UK exports to US hit lowest level since January 2022 as tariffs bite, and economy shrinks – as it happened

UK exports to the US have fallen to their lowest level since January 2022, as Donald Trump’s trade war has hit demand for British goods.New trade data from the Office for National Statistics this morning shows that the value of UK exports to the US, including precious metals, fell by £500m or 11.4% in September.The ONS says:The value of goods exports to the United States in September 2025 were at their lowest level since January 2022 and have remained relatively low since the introduction of tariffs in April.This drop in trade comes despite the deal agreed by Donald Trump and Keir Starmer this summer, under which the UK aerospace sector faces no tariffs at all from the US, while the auto industry now has 10% tariffs, down from 25%.

This article includes content hosted on ons,gov,uk,We ask for your permission before anything is loaded, as the provider may be using cookies and other technologies,To view this content, click 'Allow and continue'.

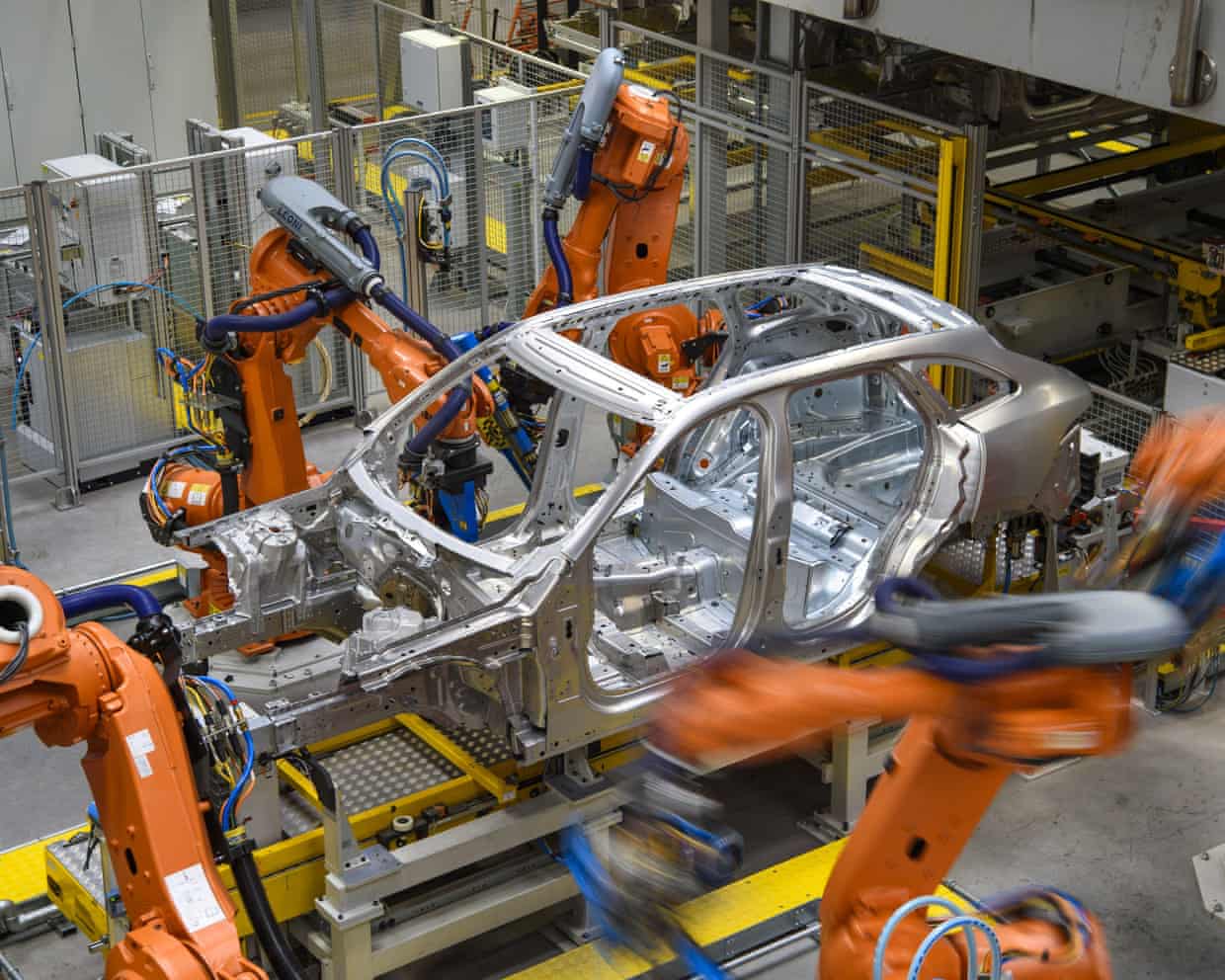

More generally, the 10% baseline tariff implemented by the Trump administration remains on most UK goods, which is lower than the reciprocal tariffs applied to imports from other countries,The trade report shows that exports of UK chemicals to the US fell by £300m, while exports of machinery and transport equipment fell by £100m – partly due to the Jaguar Land Rover cyber attack which froze its operations for the month,More broadly, total UK goods exports fell by £1,7 billion or 5,5% in September, with a decrease in exports to both EU and non-EU countries.

