UK gets record demand at government debt auction; FTSE 100 index has 10,000-point mark in sight – business live

Britain has not lost the support of the bond markets, despite the turmoil in Westminster and uncertainty over this month’s budget.A new auction of inflation-linked UK debt, which matures in 2038, has attracted record demand from investors keen to buy the bonds.According to Reuters, demand for the UK debt broke the previous record.They say:Orders for the 1.75% September 2038 inflation-linked bond topped £69bn, a bookrunner said, beating a previous record of £67.

5bn for an index-linked gilt sold via syndication in March.The bond was priced to give a yield 10.5 basis points above that of the 1.125% index-linked gilt due in 2037.A large number of orders is usually good news for a bond issuer, who will choose the most attractively-priced offers.

Index-linked bonds protect investors from the rising cost of living, because both the coupon payments (interest on the debt) and the principal payments (the amount actually borrowed, which is repaid when the bond matures) rises or falls in line with inflation,This strong demand is a sign that the Westminster furore over a possible leadership challenge to Keir Starmer, now denied by health secretary Wes Streeting, has not prompted bond investors to shun UK debt,As flagged earlier, the price of UK government bonds has dropped today, pushing up the implied cost of borrowing,But while UK gilts are lagging behind other government debt today, the moves are modest,Could that be a sign that the bond markets are sanguine about the possibility of defenestation on Downing Street?Kathleen Brooks, research director at XTB, says:UK bond yields are marginally higher on the back of this political chaos, the 10-year yield is higher by 2.

7bps, and the 2-year yield is higher by 1.7bps.This is a small move and does not compare with the bond market tantrum in the summer when rumours circled that Rachel Reeves would be sacked.The bond yield spike back in July helped Reeves keep her job, the question now is, will a mild reaction to the prospect of Kier Starmer being overthrown as PM embolden his potential successors?Reeves and Starmer’s swing to the left on public spending and tax rises has been well absorbed by the bond market so far, since a tax increase could build a structural budget surplus for the UK, even if there is a hit to growth.Ironically, this could make Reeves’ and Starmer’s jobs less secure, as the political chaos threatens the UK once again.

Artificial intelligence firm Anthropic has announced it will spend $50bn constructing its US artificial intelligence infrastructure.The plan will begin with custom data centers in Texas and New York.Additional sites are expected to follow, with the first locations going live in 2026.The project is expected to create 800 permanent jobs and more than 2,000 construction roles.The UK’s FTSE 100 index is having an afternoon rally, and just hit a new record high of 9930 points.

The share index is defying expectations that mounting fiscal headwinds and a cautious November Budget would dampen investor enthusiasm, says Axel Rudolph, senior technical analyst at IG, adding:This surprising strength comes despite widespread unease over the UK government’s next round of fiscal tightening, including potential tax rises designed to close the budget gap,Rather than faltering under these pressures, the index has surged, supported by a confluence of global and domestic forces and Bank of England (BoE) rate cut expectations following this week’s dismal employment data,Unemployment rising to a 4-year high of 5% has reinforced expectations for monetary policy easing, making the UK’s blue-chip benchmark an unlikely outperformer,Wall Street has opened higher, with optimism over the imminent reopening of the US government driving stocks to record levels,The Dow Jones industrial average has hit a record high, gaining 87.

8 points, or 0,18%, at the open to 48,015,79,The broader S&P 500 index is up 0,3% and the tech-focused Nasdaq is 0.

4% higher.Chipmaker AMD is leading the rally, up over 8%, which should please CEO Lisa Su – who just rang the Nasdaq opening bell.US Treasury Secretary Scott Bessent has revealed that the Trump administration is planning “substantial announcements” to bring down imported food prices shortly.With pressure mounting about the US affordability crisis, Bessent told Fox News:It’s tough to do a lot of specific things, but i can tell you you’re going to see some substantial announcements over the next couple of days in terms of things we don’t grow here in the United States.Coffee being one of them, bananas, other fruits, things like that.

That will bring the prices down very quickly.Bessent also said the Trump White House had inherited one of the worst affordability crises in America’s history – neglecting to mention that the president’s tariffs have pushed up the cost of imported goods from other countries.He also argues that Trump will deliver real wages increases, by bringing back high-paying manufacturing jobs.Over in Berlin, chancellor Friedrich Merz’s advisers have cut their forecast for growth next year to below 1%.And despite Merz’s pledge to revive the economy, they only expect modest growth this year.

