UK unemployment rises to 5%, the highest level in four years

The UK unemployment rate has risen by more than expected to reach its highest level in four years, fuelling expectations of a Bank of England interest rate cut after Rachel Reeves’s budget,With under three weeks to go before the chancellor’s tax and spending statement, figures from the Office for National Statistics (ONS) show the headline unemployment rate rose to 5,0% in the three months to the end of September, up from 4,8% in the previous quarter,City economists had forecast an increase to 4.

9%,Representing an increase in unemployment to 1,8 million, the official jobless rate was last higher in January 2021, during the height of the Covid pandemic,Suren Thiru, the economics director at the Institute of Chartered Accountants in England and Wales, said: “These figures suggest that the UK’s labour market is suffering from pre-budget jitters, as businesses already weakened by April’s rise in national insurance look to cut recruitment further in anticipation of another difficult budget,”Concerns over the strength of the jobs market prompted City investors to bet that the Bank would be more likely to cut interest rates at its next policy meeting in December.

The pound fell by 0.3% against the US dollar before recovering ground, while the odds of a post-budget cut in borrowing costs increased from about 60% to 75%.The FTSE hit a record high of 9,899, driven by hopes of the US government ending its 53-day shutdown and predictions that a cut in borrowing costs could bolster Britain’s economy.Threadneedle Street kept rates on hold last week, but opened the door to a cut as early as next month after signalling that inflation had peaked amid a slowdown in the economy.Reeves is expected to raise taxes in the budget on 26 November to plug a shortfall in the public finances of up to £30bn.

However, the chancellor has been warned that doing so could hit jobs and growth in a repeat of her first autumn budget.Business leaders have warned the chancellor’s £25bn rise in employer national insurance contributions and increase in the national living wage from April has led to job cuts and sapped hiring demand, hitting part-time employment and jobs in the hospitality, leisure and retail sectors in particular.Martin Beck, the chief economist at WPI Strategy, said: “The prospect of new tax rises in the upcoming budget poses further risks to employment, particularly if the chancellor again looks to raise taxes on businesses.But this time, Rachel Reeves is more likely to target earners rather than employers.”Ministers have grown increasingly alarmed over the jobs market slowdown – including a dramatic increase in youth unemployment, amid a jump in the number of young people who are not in employment, education or training (Neet) to almost 1 million, the highest level in a decade.

The government this week appointed the former Labour health secretary Alan Milburn to lead an independent review of the role of mental health issues and disability in youth unemployment.A separate review by the former boss of John Lewis, Charlie Mayfield, warned last week that young adults were one of the key cohorts affected by an “economic inactivity crisis” hitting Britain.Sign up to Business TodayGet set for the working day – we'll point you to all the business news and analysis you need every morningafter newsletter promotionThe Bank warned last week that unemployment could push further above 5% next year, in a development with potential to cool inflationary pressures by making it harder for workers to bargain for higher wages and for businesses to raise their prices.While the ONS’s figures are based on its widely criticised labour force survey, which has suffered from collapsing response rates, separate data suggests the jobs market has slowed sharply.Figures from HMRC published on Tuesday showed the number of workers on company payrolls fell by 180,000 in the year to October, and by 32,000 compared with September.

Job vacancies were broadly flat in the three months to October, but the figure was down by 99,000 from a year earlier.Over the past year, the biggest falls in payrolled employment were in the wholesale and retail, accommodation and food services, and IT sectors.Highlighting the worsening slowdown in the jobs market, annual growth in average weekly earnings dropped by more than expected to 4.8%.City economists had forecast an unchanged reading of 5%.

The secretary of state for work and pensions, Pat McFadden, said: “Over 329,000 more people have moved into work this year already, but today’s figures are exactly why we’re stepping up our plan to get Britain working.“We’ve introduced the most ambitious employment reforms in a generation to modernise job centres, expand youth hubs and tackle ill-health through stronger partnerships with employers.”

