Bank of England defends OBR’s independence against political attacks; UK banks pass stress tests – business live

Having resisted two invitations to comment on the Office for Budget Responsibility, Bank of England governor Andrew Bailey can’t resist swishing at the third (has he been watching England batting in Australia?)Q: You have commented on political attacks on the Federal Reserve before, so are the political attacks on the Office for Budget Responsibility dangerous?Bailey reminds today’s press conference that there are good reasons why the Office for Budget Responsibility was created by George Osborne in 2010, telling reporters:The reason the OBR was created was to ensure there was a source of independent forecasting and an independent assessment of fiscal policy.That’s important, it’s important in many countries.Britain’s not unique… there’s nothing unusual about this absolutely core principle.So where attacks on the OBR are concerned, Bailey says we should “please remember why it was done and the principles underlying it”.However, it’s not for the Bank to get involved in “the day-to-day affairs of that”, he adds.

Away from the Bank of England, the OECD has forecast that the UK will be the third-fastest growing member of the G7 next year,In a new report, the Paris-based thinktank has warned Rachel Reeves that tight government spending and higher taxes will restrict consumer expenditure,The OECD predicts the UK economy will grow by 1,2% in 2026, faster than France, Germany, Italy and Japan, but slower than the US (1,7%) and Canada (+1.

3%).More here:Q: Is there a risk that more retail investors are lured into the stock market, and then the AI bubble bursts?Andrew Bailey says the UK needs more investment in the real economy, that’s why pension reforms are important.Andrew Bailey declines to comment on whether last week’s budget would boost UK growth.He says artificial intelligence is likely to be the next technology to spur productivity growth.But its vital that the UK has an environment of policies where we can support growth,, he says:If we don’t raise the potential growth rate, and thus the actual growth rate of the economy, the whole policy context is much more difficult.

As we’re seeing, the choices are much more difficult to make.So we have, all of us, to be absolutely focused on raising the growth rate.Another line from the Bank of England press conference: it is paying close attention to dollar funding gaps at banks.Governor Andrew Bailey told reporters in London said dollar supervision had improved since the global financial crisis but the central bank had to “watch that very carefully”.He said:“We do spend a lot of time in the Bank of England looking at.

..what would be the context or a stress in those markets, and how would they feed through into our system, and what access might we need to dollars as a system.”Q: You say cyber attacks are danger to financial stability – are you concerned that many British businesses aren’t ready?Andrew Bailey replies that “sadly” cyber has risen “right to the top” of the league table of risks since the financial crisis.It’s a problem that never goes away, he adds:“You can’t mitigate cyber-risk in a way that takes it off the table”.

There is evidence that the impact of these attacks are building, Bailey continues, so the Bank is working with financial firms to help them keep protected.Q: There were big swings in gilt yields ahead of the budget.Were markets reacting to the pre-budget speculation, some of which was incorrect?The budget is a market-sensitive event, that’s a statement of the obvious, Andrew Bailey replies.But he won’t comment on the budget process.Q: Do you agree that budget speculation dampened growth in September, as ex-Bank of England economist Andy Haldane has warned?Bailey says there was a lot of expectation about what was going to be in the budget – due to its general significance, rather than what was said on any particular day.

Businesses now know what’s in the budget, so can plan on that basis.Having resisted two invitations to comment on the Office for Budget Responsibility, Bank of England governor Andrew Bailey can’t resist swishing at the third (has he been watching England batting in Australia?)Q: You have commented on political attacks on the Federal Reserve before, so are the political attacks on the Office for Budget Responsibility dangerous?Bailey reminds today’s press conference that there are good reasons why the Office for Budget Responsibility was created by George Osborne in 2010, telling reporters:The reason the OBR was created was to ensure there was a source of independent forecasting and an independent assessment of fiscal policy.That’s important, it’s important in many countries.Britain’s not unique… there’s nothing unusual about this absolutely core principle.So where attacks on the OBR are concerned, Bailey says we should “please remember why it was done and the principles underlying it”.