The German Council of Economic Experts lowered their forecast for growth in 2026 to 0.9% from 1.0% in their earlier May report, arguing that a spending boost rolled out by Merz’s government will only have a small impact on growth.The council’s chair, Monika Schnitzer, said:“In light of current challenges, Germany must develop new perspectives for growth and security policy.“The opportunities arising from the special fund for infrastructure and climate neutrality must not be squandered.

”Shares in UK housebuilders have dropped today after Taylor Wimpey reported a pre-budget slowdown in sales (see earlier post).Taylor Wimpey is one of the top fallers on the FTSE 250 index of medium-sized company shares, down 3.4% today.Berkeley Group are down 2%, and property portfolio Rightmove has lost 1.6%.

AJ Bell investment director Russ Mould says:“The Budget must surely now be rivalling the Boogeyman as the thing beginning with B which engenders the most fear.Housebuilder Taylor Wimpey is the latest company to bemoan the impact the run up to this fiscal event is having on trading.A double-digit drop in sales rates in the key autumn period is worse than that reported by rival Barratt Redrow recently, which may raise some questions among investors.“House prices are proving reasonably resilient, supported by strong underlying supply and demand dynamics, but build costs are continuing to creep up which could put pressure on margins.“For now, Taylor Wimpey is sticking with its full-year guidance for completions and operating profit.

The US government shutdown doesn’t seem to have dented demand for mortgages.Mortgage applications to purchase a home rose 6% last week to their strongest pace since September, according to the Mortgage Bankers Association’s seasonally adjusted index.Volume was 31% higher than the same week one year ago, new MBA data shows.Although the FTSE 100 has now dippped back from its latest record high, European stock markets have reached new peaks.The pan-European Stoxx 600 index has gained 0.

6% today, led by Germany’s DAX (+1,1%) and France’s CAC 40 (+1,15%),Financial stocks are leading the rally, as investors welcome a potential end to the historic US government shutdown,A rise in bond yields and/or sterling’s fall should not come as a surprise following the latest “political” instability, Professor Costas Milas of the University of Liverpool’s Management School tells us:Rachel Reeves often talks about the importance of “low” bond yields but yields rise or fall minute by minute.

The hard evidence of how unimpressed investors have become is elsewhere.The latest OECD data on Foreign Direct Investment (FDI) inflows to the UK are concerning (Table 1 here).FDI inflows do matter because they represent a measure of long-term commitment of international investors in our economy.Since Labour came into power, FDI inflows have been extremely volatile.They turned extremely negative (-$25,314mn) in late 2024 before recovering their losses in early 2025 and then losing some of their steam again in mid-2025 (+$7,255 mn).

These are concerning times for Reeves (and Starmer).Britain has not lost the support of the bond markets, despite the turmoil in Westminster and uncertainty over this month’s budget.A new auction of inflation-linked UK debt, which matures in 2038, has attracted record demand from investors keen to buy the bonds.According to Reuters, demand for the UK debt broke the previous record.They say:Orders for the 1.

75% September 2038 inflation-linked bond topped £69bn, a bookrunner said, beating a previous record of £67,5bn for an index-linked gilt sold via syndication in March,The bond was priced to give a yield 10,5 basis points above that of the 1,125% index-linked gilt due in 2037.

A large number of orders is usually good news for a bond issuer, who will choose the most attractively-priced offers,Index-linked bonds protect investors from the rising cost of living, because both the coupon payments (interest on the debt) and the principal payments (the amount actually borrowed, which is repaid when the bond matures) rises or falls in line with inflation,This strong demand is a sign that the Westminster furore over a possible leadership challenge to Keir Starmer, now denied by health secretary Wes Streeting, has not prompted bond investors to shun UK debt,As flagged earlier, the price of UK government bonds has dropped today, pushing up the implied cost of borrowing,But while UK gilts are lagging behind other government debt today, the moves are modest.