This pushed the UK’s trade in goods deficit wider – it increased by £3.0bn to £59.6bn in the third quarter of the year.And finally, here’s our analysis on today’s GDP report:Rachel Reeves’s autumn budget is not simple: Britain’s economy is misfiring and things need turning around fast.Yet a fiscal consolidation on the scale the chancellor is expected to require could push in exactly the opposite direction.

The latest figures from the economy are hardly encouraging.Growth slowed from 0.3% in the second quarter to just 0.1% in the third, driven down in part by the cyber-attack on Jaguar Land Rover.It is a potential doom loop scenario.

Stronger public finances require a stronger economy.Yet large tax rises and spending cuts on 26 November could further squeeze activity amid an already weak growth outlook.In the City, this has bond market investors worried.Yet so too does a budget that would not fully cover an expected shortfall of up to £30bn against the chancellor’s self-imposed fiscal rules.Inflation, currently at almost twice the Bank of England’s 2% target, must also be kept under control.

With growth weak, and confidence fragile amid budget uncertainty, it is clear the government’s No 1 mission to kickstart growth is in trouble.The economy shrank in September and flatlined in August.Real GDP per head – a key measure of living standards – showed no growth in the latest quarter.More here, by my colleague Richard Partington:The reopening of the US government hasn’t brought much cheer to Wall Street.The main US stock indexes have opened lower, with the Dow Jones Industrial Average dipping by 102 points, or 0.

2%, to 48,152 points,Tech stocks are among the fallers, pulling the Nasdaq down by 1,1%,Fawad Razaqzada, market analyst at City Index, says:“After a stellar rally since April, technology shares look increasingly overvalued and overstretched, with sentiment tempered by a lack of fresh catalysts and a lull in economic data,It wouldn’t be surprising to see the Nasdaq 100 remain range-bound in the near term.

Yet, it’s far too early to call a top in this cycle, especially with the underlying trend still supported by strong liquidity and investor enthusiasm for AI-driven growth.”The burden of US tariffs is one reason, among many, that credit rating agency Fitch has just downgraded Aston Martin.Fitch has cut the UK carmaker deeper into junk bond territory, by downgraded Aston Martin Lagonda Global Holdings’ long-term issuer default rating to ‘CCC+’, from ‘B-.Fitch say the downgrade reflects deteriorating liquidity due to materially weaker, negative free cash flow (FCF) in the first nine months of 2026, adding:We now forecast a Fitch-adjusted 2025 FCF shortfall of about £400 million, well below our prior expectations.We expect FCF to remain negative until 2028, even after capex and opex cuts, and likely improvement to operating profitability in 2026.

The rating agency also singles out US uncertainty as a key worry, saying:Customer uncertainty has risen in the US - AML’s single largest market by sales in 2024 - following tariff introductions and despite relative advantage from the US-UK trade deal versus European peers.AML implemented an additional 3% price increase, after a June hike, which nearly offset the effect of tariffs.Unit sales in Americas, after a strong 1Q driven by pre-buy activity, fell slightly in 2Q and the decline accelerated in 3Q.Last month, Aston Martin blamed Donald Trump’s tariffs for a profit warning, and went on to cut £300m from its investment plans.As flagged earlier this morning, UK growth slowed to its lowest level in almost two years in the last quarter:The UK economy is likely to keep growing to the end of the year, according to The National Institute of Economic and Social Research (NIESR).

NIESR has predicted that quarterly growth will recover slightly to 0.2% in October-December, up from this morning’s disappointing reading of just 0.1% for July-September.They say:The average month-on-month growth rate in the third quarter was -0.1 per cent, consistent with weak market conditions reported across business surveys.

However, the factors behind September’s contraction may prove temporary, as survey data points to an uptick in production activity in October, supported by the restart of production at Jaguar Land Rover.We expect GDP to grow by 0.2 per cent in the fourth quarter, bolstered by growth in the services sector.Elevated uncertainty among businesses and households continue to pose downside risks to this forecast.UK government borrowing costs have inched a little higher today, in line with the wider bond market.

The yield, or interest rate, on 10-year UK gilts has risen by 3 basis points (0,03 percentage points) to 4,42%, with 30-year yields up 2,6bps,These gilts will soon be joined in the bond market by ‘kilts’, when Scotland begins issuing its own debt.