However, it’s not for the Bank to get involved in “the day-to-day affairs of that”, he adds,Q: Have tensions between the Treasury and the Office for Budget Responsibility over its forecasts undermined faith in economic policymaking?And are attacks on independent institutions such as the OBR dangerous?Bailey refuses to engage, again, with this issue, saying it’s “not appropriate at all” for the Bank to comment on the position of the OBR or the Treasury,Q: You say that financial risks are increasing, so isn’t this the worst time to be loosening bank’s capital ratios?Andrew Bailey says the question of timing is important, pointing to the stress tests results (which showed banks were resilient),He adds:We’ve been through some very, very substantial economic shocks in recent years, and the banking sector has come through those robustly,So it is ‘perfectly sensible and responsible’ to come to today’s conclusions (the decision to reduce the amount of capital lenders must hold in reserve).

Q: Various other measures brought in after the 2008 crisis, such as bankers’ bonus rules, are also been pared back – did regulators go to far after the crisis?Bailey denies that the Bank ‘overdid it’ in its post-crisis mode, insisting that all its measures were sensible.He adds:We learn from experience..that’s why we feel comfortable making these changes.Q: Does the Bank of England agree that the leaks ahead of last week’s budget were to be “deplored”, as the Office for Budget Responsibility said yesterday.

Were you alarmed by the OBR leak and the heavy briefing by the Treasury which apparently moved the markets – should there be an inquiry?Andrew Bailey refuses to comment on this, as the Bank isn’t involved.Q: Has the Bank taken measures to avoid its own reports being accidentally leaked early?Protecting market sensitive information is very important, he replies.That’s why the Bank confined reporters in a windowless room at a very early hour this morning, he adds, so they could see information before it was officially released.Bailey says the Bank looked ‘very carefully’ at yesterday’s report into the OBR’s blunder, to see what it could learn about releasing information.The Bank uses “different procedures” when releasing information, Bailey says, adding:We always seek to learn from these events and we are looking at it very carefully to see if there’s anything there we should be aware of, and act if necessary.

Q: Is there anything the Bank of England can do to address concerns about hedge fund trading in the UK bond market, beyond warning it’s a worry? (see earlier post),Andrew Bailey says the Bank is recommending strengthening the ‘infrastructure’ in the gilt market,He adds that changes in the UK gilt market aren’t unusual, compared to other government bond markets, and the Bank is monitoring it “very closely”,Q: Has the Bank compromised its independence by caving into Rachel Reeves’s demands to support growth, my colleague Kalyeena Makortoff asks,BoE governor Andrew Bailey says it is “perfectly reasonable” for the Treasury and chancellor to set out how they see the Bank’s remit [in November 2024, Reeves wrote to the Bank urging it to ensure the financial system is supporting economic growth].

Bailey repeats that financial stability is a pre-condition for growth.But, it does think its changes are consistent with that – it isn’t efficient to hold more capital than needed (when it could be used in the real economy).Q: Do you reserve the right to reverse this capital cut before it comes in, in 2027, if there is a downturn?Bailey says the Bank will continue to conduct stress tests, every two years for the banks.So it will “obviously” be heavily influenced by what happens, and what those stress tests show.The Bank of England are now fielding questions from the press – and the first homes in on today’s decision to ease capital rules for high street banks for the first time in a decade.

Q: Are today’s cuts to bank capital ratios sowing the seeds for the next financial crisis?Governor Andrew Bailey says the decision was taken in the light of the evolution of the banking system, and the economic conditions today,He insists it is a “sensible reflection of conditions”, and also “a sensible reflection of the health of the banking system”,Playing down concerns about the decision, Bailey says:“I don’t have any concerns about this in terms of where it takes the regulatory system to,I think it’s a sensible thing do to,”Q: Can you stop the banks simply using this cut to boost their dividends?Bailey says it’s not up to the Bank of England to tell banks how to run their busineses.

But there is a “two-way” relationship here, he adds: if the banks support the economy by lending, that will strengthen the economy, and the banks will benefit.