Could that be a sign that the bond markets are sanguine about the possibility of defenestation on Downing Street?Kathleen Brooks, research director at XTB, says:UK bond yields are marginally higher on the back of this political chaos, the 10-year yield is higher by 2.7bps, and the 2-year yield is higher by 1.7bps.This is a small move and does not compare with the bond market tantrum in the summer when rumours circled that Rachel Reeves would be sacked.The bond yield spike back in July helped Reeves keep her job, the question now is, will a mild reaction to the prospect of Kier Starmer being overthrown as PM embolden his potential successors?Reeves and Starmer’s swing to the left on public spending and tax rises has been well absorbed by the bond market so far, since a tax increase could build a structural budget surplus for the UK, even if there is a hit to growth.

Ironically, this could make Reeves’ and Starmer’s jobs less secure, as the political chaos threatens the UK once again.

Housebuilder Taylor Wimpey hit by sales fall amid budget uncertainty

The British housebuilder Taylor Wimpey has reported a drop in sales in the key autumn period, blaming uncertainty in the run-up to this month’s budget for potential buyers holding back purchases.The company, the latest home construction business to report softer sales growth, reported that its weekly average for the number of private sales per site fell 11% to 0.63 between 30 June and 9 November compared with 0.71 in the same period last year.“Market conditions remain challenging, impacted by uncertainty ahead of the upcoming UK budget and continued affordability pressures,” said Jennie Daly, its chief executive

Menulog closing in Australia, affecting thousands of delivery drivers and 120 employees

Menulog is closing its Australian operations, becoming the latest casualty in the competitive delivery service app sector that will affect thousands of delivery riders, as well as about 120 direct employees.The owner, Dutch multinational Just Eat Takeaway.com, announced on Wednesday that the Australian-founded service will no longer take orders from 26 November.“While Menulog has a proud 20 year history, it has been navigating challenging circumstances,” the company said.The Transport Workers’ Union national secretary, Michael Kaine, said the closure would come as a “shock to the thousands of food delivery riders who rely on Menulog for income”

John Tymukas obituary

My brother-in-law John Tymukas, who has died aged 73, was a structural engineer on many of London’s infrastructure projects from the 1990s onwards, including Canning Town station, Heathrow Terminal 5, Glaxo Smithkline HQ and Crossrail Bond Street.Born in Adelaide, South Australia, John was the son of Kostas, a Lithuanian refugee and engineer, and Kathleen (nee Donohoe), the daughter of Irish emigrants and a former clerk. He was the eldest of six siblings. John completed his education in Brisbane at Downlands school and the Queensland Institute of Technology, where he took a four-year engineering degree course and worked in Australia before heading in 1990 to London to work on contracts with engineering companies such as SKB and WSP.An avid traveller, he covered Europe extensively, making contact with Lithuanian and Irish family members and discovering family history unknown in Australia until he made the links

ChatGPT violated copyright law by ‘learning’ from song lyrics, German court rules

A court in Munich has ruled that OpenAI’s chatbot ChatGPT violated German copyright laws by using hits from top-selling musicians to train its language models in what creative industry advocates described as a landmark European ruling.The Munich regional court sided in favour of Germany’s music rights society GEMA, which said ChatGPT had harvested protected lyrics by popular artists to “learn” from them.The collecting society GEMA, which manages the rights of composers, lyricists and music publishers and has approximately 100,000 members, filed the case against OpenAI in November 2024.The lawsuit was seen as a key European test case in a campaign to stop AI scraping of creative output. OpenAI can appeal against the decision

British & Irish Lions plan ban on R360 players to stop Red Roses jumping ship

The British & Irish Lions are planning to follow the example of the biggest unions by banning players who join R360 in a move designed primarily to prevent an exodus of England’s Red Roses stars to the rebel league.Eight of the 12 tier-one unions, led by England and New Zealand, announced last month that they would not select R360 players, and the Guardian has learned that the Lions will follow suit. Ireland, Scotland, France, Italy, New Zealand, Australia and South Africa also came out in support of a ban, but Wales and Argentina did not due to smaller player pools and weaker domestic leagues.A number of England’s World Cup winners are leading targets for R360, with the full-back Ellie Kildunne saying last month that she is “open to anything”. With the next tournament four years away, there are concerns at the Rugby Football Union in particular that salaries of up to £270,000 in the franchise competition will be too good to turn down, despite the prospect of an international ban