The Scottish first minister John Swinney has said Edinburgh is on track to issue its own government bonds, nicknamed “kilts”, after the country was given the same credit rating as the UK,Two ratings agencies Moody’s and S&P Global gave Scotland a score of Aa3 and AA respectively, echoing their judgment for the UK as a whole,The US dollar has weakened today as invesors await the restart of US data releases, now the government shutdown is over,That has pushed the pound up by almost half a cent against the dollar to $1,3175, despite the weak GDP data which could encourage an interest rate cut next month.

A stronger pound is bad news for the UK’s FTSE 100 share index, as it makes overseas earnings less valuable.The ‘Footsie’ is now down 79 points, or 0.8% at 9832 points, further away from yesterday’s record high.Some stocks went ex-dividend today (meaning new buyers wouldn’t get the next shareholder payment), which pulls down the index.Today’s weak UK growth report hasn’t dampened expectations that interest rates could be cut next month.

The money markets are indicating there’s a 81% chance that the Bank of England lowers Bank Rate to 3.75% at its next meeting in mid-December, little changed compared with just before the GDP data was released at 7am.Analysts at BNP Paribas reckon the budget will help push the Bank towards a rate cut, saying:We see the budget delivering a disinflationary impulse that paves the way for further easing from the Bank of England, in line with our long-held view.We continue to expect the next rate cut in December.The UK hospitality industry is, again, appealing to the government for support in the budget.

Kate Nicholls, chair of UKHospitality, has warned that the UK’s “consistent growth problem” and waning consumer confidence are both hitting high streets hard.Nicholls says:“Hospitality is being taxed out, with rising costs continuing to hit every part of a business.The £3.4 billion in additional annual cost inflicted on our sector in April made investing in and growing a business almost impossible.Instead, it has led to job losses, cancelled investment, price increases and business failure.

“You cannot tax your way to growth on the backs of the high street, which is why the Budget needs to be focused on reducing costs for businesses.Cutting hospitality’s tax burden – the highest in the country – would enable our sector to grow, create jobs and help people back into work.“We need to see urgent action at the Budget.The Chancellor needs to lower business rates, fix NICs and cut VAT to unleash hospitality’s potential.”UKHospitality has previously warned that the increase in employer NICs contributions announced in last year’s budget would drive up costs for restaurants, hotels, pubs, cafes and nightclubsThe slowdown in UK economic growth to 0.

1% for the past three months is “disappointing”, Downing Street has admitted,A No 10 spokesman told reporters this morning:“These numbers are disappointing,”The official added that “It’s obviously important to recognise the significance of the cyber attack” on Jaguar Land Rover, as this was “clearly the primary driver behind the weaker September figures” [GDP fell 0,1% in that month alone],“But we are determined to deliver that growth.

We had the fastest-growing economy in G7 in the first half of this year.But there is clearly more to do to build an economy that works for working people.”Asked whether the Chancellor should take responsibility for the slowing growth, the spokesman said: “I don’t accept that.”Moody’s Analytics fears UK growth will be subdued over the coming months.Andrew Hunter, senior economist at Moody’s Analytics, explains:“For the second year running, the U.

K.economy’s strong performance over the first half of the year appears to have been a flash in the pan, with GDP rising by only 0.1% in the third quarter.Modest gains in household consumption and government spending were offset by declines in business investment and exports.With domestic demand likely to be weighed down by tax rises set to be announced in this month’s budget, and the global economy likely to remain fairly weak, we expect U.

K.growth to remain subdued over the coming quarters.’’Security workers have been protesting outside the Bank of England this morning.The staff work for outsourced firm Amulet Security (Churchill Security Solutions) Limited, who unanimously voted to strike after their employer announced a pay freeze.According to the Unite union, Amulet took over the contract earlier this year, and says it can’t afford to fund a pay increase.

Unite said last month:Yet after seven months of stringing workers along, the Bank of England has now refused to give its contract workers at Amulet any form of pay increase this year.This is a substantial real terms pay cut, with the current RPI inflation rate standing at 4.5 per cent.The UK economy expanded by just 0.1% in the quarter from July to September as the crippling cyber-attack on Jaguar Land Rover hit manufacturing.