Bank of England defends OBR’s independence against political attacks; UK banks pass stress tests – business live

Having resisted two invitations to comment on the Office for Budget Responsibility, Bank of England governor Andrew Bailey can’t resist swishing at the third (has he been watching England batting in Australia?)Q: You have commented on political attacks on the Federal Reserve before, so are the political attacks on the Office for Budget Responsibility dangerous?Bailey reminds today’s press conference that there are good reasons why the Office for Budget Responsibility was created by George Osborne in 2010, telling reporters:The reason the OBR was created was to ensure there was a source of independent forecasting and an independent assessment of fiscal policy.That’s important, it’s important in many countries. Britain’s not unique… there’s nothing unusual about this absolutely core principle.So where attacks on the OBR are concerned, Bailey says we should “please remember why it was done and the principles underlying it”.However, it’s not for the Bank to get involved in “the day-to-day affairs of that”, he adds

OBR complained to Treasury before budget about leaks spreading ‘misconceptions’

The Office for Budget Responsibility complained to senior Treasury officials in the run-up to the budget about a flurry of leaks that it said spread “misconceptions” about its forecasts, it has emerged.Prof David Miles of the OBR’s budget responsibility committee told MPs on the Treasury select committee on Tuesday that the watchdog had raised the issue of leaks with the department before the chancellor’s statement last week.“I think it was clear that there was lots of information appearing in the press which perhaps wouldn’t normally be out there and that this wasn’t from our point of view particularly helpful,” he said.He added: “We made it clear that they were not helpful and that we weren’t in a position of course to put them right.”Miles was appearing before the committee after the OBR chair, Richard Hughes, resigned on Monday, taking responsibility for the inadvertent release of its budget documents about an hour before Rachel Reeves stood up to announce her tax and spending plans

Age of the ‘scam state’: how an illicit, multibillion-dollar industry has taken root in south-east Asia

For days before the explosions began, the business park had been emptying out. When the bombs went off, they took down empty office blocks and demolished echoing, multi-cuisine food halls. Dynamite toppled a four-storey hospital, silent karaoke complexes, deserted gyms and dorm rooms.So came the end of KK Park, one of south-east Asia’s most infamous “scam centres”, press releases from Myanmar’s junta declared. The facility had held tens of thousands of people, forced to relentlessly defraud people around the world

Siri-us setback: Apple’s AI chief steps down as company lags behind rivals

Apple’s head of artificial intelligence, John Giannandrea, is stepping down from the company. The move comes as the Silicon Valley giant has lagged behind its competitors in rolling out generative AI features, in particular its voice assistant Siri. Apple made the announcement on Monday, thanking Giannandrea for his seven-year tenure at the company.Tim Cook, Apple’s CEO, said his fellow executive helped the company “in building and advancing our AI work” and allowing Apple to “continue to innovate”. Giannandrea will be replaced by longtime AI researcher Amar Subramanya

The Breakdown | Thirty years of Champions Cup has given us the beastly, beautiful and bizarre

Bloodgate, the ‘Hand of Back’ and a drop goal off ‘someone’s arse’ are among the tournament’s delightful eccentricitiesOn the eve of a new Champions Cup season it is worth remembering when and where it all began. The answer is 30 years ago on the shores of the Black Sea where Farul Constanta of Romania hosted France’s mighty Toulouse in the opening pool game of the old Heineken Cup on 31 October 1995.Let’s just say they were different times. The match was played on a Tuesday and, while the crowd was recorded as 3,000, eyewitnesses were focused on the large number of security personnel with barking Alsatian dogs straining at the leash. Toulouse, boasting an array of internationals including Émile Ntamack and Thomas Castaignède, duly registered eight tries and won 54-10