Rising unemployment could affect budget, interest rates, pay and more

There are significant implications from the latest unemployment figures showing a rise from 4.8% in August to 5.0% in September, not least for the 1.8 million people it directly affects.Rachel Reeves will be mulling over how to avoid depressing the economy and putting even more people out of work while raising tens of billions of pounds in extra tax in her upcoming budget

Wessex Water must pay £11m over wastewater failures, says regulator

Wessex Water has been ordered to pay £11m over wastewater failures and told to spend it on improvements to reduce sewage spills and other measures.Ofwat, the industry regulator for England and Wales, said that Wessex Water and its shareholders would fund a total enforcement package of £11m, none of which will be paid for by customers through bills.The watchdog found that Wessex Water failed to operate, maintain and upgrade its wastewater network adequately to ensure that it could cope with the flows of sewage and wastewater.The company, which this year increased its bills by an average of 20%, or £113, serves households across Bristol, Dorset and Somerset, as well as most of Wiltshire and parts of Gloucestershire and Hampshire.The measures Wessex Water has been ordered to take include helping private landowners to seal their sewer pipes, reducing spills at specific storm overflows by bringing forward investment, installing additional monitoring equipment and helping customers to sustainably manage rainwater at their properties

Nexperia row shows how China is weaponising EU relationship - and winning

As interventions go it was pretty audacious. The Dutch government decision at the end of September to take over Nexperia, a Chinese-owned chip factory, almost brought the entire European car industry to a halt.Tensions between Europe and China de-escalated over the weekend as Beijing confirmed it would ease restrictions on automotive chip supplies to the EU, prompting sighs of relief in car factories around the world.But it has only intensified the questions about the EU’s asymmetric relationship with China, with many in industry, diplomacy and governments asking if Europe is no longer collateral damage in the wider Sino-American political war but a target in itself.“We can buy a bit of time, but there is a sense that we are entering into a situation where we are going to be dealing with rolling crises from now on and that things have really crossed a threshold with China,” said Andrew Small, a senior fellow at the German Marshall Fund thinktank and former China adviser within the European Commission

UK retail sales growth slows as shoppers await Black Friday and budget

Retailers suffered the slowest sales growth since May last month as shoppers were cautious in the run-up to expected budget tax rises and held out for Black Friday discounts.Sales rose 1.6% in October, a step down from 2.3% the month before, according to the latest figures from the British Retail Consortium (BRC) trade body and the advisory group KPMG.Food sales growth posted the biggest slowdown, by 0

Can ex-Tesco boss Drastic Dave refresh the fortunes of drinks giant Diageo?

On landing a new job, nothing puts a spring in the step like knowing that news of your appointment has inflated the stock market value of your employer by more than £2bn.Dave Lewis could be forgiven for keeping that confidence-boosting figure front of mind as he faces up to the challenge of reviving Diageo.The London-based alcoholic drinks business runs a sprawling global empire upon which the sun never sets but whose glory has been on the wane.News that Diageo had not only ended an uncomfortably long four-month recruitment drive – but had sent for the man widely credited with saving Tesco – boosted the misfiring booze group’s shares by as much as 7% on Monday.When Lewis formally starts work in earnest, on 1 January, many customers will be recovering from an overindulgence in Diageo brands such as Johnnie Walker and Guinness

Troubled drinks giant Diageo names former Tesco boss to lead turnaround push

The executive credited with steering Tesco out of the worst financial crisis in its history has been handed the top job at the struggling Guinness maker Diageo.On 1 January, Sir Dave Lewis will become chief executive of the FTSE 100 drinks company, whose shares have fallen by a third this year.Lewis ran Tesco from 2014 to 2020 and previously spent nearly three decades at the Marmite maker Unilever. He revived Britain’s biggest supermarket chain after revealing an accounting scandal, which threatened the future of the business.His appointment marks a significant coup for the drinks maker, which owns more than 200 brands including Johnnie Walker whisky, Smirnoff vodka, Baileys Irish Cream and Don Julio tequila

Judy Bell obituary

Cowboys owner Jerry Jones speaks of grief over death of ‘unique’ Marshawn Kneeland at 24