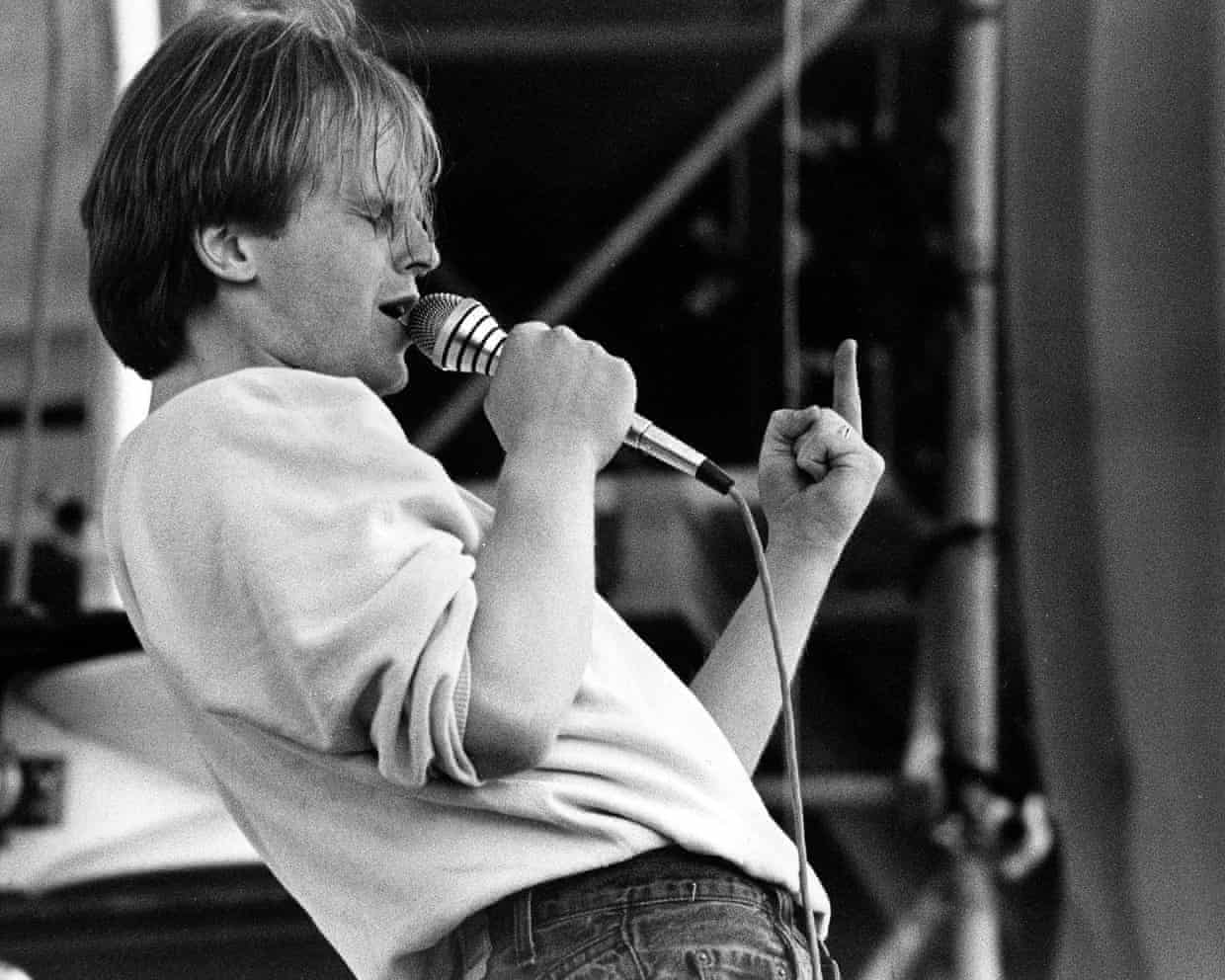

Susie Wolff: ‘I can be very punchy and pragmatic. If I have to fight for something, I’ll fight’

Head of F1 Academy explains how close she came to a grand prix debut, her quest to produce female drivers and a frightening knock on her hotel room door by a powerful man in the sport“There was a deep loneliness to karting, and then definitely in single-seaters, because no one else was going through the same thing as me,” says Susie Wolff as she remembers her long struggle in motorsport, from racing as a teenager against Lewis Hamilton and Nico Rosberg to her determined, but unfulfilled, quest to become a Formula One driver.“After the whole #MeToo movement, we forget what it was like before. But the way I heard boys talking about girls in the paddock made me think I never want to be spoken about in that way. I realised I’d have to be whiter than white to get through it unscathed.”The 42-year-old says: “I couldn’t open up to anyone until I met [her husband] Toto