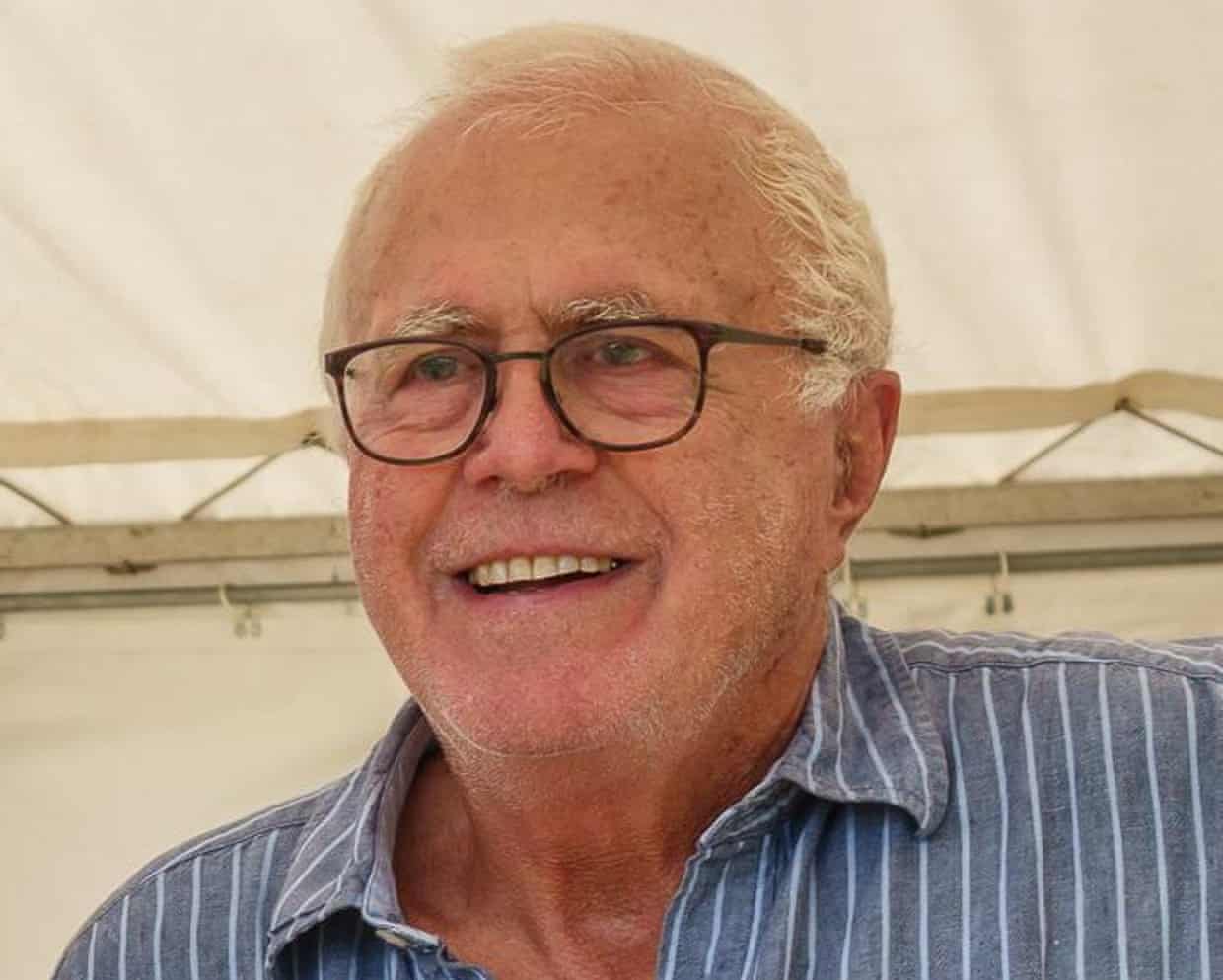

Robin Smith, former England cricketer, dies aged 62

The former England cricketer Robin Smith has died at the age of 62 with his family and former county Hampshire saying they were devastated by his loss.Smith played 62 Tests and 71 one-day internationals for England between 1988 and 1996 and was a resolute middle-order bulwark for the side during often difficult times for the team. He particularly excelled against pace, making his highest Test score of 175 against the fearsome West Indies attack at Antigua in 1994.He made 4,236 Test runs overall at an average of 43.67, including nine centuries

England abandon all-out pace attack with recall of Will Jacks for second Ashes Test in Brisbane

Win in Abu Dhabi and hope for carnage: how Oscar Piastri can still win the F1 world title

Max Verstappen prepared to ‘maximise everything’ in F1 season-deciding finale

Eben Etzebeth to appear at hearing after red card for alleged eye-gouging

Peter Wright obituary

Fuzzy Zoeller obituary