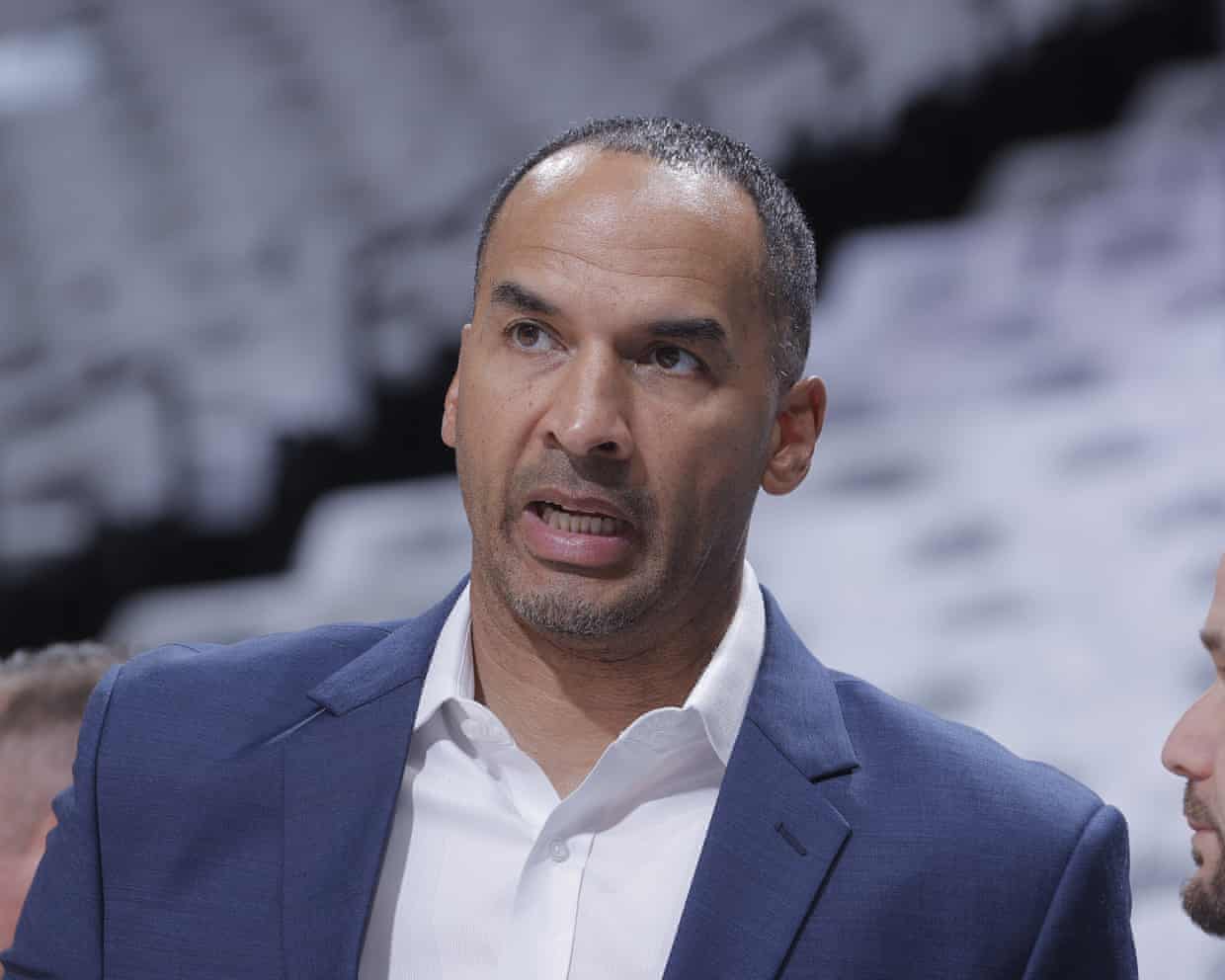

Dallas Mavericks fire GM Nico Harrison nine months after Luka Dončić trade

Carlos Alcaraz battles back to beat Taylor Fritz: ATP Finals tennis – as it happened

The remarkable story of the 1879 Sydney riot that set the tone for 150 years of Ashes rivalry

Trescothick defends England’s Ashes buildup and shrugs off hypocrisy jibes