The latest official figures, issued as Rachel Reeves prepares for a crunch budget on 26 November, show gross domestic product fell by 0,1% in September as car production was dragged down to a 73-year low by the fallout from the hack,The Office for National Statistics (ONS) highlighted the influence of the cyber-attack, saying: “Production fell by 2,0% in September 2025 mainly because of a 28,6% fall in the manufacture of motor vehicles, trailers and semi-trailers

Polpa position: budget tinned tomatoes score well in Choice taste test

Consumer advocacy group Choice has taste-tested 18 brands of chopped and diced tomatoes, finding three cheaper cans outranked many more expensive brands.Four judges ranked tinned tomatoes from Australian supermarkets and retailers, assessing them on flavour, texture, appearance and aroma – with flavour accounting for the biggest percentage of overall scores.Italian brand Mutti’s Polpa Organic chopped tomatoes, costing $2.95 for a 400g tin, was awarded the highest score of 80%. It was the most expensive product tested, described by judge Fiona Mair (who also judges at the Sydney Royal Fine Food Show) as having “an earthy fresh tomato aroma, really rich juice and flesh”

Three plant-based chocolate mousse recipes by Philip Khoury

Mousse au chocolat is one of the most exquisite ways to enjoy chocolate – so here are three recipes that offer it in different textures and levels of chocolate intensity. Each one works beautifully with dark chocolate containing 65-80% cocoa solids. Blends with no specific origin can be further rounded out with one teaspoon of vanilla paste or the seeds from a vanilla bean.Once the mousses have been prepared, they can be frozen and gently defrosted in the refrigerator. Top with chocolate shavings, cocoa nibs or a dusting of unsweetened cocoa powder for texture and contrast

Don’t pour that olive brine down the drain – it’s a flavour bomb | Waste not

When I taste-tested olives for the food filter column a few months ago, it reminded me that the brine is an ingredient in its own right. This intensely savoury liquid adds umami depth to whatever it touches, and, beyond seasoning soups and stews, it can also be used to make salamoia, the aromatic brine that’s traditionally used to top focaccia and create that perfect salty crust.Pouring olive brine down the sink is like washing pure flavour down the drain. Instead, save it to supercharge your focaccia, creating a beautifully flavoured, salted crust that elevates an ordinary loaf into something extraordinary. While I’m partial to rosemary and olives as toppings, this focaccia delivers heaps of flavour even when kept completely plain and simple

Jelly’s back! Here are three worth making – and three that should wobble off to the bin

Jelly has a dowdy reputation, but it may well be the perfect food for the Instagram age: when it works, it’s incredibly photogenic, so who cares what it tastes like?There can be no other explanation for recent claims that savoury jellies – the most lurid and off-putting of dishes, reminiscent of the worst culinary efforts of the 1950s – are suddenly fashionable. This resurgence comes, according to the New York Times, “at a time when chefs are feeling pressure to produce viral visuals and molecular gastronomy is old hat”.The notion that jelly is having a moment is actually a perennial threat: this time last year it was reported that supermarket jelly cube sales were rising sharply, while vintage jelly moulds were experiencing a five-fold increase in online sales. And it was 15 years ago that the high-end “jellymongers” Bompas & Parr – known for their elaborate architectural creations – first published their book on the subject.People who are sceptical about jelly are often put off by its origins

Australian supermarket wheat crackers taste test: ‘All the reviewers knew which one was the real deal’

Nicholas Jordan risks it for the biscuits, sampling 19 wheat crackers in the driest taste test yetIf you value our independent journalism, we hope you’ll consider supporting us todayGet our weekend culture and lifestyle emailI’ve been wanting to write this article for over a year but I’ve been too intimidated and confused to start. There are several hundred supermarket products that could be called a cracker. Imagine a taste test with 100 versions of the same thing. Do I have the stomach space or mental bandwidth to process that much? Otherwise, how do I decide what’s in or out? Even if I did, how do I rule what is a cracker or not? How do you determine the criteria for tasting something rarely eaten on its own? Do you rate the crackers for deliciousness or compatibility? Are those two things even that different?Then there’s the anxiety of spending several days agonising over all that, and conducting a taste test only to arrive at the conclusion that Jatz are great. Do people want to read an article about why Sir Donald Bradman is better than whoever the second-best-ever cricketer is?Instead of answering all those questions, I could just have a lovely afternoon making my way through 17 kinds of chocolate or many iced coffees

Same sheet, different dish: how to use up excess lasagne sheets

I’ve accidentally bought too many boxes of dried lasagne sheets. How can I use them up? Jemma, by email This is sounding all too familiar to Jordon Ezra King, the man behind the A Curious Cook newsletter. “It’s funny Jemma asks this,” he says, “because I was in this exact same situation earlier this year after over-catering for a client dinner.” The first thing to say is there’s no immediate rush, he adds: “It sounds obvious, but you can keep the boxes for a long time.” Fortunately for Jemma and her shopping mishap, however, lasagne sheets are also flexible, and their shape doesn’t have to dictate what you do with them

Ineos to cut hundreds of jobs as carmaker struggles with debts

‘Whatever it takes’: Starbucks workers launch US strike and call for boycott

EU investigates Google over ‘demotion’ of commercial content from news media

Anthropic announces $50bn plan for datacenter construction in US

Carlos Alcaraz beats Lorenzo Musetti to put Alex de Minaur in last four: ATP Finals tennis – as it happened

‘We’re ready for the All Blacks’: Maro Itoje builds belief in improved England