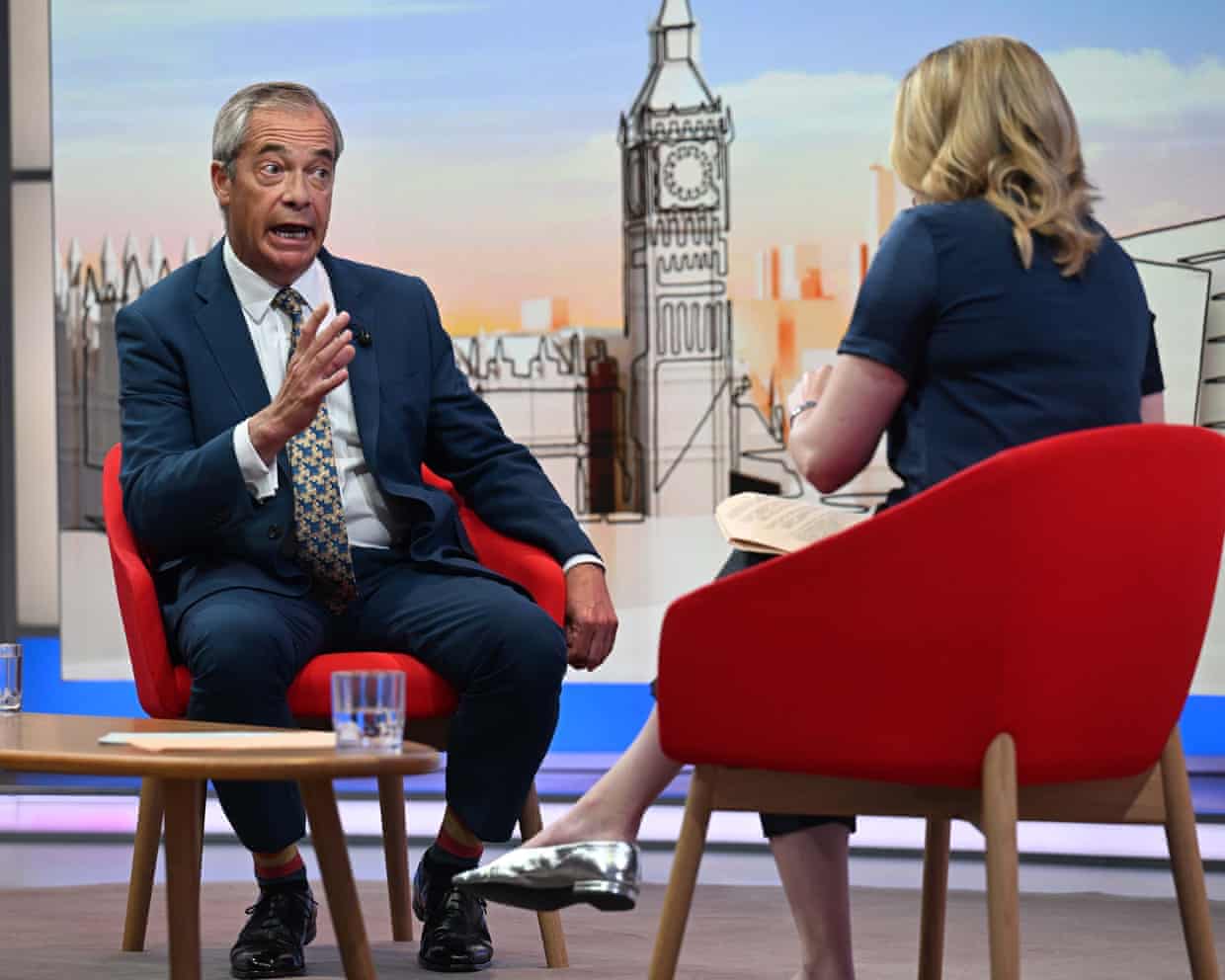

Reform UK pulls out of BBC film amid Trump speech edit row

Thin majorities and chaotic strategy push Labour MPs toward regime change

Starmer allies issue warning to PM’s rivals as fears grow over leadership challenge

