who may still be at large.The shadow justice secretary, Robert Jenrick, mocked Lammy for not knowing how many remain at large. “The justice secretary is so clueless, he’s literally lost track of how many prisoners he’s lost,” he told MPs

NHS trust fined £565,000 after woman killed herself on ‘death trap’ ward

A woman whose daughter killed herself on a “death trap” mental health ward in London has called for urgent change after an NHS trust was fined more than half a million pounds.Alice Figueiredo, 22, took her own life at Goodmayes hospital, Redbridge, after 18 similar attempts.Her death on 7 July 2015 followed a failure to remove plastic items from the communal toilets on Hepworth ward that had been used by her to self-harm, a court was told.On Tuesday, North East London NHS foundation trust (NELFT) was fined £565,000 plus £200,000 in costs after being found guilty of breaching health and safety.In setting the amount, Judge Richard Marks KC noted its finances were in an “absolutely parlous state” and a large fine could affect its services

UK 18- to 24-year-olds: we would like to hear your experiences of trying to find a job

Almost a million young people in the UK are not in education, employment or training (Neet).This week, the government announced the launch of an independent investigation into the issue, which Secretary of State for Work and Pensions, Pat McFadden has called a “crisis of opportunity”.He added: “We cannot afford to lose a generation of young people to a life on benefits, with no work prospects and not enough hope.”We would like to hear from 18- to 24-year-olds in the UK about their experiences of trying to find a job. How have you found it? Did you get a job? Or are you still looking for one? What would you like to see changed to help with finding employment? Tell us

Paperwork blunder by UK bookmaker reveals possible illegal offshore operation

The Gambling Commission has demanded a UK bookmaker hand over a trove of financial documents after the company accidentally disclosed information suggesting it may be running an illegal offshore betting operation.The Guardian understands that the company, which sponsors sporting events and boasts connections to high-profile figures in sport and politics, is the subject of early inquiries that could lead to a full-blown investigation.Sources said the company, which takes billions of pounds of bets from British punters every year, inadvertently alerted the Gambling Commission to potential wrongdoing during a routine disclosure of documents required by the regulator.The company mistakenly included documents indicating it had been transacting with entities based overseas, sources said. Details were written in white text on a white background but were spotted by staff at the regulator

Crime gangs in UK making weight-loss drugs with ‘sophisticated’ fake branding

Organised crime gangs have begun manufacturing their own branded weight-loss drugs, designed to look like legitimate medicines, in what authorities warn is a significant threat.The Medicines and Healthcare products Regulatory Agency (MHRA) said the trend had only just emerged, leading them to conduct the largest single seizure of trafficked weight-loss drugs ever recorded by any global law enforcement agency.Andy Morling, the head of the MHRA’s criminal enforcement unit, said that in the last few months it had seen a new model of production, “where criminals are putting investment into designing their own packaging and branding … and selling it purporting to be a genuine product”.He added: “That is an unusual model. [What they seized] looked like genuine medicines, but are entirely unlicensed and illegal to sell in the UK

Tech shares slide after SoftBank sells Nvidia stake; UK interest rate cut expected in December – as it happened

SoftBank sells stake in Nvidia for $5.8bn as it doubles down on OpenAI bets

John Tymukas obituary

ChatGPT violated copyright law by ‘learning’ from song lyrics, German court rules

Advantage England? Emma Raducanu gives tips to squad for All Blacks clash

England play Generation Game against All Blacks with overhaul of traditional order of selection | Robert Kitson