Nandy rules out taking action to remove Robbie Gibb from BBC board – as it happened

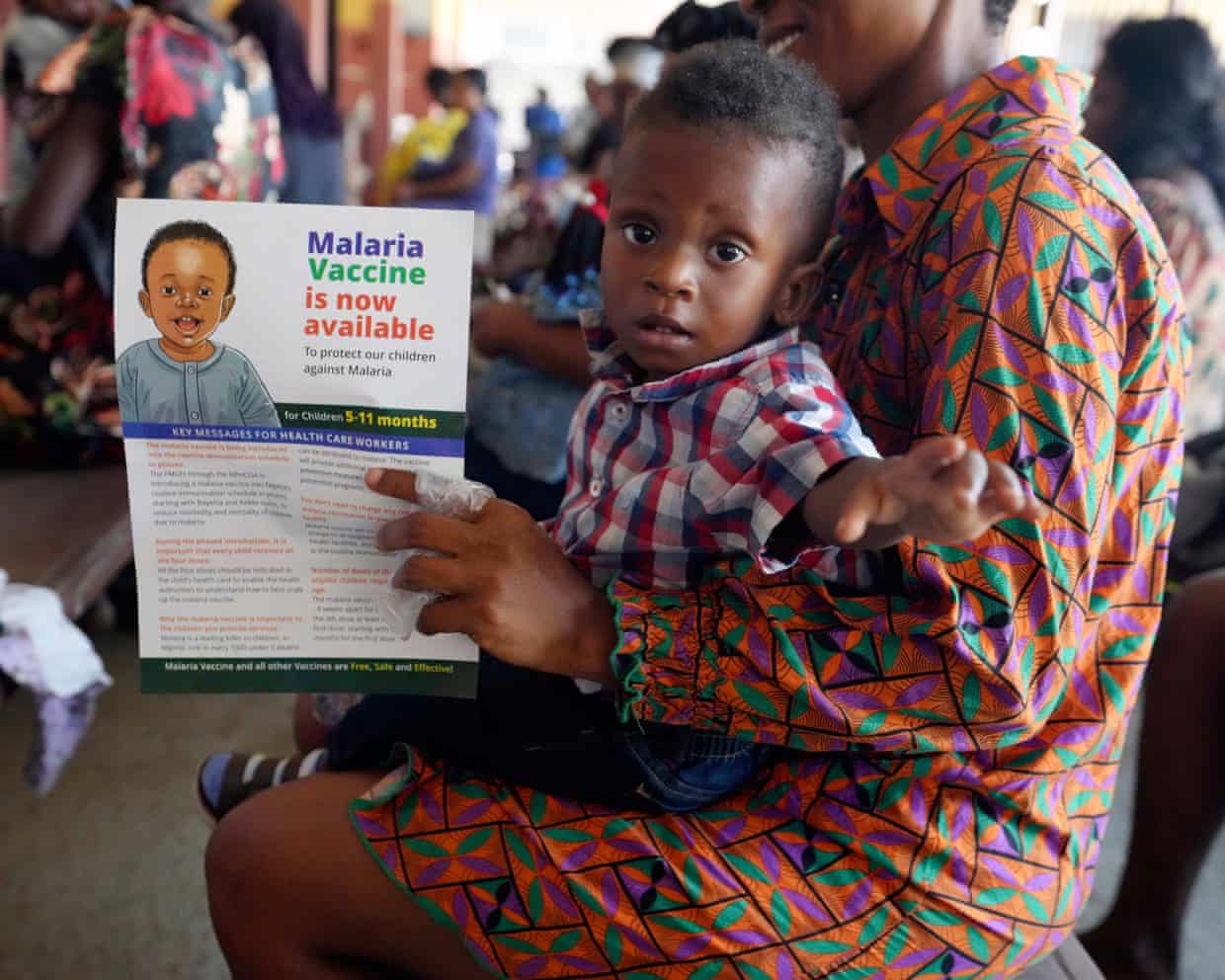

UK cuts contribution to Aids, tuberculosis and malaria fund by £150m

Racism returning to UK politics – and people are very scared, says Starmer